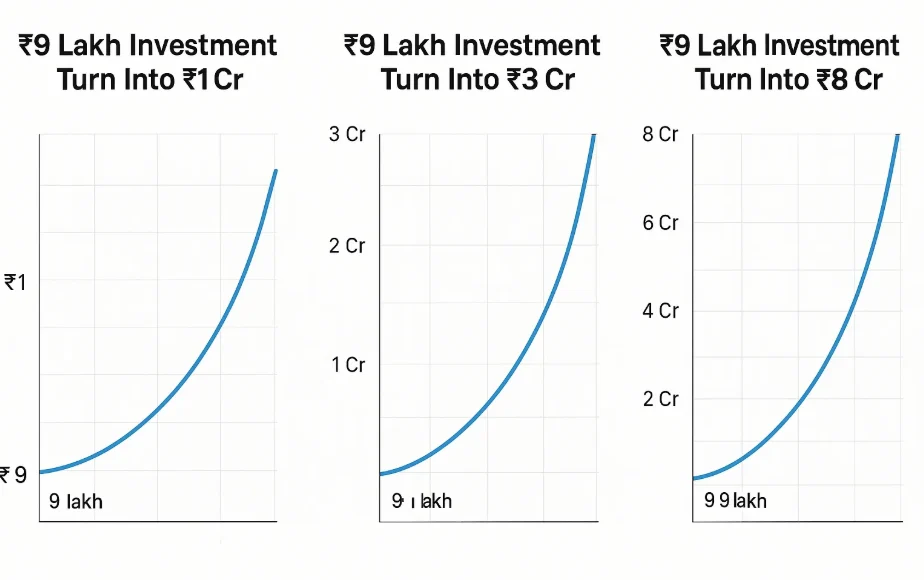

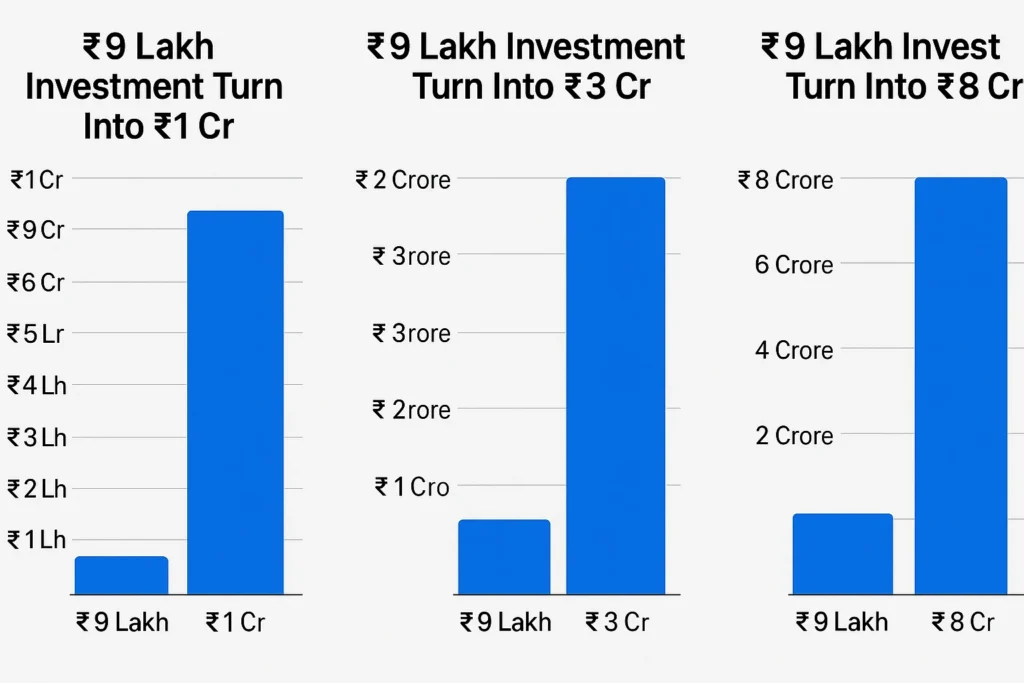

You invest ₹9 lakh just once, sit back, and watch it balloon into ₹1 crore, ₹3 crore, or even ₹8 crore. Sounds like a fantasy, doesn’t it? But here’s the kicker—it’s not. With the right strategy, a sprinkle of patience, and the superpower of compounding, this financial dream can become your reality. Whether you’re a newbie dipping your toes into investing or a seasoned pro looking to maximize your wealth, unravel the secrets of turning a modest ₹9 lakh into jaw-dropping crore figures. Buckle up as we dive into the numbers, explore investment options, and map out your path to crorepati status—all in an engaging, easy-to-digest

