Waking up 10 years from now with ₹1 crore sitting in your bank account. Sounds like a fantasy, doesn’t it? But what if I told you that this dream could become your reality with a simple, disciplined investment strategy called SIP? Yes, a Systematic Investment Plan (SIP) can be your ticket to building a massive ₹1 crore corpus in just a decade. Whether you’re a salaried professional, a small business owner, or someone just starting their financial journey, this blog post will walk you through a step-by-step guide to achieve this ambitious goal. Packed with actionable tips, expert insights, and easy-to-understand examples, this guide is designed to make wealth creation both achievable and exciting. Let’s dive in!

What is SIP and Why Does It Matter?

Before we jump into the nitty-gritty, let’s get the basics straight. SIP, or Systematic Investment Plan, is a way to invest in mutual funds by putting in a fixed amount regularly—usually monthly. Think of it as a recurring deposit with a twist: instead of earning a fixed interest rate, your money grows based on how well the mutual fund performs. Over time, this growth can be exponential, thanks to two magical ingredients: compounding and rupee cost averaging.

Why does SIP matter? Because it’s a beginner-friendly, disciplined, and powerful tool to build wealth. You don’t need to be a stock market guru or have lakhs of rupees lying around. With as little as ₹500 a month, you can kickstart your journey toward financial freedom. And when your goal is as big as ₹1 crore in 10 years, SIP’s ability to harness the power of time and consistency makes it the perfect vehicle.

The Benefits of SIP: Why It’s a Game-Changer

SIP isn’t just another investment option—it’s a wealth-building superpower. Here’s why:

- Discipline Made Simple: SIP forces you to save and invest regularly, turning it into a habit you don’t even have to think about.

- Affordable for All: Start small—₹500, ₹1,000, or whatever fits your budget—and scale up as you go.

- Rupee Cost Averaging: When markets dip, you buy more units; when they rise, you buy fewer. This averages out your cost and reduces the risk of bad timing.

- The Power of Compounding: Your returns earn returns, creating a snowball effect that grows bigger with time.

- Flexibility: Increase, decrease, or pause your SIP whenever life demands it—no strings attached.

These benefits make SIP the go-to choice for anyone aiming to save ₹1 crore in 10 years. It’s not about how much you start with—it’s about starting smart and staying consistent.

Can You Really Save ₹1 Crore in 10 Years with SIP?

Yes, absolutely! But it’s not magic—it’s math. To hit ₹1 crore in 10 years, you’ll need to invest a certain amount every month through SIP, and the exact figure depends on the rate of return you expect from your mutual funds. Equity mutual funds, which invest in stocks, typically offer higher returns (10-15% annually) over the long term, making them ideal for this goal. Let’s break it down with a step-by-step plan that anyone can follow.

Step-by-Step Guide to Save ₹1 Crore in 10 Years with SIP

Step 1: Calculate Your Monthly SIP Amount

The first step is figuring out how much you need to invest each month to reach ₹1 crore in 10 years. This depends on the expected annual return of your mutual fund. For simplicity, let’s assume three scenarios with returns of 10%, 12%, and 15%—rates that are realistic for equity mutual funds over a decade.

Using a SIP calculator (available free online), here’s what you’d need to invest monthly:

- At 10% annual return: ₹50,000 per month

- At 12% annual return: ₹44,000 per month

- At 15% annual return: ₹37,000 per month

Feeling overwhelmed by these numbers? Don’t be. Later, we’ll explore ways to make this goal more achievable, even if you can’t start with ₹44,000 right away. The key takeaway? The higher the return, the less you need to invest monthly—but higher returns come with higher risk, so balance is everything.

Step 2: Pick the Right Mutual Funds

Your SIP is only as good as the mutual funds you choose. Since your goal is 10 years away, equity mutual funds are your best bet—they offer the potential for higher returns compared to debt or hybrid funds. But not all funds are created equal. Here’s how to choose wisely:

- Check the Track Record: Look for funds that have consistently outperformed their benchmarks (like the Nifty 50 or Sensex) over 5-10 years.

- Fund Manager Expertise: A seasoned manager with a proven strategy can make a big difference.

- Low Expense Ratio: This is the fee charged by the fund—lower fees mean more of your money stays invested.

- Diversify: Spread your SIP across large-cap (stable companies), mid-cap (growth potential), and multi-cap (a mix of both) funds to balance risk and reward.

