Investing in equity can be very rewarding. Some portfolios have seen amazing growth, like Wright’s 2024 Wrapped. It returned 37.06% and the New India smallcase returned 43.24%1. This shows how key it is to find effective ways to invest in equity.

Equity investment techniques, strategies, and management are vital for big returns2.

Using the right techniques helps us make smart choices. This can lead to reaching our investment goals. Whether it’s through passive index investing or mutual funds, both are popular in India12.

Table of Contents

Key Takeaways

- Equity investment techniques are key for big returns.

- Strategies like passive index investing offer broad diversification1.

- Portfolio management is vital for smart decisions and goals.

- Mutual funds are a hit in India for equity, allowing for lump sums or monthly SIPs2.

- Long-term equity fund investment is advised for good returns over time, not just short-term gains2.

- Risk management in equity investing is critical, considering personal risk levels during market ups and downs2.

Understanding the Fundamentals of Equity Investment

Equity investment is key in the stock market. Knowing its basics is vital for smart investment choices. We’ll explore equity investment, focusing on stock market analysis. This includes both fundamental and technical analysis3.

Fundamental analysis looks at a company’s financial health. It examines income statements, balance sheets, and cash flow statements3. This helps figure out a company’s growth chances.

Understanding investment terms is also important. Investors need to know about ratios like P/E, EPS, ROE, and D/E3. Knowing these helps in making better investment choices.

There are different types of equity funds, like large-cap, midcap, and small-cap funds4. These funds invest in companies of different sizes.

Some key points about equity investment include:

- Equity investments can lead to capital gains and dividends5.

- Equity funds offer diversified options with a minimum investment5.

- Getting diversification like equity funds with individual investments needs more money5.

By grasping these basics and exploring equity investment types, investors can craft a winning strategy4.

Essential Tools for Equity Market Analysis

For equity market analysis, the right tools are key. Technical analysis uses charts and indicators to forecast prices6. Important tools include technical indicators, chart patterns, and fundamental analysis6.

Many brokers offer advanced tools for technical analysis. Platforms like Ally Invest, Charles Schwab, and E*TRADE provide these tools7. They help spot trends and predict price movements. For instance, Fidelity Investments’ Active Trader Pro has over 60 customizable indicators and alerts7.

Popular software for technical analysis includes eSignal, MetaStock, and NinjaTrader7. These tools offer customizable indicators and backtesting. They also provide real-time data from global exchanges. Using these tools helps investors understand the market better and make informed decisions.

Here are some key features to look for in equity market analysis tools:

- Technical indicators, such as moving averages and relative strength index (RSI)

- Chart patterns, such as trends and reversals

- Fundamental analysis, including financial statements and news events

- Customizable indicators and alerts

- Real-time data from global exchanges

By using these tools and techniques, investors can better understand the equity market. This helps make more informed investment decisions6. Whether you’re new or experienced, the right tools can help you reach your investment goals.

Proven Equity Investment Techniques for Long-term Growth

We’ve discovered that the best ways to grow your money in the long run include value, growth, and dividend investing8. These methods help investors reach their financial dreams and lower risks. Value investing means buying stocks that are cheaper but have great fundamentals. Growth investing is about picking stocks that will grow a lot.

Studies show that most winners in investing stick to long-term plans, not quick profits9. This way, they can handle market ups and downs and enjoy the economy’s growth. Also, keeping good investments for their full growth can lead to big gains9.

Some important things to think about when investing in stocks are:

- How fast companies in the growth stage are making money8

- How taxes affect long-term gains9

- Spreading out investments to manage risks9

By knowing and using these investment strategies, you can boost your chances of long-term success. It’s key to keep up with market changes to get the most from these methods8.

| Investment Technique | Description |

|---|---|

| Value Investing | Buying undervalued stocks with strong fundamentals |

| Growth Investing | Buying stocks with high growth prospects |

| Dividend Investing | Investing in stocks that pay consistent dividends |

Technical Analysis Methods for Stock Selection

Technical analysis looks at past data to guess future price changes. It mainly focuses on price and volume10. This method uses chart patterns and indicators to spot trends and guide investment choices. It helps us understand how supply and demand impact price, volume, and volatility11.