Understanding the Magic of Compounding

Before we crunch the numbers, let’s talk about the engine driving this wealth creation: compounding. Picture it as a snowball rolling down a hill. It starts small, but as it picks up more snow (returns), it grows bigger and faster. In investing, compounding means your returns don’t just sit there—they reinvest and earn more returns. Over time, this creates exponential growth, turning modest sums into massive wealth.

“Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it.” – Albert Einstein

This quote nails it. Compounding isn’t about how much you start with—it’s about how long you let it grow. The earlier you invest that ₹9 lakh, the more time compounding has to work its magic. Now, let’s see how this applies to hitting ₹1 crore, ₹3 crore, and ₹8 crore.

Goal 1: Turning ₹9 Lakh into ₹1 Crore

Let’s kick things off with the first milestone: growing ₹9 lakh into ₹1 crore. To figure this out, we need two key ingredients:

- Rate of Return: The annual percentage your investment grows.

- Time: How many years you’re willing to stay invested.

We’ll use the compound interest formula, simplified for annual compounding:

[ A = P (1 + r)^t ]

Where:

- ( A ) = Final amount (₹1 crore = ₹10,000,000)

- ( P ) = Principal (₹9 lakh = ₹900,000)

- ( r ) = Annual rate of return (as a decimal)

- ( t ) = Time in years

Let’s calculate how long it takes at different rates:

Time to Reach ₹1 Crore

| Rate of Return | Years to Reach ₹1 Crore |

|---|---|

| 8% | 31 years |

| 10% | 25 years |

| 12% | 21 years |

| 15% | 17 years |

Here’s what this tells us:

- At a conservative 8% return (think fixed deposits or debt funds), it takes 31 years.

- Bump it up to 12% (achievable with equity mutual funds), and you’re there in 21 years.

- Push for an aggressive 15% (possible with high-growth stocks), and it’s yours in just 17 years.

So, how do you get these returns? Let’s explore your options.

Best Investment Options for High Returns

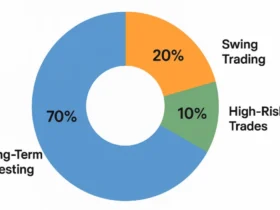

To hit these crore targets, you need investments that pack a punch. Here’s a rundown of the best vehicles to grow your ₹9 lakh:

1. Equity Mutual Funds

- What: Funds that invest in a basket of stocks.

- Returns: Historically 12-15% annually over the long term.

- Risk: Moderate to high, but diversification reduces it.

- Best For: Long-term investors comfortable with market ups and downs.

2. Index Funds & ETFs

- What: Track market indices like Nifty 50 or Sensex.

- Returns: Around 10-12% annually.

- Risk: Lower than individual stocks, tied to market performance.

- Best For: Hands-off investors seeking steady growth.

3. Direct Stocks

- What: Buying shares of individual companies.

- Returns: Can exceed 15-20%, but varies wildly.

- Risk: High—requires research and timing.

- Best For: Savvy investors with market know-how.

4. ULIPs (Unit-Linked Insurance Plans)

- What: Combine insurance with market-linked investments.

- Returns: 10-12% with disciplined investing.

- Risk: Moderate, with lock-in periods.

- Best For: Those wanting growth plus insurance cover.

Pro Tip: Don’t put all your eggs in one basket. Diversify across equity, debt, and other assets to balance risk and reward.

Goal 2: Scaling ₹9 Lakh to ₹3 Crore

Now, let’s aim higher—₹3 crore. This requires more growth, meaning higher returns or more time. Here’s how long it takes:

Time to Reach ₹3 Crore

| Rate of Return | Years to Reach ₹3 Crore |

|---|---|

| 10% | 41 years |

| 12% | 34 years |

| 15% | 28 years |

| 18% | 24 years |

Key takeaways:

- At 10%, you’ll need 41 years—a long haul, but doable.

