You’ve got ₹1 crore sitting in your bank account, and you’re wondering how to turn it into a reliable income stream without losing it all in one go. Sounds like a dream scenario, right? Well, that’s where a Systematic Withdrawal Plan (SWP) in mutual funds comes into play. It’s like setting up your own personal paycheck system—except it’s your money working for you! With an SWP, you can withdraw a fixed amount regularly from your mutual fund investment while letting the rest grow over time.

What Is an SWP and Why Should You Care?

A Systematic Withdrawal Plan (SWP) is a feature offered by mutual funds that lets you pull out a set amount of money at regular intervals—think monthly, quarterly, or even annually. It’s like having a salary from your own investment! For a ₹1 crore investment, this can be a game-changer, giving you a steady income while keeping most of your money invested for potential growth.

Here’s how it works in simple terms: You invest your ₹1 crore in a mutual fund, and then you tell the fund house, “Hey, I want ₹50,000 every month.” They’ll redeem just enough units from your investment to give you that amount, based on the current Net Asset Value (NAV)—the price per unit of the fund. The rest of your money stays in the fund, growing (hopefully) with the market.

Why SWP Rocks for a ₹1 Crore Investment

- Steady Cash Flow: Unlike dividends, which can be hit-or-miss, SWP gives you predictable income.

- Flexibility: You decide how much and how often you withdraw—tailor it to your lifestyle!

- Growth Potential: Your remaining investment keeps earning returns, helping your money last longer.

- Tax Smarts: Only the profit (capital gains) part of your withdrawal is taxed, not the whole amount.

Let’s say you’re retired and need ₹50,000 a month to cover expenses. With SWP, you can set that up and still have your ₹1 crore growing in the background. Compare that to dumping it all in a fixed deposit—sure, it’s safe, but the interest might not keep up with inflation, and you’d pay tax on every rupee of it. SWP gives you control and efficiency, which is why it’s perfect for big investments like ₹1 crore.

Choosing the Best Mutual Fund for Your SWP

Not all mutual funds are SWP superstars. With ₹1 crore on the line, you want a fund that’s stable, delivers consistent returns, and doesn’t rollercoaster your money away. So, which ones should you look at?

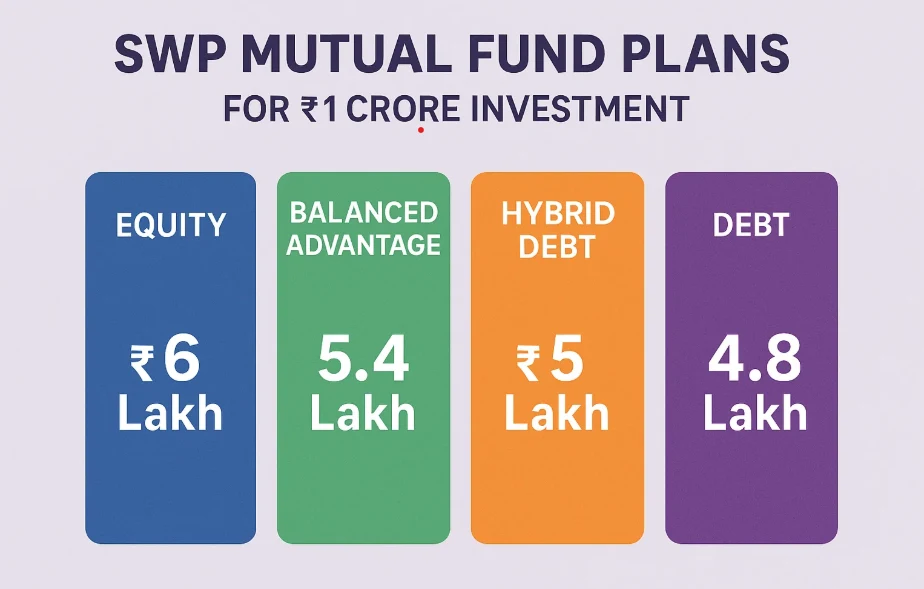

Types of Funds for SWP

- Hybrid Funds: These are the Goldilocks of mutual funds—mixing equity (stocks) and debt (bonds) for a balance of growth and safety. Perfect for SWP because they’re not too wild but still offer decent returns.