There are many ways to use technical analysis for picking stocks. These include recognizing chart patterns, using technical indicators, and analyzing volume10. Patterns like head and shoulders can show trends and predict price shifts. Indicators like moving averages help spot trends and signal when to buy or sell.

These tools help spot trends, predict prices, and guide investment choices12. Mixing technical analysis with fundamental analysis gives a deeper market understanding. This way, investors can make better choices10.

Fundamental Analysis Approaches

We use fundamental analysis to find a company’s true value. We look at its financial statements, management team, and industry trends13. This method checks a company’s financial health, its place in the industry, and the economy to figure out its worth13.

It includes both qualitative and quantitative analysis. Qualitative looks at things you can’t measure, while quantitative deals with numbers you can14.

Key parts of fundamental analysis are economic, industry, and company analysis13. We use ratio analysis to check a company’s health. This involves looking at financial statements like the balance sheet and income statement14.

This helps us see how well a company is doing financially.

When we do fundamental analysis, we look at many things. These include:

- Financial statements, such as the balance sheet, income statement, and cash flow statement14

- Ratio analysis, including liquidity ratios, profitability ratios, efficiency ratios, leverage ratios, and valuation ratios14

- Qualitative factors, such as business model, brand strength, corporate governance, regulatory environment, and market conditions14

By using fundamental analysis, we can find a company’s true value. We can spot companies that are undervalued but have growth chances. This helps us avoid risky investments13.

This method helps us see beyond short-term price changes. It focuses on what drives a company’s performance. This guides our investment choices13.

Portfolio Diversification Strategies

We know how key it is to cut down on risk and boost returns in our investments. Portfolio diversification strategies are vital here. They include asset allocation, sector distribution, and geographic diversification15. By spreading our investments across various asset classes like stocks, bonds, and real estate, we can lower risk16.

Some important points for diversifying your portfolio are:

- Asset class diversification: spreading investments across different asset classes like stocks, bonds, commodities, real estate, and cash equivalents17.

- Sector diversification: investing in different sectors of the economy, such as IT, healthcare, energy, consumer goods, banking, and finance17.

- Geographic diversification: investing in different states, regions, and countries worldwide17.

Regularly rebalancing your portfolio is key to keeping it diversified and in line with your goals16. By thinking about these points and using a smart diversification strategy, we can lower risk and possibly increase returns17.

Risk Management in Equity Investments

Risk management is key in equity investments. It helps lower the chance of losing money and increase gains18. To manage risk, investors use hedging strategies like options19. Also, spreading investments across different assets helps reduce risk20.

Equity investments face risks like business, inflation, and interest rate risks19. Investors can tackle these risks with various strategies. For example:

- Stop-loss orders to limit losses

- Diversification to spread risk across assets

- Hedging strategies, such as options, to reduce risk

By using these strategies, investors can manage risk well and increase their returns18. It’s important to remember that managing risk is an ongoing task. Investors must always keep an eye on their investments and make changes as needed20.

Market Timing and Entry Point Strategies

Investing in the stock market requires careful timing and entry strategies. Between 1995 and 2014, staying fully invested in the S&P 500 Index gave an annual return of 9.85%21. But, missing just 10 of the best days cut that return to 5.1%21. This shows how vital market cycle analysis is for smart investing.

Understanding trends and future prices is key to market cycle analysis. This can be done through technical analysis and research22. Investors use tools like moving averages and RSI to find the right time to buy or sell.

