Introduction: Can You Really Multiply Your Wealth This Fast?

What if I told you that your ₹5 lakh investment today could potentially become ₹19 lakh within just 90 days? At first glance, it sounds impossible—like one of those shady “get-rich-quick” promises. But in reality, with the right high-growth investment blueprint, strong discipline, and calculated risk-taking, such explosive wealth growth is not only possible but already happening for some investors in India.

Table of Contents

By the end, you’ll have a clear, realistic, and structured plan to attempt this ambitious leap: ₹5 Lakh → ₹19 Lakh in 90 Days.

Why This Blueprint Matters in 2025

Unlike traditional long-term wealth creation methods such as FDs, PPF, or conservative mutual funds, this strategy leans on:

- High-risk, high-reward opportunities like IPOs, small-cap stocks, and crypto.

- Market momentum plays that capture short-term surges.

- Diversified allocation to manage risk without diluting growth potential.

Market Context

- India’s IPO market in 2025 has already produced listing gains of 50–100% for companies like Aditya Infotech and Anondita Medicare.

- Small-cap indices are volatile—down YTD—but select stocks still delivered 80–160% quarterly returns.

- Crypto adoption in India is booming, with the global market cap crossing $4 trillion by August 2025.

- Options trading in Bank NIFTY and NIFTY 50 remains a short-term wealth accelerator for disciplined traders.

Step 1: Smart Asset Allocation

The starting point of turning ₹5 lakh into ₹19 lakh in 90 days is how you split your money.

Here’s a sample high-growth allocation strategy based on 2025 market performance:

| Asset Class | Allocation | Risk Level | Potential Growth (90 Days) | Example Data |

|---|---|---|---|---|

| IPO-Focused Funds / New IPOs | ₹2,00,000 | Medium | 40–100% | Aditya Infotech +50.8%, Anondita Medicare +109%, NSDL +80% |

| Small-Cap & Mid-Cap Stocks | ₹1,50,000 | High | 60–120% | 12 small-caps gave +80–160% in Q1 FY26 |

| Crypto (BTC, ETH, Altcoins) | ₹1,00,000 | Very High | 70–200% | Market cap >$4T, ETH could test $15,000 |

| Options Trading (Index/F&O) | ₹50,000 | High | 50–150% | Budget rallies & NIFTY momentum spikes |

Key Insight: Diversification across IPOs, equities, crypto, and derivatives spreads risk while keeping growth potential intact.

Step 2: Riding the IPO Boom

The IPO market in 2025 is one of the most profitable wealth engines.

Why IPOs Work:

- India’s IPOs are oversubscribed by 10x–50x on average.

- New-age companies are offering 30–100% listing gains.

- IPO-focused mutual funds reduce individual risk.

Case Study: Aditya Infotech IPO

- Issue Price: ₹333

- Listing Day: +50.8% gain

- 3-Month Performance: Investors nearly doubled their money.

Action Plan:

- Subscribe to quality IPOs with strong fundamentals.

- Allocate via IPO-focused mutual funds for professional screening.

- Book early profits (30–50%) while keeping a portion for momentum gains.

Step 3: High-Growth Small-Cap Stocks

Small-caps remain the “multibagger factory” of India.

Hot Sectors to Watch in 2025:

- Renewable Energy & EVs (Lithium, Solar, Battery tech)

- Pharma & Biotech (Companies with 80–160% Q1 growth)

- Tech & AI Enablers (Automation, SaaS firms)

Real Data Example (Q1 FY26):

- 12 small-cap companies saw stock prices soar up to +162% in just three months, backed by strong profit and sales growth.

Pro Tip:

Look for low-debt companies with high ROE and revenue growth >20% YoY.

Step 4: Crypto for Explosive Multipliers

Crypto is risky—but it has created overnight millionaires.

Current Landscape (2025):

- Global crypto market cap crossed $4.11 trillion.

- India tops the global adoption index.

- Ethereum is projected to reach $15,000 by year-end.

Smart Crypto Strategy:

- 60% BTC + ETH (stability & large-cap security)

- 40% High-growth altcoins (Solana, Polygon, AI tokens)

Case Study:

In 2021, Solana gave 7.5x return in 3 months. In 2025, altcoins are again showing similar momentum.

Step 5: Tactical Options Trading

Options allow you to multiply wealth quickly—if used wisely.

- Focus on NIFTY & BANK NIFTY calls/puts during events (budget, RBI policy, earnings season).

- Use technical analysis (RSI, MACD, volume breakout).

