Investing your hard-earned money can feel like stepping into a financial jungle—exciting yet overwhelming. With so many options available, how do you choose the path that’s right for you? Two popular strategies that often catch the eye of investors are Stock SIPs and ETF SIPs. Both promise growth over time, but they cater to different types of investors with unique goals, risk appetites, and levels of involvement. So, which one is the best—Stock SIP or ETF SIP?

Table of Contents

What’s a SIP, Anyway?

Before we pit Stock SIPs against ETF SIPs, let’s lay the groundwork. A Systematic Investment Plan (SIP) is like a financial fitness plan—it’s all about discipline and consistency. With a SIP, you invest a fixed amount of money at regular intervals (say, monthly) into a chosen investment vehicle. Think of it as planting small seeds today that grow into a lush financial forest over time.

SIPs are loved by investors for two big reasons:

- Rupee Cost Averaging: By investing a fixed amount regularly, you buy more shares when prices are low and fewer when prices are high, smoothing out the ups and downs of the market.

- Power of Compounding: The earlier you start, the more your money grows, thanks to returns earning returns.

Now that we’ve got the basics down, let’s zoom into the stars of this show: Stock SIPs and ETF SIPs.

Stock SIP: Betting on Individual Winners

A Stock SIP is when you commit to investing a set amount periodically—say, ₹5,000 every month—into individual stocks. These are shares of specific companies like Apple, Reliance Industries, or Tesla. Each month, your money buys however many shares it can afford at the current market price.

Imagine you’re a fan of tech giants. You might set up a Stock SIP to buy shares of Microsoft one month, Amazon the next, and so on. It’s like assembling your dream team of companies, hoping they’ll hit home runs over time.

ETF SIP: Riding the Market Wave

An ETF SIP, on the flip side, involves investing that same ₹5,000 monthly into an Exchange-Traded Fund (ETF). ETFs are baskets of securities—like stocks, bonds, or commodities—that trade on stock exchanges just like individual stocks. Most ETFs track an index (e.g., the S&P 500 or Nifty 50), meaning they mirror the performance of a broad market or sector.

For example, if you invest in a Nifty 50 ETF, your money is spread across the top 50 companies in India, from banking heavyweights like HDFC to tech titans like Infosys—all in one go.

Stock SIP vs. ETF SIP: The Ultimate Showdown

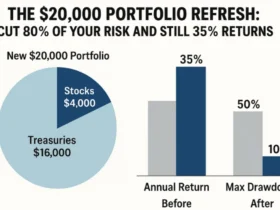

So, which SIP reigns supreme? To find out, let’s compare them across five key battlegrounds: risk, returns, diversification, costs, and ease of management. Grab a snack—this is where it gets juicy!

1. Risk: How Much Can You Handle?

- Stock SIP: Investing in individual stocks is like riding a rollercoaster blindfolded. If you pick a winner—like Tesla during its meteoric rise—you could see jaw-dropping gains. But if your chosen company stumbles (think Enron or Yes Bank), your investment could take a nosedive. The risk here is company-specific—tied to one firm’s fortunes.

- ETF SIP: ETFs are the safer bet, like a sturdy ship sailing through market storms. Because they hold dozens or hundreds of securities, the failure of one company doesn’t sink the whole boat. For instance, an S&P 500 ETF spreads your money across 500 major U.S. companies. If one flops, the others can keep you afloat. The risk is market-wide, not tied to a single player.

Expert Quote: “By periodically investing in an index fund, the know-nothing investor can actually outperform most investment professionals.” – Warren Buffett, legendary investor and advocate of low-risk, diversified investing.

2. Returns: Chasing the Big Wins

- Stock SIP: Here’s where Stock SIPs shine for the bold. If you’ve got a knack for spotting diamonds in the rough—say, buying into Amazon in the early 2000s—you could outpace the market by miles. But it’s a gamble. For every Amazon, there’s a company that fizzles out. Returns are variable and potentially sky-high, but they come with no guarantees.

- ETF SIP: ETFs play it steady. They aim to match the performance of their underlying index. If the Nifty 50 grows at 12% annually, your ETF SIP should too (minus fees). You won’t beat the market, but you’ll ride its long-term upward trend. Returns are consistent and market-average, ideal for those who prefer predictability over lottery-like wins.

