You’ve been holding a stock, waiting for the moment you can finally cash in—but a rule has kept your hands tied. Suddenly, the gates swing open, and a flood of shares worth over ₹2,500 crore surges into the market. What happens next? Today, we’re diving into six stocks whose lock-in periods have just ended, unleashing a tidal wave of trading potential that could shake up prices and spark opportunities—or risks—for investors like you.

A lock-in period is that critical window after an IPO when insiders, early investors, or anchor shareholders can’t sell their shares. It’s designed to stabilize stock prices by preventing a sudden oversupply. But when it ends? That’s when the real action begins. With shares worth over ₹2,500 crore now free to trade, the Indian stock market is buzzing. Let’s unpack what this means, spotlight the six stocks in focus, and arm you with the insights to navigate this game-changing moment.

Table of Contents

Why Lock-in Periods Matter in the Stock Market

Lock-in periods aren’t just technical jargon—they’re a big deal for investors. They’re like a dam holding back a river of shares. When the dam breaks, the market can either soak it up or get swamped. Historically, the end of a lock-in period can trigger volatility. Why? Because insiders—like company founders or venture capitalists—might rush to sell, increasing supply and potentially pushing prices down.

Take Ather Energy, for example. On October 30, 2024, when its lock-in period ended, shares slipped by 2% as 1.8 crore shares became tradable (source: Moneycontrol). Yet, not every stock tanks. Some hold steady or even climb if investor confidence is high. As of June 2025, India’s market has been resilient, with sectors like infrastructure and banking shining despite global headwinds. This sets the stage for our six stocks, whose lock-in expirations on June 30, 2025, could ripple through the market.

The 6 Stocks in Focus: A Deep Dive

On June 30, 2025, six newly listed companies saw their lock-in periods end, unlocking 11.2 crore shares worth approximately ₹3,623 crore (source: CNBC-TV18). That’s a massive influx! Here’s who they are and what you need to know:

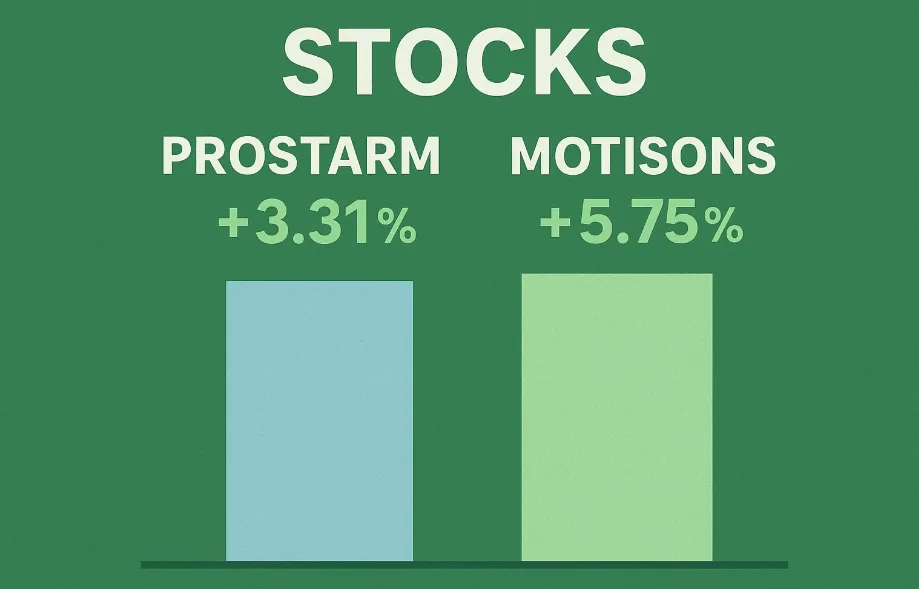

1. Prostarm Info Systems Limited

- What They Do: An IT firm delivering software solutions and services.

- Lock-in Details: One-month lock-in ended June 30, 2025. 20 lakh shares (4% of equity) hit the market.

- Market Cap: ₹863.40 crore

- Share Price: ₹146.65

- Day-of Performance: Up 3.31%—a sign of solid investor trust.

- What’s Next: With only 4% of equity released, don’t expect a tsunami of selling. The stock’s upward tick suggests the market shrugged off the new supply. If IT demand stays strong, this could be a sleeper hit.

