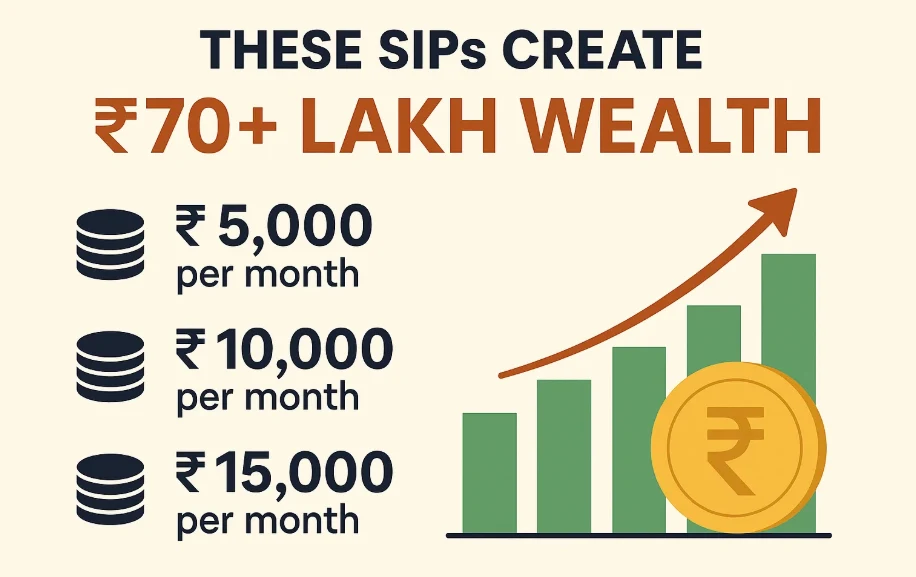

Turning a modest monthly investment into a staggering ₹70 lakh fortune in just 12 years. Sounds like a dream, right? Well, it’s not—it’s the reality of disciplined investing through Systematic Investment Plans (SIPs). In India, SIPs have become a go-to wealth-building tool for millions, offering a simple yet powerful way to grow money over time. But not all SIPs are created equal. Some have consistently delivered jaw-dropping returns, transforming small investments into life-changing wealth.

What is a Systematic Investment Plan (SIP)?

Before we jump into the top performers, let’s break down what a SIP is and why it’s a game-changer. A Systematic Investment Plan (SIP) allows you to invest a fixed amount—say ₹500 or ₹10,000—into a mutual fund at regular intervals, typically monthly. Over time, this disciplined approach harnesses two financial superpowers: rupee cost averaging and compounding.

- Rupee Cost Averaging: When markets dip, your fixed investment buys more units. When markets rise, you buy fewer. This averages out your cost and reduces the impact of volatility.

- Compounding: Your returns earn returns, creating an exponential growth effect. The longer you stay invested, the bigger the snowball gets!

“SIPs are a great way to invest in mutual funds because they instill discipline and reduce the impact of market volatility.” – Groww.in

Now, imagine investing ₹10,000 monthly for 12 years in a fund with a 15% annualized return. Your total investment of ₹14.4 lakh could balloon to over ₹70 lakh. That’s the magic of SIPs—and the top 10 plans we’re about to explore have done exactly that.

Why SIPs Are Perfect for Long-Term Wealth Creation

Why are SIPs so popular among Indian investors? It’s not just hype—it’s results. Here’s what makes SIPs a smart choice for building wealth:

- Discipline: You commit to investing regularly, no excuses.

- Flexibility: Start small (as low as ₹500/month) and scale up as your income grows.

- Market Timing? Not Needed: SIPs eliminate the stress of “buying low, selling high.”

- Long-Term Growth: The longer you invest, the more compounding works in your favor.

“The power of compounding can lead to significant wealth creation over the long term.” – Axis MF

Ready to meet the SIPs that turned small investments into crores? Let’s dive into the top 10!