3. Diversification: Spreading the Risk

- Stock SIP: Diversification with Stock SIPs? It’s on you. If you only invest in one or two stocks, your eggs are in very few baskets. To diversify, you’d need to buy shares in multiple companies across industries—say, tech, healthcare, and energy. That’s doable, but it takes time, money, and know-how.

- ETF SIP: ETFs hand you diversification on a silver platter. One ETF can hold hundreds of stocks. For example, a Total Stock Market ETF might include thousands of U.S. companies, from giants like Apple to small-cap hidden gems. It’s instant peace of mind—your risk is spread wide without lifting a finger.

4. Costs: What’s Eating Your Profits?

- Stock SIP: Every time you buy a stock, you pay a brokerage fee. If you’re investing monthly in five different stocks, those fees stack up fast—₹50 here, ₹50 there, and suddenly you’re losing hundreds yearly. Plus, building a diversified portfolio means more transactions, amplifying costs.

- ETF SIP: ETFs have their own price tag: the expense ratio, a small annual fee (e.g., 0.1% for a Nifty 50 ETF) that covers management costs. You might also pay a transaction fee, but many brokers offer commission-free ETF trades. Overall, ETFs tend to be lighter on your wallet, especially for broad market exposure.

Here’s a quick comparison table to break it down:

| Feature | Stock SIP | ETF SIP |

|---|---|---|

| Diversification | Low (unless you buy many stocks) | High (built-in) |

| Risk | Higher (company-specific) | Lower (market-wide) |

| Returns | Variable, potentially high | Market average |

| Costs | Brokerage fees per trade | Expense ratio + minimal fees |

| Management | Active, research-heavy | Passive, low effort |

5. Ease of Management: Set It and Forget It?

- Stock SIP: This is hands-on territory. You’ll need to research companies, track earnings reports, and decide when to buy or sell. It’s like tending a garden—rewarding if you’ve got green thumbs, but exhausting if you don’t. Perfect for investors who love the game.

- ETF SIP: ETFs are the ultimate “set it and forget it” option. Pick a solid ETF, automate your monthly investment, and let it grow. You’ll still want to check in yearly to ensure it aligns with your goals, but the day-to-day hassle? Nonexistent. Ideal for busy bees or beginners.

Real-Life Stories: Stock SIP vs. ETF SIP in Action

Let’s bring this to life with a tale of two investors: Priya and Rohan.

- Priya’s Stock SIP Adventure: Priya, a tech enthusiast, started a Stock SIP in 2013, investing ₹10,000 monthly across five stocks: Infosys, TCS, Reliance, HDFC Bank, and Maruti Suzuki. Over a decade, Reliance soared, doubling her money there, but Maruti lagged during a tough auto market. Her average annual return? A solid 14%, beating the market—but it took hours of research and some nail-biting moments.

- Rohan’s ETF SIP Journey: Rohan, a busy professional, chose a Nifty 50 ETF SIP, also investing ₹10,000 monthly since 2013. He didn’t pick stocks or sweat the news. The Nifty 50 averaged 12% annually, and his ETF mirrored it (minus a 0.1% expense ratio). His return? A steady 11.9%—slightly less than Priya’s, but with zero stress.

Priya won the returns race, but Rohan slept better at night. Which sounds more like you?

Pros and Cons: The Highlights

Let’s sum it up with some bite-sized pros and cons.

Stock SIP

- Pros:

- Potential for blockbuster returns if you pick winners.

- Full control over your portfolio—own the companies you love.

- Flexibility to focus on specific sectors or trends.

- Cons:

- Higher risk if your stocks tank.

- Time-intensive—research is a must.

- Costs pile up with frequent trades.

ETF SIP

- Pros:

- Diversification from day one.

- Lower risk thanks to a broad base.

- Affordable and low-maintenance.

- Cons:

- Returns capped at market average.

- No say in individual holdings.

- Small expense ratios nibble at profits.

How to Choose: Stock SIP or ETF SIP?

