Sipping your morning chai, glancing at your phone, and discovering that your modest investment of 1 lakh rupees has ballooned into a staggering 10 lakhs in just four years. It’s a dream that sparks excitement in the hearts of countless investors across India. The stock market, with its tales of overnight crorepatis and life-changing windfalls, often feels like a golden ticket to financial freedom. But is it really possible to achieve such extraordinary returns? And if so, how can you navigate this thrilling yet treacherous terrain?

Table of Contents

But let’s hit the brakes for a moment: achieving a 10x return in four years isn’t just ambitious—it’s a high-stakes gamble. It demands sharp skills, a sprinkle of luck, and a stomach for risk. So, buckle up as we journey through the possibilities, pitfalls, and practical steps to chase this dream, all while keeping your expectations grounded and your decisions informed.

Understanding the Risks: High Rewards, Higher Stakes

In the stock market, the promise of high returns often dances hand-in-hand with high risks. Aiming for a 10-fold return in four years means hunting for stocks that skyrocket—think startups disrupting industries, tech innovators, or companies riding massive growth waves. But here’s the catch: what goes up fast can crash just as hard.

Take the tech sector, for example. Giants like Tesla and Amazon have minted millionaires, but for every success, there are dozens of startups that fizzled out, leaving investors empty-handed. The stock market isn’t a crystal ball; it’s a rollercoaster influenced by economic shifts, global events, and investor moods.

Consider these risks:

- Volatility: High-growth stocks can double or halve in value in a blink.

- Unproven Ventures: Many 10x candidates are young companies with shaky track records.

- Market Swings: A recession or policy change can derail even the best picks.

As Warren Buffett wisely said, “The stock market is a device for transferring money from the impatient to the patient.” Chasing quick riches might tempt you, but sustainable wealth often comes from patience and strategy—not reckless bets.

Historical Examples: Stocks That Defied the Odds

Can stocks really deliver 10x returns in four years? History says yes—but it’s rare. Let’s peek at some standout examples (note: these are for inspiration, not recommendations):

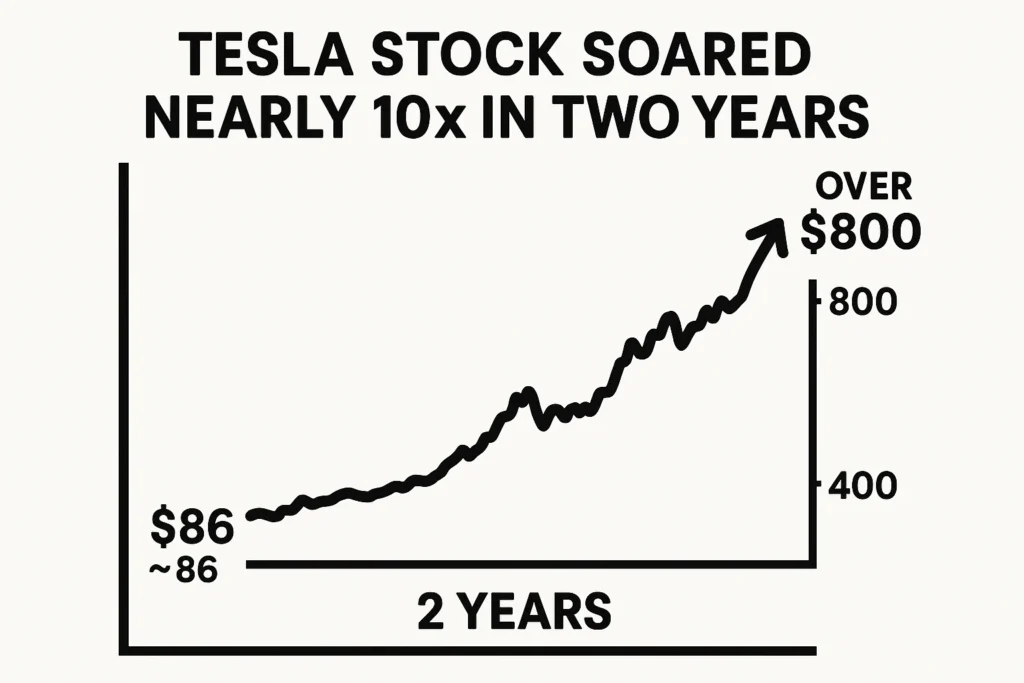

Tesla (TSLA)

From 2019 to 2021, Tesla’s stock soared from ~$86 to over $800—a nearly 10x jump in two years. Electric vehicles and visionary leadership fueled this meteoric rise.

Shopify (SHOP)

Between 2017 and 2021, Shopify’s stock climbed from ~$130 to over $1,400, riding the e-commerce boom during the pandemic. That’s a 10x return in four years!

Zoom (ZM)

In 2020 alone, Zoom’s stock leaped from ~$68 to over $500 as remote work exploded—a 7x gain in months, not even years.

Here’s a quick comparison:

| Stock | Start Price (Approx.) | Peak Price (Approx.) | Time Frame | Return |

|---|---|---|---|---|

| Tesla | $86 (2019) | $800+ (2021) | 2 years | ~900% |

| Shopify | $130 (2017) | $1,400+ (2021) | 4 years | ~1000% |

| Zoom | $68 (2020) | $500+ (2020) | <1 year | ~635% |

These outliers thrived on innovation and timing, but for every Tesla, countless others flopped. Past performance isn’t a crystal ball—replicating these wins takes foresight and guts.