- Debt Funds: These focus on fixed-income stuff like bonds. They’re safer, with lower ups and downs, but the returns are usually modest. Good if you’re super cautious.

- Equity Funds: All-in on stocks, these can grow fast but crash hard too. They’re riskier for SWP unless you’re okay with some drama and have a long horizon.

For most folks with ₹1 crore, hybrid funds are the sweet spot. They give you enough growth to beat inflation while keeping things steady enough for regular withdrawals.

How to Pick the Right Fund

Here’s what to check before you commit:

- Past Performance: Look at returns over 3, 5, or 10 years. Consistency beats flashy one-year spikes.

- Expense Ratio: This is the fee the fund charges. Lower is better—more money stays with you.

- Fund Manager: A rockstar manager with a solid track record can make a big difference.

- Risk Level: Match the fund’s risk to your comfort zone. Hybrid or debt for safety, equity for thrill-seekers.

- Exit Load: Some funds charge a fee if you cash out early. For SWP, pick ones with low or no exit loads.

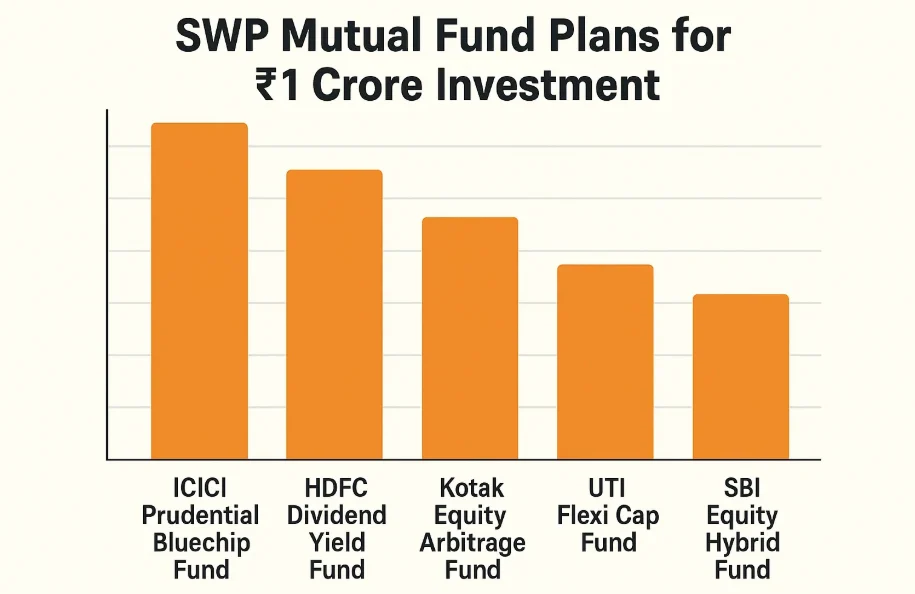

Top SWP Mutual Funds in India (2025)

Here’s a handy table of some top picks based on performance and SWP suitability:

| Fund Name | Category | 3-Year Returns | Expense Ratio | Exit Load |

|---|---|---|---|---|

| ICICI Prudential Equity & Debt Fund | Hybrid | 12.5% | 1.2% | 1% |

| HDFC Hybrid Equity Fund | Hybrid | 11.8% | 1.3% | 1% |

| SBI Magnum Balanced Fund | Hybrid | 10.9% | 1.4% | 1% |

| Aditya Birla Sun Life Regular Savings Fund | Conservative Hybrid | 9.5% | 1.5% | 1% |

| Kotak Standard Multicap Fund | Equity | 13.2% | 1.1% | 1% |

(Disclaimer: These numbers are hypothetical for 2025. Always check the latest data before investing!)

