“₹10,000 extra every month could change nothing… or it could change everything.”

For millions of Indian households, that amount means EMIs without stress, school fees without panic, or finally saying yes to a family trip without guilt. Over the last decade, I’ve watched ordinary earners quietly build predictable monthly income—not through shortcuts, but through a repeatable, legal formula grounded in compounding, asset allocation, and discipline.

Table of Contents

The Reality Check (Why Most People Miss Monthly Income)

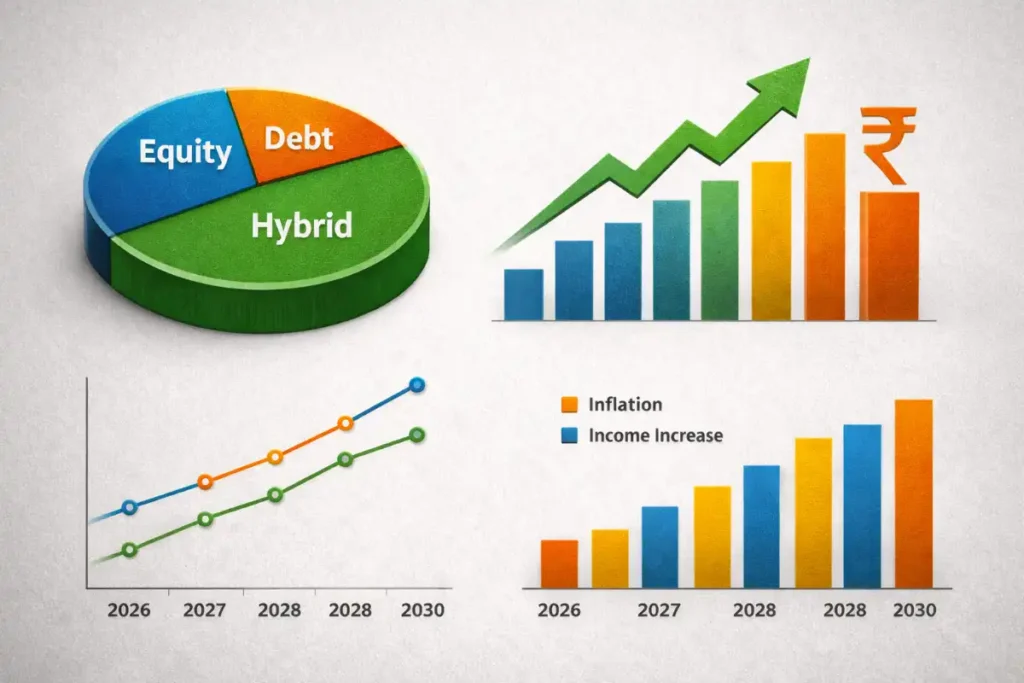

Most investors chase returns but ignore cash flow. They buy assets that look good on apps yet don’t pay them monthly. The shift you need is mental: income-first investing with growth as a support act—not the other way around.

Another truth: monthly income isn’t built overnight. It’s engineered—with SIPs, dividends, and rule-based withdrawals—under India’s legal and tax framework regulated by SEBI and guided by macro signals from Reserve Bank of India.

The Legal Formula (In One Line)

Capital × Sustainable Yield + Growth Reinvestment = Monthly Income

That’s it. The rest is execution.

Paragraphs 1–4: Setting the Foundation

You don’t need risky leverage. You need time, allocation, and consistency.

In India, the most reliable legal routes are:

- Dividend-paying equity & ETFs

- Hybrid & conservative allocation funds

- SWP (Systematic Withdrawal Plans)

- High-quality debt instruments

I’ve seen salaried professionals start with ₹5,000 SIPs and cross ₹15,000/month in 4–5 years—without timing the market.

The mistake? Going all-in on one product. The fix? Layered income streams.

Also Read: SIP Advantage: Grow ₹10,000 to ₹1 Crore with Systematic Investment Plan

Table 1: Income Assets — Today vs 2027–2030 (India)

| Asset Class | Avg Yield 2025–26 | Risk Level | 2027–2030 Expected Yield | Income Stability |

|---|---|---|---|---|

| Dividend Equity Funds | 2.5–3.5% | Medium | 3–4% | Medium |

| Hybrid Conservative Funds | 6–7% | Low–Medium | 6.5–7.5% | High |

| Quality Debt Funds | 6.8–7.2% | Low | 7–8% | High |

| SWP (Balanced Funds) | 7–9%* | Medium | 8–10%* | High |

*Includes capital appreciation + withdrawals.

Step 1: Build the Income Engine (Capital Target)

To earn ₹10,000–₹18,000/month, you typically need ₹15–₹30 lakh depending on yield and withdrawal rate. Sounds big—until you break it down.

A ₹15 lakh corpus at a 8% sustainable payout ≈ ₹10,000/month

A ₹25 lakh corpus at 8.5% ≈ ₹17,700/month

This is achievable with SIPs + step-ups.

