Introduction: Could 18.2% Returns Change Your Life?

You’re scrolling through your phone one lazy Sunday morning, and a notification pops up. Your investment portfolio has grown by 18.2% in just one year. That’s not a typo—18.2%! Suddenly, that dream vacation, your child’s education, or even early retirement feels within reach. Now, imagine achieving this with a simple habit: investing a small amount every month through a Systematic Investment Plan (SIP).

Table of Contents

Take Priya, a 29-year-old teacher from Pune. Five years ago, she started an SIP with just ₹2,000 a month. Today, her portfolio is worth over ₹5 lakhs, growing at an average of 18% annually. She’s not a finance guru—she’s just someone who took a chance on SIPs. And you can too.

I’m going to walk you through the 18.2% Return Plan—a practical, proven way to build wealth with SIPs. You’ll learn what SIPs are, how they can deliver jaw-dropping returns, and why starting right now is the smartest move you’ll ever make. Whether you’re a newbie or an investment pro, this guide is packed with actionable tips, real stories, and expert insights to help you take control of your financial future. Ready to transform your money game? Let’s get started!

What Are SIPs and Why Should You Care?

The Basics: SIPs Made Simple

If you’re new to investing, don’t worry—I’ve got you covered. A Systematic Investment Plan (SIP) is like a subscription for growing your money. Instead of dumping a big chunk of cash into the market, you invest a fixed amount regularly—say, ₹1,000 every month—into mutual funds. It’s disciplined, it’s affordable, and it’s powerful.

Here’s why SIPs are a big deal:

- Start Small: You can begin with as little as ₹500 a month. No need to break the bank!

- Smooth Out Risk: By spreading your investment over time, you avoid the stress of market ups and downs.

- Compounding Power: Your returns earn more returns, turning small sums into serious wealth.

Think of it like planting a seed. Water it regularly, give it time, and watch it grow into a massive tree. That’s the SIP magic.

How Can SIPs Deliver 18.2% Returns?

Now, let’s tackle the big question: How can an SIP give you 18.2% returns? It’s not a wild promise—it’s based on real data. Over the past 10-15 years, some equity mutual funds in India have delivered average annual returns of 15-20%. With the right fund and a long-term mindset, hitting 18.2% is totally doable.

Here’s the trick: time and consistency. The longer you invest, the more your money compounds. Let’s break it down with numbers.

Table 1: How Your SIP Grows Over Time

| Years | Monthly SIP (₹) | Expected Return (%) | Total Invested (₹) | Maturity Value (₹) |

|---|---|---|---|---|

| 5 | 5,000 | 18.2% | 3,00,000 | 5,25,000 |

| 10 | 5,000 | 18.2% | 6,00,000 | 18,75,000 |

| 15 | 5,000 | 18.2% | 9,00,000 | 45,00,000 |

Look at that! In 15 years, your ₹9 lakh investment could balloon to ₹45 lakhs. That’s the kind of growth that turns skeptics into believers.

Why You Should Start an SIP Today

Beat Inflation and Secure Your Future

Inflation is sneaky—it eats away at your savings every year. If your money isn’t growing faster than rising prices, you’re losing value. SIPs in equity funds have historically outpaced inflation, often delivering returns of 15-20% over the long term. That means your wealth doesn’t just survive—it thrives.

Expert Quote: “The best way to beat inflation is to invest in equity markets through SIPs. Time is your greatest asset.” – Nilesh Shah, MD, Kotak Mahindra AMC

It’s Easier Than You Think

You don’t need to be rich or a stock market wizard to start an SIP. With online platforms, it’s as simple as ordering food on your phone. Pick a fund, set up auto-debit, and you’re done. Plus, you can:

- Pause or stop anytime—no penalties.

- Increase your investment as your income grows.

- Choose funds that match your goals.

It’s investing made human-friendly.

Turn Market Volatility Into Your Friend

Markets can be a rollercoaster, but SIPs turn that into an advantage. When prices dip, your fixed amount buys more units. When prices rise, your units are worth more. This strategy, called rupee cost averaging, keeps your risk low and your returns high.

Dream Big, Achieve More

Want to buy a house? Fund a wedding? Retire early? SIPs can get you there. The key is starting early. Even a small monthly investment can snowball into a fortune over time.

Real-Life Example: Meet Arjun, a 32-year-old engineer from Hyderabad. He started a ₹3,000 SIP in 2016. By 2023, his portfolio hit ₹6 lakhs, growing at 17.5% annually. Now, he’s planning a down payment for his first home—all thanks to SIPs.

