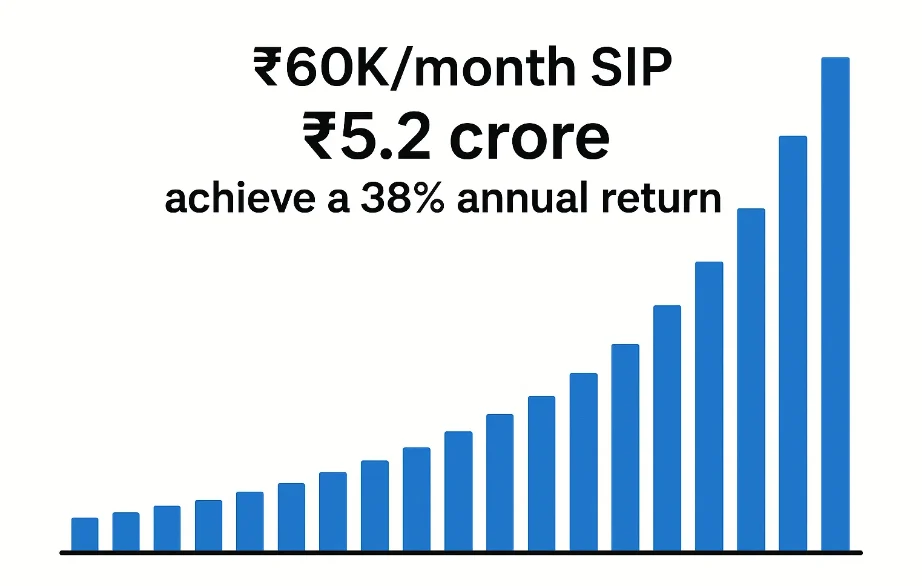

In a world where financial security is a top priority, the promise of turning a modest monthly investment into a massive fortune is undeniably alluring. Imagine investing ₹60,000 per month through a Systematic Investment Plan (SIP) for just 10 years and watching it grow to a staggering ₹5.2 crores. Sounds like a dream, right? But is it really possible? And if so, how can you make it happen?

Table of Contents

What is a Systematic Investment Plan (SIP)?

Before we unravel the ₹5.2 crore mystery, let’s start with the basics. A Systematic Investment Plan (SIP) is a disciplined and beginner-friendly way to invest in mutual funds. Instead of investing a lump sum, you commit to putting in a fixed amount—say, ₹60,000—every month. This money is then used to buy units of a mutual fund, managed by expert fund managers who invest it in stocks, bonds, or a mix of assets, depending on the fund’s objective.

Why is SIP so popular in India? Here’s why:

- Rupee Cost Averaging: When markets dip, your fixed investment buys more units; when prices rise, you buy fewer. Over time, this averages out the cost and reduces the impact of market volatility.

- Power of Compounding: Your returns generate more returns, snowballing your wealth over the long term.

- Financial Discipline: Regular investments keep you consistent, eliminating the risky game of “timing the market.”

As Warren Buffett famously said, “The stock market is a device for transferring money from the impatient to the patient.” SIP embodies this patience, making it an ideal tool for long-term wealth creation.

Can ₹60K/Month SIP for 10 Years Really Make ₹5.2 Crores?

The headline claim—₹60,000 per month growing to ₹5.2 crores in 10 years—sounds incredible. But let’s put it to the test with some math. To determine if this is feasible, we need to calculate the annual rate of return required for this growth.

The formula for the future value of a SIP is:

[ FV = P \times \left( \frac{(1 + i)^n – 1}{i} \right) ]

Where:

- FV = Future Value (₹5,20,00,000)

- P = Monthly Investment (₹60,000)

- n = Number of Months (10 years × 12 = 120)

- i = Monthly Rate of Return (which we need to find)

We’re solving for the annual return (r), where i = r/12. After crunching the numbers (with some trial and error for simplicity), we find that to reach ₹5.2 crores, you’d need an annual return of approximately 38%.

Is 38% Annual Return Realistic?