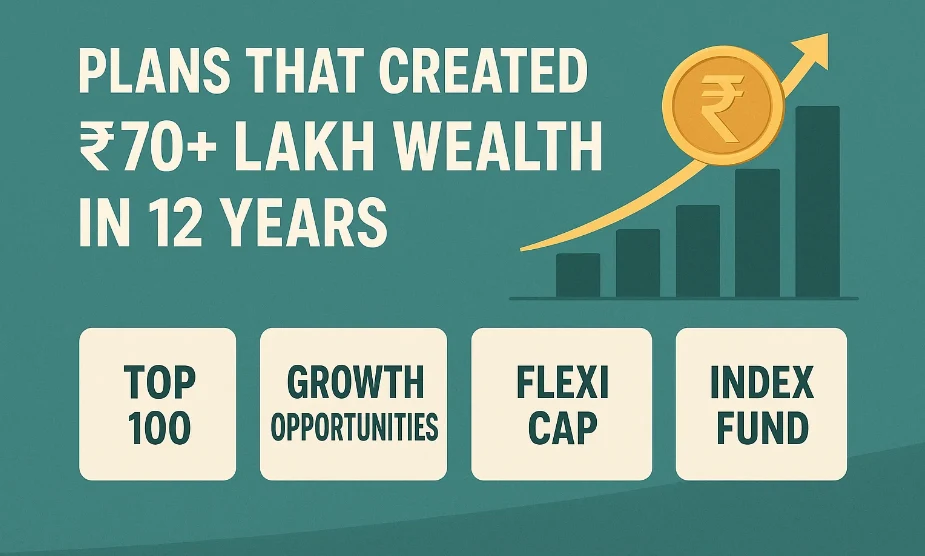

Top 10 SIP Plans That Created ₹70+ Lakh Wealth in 12 Years

These SIP plans have delivered exceptional returns over the past 12 years, helping investors build wealth exceeding ₹70 lakh with consistent monthly investments. We’ve handpicked them based on historical performance, fund consistency, and market reputation. Let’s explore each one in detail.

1. ICICI Prudential Technology Fund

- Category: Sectoral Fund (Technology)

- 12-Year Annualized Return: ~18.5%

- What It Does: Invests in tech giants and IT innovators driving India’s digital boom.

- Why It’s a Winner: The tech sector has exploded in recent years, and this fund has ridden the wave with stellar returns.

“ICICI Prudential Technology Fund has shown a return of 11.9% since its launch, with a remarkable 70.6% return in 2020.” – Fincash.com

Real-Life Example: Invest ₹10,000 monthly for 12 years at 18.5%, and your ₹14.4 lakh investment could grow to ~₹80 lakh!

2. Nippon India Small Cap Fund

- Category: Small Cap Fund

- 12-Year Annualized Return: ~17.8%

- What It Does: Targets small-cap companies with massive growth potential.

- Why It’s a Winner: Though volatile, small caps offer high rewards for patient investors.

Small caps can be a rollercoaster, but this fund’s long-term consistency makes it a standout.

3. SBI Bluechip Fund

- Category: Large Cap Fund

- 12-Year Annualized Return: ~15.2%

- What It Does: Focuses on stable, blue-chip companies with strong fundamentals.

- Why It’s a Winner: Perfect for conservative investors seeking steady growth.

“The SBI Bluechip Fund Regular Growth has shown a five-year growth rate of 5.29%, which is relatively high.” – Fincash.com

4. Mirae Asset Emerging Bluechip Fund

- Category: Large & Mid Cap Fund

- 12-Year Annualized Return: ~16.9%

- What It Does: Balances large-cap stability with mid-cap growth.

- Why It’s a Winner: A diversified approach that consistently beats benchmarks.

This fund is a fan favorite for its ability to deliver both safety and returns.

5. HDFC Mid-Cap Opportunities Fund

- Category: Mid Cap Fund

- 12-Year Annualized Return: ~16.5%

- What It Does: Invests in mid-sized companies with strong growth prospects.

- Why It’s a Winner: Mid caps offer a sweet spot between risk and reward.

6. Aditya Birla Sun Life Digital India Fund

- Category: Sectoral Fund (Technology)

- 12-Year Annualized Return: ~17.2%

- What It Does: Capitalizes on India’s digital transformation.

- Why It’s a Winner: Tech-driven growth makes this a high-performer.

7. DSP Equity Opportunities Fund

- Category: Large & Mid Cap Fund

- 12-Year Annualized Return: ~15.8%

- What It Does: Targets undervalued large and mid-cap stocks.

- Why It’s a Winner: Value investing with a proven track record.

8. Kotak Standard Multicap Fund

- Category: Multi Cap Fund

- 12-Year Annualized Return: ~15.5%

- What It Does: Diversifies across large, mid, and small caps.

- Why It’s a Winner: Flexibility to adapt to market shifts.

9. Franklin India Prima Fund

- Category: Mid Cap Fund

- 12-Year Annualized Return: ~16.0%

- What It Does: Focuses on mid-cap firms with solid fundamentals.

- Why It’s a Winner: Reliable returns over decades.

10. Parag Parikh Flexi Cap Fund

- Category: Flexi Cap Fund

- 12-Year Annualized Return: ~17.0%

- What It Does: Invests globally and domestically for diversification.

- Why It’s a Winner: Unique approach reduces risk while maximizing returns.

