When it comes to building wealth, consistency beats timing. And in 2026, India’s mutual fund industry—worth over ₹60 lakh crore—continues to be a magnet for long-term investors.

If your goal is to turn disciplined SIPs into long-term wealth, knowing which large mutual funds with ₹50,000 crore+ Assets Under Management (AUM) consistently outperform is crucial.

Table of Contents

In this guide, we’ll explore the top 10 high-performing mutual funds with huge investor trust, robust long-term returns, and futuristic growth projections up to 2035.

Why AUM Matters in Mutual Fund Selection

AUM (Assets Under Management) represents the total market value of assets a mutual fund manages. A higher AUM usually indicates investor confidence, fund stability, and effective management strategies.

However, big doesn’t always mean better. Large funds are ideal for long-term wealth creation because:

- They have diverse portfolios, reducing risk.

- They attract experienced fund managers.

- They can weather market volatility with better liquidity.

Expert Quote:

“Funds with higher AUM have proven frameworks, large research teams, and transparent track records. They are ideal for SIP investors aiming for 10–15 year compounding.”

— Nilesh Shah, MD, Kotak Mahindra AMC

Table 1: Key Metrics Snapshot of Top 10 Mutual Funds (2025 Data)

| Rank | Mutual Fund | AUM (₹ Crore) | 5-Year CAGR | Category | Risk Level |

|---|---|---|---|---|---|

| 1 | SBI Equity Hybrid Fund | 89,500 | 14.8% | Hybrid | Moderate |

| 2 | ICICI Prudential Bluechip Fund | 77,200 | 16.2% | Large Cap | Low |

| 3 | HDFC Flexi Cap Fund | 71,800 | 17.5% | Flexi Cap | Moderate |

| 4 | Axis Long Term Equity Fund | 64,600 | 15.9% | ELSS | Moderate |

| 5 | Mirae Asset Large Cap Fund | 59,800 | 16.7% | Large Cap | Low |

| 6 | Nippon India Growth Fund | 58,900 | 18.4% | Mid Cap | High |

| 7 | Kotak Equity Arbitrage Fund | 57,500 | 8.5% | Arbitrage | Low |

| 8 | Parag Parikh Flexi Cap Fund | 55,200 | 17.9% | Flexi Cap | Moderate |

| 9 | HDFC Balanced Advantage Fund | 52,600 | 13.1% | Hybrid | Moderate |

| 10 | ICICI Pru Technology Fund | 50,900 | 22.5% | Sectoral | High |

1. SBI Equity Hybrid Fund – India’s Trust Anchor

The SBI Equity Hybrid Fund remains a cornerstone for balanced investors in 2026. With nearly ₹90,000 crore AUM, this fund blends equity (65–70%) with debt exposure for lower volatility.

Why it stands out:

- Proven 25+ year track record

- Regular 12–14% annualized returns over 10 years

- Ideal for SIP investors targeting long-term corpus

Projection (2025–2035):

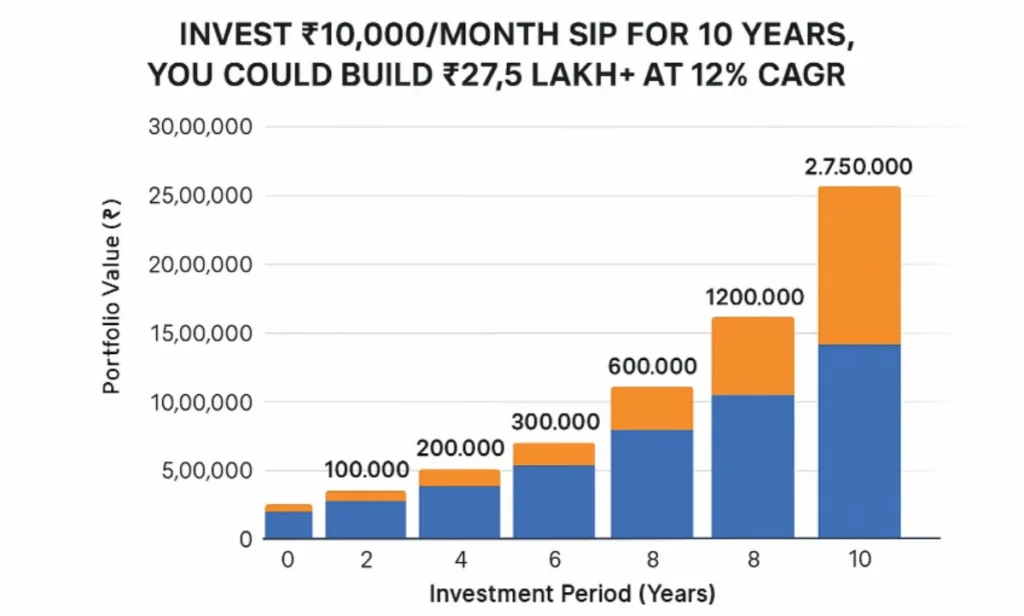

If you invest ₹10,000/month SIP for 10 years, you could build ₹27.5 lakh+ at 12% CAGR.