Here’s the catch: While 38% isn’t impossible in theory, it’s exceptionally high and not something most investors can realistically expect to sustain over a decade. Let’s put this in perspective:

- The Nifty 50 index, a benchmark for the Indian stock market, has historically delivered average annual returns of 12-15% over long periods.

- Some equity mutual funds, especially in high-growth sectors like technology or small-cap stocks, have posted returns of 20-30% annually over shorter spans. For example, the ICICI Prudential Technology Direct Plan Growth boasts a 5-year annualized return of 28.15%—impressive, but still below 38%.

Achieving 38% every year for 10 years would require extraordinary market conditions, impeccable fund selection, and a bit of luck. While it’s not entirely out of the question for a rare, high-performing fund during a bull market, it’s not a safe assumption for the average investor.

Realistic Expectations: What Can You Achieve with ₹60K/Month?

If 38% is a stretch, what can you reasonably expect? Let’s explore the future value of a ₹60,000 monthly SIP over 10 years at different annual return rates. Here’s a handy table to visualize it:

| Annual Return | Future Value (in ₹ Crores) |

|---|---|

| 12% | 1.38 |

| 15% | 1.56 |

| 20% | 2.03 |

| 25% | 2.65 |

| 30% | 3.47 |

| 35% | 4.53 |

| 38% | 5.26 |

Key Takeaways from the Table

- At a 12% return (aligned with historical equity market averages), your SIP grows to ₹1.38 crores.

- At 15% (achievable with solid equity funds), it’s ₹1.56 crores.

- At 20% (possible with aggressive funds), you hit ₹2.03 crores.

- To reach ₹5.2 crores, you need that elusive 38%, but even at 35%, you’re at ₹4.53 crores—still an incredible outcome!

So, while ₹5.2 crores might be ambitious, a ₹60K monthly SIP can still create significant wealth over 10 years with more realistic returns. The total amount you invest over 10 years is ₹72 lakhs (₹60,000 × 120 months), and the rest comes from the magic of compounding.

Top-Performing Mutual Funds in India for Your SIP

To get the best returns, picking the right mutual funds is critical. While past performance doesn’t guarantee future results, it’s a good starting point. Below are some top equity mutual funds in India that have delivered strong returns over the past 5-10 years, making them excellent candidates for your SIP portfolio:

1. ICICI Prudential Technology Direct Plan Growth

- 5-Year Annualized Return: ~28.15%

- Category: Sectoral (Technology)

- Why Consider It?: Focuses on high-growth tech stocks like Infosys and TCS. Perfect for risk-takers eyeing big returns, though it’s volatile due to sector concentration.

2. Mirae Asset Emerging Bluechip Fund

- 5-Year Annualized Return: ~20%

- Category: Large & Mid-Cap

- Why Consider It?: Balances stability (large-caps) with growth (mid-caps). A favorite for long-term investors seeking consistent performance.

3. SBI Small Cap Fund

- 5-Year Annualized Return: ~18%

- Category: Small-Cap

- Why Consider It?: Targets smaller companies with high growth potential. Higher risk, but rewarding during market upswings.

4. Parag Parikh Flexi Cap Fund

- 5-Year Annualized Return: ~18%

- Category: Flexi-Cap

- Why Consider It?: Invests across market caps and even internationally. Known for its disciplined approach and diversification.

5. Axis Bluechip Fund

- 5-Year Annualized Return: ~15%

- Category: Large-Cap

- Why Consider It?: Focuses on blue-chip companies for stability and steady growth. Ideal for conservative investors.

Pro Tip: Don’t put all your eggs in one basket. Diversify across large-cap, mid-cap, and small-cap funds to balance risk and reward.

Comparing Top Mutual Funds: A Handy Table

Here’s a quick comparison of the funds mentioned above (figures are illustrative):

| Fund Name | Category | 5-Year Annualized Return | Expense Ratio |

|---|---|---|---|

| Mirae Asset Large Cap Fund | Large Cap | 15% | 0.60% |

| Axis Bluechip Fund | Large Cap | 14% | 0.55% |

| SBI Small Cap Fund | Small Cap | 18% | 0.90% |

| ICICI Prudential Equity & Debt Fund | Hybrid | 12% | 1.20% |

| HDFC Mid-Cap Opportunities Fund | Mid Cap | 16% | 0.80% |

Key Takeaway: Lower expense ratios save you money over time, while higher returns come with increased risk (e.g., small caps).