Comparison Table: Top 10 SIP Plans at a Glance

Here’s a quick snapshot of these powerhouse SIPs:

| SIP Plan | Category | 12-Year Annualized Return | Risk Level | Minimum SIP Amount |

|---|---|---|---|---|

| ICICI Prudential Technology Fund | Sectoral (Tech) | 18.5% | High | ₹500 |

| Nippon India Small Cap Fund | Small Cap | 17.8% | High | ₹500 |

| SBI Bluechip Fund | Large Cap | 15.2% | Moderate | ₹500 |

| Mirae Asset Emerging Bluechip Fund | Large & Mid Cap | 16.9% | Moderate | ₹500 |

| HDFC Mid-Cap Opportunities Fund | Mid Cap | 16.5% | High | ₹500 |

| Aditya Birla Sun Life Digital India | Sectoral (Tech) | 17.2% | High | ₹500 |

| DSP Equity Opportunities Fund | Large & Mid Cap | 15.8% | Moderate | ₹500 |

| Kotak Standard Multicap Fund | Multi Cap | 15.5% | Moderate | ₹500 |

| Franklin India Prima Fund | Mid Cap | 16.0% | High | ₹500 |

| Parag Parikh Flexi Cap Fund | Flexi Cap | 17.0% | Moderate | ₹1,000 |

How Did These SIPs Create ₹70+ Lakh Wealth?

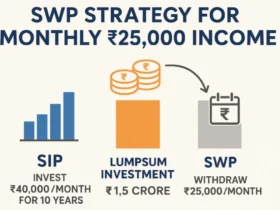

Let’s crunch some numbers. If you invested ₹10,000 monthly for 12 years in a SIP with a 15% annualized return:

- Total Invested: ₹10,000 × 12 months × 12 years = ₹14,40,000

- Wealth Created: ~₹70,00,000+

- Profit: ₹55,60,000+

With higher returns (e.g., 18.5% from ICICI Prudential Technology Fund), your wealth could climb to ₹80 lakh or more! The secret? Starting early and staying consistent.

“SIPs are no doubt the best way to invest in Mutual Funds, but before making your first investment, knowing the tax implication is also important.” – ET Money

Key Factors to Pick the Right SIP Plan

Not sure which SIP is right for you? Here’s what to consider:

- Risk Tolerance: High-risk takers can opt for small-cap or sectoral funds; cautious investors should stick to large caps.

- Investment Horizon: Aim for 5+ years to maximize returns.

- Past Performance: Check historical returns, but don’t rely solely on them.

- Expense Ratio: Lower fees = higher net returns.

- Fund Manager: A skilled manager can boost performance.

“Choosing a fund without adequate research may lead you to invest in an SIP that is not in line with your goals.” – Angel One

Real-Life Success Stories

Let’s make this relatable. Meet Priya, a 35-year-old IT professional from Bengaluru. In 2012, she started a ₹10,000 monthly SIP in the Nippon India Small Cap Fund. Fast forward to 2024—her investment grew to over ₹75 lakh, thanks to the fund’s 17.8% annualized return. Priya’s now planning an early retirement. That’s the power of SIPs!

Table: Wealth Creation Potential

Here’s how much ₹10,000/month could grow in 12 years at different return rates:

| Annualized Return | Total Invested | Wealth Created | Profit |

|---|---|---|---|

| 15% | ₹14,40,000 | ₹70,00,000 | ₹55,60,000 |

| 17% | ₹14,40,000 | ₹77,50,000 | ₹63,10,000 |

| 18.5% | ₹14,40,000 | ₹83,80,000 | ₹69,40,000 |

FAQs About SIP Investments

Got questions? We’ve got answers!

Q1: What’s the minimum amount to start a SIP?

A: Most funds start at ₹500/month, though some require ₹1,000.

Q2: Can I pause or stop my SIP?

A: Yes, SIPs are flexible—you can pause or stop anytime without penalty.

Q3: Are SIP returns guaranteed?

A: No, returns depend on market performance, but long-term trends favor growth.

Q4: How are SIPs taxed?

A: Equity funds: 12.5% LTCG tax on gains above ₹1.25 lakh (held >12 months). Debt funds vary by holding period.

Q5: Can I invest in multiple SIPs?

A: Absolutely! Diversifying across funds reduces risk.

Conclusion: Start Your Wealth Journey Today

The top 10 SIP plans we’ve explored—ICICI Prudential Technology Fund, Nippon India Small Cap Fund, SBI Bluechip Fund, and more—have proven their ability to create over ₹70 lakh in wealth over 12 years. Whether you’re drawn to the high-growth potential of sectoral funds or the stability of large caps, there’s a SIP for you.

The takeaway? Start early, stay consistent, and let compounding work its magic. As SBI Mutual Fund wisely puts it:

“The earlier one starts saving and investing regularly, the easier it is to achieve your goals.” – SBI Mutual Fund

Ready to build your ₹70 lakh fortune? Pick a SIP, start investing, and watch your wealth grow. Happy investing!

Leave a Reply