These funds are known for balancing growth and stability—key for a worry-free SWP.

Expert Quote: “The key to making money in stocks is not to get scared out of them,” said Peter Lynch, legendary investor. With a hybrid fund for SWP, you can stay invested without losing sleep over market dips.

How to Set Up an SWP for ₹1 Crore

Alright, you’ve picked your fund—now let’s get that ₹1 crore pumping out cash. Setting up an SWP is straightforward, but you need a plan to make it last.

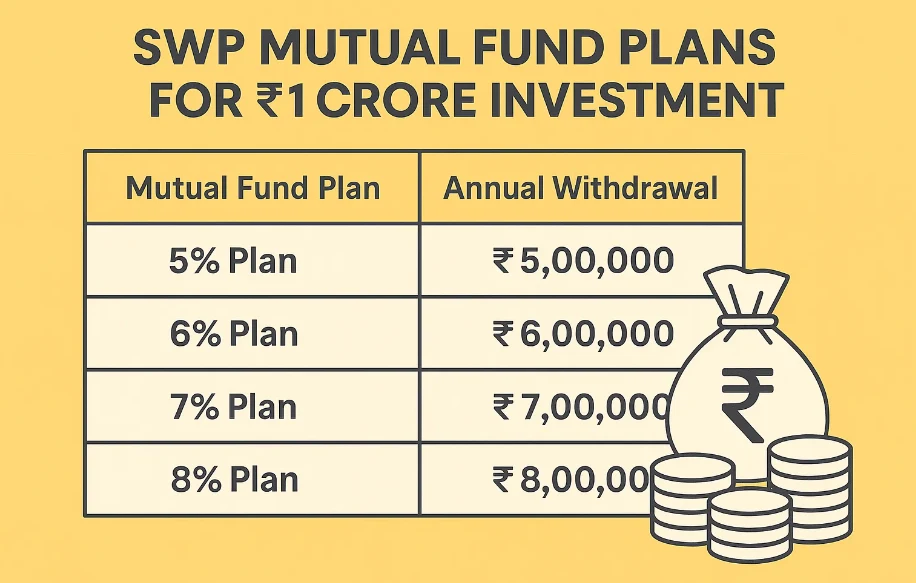

Step 1: Decide Your Withdrawal Amount

How much do you need each month? A good rule of thumb is the 4-6% rule—withdraw 4-6% of your investment per year to keep it sustainable. For ₹1 crore:

- 4%: ₹4 lakhs/year = ₹33,333/month

- 5%: ₹5 lakhs/year = ₹41,667/month

- 6%: ₹6 lakhs/year = ₹50,000/month

Want ₹50,000 a month? That’s 6%—doable, but you’ll need decent returns to avoid eating into your principal too fast.

Step 2: Pick a Frequency

- Monthly: Most popular, matches regular bills.

- Quarterly: Less frequent, good if you don’t need cash every month.

- Annually: Rare, but works if you’re saving up for big yearly expenses.

Step 3: Check the Math

Your withdrawal rate should match your fund’s expected returns. If your fund averages 8% annually and you pull out 5%, your ₹1 crore could grow over time. Here’s a quick look:

- Year 1: ₹1 crore grows to ₹1.08 crore (8% return), minus ₹6 lakhs withdrawn = ₹1.02 crore left.

But markets aren’t a straight line. Some years you’ll gain more, some less—so plan conservatively.

Step 4: Get It Rolling

Contact your mutual fund provider (online or via their app) and set:

- Amount (e.g., ₹50,000)

- Frequency (e.g., monthly)

- Start date

You’re now officially generating income from your ₹1 crore!

Tax Implications: Keeping More of Your Money

SWP isn’t just flexible—it’s tax-smart too. Unlike fixed deposits where every rupee of interest gets taxed, SWP taxes only the capital gains part of your withdrawal.