Here are some important points for entry point strategies:

- Use market cycle analysis to spot trends and predict prices

- Look at technical indicators like moving averages and RSI for entry points

- Consider economic data like GDP and job numbers for timing23

- Volume confirmation helps confirm trend strength22

By following these tips and using market cycle analysis, investors can craft effective entry point strategies. This can lead to success in the stock market21.

| Indicator | Description |

|---|---|

| RSI | Relative Strength Index, used to gauge the size of recent price moves and identify overbought or oversold positions23 |

| MACD | Moving Average Convergence and Divergence, a momentum indicator that tracks trends23 |

| Volume Confirmation | Used to support trend momentum based on trading volume22 |

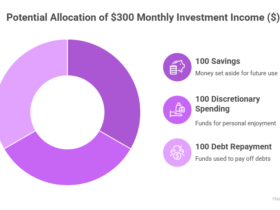

Creating a Systematic Investment Plan

Creating a systematic investment plan means setting goals, understanding risk, and picking a strategy24. It helps investors make smart choices and reach their financial targets. This plan lets investors put a set amount of money into the market at regular times. This way, they can handle market ups and downs better25.

When making a plan, think about your goals, how much risk you can take, and when you need the money. For instance, you might save for retirement or a house. Then, pick investments that fit your goals and risk level24. You can start small and grow your investments over time25.

Some big pluses of a systematic investment plan include:

- Less risk: By investing the same amount regularly, you can dodge big market swings25.

- Staying disciplined: This plan keeps you focused on your investments, avoiding emotional decisions24.

- Flexibility: You can start or stop your plan anytime, making it a flexible choice25.

In summary, a systematic investment plan is a great way to reach your long-term money goals. By setting clear goals, understanding risk, and picking the right strategy, you can confidently move through the markets24.

Advanced Trading Techniques for Experienced Investors

We’re always looking to get better at trading. Techniques like options trading and futures market strategies can help us. These methods are key for those who know their stuff26.

Options trading is great for managing risk and making more money. It lets us protect ourselves from losses or bet on price changes. For instance, studies show that topics like equity swaps and option-adjusted spreads are popular27.

Futures market strategies are also useful. They let us speculate on prices or protect against losses. This way, we can dive into various markets and assets. Here’s a quick look at options and futures trading:

| Trading Type | Description |

|---|---|

| Options Trading | Buying or selling options contracts to speculate on price movements or hedge against possible losses |

| Futures Trading | Buying or selling futures contracts to speculate on price movements or hedge against possible losses |

By mixing advanced techniques like options and futures with market knowledge, we can do better. This way, we can reach our investment goals26.

Building and Maintaining Your Investment Portfolio

Investing in the stock market is complex. It’s vital to build and keep a solid investment portfolio. This means using portfolio rebalancing techniques and performance monitoring methods. These help keep our portfolio in line with our goals and how much risk we can handle28.

Portfolio rebalancing is key. It involves sorting investments, figuring out their value, and making changes when needed29. This can lower the ups and downs in our investments. For instance, a mix of stocks and bonds has seen smaller drops than just stocks alone29.

Keeping an eye on how our portfolio is doing is also important. This means checking things like how much money we’re making, how much risk we’re taking, and how spread out our investments are. By watching these, we can spot where we might need to make changes28.

Here are some good ways to build and keep a strong investment portfolio:

- Spread your investments across different types, like stocks, bonds, and other assets

- Use a plan, like a Systemic Investment Plan (SIP), to invest regularly

- Change how your investments are spread out as you get older with a lifecycle investing strategy

By using these methods and keeping an eye on and adjusting your portfolio, you can make sure it matches your goals and risk level. This can lead to success over the long term29.

Common Investment Pitfalls to Avoid

We often face common investment pitfalls that can block our success in the equity market. These include emotional investing, not diversifying, and not managing risk30. To sidestep these, it’s key to set clear goals and follow our investment plan. We should spread our portfolio across various asset classes.

