Introduction: The ₹1 Crore Dream

What if you could retire with ₹1 crore — safely, smartly, and stress-free?

Every Indian investor — from the newly salaried to seasoned professionals — has one common financial milestone in mind: “How do I build a ₹1 crore corpus?” Whether you’re 25 or 45, this dream is now more achievable than ever. But the real challenge? Choosing the right path.

Should you rely on the time-tested PPF with 7.1% returns, the disciplined pension-focused NPS offering 10%, or ride the equity wave with Mutual Funds promising 12%+?

“Which investment can help me reach ₹1 crore faster, safer, and smarter?”

The ₹1 Crore Goal — How Hard Is It Really in 2025?

Inflation Makes ₹1 Crore a Necessity, Not a Luxury

With inflation averaging 6%, the ₹1 crore goal of yesterday is the bare minimum corpus many Indians need for retirement today.

According to RBI, ₹1 crore in 2045 will be worth just ₹31 lakhs in today’s money — thanks to the compounding impact of inflation.

That’s why it’s critical to not just save — but invest smartly.

Strategy Showdown – PPF vs NPS vs Mutual Funds

Let’s understand each investment product before we battle it out.

Public Provident Fund (PPF) — 7.1% Risk-Free Growth

- Interest Rate (Aug 2025): 7.1% (compounded annually)

- Tenure: 15 years (extendable in 5-year blocks)

- Risk: Government-backed = Low Risk

- Taxation: EEE – Exempt at investment, interest, and maturity

Ideal for: Risk-averse, long-term savers

National Pension System (NPS) — 10% Returns with Discipline

- Expected Returns: 9–10% (mix of equity + debt)

- Lock-in: Till retirement (60 years)

- Taxation: Partially taxable at withdrawal

- Additional Benefit: Extra ₹50,000 tax deduction under Sec 80CCD(1B)

Ideal for: Retirement-focused investors with moderate risk tolerance

Mutual Funds (Equity) — 12%+ Potential Growth

- Expected Returns: 12–15% (based on historical large/mid/small-cap funds)

- Flexibility: Anytime entry/exit

- Risk: Market-linked

- Taxation: LTCG above ₹1 lakh taxed at 10%

Ideal for: Growth seekers with long-term mindset

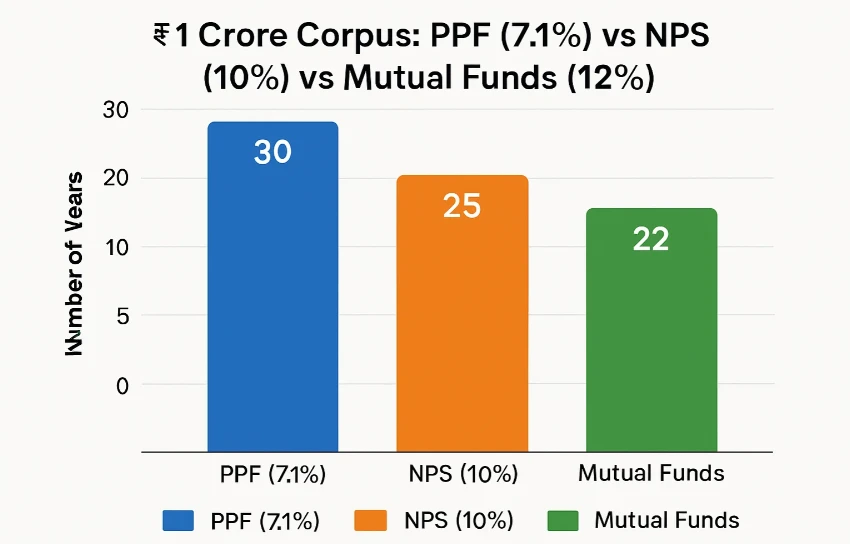

The ₹1 Crore Math — Who Gets There Faster?

Let’s break it down with real numbers for 2025.

Assumption: You invest ₹10,000/month starting in 2025.