Equity Funds (65%+ Stocks)

- Short-Term (less than 1 year): Gains taxed at 15%.

- Long-Term (over 1 year): Gains up to ₹1 lakh/year are tax-free; above that, 10% tax applies.

Debt Funds (Mostly Bonds)

- Short-Term (less than 3 years): Gains taxed at your income tax slab rate (e.g., 30% if you’re in the top bracket).

- Long-Term (over 3 years): 20% tax with indexation (adjusts for inflation, lowering your tax).

Real Example

You withdraw ₹50,000/month from an equity fund held over a year. That’s ₹6 lakhs annually. Say ₹2 lakhs of that is capital gains:

- ₹1 lakh is tax-free.

- ₹1 lakh taxed at 10% = ₹10,000 tax.

Compare that to ₹6 lakhs from a fixed deposit taxed at 30% = ₹1.8 lakhs tax. SWP wins hands down!

Tax-Saving Tips

- Hold equity funds for over a year to snag that ₹1 lakh exemption.

- Mix equity and debt funds to balance growth and stability.

- Talk to a tax pro to tweak your withdrawals for max savings.

Case Study: ₹1 Crore SWP in Action

Meet Priya, a 62-year-old retiree with ₹1 crore to invest. She wants ₹60,000/month to live comfortably. Here’s how she sets up her SWP:

- Fund: HDFC Hybrid Equity Fund (expected 10% annual return)

- Withdrawal: ₹60,000/month = ₹7.2 lakhs/year

Year-by-Year Breakdown

- Year 1: ₹1 crore grows to ₹1.1 crore (10% return), minus ₹7.2 lakhs = ₹1.028 crore.

- Year 5: With consistent 10% returns, she’d have ~₹1.15 crore left after withdrawing ₹36 lakhs total.

- Year 10: Still around ₹1.3 crore, even after ₹72 lakhs withdrawn.

(Note: This assumes steady 10% returns—real life has ups and downs!)

Priya’s ₹1 crore keeps her comfy for years, proving SWP’s power when done right.

Risks to Watch Out For

SWP isn’t a magic bullet. Here’s what could trip you up:

- Market Dips: If your fund tanks early on, your withdrawals could eat into your capital fast.

- Inflation: ₹50,000 today won’t buy as much in 10 years. Consider increasing withdrawals over time.

- Fund Flops: A poorly performing fund could shorten your money’s lifespan.

How to Protect Yourself

- Start Low: A 4% withdrawal rate is safer than 6%.

- Diversify: Spread your ₹1 crore across a couple of funds.

- Check In: Review your SWP yearly—adjust if needed.

Expert Quote: “Do not save what is left after spending, but spend what is left after saving,” said Warren Buffett. SWP lets you save and spend smartly.

FAQs: Your SWP Questions Answered

Q: Can I start an SWP with less than ₹1 crore?

A: Yes! SWP works with any amount, though ₹1 crore gives you a meatier income stream.

Q: Is SWP better than fixed deposits?

A: Depends. SWP offers growth potential and tax benefits but has market risk. FDs are safer but tax-heavy and inflation-weak.

Q: Can I tweak my SWP later?

A: Absolutely—most funds let you change the amount or stop it anytime.

Q: How’s SWP different from SIP?

A: SIP is investing regularly; SWP is withdrawing regularly. Opposite sides of the coin!

Wrap-Up: Your ₹1 Crore SWP Game Plan

With ₹1 crore and an SWP mutual fund plan, you’re holding the keys to a steady income and a growing nest egg. Pick a solid hybrid fund, set a smart withdrawal rate (4-6%), and keep an eye on taxes and risks. It’s not just about cashing out—it’s about making your money last.

Ready to dive in? Chat with a financial advisor to customize your SWP, or subscribe to our newsletter for more tips. Your ₹1 crore deserves to work as hard as you did to earn it!

Leave a Reply