A Dream That Feels Impossible… Until the Math Speaks

At some point, every middle-class Indian silently thinks:

“₹5 crore… that’s for industrialists, startup founders, or lottery winners — not people like me.”

But here’s the uncomfortable truth:

₹5 crore isn’t a dream problem. It’s a discipline + math problem.

When Investography’s Shweta Jain recently broke down the numbers behind a ₹5 crore corpus in 10 years, something clicked for thousands of investors. Not because she promised shortcuts — but because she didn’t.

Table of Contents

She spoke about:

- Life-stage based investing

- Risk appetite (not Instagram risk appetite)

- Time-adjusted SIP math

- And most importantly — why most people fail even with good returns

Why “₹5 Crore in 10 Years” Is a Dangerous Question

Before asking how, Shweta Jain insists on asking why.

Most investors approach wealth like this:

“Tell me the fund. Tell me the return. I’ll manage the rest.”

That mindset destroys portfolios.

Because ₹5 crore could mean:

- Early retirement at 45

- Financial freedom with passive income

- Children’s education + legacy wealth

- Or just ego validation

Each goal needs a completely different portfolio.

The Real Mistake People Make

They chase returns first, and purpose later.

And markets punish that.

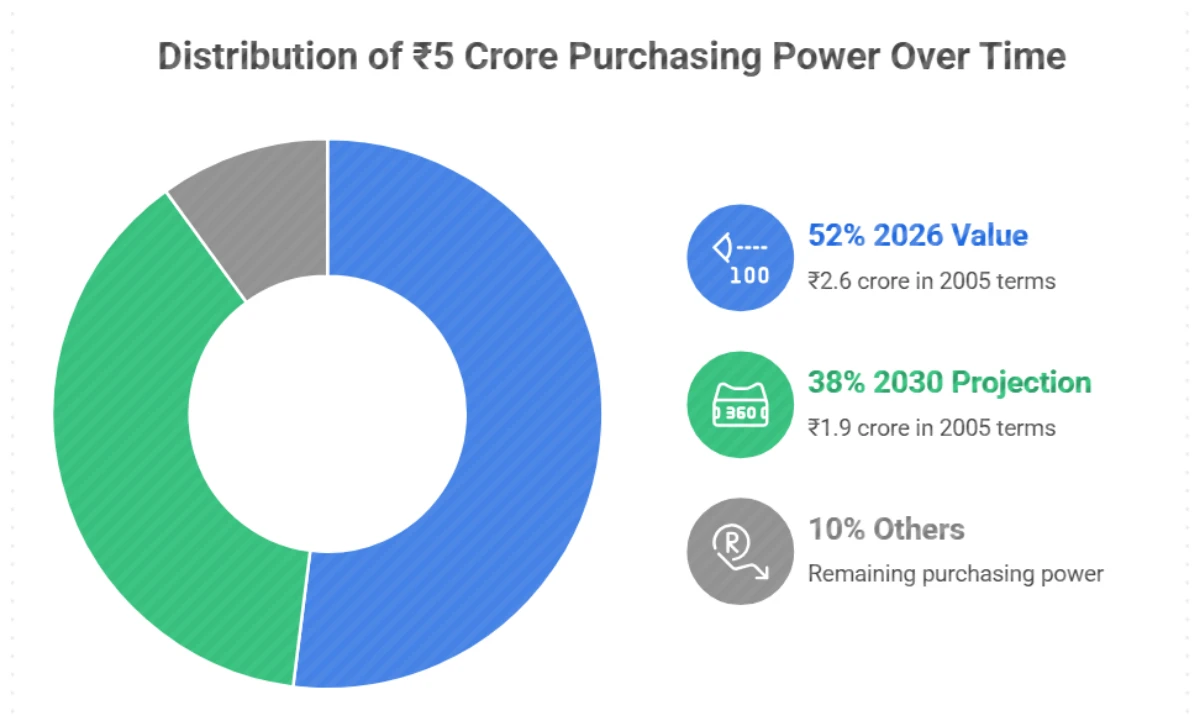

Reality Check: What ₹5 Crore Actually Means in 2026

| Metric | 2026 Value | 2030 Projection |

|---|---|---|

| ₹5 crore purchasing power | ≈ ₹2.6 crore (2005 terms) | ≈ ₹1.9 crore |

| Inflation assumption | 5.8% | 6–6.2% |

| Annual living expense (upper middle class) | ₹15–18 lakh | ₹22–25 lakh |

| Years corpus can last (4% rule) | 27–30 years | 22–24 years |

Insight:

₹5 crore is not “luxury wealth” anymore.

It’s defensive wealth against inflation.

Shweta Jain’s Core Principle: Align Money With Life, Not Markets

Shweta Jain doesn’t start with funds.

She starts with life math.

She asks investors:

- How stable is your income?

- Can you emotionally handle 30–40% drawdowns?

- Do you need money during the 10-year window?

- Is your job cyclical or stable?

Only then does asset allocation begin.