Still torn? Here’s your decision-making cheat sheet:

- Risk Tolerance: Love the thrill of a high-stakes game? Stock SIP. Prefer steady progress? ETF SIP.

- Time Commitment: Got hours to analyze markets? Stock SIP. Short on time? ETF SIP.

- Knowledge Level: Market-savvy and confident? Stock SIP. Newbie or unsure? ETF SIP.

- Goals: Aiming for quick, big wins? Stock SIP. Building long-term wealth? ETF SIP.

Picture this: If you’re a beginner saving for retirement, an ETF SIP is your trusty sidekick—safe, simple, and effective. But if you’re a seasoned investor with a hunch about the next Tesla, a Stock SIP lets you swing for the fences.

Setting Up Your SIP: A Step-by-Step Guide

Ready to jump in? Here’s how to start either SIP.

How to Start a Stock SIP

- Pick a Broker: Use platforms like Zerodha or Upstox that support Stock SIPs.

- Choose Your Stocks: Research companies with strong fundamentals—think revenue growth, low debt, and solid management.

- Set Your Amount: Decide how much (e.g., ₹5,000) and how often (e.g., monthly).

- Automate It: Link your bank account and schedule investments.

- Stay Sharp: Monitor performance and tweak your picks as needed.

How to Start an ETF SIP

- Select a Broker: Go for commission-free options like Groww or Interactive Brokers.

- Choose Your ETF: Look for low expense ratios and broad exposure (e.g., Nifty 50 ETF or SPY).

- Set Your Amount: Same deal—₹5,000 monthly, for example.

- Automate It: Set up recurring buys through your broker.

- Check In: Review once a year to ensure it’s still on track.

Taxes: What You Need to Know

Taxes can nibble at your returns, so let’s peek at the basics (using India as an example—check your local laws!):

- Dividends: Taxed in your hands for both stocks and ETFs.

- Capital Gains:

- Short-Term (less than 1 year): 15% on profits.

- Long-Term (over 1 year): 10% on gains above ₹1 lakh, tax-free below that.

ETFs sometimes have a tax edge—especially index ETFs—due to fewer taxable events. Consult a tax pro to crunch the numbers for your situation.

The Mind Game: Psychology of Investing

Here’s a curveball: Investing isn’t just math—it’s emotion. Stock SIPs can feel like a wild ride. When your stock plunges 20% overnight, panic might tempt you to sell low. ETFs? They’re calmer waters. Diversification dulls the drama, helping you stick to your plan during market chaos. If you’re prone to second-guessing, ETFs might save your sanity.

FAQs: Your Burning Questions Answered

Got questions? We’ve got answers.

1. What’s a SIP in simple terms?

A SIP is investing a fixed amount regularly (e.g., monthly) into stocks, ETFs, or mutual funds. It’s like a savings habit with growth potential.

2. Can I really do a SIP with stocks?

Yep! Many brokers let you automate stock buys monthly, though it’s less common than ETF or mutual fund SIPs.

3. Are ETFs safer than stocks for long-term goals?

Generally, yes—thanks to diversification. But “safer” doesn’t mean risk-free; markets can still dip.

4. How do I pick between Stock SIP and ETF SIP?

Weigh your risk tolerance, time, and goals. Want ease and stability? ETF SIP. Crave control and big wins? Stock SIP.

5. What costs should I watch for with ETF SIPs?

Look out for expense ratios (0.05%-0.5% typically) and any trading fees. Some brokers waive the latter—score!

The Verdict: Which is Best for You?

So, Stock SIP or ETF SIP? There’s no one-size-fits-all answer—it’s about you. For most folks—especially beginners or those craving simplicity—ETF SIPs take the crown. They offer diversification, lower risk, and a hands-off approach that’s perfect for steady, long-term growth. Think of them as the reliable friend who’s always there.

But if you’re a market maven with time, guts, and a knack for picking winners, Stock SIPs might be your golden ticket. They’re the high-flying adventure—riskier, yes, but with the potential for outsized rewards.

Final Thought: “The stock market is a device for transferring money from the impatient to the patient.” – Warren Buffett. Whether you choose stocks or ETFs, consistency is your superpower.

Leave a Reply