2. Aegis Vopak Terminals Limited

- What They Do: A logistics giant managing terminals for chemicals and petroleum.

- Lock-in Details: One-month lock-in ended, freeing 2.7 crore shares (2% of equity).

- Market Cap: ₹27,145.79 crore

- Share Price: ₹245.00

- Day-of Performance: Down 3.75%—selling pressure kicked in.

- What’s Next: Despite the modest 2%, the sheer volume (given its hefty market cap) might keep prices wobbly. Logistics is booming with India’s infra push, so a dip could tempt bargain hunters.

3. Senores Pharmaceuticals Limited

- What They Do: A pharma player crafting generic and specialty drugs.

- Lock-in Details: Six-month lock-in expired, unleashing 2.2 crore shares (48% of equity).

- Market Cap: ₹2,655.22 crore

- Share Price: ₹576.45

- Day-of Performance: Up 1.51%—resilient despite the flood.

- What’s Next: A whopping 48% of equity is now tradable. That’s a red flag for volatility, but the price bump hints at a strong drug pipeline or market faith. Pharma’s a hot sector—watch insider moves here.

4. Sai Life Sciences Limited

- What They Do: A CRAMS (contract research and manufacturing) firm for pharma giants.

- Lock-in Details: Six-month lock-in ended, releasing 20 lakh shares (0.9% of equity).

- Market Cap: ₹16,055.47 crore

- Share Price: ₹772.50

- Day-of Performance: Up 1.05%—barely a blip.

- What’s Next: With less than 1% released, this is a non-event for price swings. Sai’s role in global pharma outsourcing makes it a steady bet—volatility’s not the worry here.

5. Stanley Lifestyles Limited

- What They Do: A luxury furniture and lifestyle brand for India’s elite.

- Lock-in Details: Six-month lock-in ended, freeing 2.1 crore shares (37% of equity).

- Market Cap: Not disclosed

- Share Price: Not disclosed

- Day-of Performance: Data unavailable

- What’s Next: A hefty 37% of equity is now loose, which could spark fireworks if insiders sell. Luxury goods are riding India’s wealth wave—keep an eye on trading updates for clues.

6. Motisons Jewellers Limited

- What They Do: A jewelry retailer cashing in on India’s love for gold and gems.

- Lock-in Details: Six-month lock-in ended, unlocking 2 crore shares (20% of equity).

- Market Cap: ₹2,100.84 crore

- Share Price: ₹21.34

- Day-of Performance: Up 5.75%—a standout performer.

- What’s Next: A 20% release could’ve tanked it, but that leap says buyers are all in. Weddings and festivals fuel jewelry stocks—Motisons might shine if sentiment holds.

Quick Glance: Key Data Tables

Let’s break it down visually:

Table 1: Lock-in Period Snapshot

| Stock | Duration | Shares Released | % of Equity |

|---|---|---|---|

| Prostarm Info Systems | 1 month | 20 lakh | 4% |

| Aegis Vopak Terminals | 1 month | 2.7 crore | 2% |

| Senores Pharmaceuticals | 6 months | 2.2 crore | 48% |

| Sai Life Sciences | 6 months | 20 lakh | 0.9% |

| Stanley Lifestyles | 6 months | 2.1 crore | 37% |

| Motisons Jewellers | 6 months | 2 crore | 20% |

Table 2: Market Stats

| Stock | Market Cap (₹ Cr) | Share Price (₹) |

|---|---|---|

| Prostarm Info Systems | 863.40 | 146.65 |

| Aegis Vopak Terminals | 27,145.79 | 245.00 |

| Senores Pharmaceuticals | 2,655.22 | 576.45 |

| Sai Life Sciences | 16,055.47 | 772.50 |

| Stanley Lifestyles | N/A | N/A |

| Motisons Jewellers | 2,100.84 | 21.34 |

Table 3: Day-of Impact

| Stock | Price Change (%) |

|---|---|

| Prostarm Info Systems | +3.31% |

| Aegis Vopak Terminals | -3.75% |

| Senores Pharmaceuticals | +1.51% |

| Sai Life Sciences | +1.05% |

| Stanley Lifestyles | N/A |

| Motisons Jewellers | +5.75% |

How Lock-in Periods Shake Up the Market

When lock-in periods end, it’s not just about more shares—it’s about psychology. If insiders hold tight, it screams confidence. If they sell? It can spook the market. Studies show mixed results. A 2019 SEBI report noted that post-IPO lock-in expirations often see an average 5-10% price dip in the first week, but recovery depends on fundamentals (source: SEBI archives). For our six stocks, the range—from Motisons’ 5.75% surge to Aegis’ 3.75% drop—shows no one-size-fits-all outcome.