“Returns don’t matter if investors exit at the wrong time.” — Shweta Jain

This single sentence explains 90% of retail failure.

Also Read: Rs 13,000 SIP: The Journey From ₹0 to ₹9 Crore

Risk Appetite vs Risk Capacity (Most Confuse These)

| Factor | Risk Appetite | Risk Capacity |

|---|---|---|

| Definition | Emotional tolerance | Financial ability |

| Influenced by | Personality, fear | Income, age, liabilities |

| Changes with market | Yes | Rarely |

| Determines allocation | ❌ | ✅ |

Expert takeaway:

Portfolios should be built on risk capacity, not confidence during bull markets.

The Math Everyone Avoids: How ₹5 Crore Is Actually Built

Let’s remove motivation.

Let’s bring calculators.

Scenario 1: Aggressive Yet Realistic (High Risk Capacity)

Assumptions:

- Equity-heavy portfolio

- CAGR: 15.5%

- SIP duration: 10 years

| Monthly SIP | Total Invested | Corpus in 10 Years |

|---|---|---|

| ₹1.5 lakh | ₹1.8 crore | ₹4.9–5.2 crore |

| ₹1.25 lakh | ₹1.5 crore | ₹4.2 crore |

| ₹1 lakh | ₹1.2 crore | ₹3.4 crore |

Truth bomb:

₹5 crore needs either time or cash flow.

There is no third option.

Scenario 2: Balanced Investor (Most Professionals)

Assumptions:

- Equity + debt + alternatives

- CAGR: 12.5%

| Monthly SIP | Corpus in 10 Years |

|---|---|

| ₹2 lakh | ₹4.6–4.8 crore |

| ₹1.75 lakh | ₹4.1 crore |

| ₹1.5 lakh | ₹3.5 crore |

This is where goal mismatch frustration begins.

Why Chasing 20% Returns Usually Ends in Zero Discipline

Shweta Jain repeatedly warns against “return porn”.

The problem isn’t low returns.

The problem is return inconsistency + emotional exits.

Data proves this.

| Investor Behavior | Actual Fund CAGR | Investor CAGR |

|---|---|---|

| Disciplined SIP | 14–16% | 13–15% |

| Entry/exit timing | 14–16% | 6–8% |

| Trend chasing | 18% (peak years) | 4–6% |

Markets reward patience, not intelligence.

Asset Allocation Blueprint (2026–2036 Projection)

This is where Shweta Jain’s philosophy shines.

Instead of asking “Which fund?”, she asks:

“Which bucket does this money belong to?”

Also Read: How to Start Investing with Just ₹5,000: Growing Your Wealth

Model Allocation (High Income, Age 30–40)

| Asset Class | Allocation | Expected CAGR |

|---|---|---|

| Equity (India + Global) | 65% | 14–15% |

| Debt | 20% | 6.5–7% |

| Gold/REITs | 10% | 7–9% |

| Cash | 5% | Stability |

Blended CAGR: ~12.8–13.2%

Case Study: Rajiv Didn’t Increase Returns — He Increased Clarity

Rajiv, 34, Bengaluru.

Tech lead. ₹32 lakh CTC.

His mistake?

- 9 mutual funds

- No clear goal

- Panic redemption in 2020

- Re-entered in 2021 peak

After restructuring using goal buckets:

- Retirement bucket (10+ years)

- Medium-term wealth bucket

- Emergency buffer

Result after 3 years:

- Same funds

- Same market

- But behavior changed

| Metric | Before | After |

|---|---|---|

| Annual churn | 28% | <5% |

| SIP consistency | Broken | 100% |

| Stress level | High | Low |

Wealth doesn’t grow faster.

It leaks slower.

The 3 Silent Killers of ₹5 Crore Dreams

1. Lifestyle Inflation

Raises SIP stress.

2. Over-diversification

Creates monitoring fatigue.

3. Ignoring tax efficiency

Reduces real CAGR by 1–2%.

| Leak | Long-Term Impact |

|---|---|

| 1% CAGR loss | –₹75–90 lakh |

| Panic exit once | –2–3 years |

| Poor tax planning | –₹40–60 lakh |

What Shweta Jain Gets Right (And Most Influencers Don’t)

She doesn’t sell:

- “One fund to rule them all”

- “Secret strategy”

- “Guaranteed CAGR”

She sells process discipline.

And process compounds.

FAQ: ₹5 Crore in 10 Years — Honest Answers

Is ₹5 crore realistic for salaried people?

Yes — high-income + disciplined investors, not average savers.

Can I do it with ₹50,000 SIP?

No. Math doesn’t care about motivation.

Should I go 100% equity?

Only if your income and temperament can survive crashes.

What if returns are lower?

Increase duration or SIP. Never force returns.

Final Truth: Wealth Is Built Quietly, Not Virally

₹5 crore won’t come from:

- Viral reels

- Telegram tips

- One lucky fund

It comes from:

- Unsexy SIPs

- Boring asset allocation

- Emotional maturity during crashes

That’s the real message behind Shweta Jain’s math.

1 Comment