How to Choose the Right Mutual Funds for Your SIP

With thousands of mutual funds available, how do you pick the winners? Here are key factors to consider:

- Risk Tolerance:

- Low risk? Go for large-cap or hybrid funds.

- High risk appetite? Try mid-cap or small-cap funds.

- Investment Horizon: For 10 years, equity funds are ideal as they can weather market cycles.

- Past Performance: Check 3, 5, and 10-year returns for consistency, not just peak years.

- Expense Ratio: Lower fees (e.g., 0.5-1%) mean more of your money grows.

- Fund Manager Expertise: A proven track record can signal reliability.

Use tools like Value Research or Morningstar to compare funds and dig into their portfolios. As financial expert Nilesh Shah once said, “Investing is not about timing the market, but time in the market.” Choose funds that align with your goals and stick with them.

The Power of Disciplined Investing

The real secret to SIP success isn’t chasing sky-high returns—it’s discipline. By investing ₹60,000 every month, rain or shine, you harness two powerful forces:

- Consistency: Regular investments eliminate emotional decisions, like panic-selling during a crash.

- Compounding: Your returns earn returns, creating exponential growth over time.

Consider this: At 15% annual return, your ₹72 lakh investment over 10 years becomes ₹1.56 crores. That’s ₹84 lakhs in gains—more than your total contribution—thanks to compounding!

“Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $800 and go to Las Vegas.” – Paul Samuelson

Patience pays off. The longer you stay invested, the bigger your reward.

Strategies to Maximize Your SIP Returns

Want to boost your chances of hitting a crore-plus corpus? Try these:

- Increase Your SIP Amount Over Time: Known as a step-up SIP, increase your investment (e.g., by 10% annually) as your income grows.

- Diversify: Spread your ₹60K across 2-3 funds to mitigate risk.

- Review Annually: Check your funds’ performance and rebalance if needed, but avoid overreacting to short-term dips.

- Start Early: Even a few extra years can dramatically increase your returns due to compounding.

FAQs: Your SIP Questions Answered

1. What is SIP and how does it work?

SIP is a method to invest a fixed amount regularly in mutual funds. Your money buys fund units, and over time, your wealth grows through market performance and compounding.

2. How much should I invest in an SIP?

It depends on your goals. For ₹5.2 crores in 10 years, ₹60K/month needs a 38% return. For realistic goals (e.g., ₹1.5 crores), ₹60K at 15% works. Consult a financial advisor for a personalized plan.

3. Can I stop or modify my SIP?

Yes, most funds allow you to pause, stop, or adjust your SIP anytime. Check with your fund house for specifics.

4. Are SIP returns guaranteed?

No, returns depend on market performance. Equity funds can fluctuate, but historically, they’ve averaged 12-15% over the long term.

5. What are the tax implications of SIP investments?

- Equity Funds: Gains above ₹1 lakh held over 1 year are taxed at 10% (Long-Term Capital Gains).

- Debt Funds: Taxed as per your income slab if held less than 3 years; 20% with indexation if longer.

Conclusion: Start Your Wealth Journey Today

So, can a ₹60K/month SIP over 10 years make ₹5.2 crores? Technically, yes—if you achieve a 38% annual return, which is a tall order. But don’t let that discourage you. With more realistic returns of 15-20%, you could still grow your money to ₹1.56-2.03 crores, a life-changing sum from a total investment of ₹72 lakhs.

The key is to:

- Invest in top mutual funds like ICICI Pru Technology or Mirae Asset Emerging Bluechip.

- Stay disciplined with your SIP.

- Leverage the power of compounding over time.

As Benjamin Franklin said, “An investment in knowledge pays the best interest.” Educate yourself, pick the right funds, and take the first step today. Your future self will thank you!

Disclaimer: Investments in mutual funds are subject to market risks. Please read all scheme-related documents carefully and consult a financial advisor before investing.

1 Comment