Not sure where to start? Funds like HDFC Equity Fund, SBI Bluechip Fund, or Mirae Asset Emerging Bluechip Fund are popular choices—but always do your research or consult a financial advisor.

Step 3: Set Up Your SIP

Once you’ve picked your funds, setting up your SIP is a breeze. Here’s how:

- Choose a Platform: You can start your SIP through mutual fund websites, apps like Groww or Zerodha Coin, or even your bank.

- Pick a Date: Align your SIP debit date with your salary or cash flow—say, the 5th or 10th of every month.

- Link Your Bank Account: Ensure there’s enough balance for the auto-debit to avoid missed payments.

- Start Small if Needed: Can’t afford ₹44,000 yet? Begin with ₹5,000 or ₹10,000 and increase it over time.

Most platforms let you set up an SIP in under 10 minutes. It’s that simple!

Step 4: Monitor and Stay the Course

SIP isn’t a “set it and forget it” strategy—you need to keep an eye on it. Here’s what to do:

- Review Annually: Check how your funds are performing. Are they meeting your expectations? If not, consider switching (but don’t overreact to short-term dips).

- Stay Disciplined: Markets will fluctuate—don’t panic and stop your SIP during a downturn. That’s when rupee cost averaging shines.

- Step Up Your SIP: As your income grows (say, after a raise or bonus), increase your monthly SIP amount to reach your goal faster.

Consistency is your superpower here. Even when the market wobbles, trust the process—it’s designed to work over the long haul.

SIP Calculation Table: How Much Do You Need to Invest?

Let’s put some numbers on the table to make this crystal clear. Here’s how much you’d need to invest monthly to reach ₹1 crore in 10 years at different return rates:

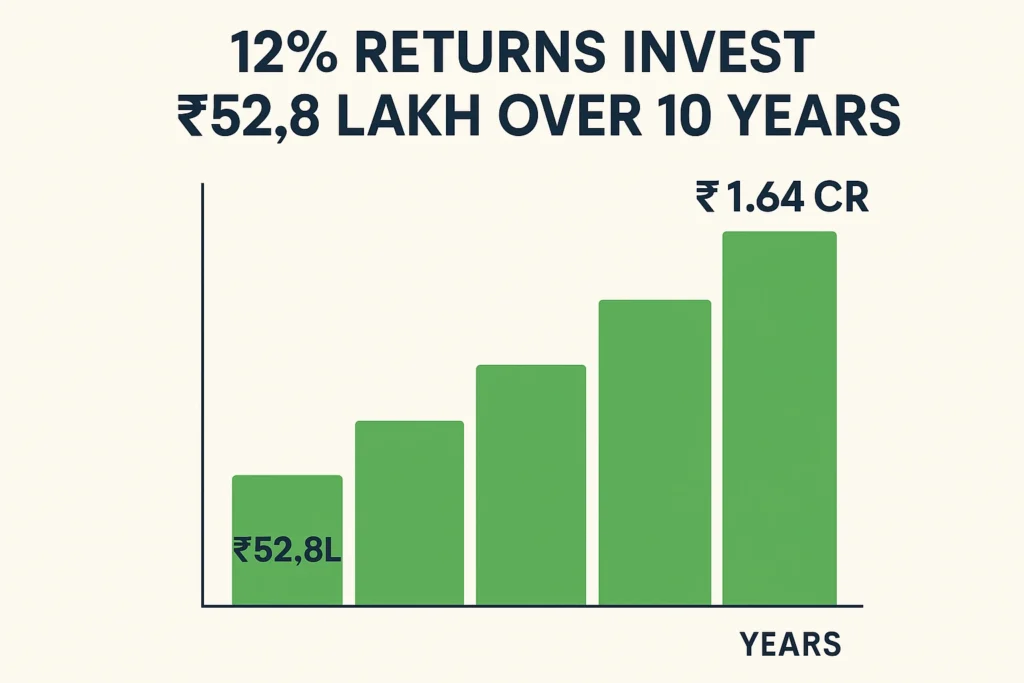

| Expected Annual Return | Monthly SIP Amount | Total Invested in 10 Years | Corpus After 10 Years |

|---|---|---|---|

| 10% | ₹50,000 | ₹60,00,000 | ₹1,02,43,000 |

| 12% | ₹44,000 | ₹52,80,000 | ₹1,00,00,000 |

| 15% | ₹37,000 | ₹44,40,000 | ₹1,00,00,000 |

What This Means: At 12% returns, you’d invest ₹52.8 lakh over 10 years, and the remaining ₹47.2 lakh comes from growth. That’s the power of compounding at work! Higher returns (15%) lower your monthly burden, but they require riskier funds—so choose based on your comfort level.