Investment Strategies: Your Roadmap to High Returns

So, how do you chase that 10x dream? Let’s explore strategies that could get you there:

1. Growth Investing

Target companies poised for explosive growth—think tech, biotech, or green energy. These firms reinvest profits to scale, often driving stock prices skyward.

- Traits: High earnings growth, cutting-edge products, premium valuations.

- Example: India’s own Reliance Jio transformed telecom and boosted Reliance Industries’ stock.

2. Value Investing

Hunt for undervalued gems—stocks trading below their true worth. When the market catches on, prices can soar.

- Traits: Low P/E ratios, strong fundamentals, overlooked by the crowd.

- Example: Tata Motors has seen bursts of growth when market sentiment shifts.

3. Momentum Investing

Ride the wave of stocks already climbing. If the trend holds, gains can pile up fast.

- Traits: Strong recent performance, technical signals like RSI.

- Risk: Trends can reverse abruptly.

4. Sector Investing

Bet on booming sectors—renewable energy, EVs, or healthcare. Pick winners within these trends.

- Hot Sectors in India: Fintech (e.g., Paytm), green energy (e.g., Adani Green).

Pro Tips:

- Start Small: Test the waters with Rs. 10,000 before going all-in.

- Dollar-Cost Averaging: Invest fixed sums monthly to smooth out volatility.

- Research Hard: Dig into financials, news, and trends.

No strategy is foolproof, but blending these approaches could boost your odds.

Diversification and Risk Management: Don’t Bet It All

Chasing 10x returns doesn’t mean throwing caution to the wind. Diversification and risk management are your safety nets.

Why Diversify?

Putting all your 1 lakh into one stock is like betting on a single IPL match. Spread it across assets to cushion the blows.

- Mix Industries: Tech, pharma, FMCG—don’t lean on one sector.

- Add Bonds: Fixed-income assets balance the rollercoaster.

- Go Global: Explore US or EU stocks via apps like INDmoney.

- ETFs/Mutual Funds: Instant diversification with one buy.

Risk Management Hacks

- Stop-Loss Orders: Sell automatically if a stock drops 10-15%.

- Limit Exposure: Cap high-risk bets at 5-10% of your portfolio.

- Review Regularly: Rebalance quarterly to stay on track.

- Emergency Fund: Keep 6 months’ expenses aside—don’t touch your investments.

Peter Lynch nailed it: “The key to making money in stocks is not to get scared out of them.” Diversify smartly, and you’ll weather the storms.

Tools and Resources: Your Stock Market Toolkit

Success starts with the right tools. Here’s what Indian investors need:

Brokerage Platforms

- Zerodha: Low fees, slick charts—perfect for beginners.

- Groww: Simple interface, great for newbies.

- Upstox: Robust tools for active traders.

News and Analysis

- Moneycontrol: Real-time updates and stock ideas.

- Economic Times: Deep dives into market trends.

- Screener.in: Filter stocks by P/E, growth, and more.

Learning Resources

- Books: “The Intelligent Investor” by Benjamin Graham.

- YouTube: Channels like Pranjal Kamra or CA Rachana Phadke.

- Courses: Zerodha Varsity (free) or Udemy’s stock basics.

Stay curious—knowledge is your edge.

FAQs: Your Stock Investing Questions Answered

1. Can I really turn 1 lakh into 10 lakhs in 4 years?

Yes, but it’s rare and risky. You’d need stocks growing at ~78% annually—possible with outliers like Tesla, but not guaranteed.

2. How do I start investing in stocks?

Open a demat account (Zerodha, Groww), research stocks, and start with Rs. 500-1,000.

3. What’s the biggest risk?

Losing it all—high-growth stocks can tank due to market crashes or company failures.

4. Should I pick individual stocks or mutual funds?

Stocks offer higher upside but more risk; mutual funds are safer and diversified.

5. How do I spot a 10x stock?

Look for innovation, strong leadership, and growing markets—e.g., India’s EV or fintech sectors.

6. What’s a good diversification strategy?

Spread across 5-10 stocks, 2-3 sectors, and add an ETF or bond.

7. How much time do I need to invest?

A few hours weekly for research and monitoring—perfect for a side hustle.

8. Are taxes a big deal?

Long-term gains (>1 year) over Rs. 1 lakh are taxed at 10%; short-term at 15%.

9. What if the market crashes?

Hold tight if the fundamentals are strong—crashes are often buying opportunities.

10. Where do I learn more?

Start with Moneycontrol, Zerodha Varsity, or books like “One Up On Wall Street.”

Conclusion: Dream Big, Invest Smart

Turning 1 lakh into 10 lakhs in four years is a tantalizing goal—one that’s sparked millionaires and broken hearts. The stock market can deliver, but it’s no magic wand. With historical stars like Shopify and Tesla lighting the way, the path exists—but it’s narrow and winding.

Armed with growth investing, diversification, and a solid toolkit, you can tilt the odds in your favor. Stay patient, stay informed, and don’t let greed cloud your judgment. As Charlie Munger put it, “The big money is not in the buying and selling, but in the waiting.”

So, take that first step—open a demat account, dip your toes with Rs. 5,000, and build from there. Your 10-lakh dream might just be a smart trade away.

Disclaimer: This blog is for informational purposes only, not financial advice. Stocks carry risks, and past performance doesn’t predict the future. Consult a financial advisor before investing.

1 Comment