Take Zomato in 2022: when its lock-in ended, shares dropped 8% in days as early investors cashed out. Contrast that with Nykaa, which held firm thanks to strong earnings. The lesson? Context is king. A flood of shares doesn’t always sink the ship—it’s about who’s selling and why.

What Should Investors Do Now?

So, you’re eyeing these stocks—should you buy, sell, or sit tight? Here’s your playbook:

- Watch the Volume: Spikes in trading signal insider moves. A surge after Senores’ 48% release? That’s a clue.

- Check the Basics: A stock like Sai Life Sciences, with a tiny 0.9% unlock, might shrug this off if its financials are rock-solid.

- Mind the Sector: Jewelry (Motisons) and pharma (Senores) are riding tailwinds—don’t sleep on that.

- Stay Calm: Volatility is normal. Aegis’ dip might be a blip, not a trend.

Financial analyst Rahul Arora, CEO of NDTV Profit, says: “Lock-in expirations test market depth. Smart investors look past the noise to the company’s core story” (source: NDTV Profit). Translation? Don’t panic—dig deeper.

Historical Hits and Misses: Learning from the Past

Lock-in endings have a storied past. In 2018, Paytm’s precursor saw a 12% plunge post-lock-in as promoters sold off chunks. But Tata Technologies in 2023? Its price barely budged, buoyed by stellar demand. What’s the difference? Fundamentals and timing. Paytm faced a shaky market; Tata rode a bullish wave.

For our six, it’s early days. Senores and Stanley, with 48% and 37% of equity freed, mirror Paytm’s risk profile. Motisons’ rally, though, echoes Tata’s strength. History says: buckle up, but don’t jump ship yet.

Expert Takes on Lock-in Periods

Experts weigh in with clarity. SEBI-registered advisor Anil Singhvi told Zee Business: “When lock-ins end, it’s a litmus test. Strong companies absorb the hit; weak ones falter” (source: Zee Business, June 2025). Meanwhile, Shalini Gupta, a market strategist, notes: “Investors should zoom in on insider behavior post-lock-in. It’s the ultimate signal” (source: Economic Times).

These pros agree: it’s not just about the shares—it’s about what happens after. For stocks like Prostarm (up 3.31%) and Motisons (up 5.75%), early signs are promising. Aegis’ dip? Could be a hiccup—or a warning.

FAQs: Your Burning Questions Answered

What’s a Lock-in Period Anyway?

It’s a rule locking shareholders—usually insiders—from selling post-IPO, keeping prices stable. Durations vary: 1 month for some (Prostarm), 6 months for others (Senores).

Does the End Always Crash Stock Prices?

Not always. Aegis fell 3.75%, but Motisons soared 5.75%. It hinges on supply size, demand, and market mood.

Should I Buy These Stocks Now?

Maybe. A dip (like Aegis) could be a deal; a rise (like Motisons) might mean momentum. Check the company’s health first.

What’s the Biggest Risk Here?

Volatility. Big releases—like Senores’ 48%—can jolt prices if insiders dump shares fast.

How Do I Spot Opportunities?

Track volume, insider sales, and news. A stock like Sai Life Sciences, with minimal impact, might be a safe play.

Conclusion: Your Move in This Market Shake-Up

The lock-in periods are over, and over ₹2,500 crore in shares are now live. From Motisons’ dazzling 5.75% jump to Aegis’ 3.75% stumble, these six stocks are a mixed bag of risks and rewards. Whether you’re hunting bargains or dodging turbulence, one thing’s clear: knowledge is your edge.

Don’t just watch—act smart. Dig into these companies, track the trends, and talk to a financial advisor. The market’s moving—will you? Subscribe to our newsletter for real-time updates, or follow us on social media to stay ahead of the curve.

Leave a Reply