Some common mistakes include not researching enough, investing emotionally, not diversifying, and not knowing our risk tolerance31. Good choices for new investors include certificates of deposit, money market funds, and Treasury bonds. Index funds and 401(k) retirement accounts are also good. You can start investing in stocks or certificates of deposit with just $10031.

Here are some tips to avoid common investment pitfalls:

- Avoid putting more than 5% to 10% of your portfolio in one investment31.

- Don’t spend more than 5% of your portfolio on “fun investments”31.

- Successful investors should limit losses to the principal and be ready to lose 100% of the investment31.

Working with a financial advisor can cost less than 1% of your portfolio but offers valuable insights30. By knowing these common pitfalls and avoiding them, we can make better investment choices. This helps us reach our financial goals.

| Investment Pitfall | Tip to Avoid |

|---|---|

| Emotional Investing | Set clear goals and stick to the investment plan |

| Lack of Diversification | Allocate portfolio across different asset classes |

| Failure to Manage Risk | Limit losses to the principal amount invested |

Conclusion: Mastering Equity Investment for Long-term Success

Mastering equity investment for long-term success needs a detailed plan32. Equity investments can grow faster than fixed-income ones but come with risks like market ups and downs32. To overcome these, investors must use tested strategies, manage risks well, and stick to a solid investment plan.

It’s vital to grasp the basics of equity investment, from stock market analysis to tools for checking out investments32. Successful strategies like value, growth, and dividend investing help spot good companies33. Long-term investments, held for over three years, can build wealth over time, aiding in financial planning.

By spreading out their investments, managing risks, and keeping up with market trends, investors can do well in the equity markets32. Mastering equity investment means using analytical skills, discipline, and a drive to keep learning32. With the right approach, we can fully benefit from equity investments and reach our financial goals.

FAQ

What is the importance of discovering proven equity investment techniques for success?

The right strategies can lead to big returns. For example, Wright’s 2024 Wrapped shows impressive results. The Wright Factor Fund returned 37.06%, and the New India smallcase returned 43.24%.

What are the key components of stock market analysis?

Knowing the basics is key. This includes understanding bull and bear markets, reading stock charts, and the importance of diversification. These skills help make smart investment choices.

What are the essential tools for equity market analysis?

Tools like moving averages and the relative strength index (RSI) are vital. They help spot trends and predict future prices.

What are the proven equity investment techniques for long-term growth?

Value investing buys undervalued stocks with strong fundamentals. Growth investing focuses on stocks with high growth. Dividend investing is also effective for long-term growth.

What are the technical analysis methods for stock selection?

Chart patterns like head and shoulders and triangles are useful. They help predict future price movements. Volume analysis is also important.

What are the fundamental analysis approaches?

Ratio analysis evaluates a company’s profitability and efficiency. Analyzing financial statements, management, and industry trends helps estimate a company’s value.

What are the portfolio diversification strategies?

Spreading investments across different asset classes reduces risk. This includes stocks, bonds, and real estate. Sector and geographic diversification are also effective.

What are the risk management strategies in equity investments?

Hedging, stop-loss orders, and diversification can lower risk. These strategies protect investments in the equity market.

What are the market timing and entry point strategies?

Market cycle analysis and price action trading help identify trends. These methods guide informed investment decisions.

What are the key elements of creating a systematic investment plan?

Setting clear goals and assessing risk tolerance are critical. Choosing a strategy that fits these criteria is essential for a systematic plan.

What are the advanced trading techniques for experienced investors?

Options trading, futures market approaches, and algorithmic trading are useful for seasoned investors. These techniques enhance trading skills.

What are the key strategies for building and maintaining an investment portfolio?

Regular rebalancing and monitoring performance are key. These ensure the portfolio stays aligned with the investor’s goals and risk tolerance.

What are the common investment pitfalls to avoid?

Emotional investing, lack of diversification, and poor risk management are major pitfalls. Avoiding these is essential for successful investing.

1 Comment