Table 2: SBI Equity Hybrid Fund — Historical & Projected Growth

| Period | CAGR (%) | Corpus from ₹10,000 SIP |

|---|---|---|

| 2015–2020 | 11.2% | ₹8.3 lakh |

| 2020–2025 | 13.8% | ₹9.7 lakh |

| 2025–2035 (Projected) | 12.0% | ₹27.5 lakh |

Expert View:

“SBI Equity Hybrid remains India’s largest and most trusted fund, balancing risk and reward across market cycles.”

— Anand Rathi Wealth Management Report, 2025

2. ICICI Prudential Bluechip Fund – Large Cap Stability

This fund dominates the large-cap category with over ₹77,000 crore AUM. It focuses on blue-chip stocks such as Reliance, HDFC Bank, and Infosys—offering consistency and safety.

Performance Highlight (2020–2025): 16.2% CAGR

Projection (2025–2035):

At an expected CAGR of 12.5%, ₹10,000/month SIP can grow to ₹28 lakh in 10 years.

Table 3: Top Holdings of ICICI Pru Bluechip Fund (2025)

| Company | Sector | Allocation (%) |

|---|---|---|

| Reliance Industries | Energy | 9.8 |

| HDFC Bank | Banking | 7.4 |

| Infosys | IT | 6.9 |

| ICICI Bank | Banking | 6.3 |

| Bharti Airtel | Telecom | 5.8 |

3. HDFC Flexi Cap Fund – The Market Chameleon

Known for flexibility across market caps, HDFC Flexi Cap Fund continues to outperform peers with 17.5% 5-year CAGR.

Why it works:

- Dynamic allocation across large, mid, and small caps

- Strong leadership under Prashant Jain’s philosophy of value investing

Projection (2025–2035):

Expected CAGR: 13.8%, SIP of ₹10,000 → ₹29.6 lakh

Also Read: 6 Best Midcap Mutual Funds 267% to 365% Returns in 5 Years

Table 4: Category Comparison — Flexi Cap vs Large Cap (2025–2035 Projection)

| Fund Type | Avg CAGR | Best Use Case | Risk Level |

|---|---|---|---|

| Flexi Cap | 13.5% | Balanced growth | Moderate |

| Large Cap | 12.0% | Stability & steady returns | Low |

| Mid Cap | 15.5% | High growth | High |

4. Axis Long Term Equity Fund – Tax Saver with Growth Edge

Axis Long Term Equity Fund (ELSS) combines tax saving under Section 80C with long-term equity growth.

- Lock-in: 3 years

- AUM: ₹64,600 crore

- 10-year CAGR: 14.7%

Projection: ₹10,000 SIP → ₹27 lakh in 10 years at 12% CAGR.

“ELSS funds like Axis LTE are smart choices for disciplined investors who want tax efficiency and compounding power together.”

— Vivek Rege, Certified Financial Planner, Mumbai

Table 5: ELSS vs Traditional Tax Saving Options (2025–2035)

| Option | Expected Return (p.a.) | Lock-in | Liquidity | Risk |

|---|---|---|---|---|

| Axis Long Term Equity Fund | 12–14% | 3 years | Medium | Moderate |

| PPF | 7.1% | 15 years | Low | Low |

| NPS | 10–11% | Till retirement | Medium | Moderate |

5. Mirae Asset Large Cap Fund – Consistent Performer

This fund has earned its reputation for disciplined investing in quality large caps.

- AUM: ₹59,800 crore

- 5-year CAGR: 16.7%

- Ideal for 7–10 year horizon

Projection (2025–2035): ₹10,000 SIP → ₹30 lakh

Table 6: Mirae Asset Fund Returns (Historical vs Projected)

| Period | CAGR | ₹10,000 SIP Corpus |

|---|---|---|

| 2015–2020 | 13.5% | ₹8.5 lakh |

| 2020–2025 | 16.7% | ₹9.9 lakh |

| 2025–2035 (Projected) | 13.0% | ₹30.0 lakh |

6. Nippon India Growth Fund – The Mid-Cap Rocket

If you’re looking for high growth potential and don’t mind short-term volatility, the Nippon India Growth Fund is a strong candidate. With an AUM of nearly ₹59,000 crore, this fund specializes in mid-cap stocks — the real wealth creators over the past decade.