- At 15%, it’s 28 years, within a working lifetime.

- At 18%, you’re there in 24 years, but that’s a stretch unless you nail high-growth investments.

Achieving 18% consistently might mean diving into small-cap funds or sector-specific stocks. It’s riskier, but the rewards could be massive.

Goal 3: The Big Leap to ₹8 Crore

Finally, the ultimate prize: ₹8 crore. This is where patience and exceptional returns collide. Check out the timelines:

Time to Reach ₹8 Crore

| Rate of Return | Years to Reach ₹8 Crore |

|---|---|

| 12% | 48 years |

| 15% | 39 years |

| 18% | 33 years |

| 20% | 30 years |

What this means:

- At 12%, it’s 48 years—think generational wealth.

- At 20%, you hit it in 30 years, but 20% returns are rare and require stellar picks like startups or top-tier funds.

Is 20% possible? Yes, but it’s not a cakewalk. You’d need to tap into high-growth sectors or ride the wave of a bull market.

Real-Life Examples of High-Growth Investments

Let’s ground this in reality with some examples:

- HDFC Equity Fund

- Past 20 Years: Averaged ~18% annual returns.

- Result: ₹9 lakh invested in 2004 would be over ₹1.5 crore today.

- Reliance Industries Stock

- Since 2000: Grown multifold with dividends.

- Result: ₹9 lakh could be worth ₹1 crore+ by now.

- Nippon India Small Cap Fund

- Past Decade: Over 20% annually.

- Result: ₹9 lakh in 2014 would be ~₹50 lakh today.

These aren’t flukes—consistent investing in quality assets can deliver. But markets dip too, so staying the course is key.

Factors That Shape Your Growth

Your journey isn’t just about picking investments. These factors play a huge role:

- Inflation: At 5-7% in India, it eats into your real returns. Aim for investments that beat it.

- Taxes: Long-term capital gains tax (10% on equity above ₹1 lakh) can nibble at profits. Tax-efficient options like ELSS help.

- Fees: High fund fees shrink your gains. Opt for low-cost index funds or direct plans.

- Reinvestment: Reinvesting dividends or interest turbocharges compounding.

Common Pitfalls to Dodge

Even the best plan can flop if you stumble. Avoid these traps:

- Timing the Market: Guessing highs and lows often backfires. Focus on time in the market, not timing it.

- Panic Selling: Crashes happen. Selling locks in losses—hold tight instead.

- Overconcentration: All in on one stock? Risky. Spread your bets.

- Ignoring Reviews: Life changes, so should your portfolio. Check it yearly.

FAQs: Your Burning Questions Answered

Q1: Can SIPs speed up reaching ₹1 crore?

A: Absolutely! Pair your ₹9 lakh with a ₹10,000 monthly SIP at 12%, and you could hit ₹1 crore in ~15 years—faster than the one-time route alone.

Q2: What if I need cash early?

A: Early withdrawals might dent your goal. Mutual funds allow partial exits, but keep an emergency fund separate.

Q3: Are these returns guaranteed?

A: Nope. High returns come with risk. Equity has historically delivered, but there’s no promise—diversify to cushion bumps.

Q4: How do I pick the right mutual fund?

A: Look for a solid 5-10 year track record, low expense ratios, and growth focus. A financial advisor can fine-tune your choice.

Q5: Does age matter?

A: Big time. A 25-year-old at 12% hits ₹1 crore by 46. A 40-year-old waits till 61. Start early!

Conclusion: Your Crorepati Blueprint

Turning ₹9 lakh into ₹1 crore, ₹3 crore, or ₹8 crore isn’t a pipe dream—it’s math, strategy, and grit. Here’s your takeaway:

- Pick Smart: Equity funds, stocks, or a mix—aim for 12-15%+ returns.

- Stay Long: Compounding needs time. Commit for decades.

- Be Savvy: Dodge mistakes, reinvest, and diversify.

Start today, and that ₹9 lakh could be your ticket to crorepati club. As Warren Buffett says, “Someone’s sitting in the shade today because someone planted a tree a long time ago.” Plant your financial tree now—future you will thank you!

Wonderful beat ! I wish to apprentice while you amend your web site, how can i subscribe for a blog web site?

The account aided me a acceptable deal. I had

been a little bit acquainted of this your broadcast offered bright clear concept