Expert Quotes to Inspire You

Need a little motivation? Here’s what some investing legends have to say about strategies like SIP:

“Investing through SIP is like planting a tree. You water it regularly, and over time, it grows into a mighty oak.” – Warren Buffett

“The key to making money in stocks is not to get scared out of them.” – Peter Lynch

These words remind us that patience and persistence are the cornerstones of wealth creation. SIP isn’t about timing the market—it’s about time in the market.

Key Takeaways for SIP Success

Here’s a quick rundown of what you need to nail this ₹1 crore goal:

- Start Early: Every month you delay costs you more in monthly SIP contributions.

- Stay Consistent: Even small amounts add up over time—don’t skip your SIPs.

- Choose Smart: Pick funds that match your risk tolerance and have a solid history.

- Hold Steady: Market dips are opportunities, not threats—keep investing.

- Step Up: Increase your SIP as your income grows to hit the target faster.

Making ₹1 Crore Achievable: Tips for Smaller Budgets

Let’s be real—₹44,000 a month is a big ask for most people. So how do you bridge the gap? Here are some practical ideas:

- Start Small, Scale Up: Begin with ₹10,000 a month. After a year, bump it to ₹15,000, then ₹20,000 as your salary rises. This “step-up SIP” approach eases the pressure.

- Extend the Timeline: If 10 years feels tight, stretch it to 12 or 15 years. At 12% returns, ₹25,000 monthly gets you to ₹1 crore in 15 years.

- Cut Expenses: Skip that extra coffee or weekend splurge—redirect the savings to your SIP.

- Side Hustle: Earn extra through freelancing or a part-time gig and funnel it into your investments.

The beauty of SIP is its flexibility. You don’t need to be rich to start—you just need to start.

Common Myths About SIP Debunked

Still hesitant? Let’s bust some myths that might be holding you back:

- Myth 1: SIP Guarantees Returns

Truth: SIPs in mutual funds aren’t risk-free—they depend on market performance. But over 10 years, equity funds tend to smooth out volatility and deliver solid returns. - Myth 2: I Need a Lot of Money to Start

Truth: You can begin with ₹500! It’s about consistency, not the starting amount. - Myth 3: SIPs Are Only for Experts

Truth: SIPs are designed for everyone—no financial degree required.

FAQs: Your Burning Questions Answered

Got doubts? Here are answers to the most common questions about saving ₹1 crore with SIP:

Q: Is ₹1 crore in 10 years really possible with SIP?

A: Yes! With disciplined investing and a decent return (say, 12%), ₹44,000 monthly can get you there. Adjust the amount or timeline to suit your budget.

Q: What if I can’t invest ₹44,000 a month?

A: Start with what you can—₹5,000 or ₹10,000—and increase it over time. Or extend your goal to 15 years to lower the monthly amount.

Q: Is SIP safe?

A: It’s not “safe” like a fixed deposit—there’s market risk. But long-term equity funds historically deliver 10-15% returns, and diversification reduces risk.

Q: Can I stop my SIP anytime?

A: Absolutely! There’s no penalty—just pause or stop when needed. But staying invested is key to hitting your goal.

Q: What happens if the market crashes?

A: A crash is actually a bonus for SIP investors—you buy more units at lower prices. Over 10 years, markets typically recover and grow.

The Road Ahead: Your ₹1 Crore Journey Starts Now

Saving ₹1 crore in 10 years with SIP isn’t a pipe dream—it’s a plan. It’s about taking small, consistent steps today to secure a big win tomorrow. Whether you’re investing ₹5,000 or ₹50,000 a month, the principles remain the same: start early, pick the right funds, and stay the course. The power of compounding and rupee cost averaging will do the heavy lifting for you.

So, what’s stopping you? Open that investment app, set up your first SIP, and take control of your financial future. Ten years from now, you’ll thank yourself for starting today. Happy investing!

Leave a Reply