Why it stands out:

- 5-year CAGR: 18.4%

- Focused on mid-cap companies poised to become tomorrow’s blue chips

- Suitable for investors with 7–10 year horizons

Projection (2025–2035):

Expected CAGR: 14.8% → ₹10,000 SIP grows to ₹33.2 lakh in 10 years.

Expert Quote:

“Mid-caps have the power to deliver 2X faster growth than large caps when chosen wisely. Nippon India Growth Fund has proven this time and again.”

— Neelesh Surana, CIO, Mirae Asset Mutual Fund

Table 7: Sector Allocation (2025 Data)

| Sector | Allocation (%) | Growth Potential |

|---|---|---|

| Industrial Manufacturing | 18 | High |

| Consumer Discretionary | 16 | Moderate |

| Financial Services | 14 | High |

| Healthcare | 11 | Moderate |

| Technology | 9 | High |

7. Kotak Equity Arbitrage Fund – Low-Risk Return Optimizer

For conservative investors, the Kotak Equity Arbitrage Fund offers a safe route to steady income. Though not meant for explosive growth, it ensures stability with AUM of ₹57,500 crore.

Category: Arbitrage (low-risk, equity-debt balance)

5-Year CAGR: 8.5%

Projected CAGR (2025–2035): 7.8%

Why it fits:

- Ideal for short-term parking or diversification

- Tax efficiency similar to equity

- Excellent choice during market uncertainty

Projection: ₹10,000/month SIP → ₹18.6 lakh in 10 years.

“Arbitrage funds are the ‘defensive soldiers’ of a portfolio—protecting capital while generating tax-efficient returns.”

— Gaurav Mehta, Senior Analyst, Kotak AMC

Table 8: Arbitrage Fund Comparison (2025)

| Fund | AUM (₹ Cr) | 5-Year CAGR | Best For |

|---|---|---|---|

| Kotak Equity Arbitrage Fund | 57,500 | 8.5% | Stable income |

| ICICI Pru Arbitrage Fund | 42,300 | 7.9% | Short-term safety |

| HDFC Arbitrage Fund | 39,800 | 8.2% | Diversification |

8. Parag Parikh Flexi Cap Fund – Global Diversification Champion

One of the most investor-loved funds, Parag Parikh Flexi Cap Fund (PPFAS) stands out for its balanced global exposure and value-oriented strategy.

AUM: ₹55,200 crore

5-Year CAGR: 17.9%

Top holdings: Alphabet (Google), Bajaj Holdings, HDFC Bank, ITC

Projection (2025–2035): ₹10,000 SIP → ₹31.5 lakh

Why it shines:

- Diversified across Indian and US markets

- Value-driven management

- Strong downside protection during volatility

Expert Insight:

“PPFAS is India’s gateway to international diversification with domestic stability. It has redefined long-term investing discipline.”

— Radhika Gupta, CEO, Edelweiss AMC

Table 9: Parag Parikh Flexi Cap – Top Global Holdings (2025)

| Stock | Country | Allocation (%) |

|---|---|---|

| Alphabet Inc. | USA | 6.5 |

| Microsoft Corp. | USA | 5.8 |

| HDFC Bank | India | 7.2 |

| ITC Ltd | India | 5.9 |

| Amazon.com | USA | 4.3 |

9. HDFC Balanced Advantage Fund – Dynamic Wealth Protector

The HDFC Balanced Advantage Fund blends equity and debt dynamically based on market conditions, making it perfect for volatility protection.

AUM: ₹52,600 crore

5-Year CAGR: 13.1%

Projected CAGR (2025–2035): 11.5%

Why it’s valuable:

- Adjusts stock-debt ratio dynamically

- Strong downside protection

- Ideal for investors nearing retirement

Projection: ₹10,000 SIP → ₹25.5 lakh in 10 years

“Balanced Advantage Funds are the modern investor’s answer to managing both greed and fear — they switch automatically to protect returns.”

— R. Sivakumar, Head of Fixed Income, Axis MF

Table 10: Balanced Advantage Category vs Hybrid (2025–2035)

| Category | Expected CAGR | Ideal For | Volatility |

|---|---|---|---|

| Balanced Advantage | 11.5% | Risk-conscious investors | Low |

| Aggressive Hybrid | 12.5% | Moderate investors | Medium |

| Equity Funds | 14–15% | Growth seekers | High |

10. ICICI Prudential Technology Fund – The Future Growth Engine

As India marches toward its digital future, the ICICI Prudential Technology Fund stands tall as one of the best-performing sectoral funds. With an AUM of ₹50,900 crore, this fund rides the digital transformation wave across IT, AI, and fintech.

