Introduction: The Day I Stopped Gambling and Started Compounding

In 2018, I watched a close friend turn ₹4 lakh into ₹11 lakh during a raging bull market. Six months later, that same portfolio was worth ₹2.9 lakh. No risk system. No allocation logic. Just hope, tips, and overconfidence.

Table of Contents

That moment changed how I looked at investing forever.

Real wealth isn’t built by chasing the hottest stock or the next viral trade. It’s built by structure, discipline, and emotional control. After years of market cycles, crashes, rallies, and personal investing mistakes, one framework stood out as both emotionally survivable and financially powerful:

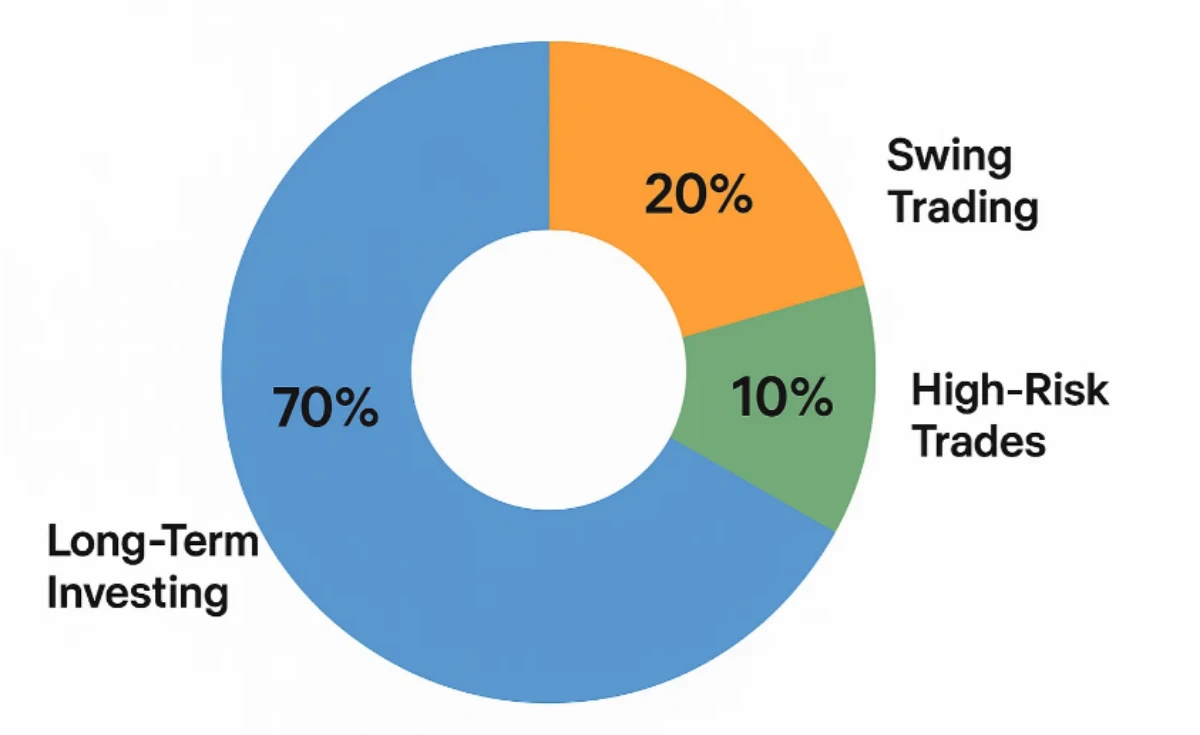

70% Long-Term Investing

20% Swing Trading

10% High-Risk Opportunistic Trades

This is not theory.

This is how real investors survive volatility and still outperform.

Why Portfolio Allocation Matters More Than Stock Selection

Most investors obsess over what to buy. Smart investors focus on how much to allocate.

A well-structured portfolio:

- Protects you during crashes

- Keeps emotions in check

- Allows you to benefit from multiple market phases

- Prevents catastrophic losses

Without allocation, even the best stock ideas fail.

The Psychological Truth Most Gurus Ignore

Markets don’t just test intelligence.

They test patience, fear tolerance, and discipline.

Long-term investing builds wealth.

Swing trading feeds confidence and cash flow.

High-risk trades satisfy curiosity and opportunity—without destroying your base.

That’s why this 70-20-10 framework works so well.

Portfolio Allocation Impact Snapshot (2025–2030)

| Component | Allocation | 2025 Expected CAGR | 2030 Projection | Risk Level |

|---|---|---|---|---|

| Long-Term Core | 70% | 12–15% | 2.3×–2.8× | Low–Moderate |

| Swing Trades | 20% | 18–25% | 3×–4× | Moderate |

| High-Risk Trades | 10% | 30%+ (variable) | 0×–10× | High |

| Overall Portfolio | 100% | 15–18% blended | 3×–4.5× | Balanced |

Part 1: 70% Long-Term Investing – The Wealth Engine

Long-term investing is boring.

And boring is beautiful.

This 70% is what protects you when markets fall and compounds silently when markets rise.

What Goes Into the 70% Bucket?

- Large-cap quality stocks

- Index funds (Nifty 50, Sensex)

- Flexi-cap & large-cap mutual funds

- Strong businesses with cash flow and moats

Think of companies like Reliance, TCS, HDFC Bank, or funds that own them.

Why 70% and Not 100%?

Because humans aren’t robots.

All-long-term portfolios fail not financially—but emotionally. When markets stagnate for years, investors lose patience and exit at the worst time.