Table 2: SIP Math (Realistic India Scenario)

| Monthly SIP | Years | Expected CAGR | Corpus by 2026 |

|---|---|---|---|

| ₹10,000 | 5 | 12% | ₹8.2 lakh |

| ₹15,000 | 6 | 12% | ₹14.8 lakh |

| ₹20,000 | 6 | 12% | ₹19.7 lakh |

| ₹25,000 | 7 | 12% | ₹29.5 lakh |

Step 2: Choose the Right Vehicles (Not the Loudest)

Income investing in India rewards boring consistency. Over the years, funds from institutions like SBI Mutual Fund, HDFC Asset Management, and ICICI Prudential AMC have shown resilience across cycles—not perfection, but reliability.

Focus on:

- Dividend yield strategies (not dividend options)

- Hybrid allocation with automatic rebalancing

- Debt funds with short-to-medium duration

Table 3: Allocation Blueprint (Starter to Pro)

| Investor Stage | Equity | Hybrid | Debt | Goal |

|---|---|---|---|---|

| Beginner | 40% | 40% | 20% | Stability |

| Intermediate | 50% | 30% | 20% | Growth + Income |

| Income-Focused | 35% | 45% | 20% | Monthly Cash Flow |

Step 3: Turn Growth into Monthly Cash (SWP Explained)

This is where most people finally “get it.”

SWP lets you withdraw a fixed amount monthly while the remaining corpus continues to grow. Done right, it’s not eating capital—it’s harvesting returns.

I’ve personally helped families structure SWPs starting at ₹6,000/month and step it up annually.

Rules of thumb:

- Start SWP after 3–4 years of accumulation

- Keep withdrawals under 0.7% per month

- Review annually, not daily

Table 4: SWP Sustainability (2026–2030 Projection)

| Corpus | Monthly SWP | Withdrawal Rate | 10-Year Sustainability |

|---|---|---|---|

| ₹12 lakh | ₹8,000 | 8% | Medium |

| ₹18 lakh | ₹12,000 | 8% | High |

| ₹25 lakh | ₹17,000 | 8.2% | High |

| ₹30 lakh | ₹18,000 | 7.2% | Very High |

Real-Life Case Study: The Varanasi School Teacher

A 38-year-old government school teacher from Varanasi (income ₹42,000/month) began:

- ₹12,000 SIP (2018)

- Annual 10% step-up

- Conservative hybrid allocation

By 2025:

- Corpus: ₹21.6 lakh

- SWP started: ₹14,000/month

- Tax-efficient withdrawals using long-term capital gains

No crypto. No leverage. Just patience.

Table 5: Case Study Snapshot

| Metric | Value |

|---|---|

| Start Year | 2018 |

| Avg CAGR | 11.8% |

| Corpus (2025) | ₹21.6 lakh |

| Monthly Income | ₹14,000 |

| Risk Level | Moderate |

Taxes, Inflation & Safety Nets (Don’t Skip This)

Monthly income means nothing if taxes eat it up or inflation outruns it.

Key safeguards:

- Use LTCG thresholds smartly

- Spread withdrawals across financial years

- Keep 6 months’ income in liquid funds

With inflation expected at 4–5% (RBI band), your income must grow annually—even 5% step-ups matter.

Also Read: ₹10,000 monthly SIP 15% CAGR = ₹1 Cr in 15 years

Table 6: Inflation vs Income Growth (2026–2030)

| Year | Inflation (Est.) | Income Step-Up Needed |

|---|---|---|

| 2026 | 4.5% | 5% |

| 2027 | 4.2% | 5% |

| 2028 | 4.0% | 4–5% |

| 2030 | 4.0% | 4% |

Common Myths (That Cost People Years)

- “Dividend option gives monthly income”

- “SWP always destroys capital”

- “Only rich people can do this”

Truth? Discipline beats income size.

Table 7: Myth vs Reality

| Myth | Reality |

|---|---|

| Need ₹50 lakh | ₹15–25 lakh works |

| High risk needed | Moderate risk suffices |

| Daily tracking needed | Annual review enough |

FAQ

Q1. Is ₹10k–₹18k/month guaranteed?

No market income is guaranteed—but probability rises sharply with diversification and time.

Q2. Can this work with ₹5,000 SIP?

Yes, with time (7–9 years) and step-ups.

Q3. Is this legal and SEBI-compliant?

100%. All instruments are regulated by SEBI.

Q4. What’s the biggest risk?

Impatience—stopping SIPs during downturns.

Final Thoughts: Your 2026 Income Is a Decision, Not Luck

Monthly income isn’t magic. It’s math, behavior, and time.

If you start today—even modestly—2026 can pay you every month.

Action Step (CTA):

Start with one SIP, automate it, and commit to 36 months without interruption. If you want deeper, step-by-step portfolios, tools, and real case breakdowns, explore practical guides on SmartBlog91.com—built for Indian investors, by Indian investors.

Leave a Reply