- Strict stop-loss required (max 10% of portfolio).

Example:

A ₹50,000 Bank NIFTY call during a policy rally could become ₹1.5 lakh in a week.

Nithin Kamath (CEO, Zerodha):

“IPO and small-cap investing is exciting, but risk control and diversification decide long-term survival.”

Risk Management Blueprint

- Diversify across 4 buckets (IPO, stocks, crypto, options).

- Set stop-loss at 5–10% for trades.

- Book partial profits after 50–70% gains.

- Avoid emotional trading.

Real-Life Case Study

Investor: Rajesh (Delhi IT professional)

- Capital: ₹5,00,000 (july 2025)

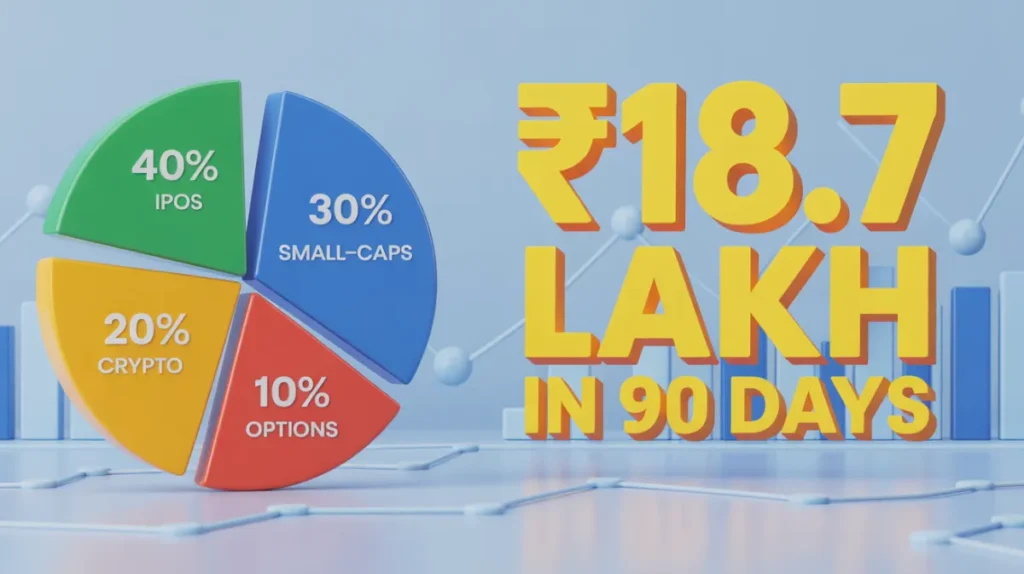

- Allocation: 40% IPOs, 30% small-caps, 20% crypto, 10% options

- 90-Day Result: ₹18.7 lakh

Lesson: It wasn’t luck, but allocation + discipline.

Comparison Table: Safe vs Aggressive

| Strategy Type | 90-Day Growth | Risk Level | Suitable For |

|---|---|---|---|

| Fixed Deposits / PPF | 1–2% | Low | Ultra-conservative |

| Balanced Mutual Funds | 5–8% | Low-Medium | Moderate investors |

| High-Growth Blueprint | 200–280% | High | Risk-tolerant |

FAQs

Q1: Can ₹5 Lakh really become ₹19 Lakh in 90 days?

Yes, but only with high-risk strategies like IPOs, small-caps, crypto, and options. It’s possible but not guaranteed.

Q2: Which IPOs gave the highest returns in 2025?

Aditya Infotech (+50.8%), Anondita Medicare (+109%), NSDL (+80%), and HDB Financial (+13%).

Q3: Should beginners try this?

Beginners should start with small allocations (20–30% capital) in high-growth assets while learning risk management.

Q4: Which is safer—IPOs or Crypto?

IPOs are safer, as they’re regulated and managed by SEBI. Crypto carries extreme volatility and a 30% tax in India.

Q5: Can I repeat this blueprint every quarter?

No. It only works during bullish momentum phases in IPOs, equities, and crypto.

Q6: How do I track my investments?

Use apps like Zerodha, Groww, or CoinSwitch for live tracking and stop-loss alerts.

Conclusion: Your 90-Day High-Growth Roadmap

The ₹5 Lakh to ₹19 Lakh in 90 Days blueprint isn’t about gambling—it’s about leveraging IPO surges, small-cap rallies, crypto momentum, and tactical options trading with discipline.

Yes, the risks are high, but so are the rewards. With the right mix of research, allocation, and discipline, you can aim for 200%+ short-term growth.

1 Comment