The remaining 30% solves that emotional leakage.

Long-Term Investing Reality Check (India)

| Metric | 2010–2024 Actual | 2025–2030 Projection |

|---|---|---|

| Nifty 50 CAGR | ~13.8% | 11–13% |

| Inflation Avg | 6% | 4.5–5.5% |

| Real Return | ~7–8% | ~6–8% |

| ₹10L → Value | ₹56L | ₹1.2–1.5 Cr |

The Compounding Effect Most Investors Underestimate

A ₹10 lakh investment at:

- 12% becomes ₹31 lakh in 10 years

- 15% becomes ₹40 lakh

- 18% becomes ₹52 lakh

That difference is not luck.

It’s allocation discipline + time.

Long-term investing doesn’t make headlines.

It makes millionaires.

Common Long-Term Mistakes (Learned the Hard Way)

- Over-diversification (30+ stocks)

- Panic selling during corrections

- Chasing thematic funds late

- Ignoring valuation

Long-term doesn’t mean lazy.

It means patient but informed.

70% Core Portfolio Growth Projection

| Year | Invested Amount | Value @ 13% CAGR |

|---|---|---|

| 2025 | ₹7,00,000 | ₹7,91,000 |

| 2027 | ₹7,00,000 | ₹10.1L |

| 2030 | ₹7,00,000 | ₹14.9L |

Part 2: 20% Swing Trading – Controlled Aggression

Swing trading is where strategy meets psychology.

This 20% is designed for:

- 2–8 week trades

- Technical + fundamental setups

- Volatility harvesting

Not intraday gambling.

Not Telegram tips.

Why Swing Trading Works in India

India is a volatile, news-driven market:

- Earnings reactions

- Budget rallies

- Sector rotations

- FII/DII flows

Swing trading captures these moves without the stress of daily trading.

Also Read :How to Start Investing with Just ₹5,000: Growing Your Wealth

Real Swing Trade Example

In 2024:

- Stock: PSU Bank

- Entry: ₹82

- Exit: ₹104

- Duration: 6 weeks

- Gain: ~26%

This wasn’t luck.

It was trend + volume + sector momentum.

Swing Trading Risk Control Rules

- Max 2–3% capital risk per trade

- Strict stop losses

- No overtrading

- Journal every trade

Swing trading rewards discipline—not prediction.

Swing Trading Performance Metrics

| Metric | Conservative | Skilled Trader |

|---|---|---|

| Avg Monthly Return | 1.5% | 2.5–3% |

| Annual CAGR | 18–22% | 25–30% |

| Drawdown | Moderate | Controlled |

| Time Commitment | Medium | Medium |

Why 20% Is the Sweet Spot

Less than 10% → insignificant impact

More than 30% → emotional burnout

20% gives:

- Faster portfolio growth

- Liquidity for opportunities

- Psychological satisfaction

It keeps you engaged but not reckless.

20% Swing Portfolio Projection (2025–2030)

| Year | Capital | CAGR 22% |

|---|---|---|

| 2025 | ₹2,00,000 | ₹2.44L |

| 2027 | ₹2,00,000 | ₹3.63L |

| 2030 | ₹2,00,000 | ₹6.52L |

Part 3: 10% High-Risk Trades – Optional, Not Essential

This is the most misunderstood part.

High-risk doesn’t mean stupid.

It means asymmetric opportunity.

What Falls Under High-Risk?

- Small-cap turnarounds

- IPO bets

- Crypto (BTC/ETH exposure)

- Deep value or special situations

This 10% satisfies curiosity without threatening survival.

The Rule That Saves You

Never risk money you can’t emotionally write off.

If this bucket goes to zero—your life doesn’t change.

If it works—it accelerates wealth massively.

Also Read: Make ₹1 Crore by Investing ₹1 Lakh – 4 Powerful Ways

High-Risk Outcomes Reality

| Outcome | Probability | Impact |

|---|---|---|

| 0–50% loss | High | Limited damage |

| 2× return | Medium | Portfolio boost |

| 5×–10× | Low | Life-changing |

This is calculated optionality, not addiction.

10% High-Risk Projection

| Scenario | ₹1L Invested | 2030 Value |

|---|---|---|

| Worst Case | ₹30,000 | Loss absorbed |

| Base Case | ₹2,50,000 | Nice upside |

| Best Case | ₹8–10L | Wealth accelerator |

How the 70-20-10 Strategy Performs in Real Life

Let’s combine everything.

₹10 Lakh Portfolio (2025–2030)

| Bucket | Capital | 2030 Expected Value |

|---|---|---|

| 70% Long-Term | ₹7L | ₹14.9L |

| 20% Swing | ₹2L | ₹6.5L |

| 10% High-Risk | ₹1L | ₹3–5L |

| Total | ₹10L | ₹24–26L |

That’s ~18% blended CAGR—with emotional stability.

FAQ

Is this strategy suitable for beginners?

Yes—if you start small and focus first on the 70%.

Can I skip high-risk trades?

Absolutely. Even 70-30 works well.

How often should I rebalance?

Once a year or after extreme market moves.

Does this work in bear markets?

Especially in bear markets. Allocation saves capital.

Final Thoughts: Wealth Is Built by Structure, Not Excitement

The market doesn’t reward intelligence alone.

It rewards discipline, patience, and survival.

The 70-20-10 strategy works because:

- It respects human psychology

- It balances growth and safety

- It keeps you invested long enough to win

Most investors don’t fail due to bad stocks.

They fail due to bad structure.

Leave a Reply