Comparison Table 1: Years to ₹1 Crore – ₹10,000/month

| Investment | Return Rate | Time to ₹1 Crore | Total Invested | Wealth Gained |

|---|---|---|---|---|

| PPF | 7.1% | 25 years | ₹30 lakhs | ₹70 lakhs |

| NPS | 10% | 19 years | ₹22.8 lakhs | ₹77.2 lakhs |

| Mutual Funds | 12% | 16 years | ₹19.2 lakhs | ₹80.8 lakhs |

Mutual Funds win on speed.

Comparison Table 2: Required Monthly SIP for ₹1 Crore in 15 Years

| Investment | Return Rate | Monthly Investment Needed |

|---|---|---|

| PPF | 7.1% | ₹15,260 |

| NPS | 10% | ₹9,170 |

| Mutual Funds | 12% | ₹6,850 |

Mutual Funds are the most cost-efficient path.

Comparison Table 3: Wealth after 30 Years — ₹5,000/month

| Investment | Return Rate | Final Corpus |

|---|---|---|

| PPF | 7.1% | ₹61 lakhs |

| NPS | 10% | ₹1.13 crore |

| Mutual Funds | 12% | ₹1.50 crore |

Mutual Funds compound wealth more aggressively over long term.

Real-Life Investor Story: From ₹3,000 to ₹1 Crore in 17 Years

Meet Ankita Rao, a Mumbai-based teacher who started investing ₹3,000/month in 2007 in equity mutual funds. Despite 2008 and COVID crashes, she remained invested.

By 2024, her portfolio crossed ₹1 crore, driven by SIPs in large-cap and flexi-cap funds averaging 14–15% returns.

Her Mantra:

“Time in the market beats timing the market. I never stopped my SIP — no matter what.”

Proof that patience + consistency = compounding success.

“NPS balances equity and debt smartly. It’s ideal for disciplined retirement planning, especially for tax-conscious investors.”

— Radhika Gupta, CEO, Edelweiss AMC

Key Takeaways – Choosing the Right Path

Choose PPF if:

- You want 100% safety

- You prefer tax-free returns

- You’re okay with a long timeline (25+ years)

Choose NPS if:

- You want moderate growth + tax saving

- You’re focused on retirement

- You’re fine with partial withdrawal restrictions

Choose Mutual Funds if:

- You want to grow faster

- You can handle market volatility

- You’re aiming for early financial freedom

Emotional Angle — Don’t Let Safety Kill Your Growth

Many Indians play it too safe. They over-rely on PPF and FDs, earning just 7% when inflation is already at 6%.

That’s like running on a treadmill — sweating, but staying in the same place.

To beat inflation and build real wealth, a small dose of risk is necessary — especially when you’re young.

FAQs — Answering Your Top Queries

Is PPF better than NPS?

Not necessarily. PPF is tax-free and safe, but NPS offers higher returns with some lock-in. For long-term retirement, NPS may be better.

Can mutual funds guarantee ₹1 crore?

No. Mutual funds are market-linked. But historically, long-term SIPs in equity funds have delivered 12–15% returns consistently.

Can I invest in all three?

Yes. A smart portfolio includes:

- PPF for stability

- NPS for retirement

- Mutual Funds for growth

How to start a mutual fund SIP?

Use platforms like Groww, Zerodha Coin, Kuvera, or consult a SEBI-registered advisor.

What if I miss SIP payments?

Most platforms allow skipping. But avoid frequent breaks — consistency is key to compounding.

Conclusion: Your ₹1 Crore Strategy Starts Today

The road to ₹1 crore is not reserved for the rich. It’s built brick by brick — with smart choices, consistent investing, and a bit of courage.

Here’s Your Action Plan:

- Split your ₹10,000/month like this:

- ₹4,000 in Mutual Funds (equity SIP)

- ₹3,000 in NPS (tax-saving + growth)

- ₹3,000 in PPF (safety + tax-free corpus)

- Rebalance yearly

- Stay invested for 15–20 years

“Don’t wait to invest. Invest, then wait.”

This ₹1 crore goal is no longer a dream. It’s a destination — and you now have the map.

Ready to Start?

Explore SIPs, open an NPS account, or automate your PPF — but start today.

Share this with a friend who’s also chasing that ₹1 crore dream.

Leave a Reply