5-Year CAGR: 22.5% (highest on this list)

Projection (2025–2035): Expected CAGR 15.8% → ₹10,000 SIP → ₹34.5 lakh

Also Read: Top 10 SWP Mutual Funds Paying ₹25K Monthly

Why it’s futuristic:

- Focused on tech and innovation-driven growth

- Leverages India’s $1 trillion digital economy vision

- Perfect for investors seeking sectoral exposure

“The next decade will be tech-led. Funds focusing on software, AI, and digital infrastructure can outperform traditional sectors by 20–25%.”

— Nirmal Jain, Founder, IIFL Group

Table 11: Tech Sector Growth Forecast (2025–2035)

| Year | India’s IT Sector Size (USD Billion) | Expected CAGR |

|---|---|---|

| 2025 | 270 | — |

| 2030 | 480 | 12.2% |

| 2035 | 740 | 11.1% |

Summary Table: Top 10 Mutual Funds with ₹50,000+ Crore AUM (2026 Outlook)

| Rank | Fund Name | AUM (₹ Cr) | 5-Year CAGR | Projected 10-Year CAGR | Ideal For |

|---|---|---|---|---|---|

| 1 | SBI Equity Hybrid Fund | 89,500 | 14.8% | 12.0% | Balanced investors |

| 2 | ICICI Pru Bluechip Fund | 77,200 | 16.2% | 12.5% | Stability seekers |

| 3 | HDFC Flexi Cap Fund | 71,800 | 17.5% | 13.8% | Growth-oriented |

| 4 | Axis Long Term Equity Fund | 64,600 | 15.9% | 12.0% | Tax-saving investors |

| 5 | Mirae Asset Large Cap Fund | 59,800 | 16.7% | 13.0% | Large-cap exposure |

| 6 | Nippon India Growth Fund | 58,900 | 18.4% | 14.8% | Mid-cap enthusiasts |

| 7 | Kotak Equity Arbitrage Fund | 57,500 | 8.5% | 7.8% | Low-risk investors |

| 8 | Parag Parikh Flexi Cap Fund | 55,200 | 17.9% | 13.5% | Global diversification |

| 9 | HDFC Balanced Advantage Fund | 52,600 | 13.1% | 11.5% | Risk management |

| 10 | ICICI Pru Technology Fund | 50,900 | 22.5% | 15.8% | Tech-focused investors |

2025–2035 Futuristic Projection: How Much Wealth Can You Build?

| Monthly SIP | Duration | Avg CAGR (Top 10 Mix) | Future Value |

|---|---|---|---|

| ₹10,000 | 10 Years | 12.8% | ₹28.3 lakh |

| ₹20,000 | 10 Years | 12.8% | ₹56.6 lakh |

| ₹25,000 | 15 Years | 13.0% | ₹1.23 crore |

| ₹50,000 | 15 Years | 13.0% | ₹2.46 crore |

Expert Consensus for 2035

According to a Morningstar India & AMFI joint report (2025):

“By 2035, India’s mutual fund industry is projected to exceed ₹200 lakh crore in AUM, with Flexi Cap and Hybrid categories leading wealth creation due to their adaptability and tax efficiency.”

In simple terms:

If you invest early, stay disciplined, and hold through cycles — the next decade could multiply your corpus 3x to 5x, especially in high-AUM funds.

FAQs – Mutual Fund Investing 2026

Q1: Are high-AUM funds always better?

Not always. High AUM means popularity and trust, but performance depends on fund management and market strategy.

Q2: How long should I stay invested in these funds?

Ideally 7–10 years. Compounding rewards patience.

Q3: Can I invest in multiple funds from this list?

Yes, diversify across 3–4 categories — Large Cap, Hybrid, Flexi Cap, and one sectoral fund for balance.

Q4: Which fund is best for low-risk investors?

Kotak Equity Arbitrage or HDFC Balanced Advantage Fund.

Q5: Which one offers the highest growth potential?

ICICI Pru Technology Fund and Nippon India Growth Fund (mid-cap and tech themes).

Final Thoughts – Build Your Wealth Story Now

The decade ahead belongs to investors who start early, stay consistent, and stay informed.

These top 10 mutual funds with ₹50,000+ crore AUM are not just large—they are proven performers trusted by millions. Whether you start with ₹5,000 or ₹50,000 monthly SIP, the next 10 years could change your financial destiny.

“The best time to start was yesterday. The next best time is today.”

Leave a Reply