How to Pick the Perfect Mutual Fund for Your SIP

Step 1: Know Your Risk Comfort Zone

Not every fund is right for everyone. Ask yourself:

- Can I handle market dips? If yes, equity funds are your go-to for high returns like 18.2%.

- How long can I invest? Longer horizons (10+ years) suit aggressive funds; shorter ones (3-5 years) need safer options.

For the 18.2% Return Plan, equity funds are the star players. They’re volatile but reward patience.

Step 2: Check the Track Record

Past performance isn’t a crystal ball, but it’s a solid clue. Look for funds with consistent returns of 15%+ over 5-10 years. Here’s a quick look at some top performers:

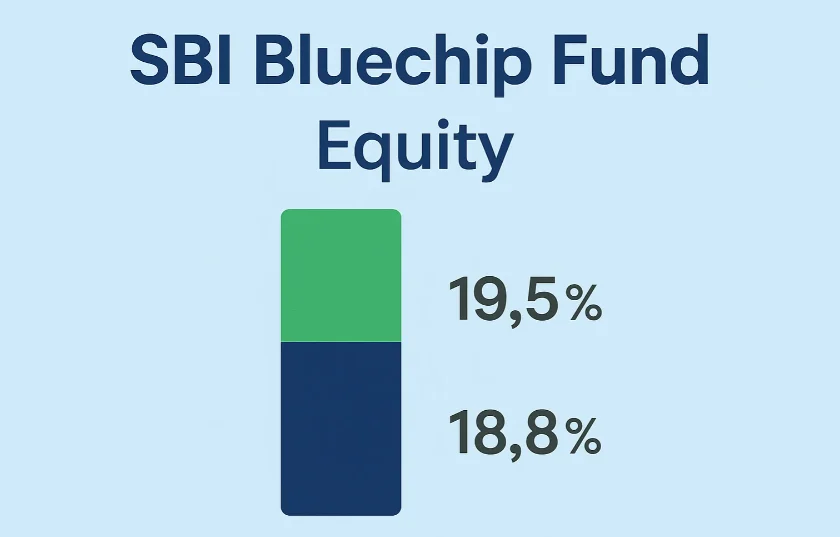

Table 2: Top Mutual Funds for SIPs

| Fund Name | Category | 5-Year Return (%) | 10-Year Return (%) |

|---|---|---|---|

| SBI Bluechip Fund | Equity | 18.8% | 19.5% |

| Mirae Asset Large Cap | Equity | 17.5% | 18.0% |

| ICICI Pru Balanced | Hybrid | 14.5% | 15.8% |

Disclaimer: Returns vary. Consult a financial advisor before investing.

Step 3: Trust the Fund Manager

A great fund manager is like a chef—skill matters. Research their experience and success rate. Funds led by seasoned pros tend to perform better.

Expert Quote: “Investing is about trust. Pick a fund manager who’s weathered storms and delivered results.” – Radhika Gupta, CEO, Edelweiss AMC

Step 4: Keep Costs Low

Every fund has an expense ratio—a fee you pay. Lower ratios (below 1.5%) mean more money stays in your pocket. Compare options and choose wisely.

Your 18.2% Return Plan: A Step-by-Step Blueprint

Step 1: Define Your “Why”

What’s driving you? A dream home? Your kid’s college fund? Early retirement? A clear goal keeps you motivated.

Step 2: Pick Your SIP Amount

Start with what you can afford—₹500, ₹1,000, whatever works. Use an SIP calculator to see how it grows. Here’s a tip: Step up your SIP by 10% each year as your income rises.

Step 3: Choose Your Fund

Based on your risk appetite, select a fund with a strong history of 18%+ returns. Diversify across 2-3 funds to play it smart.

Step 4: Automate It

Set up auto-debit from your bank. It’s like a “set it and forget it” recipe for wealth. No excuses, no missed payments.

Step 5: Stay on Track

Check your portfolio every 6-12 months. If a fund lags, switch to a better performer. But don’t overthink it—consistency is king.

Avoid These SIP Traps

1. Chasing the Market

Trying to time the market is a fool’s game. SIPs work because they ignore short-term noise. Just keep investing.

2. Panicking in Downturns

When markets drop, don’t pull out. It’s a chance to buy low. Stick to your plan—your future self will thank you.

3. Picking Flashy Funds

A fund that spiked last year might crash tomorrow. Focus on long-term consistency, not short-term hype.

4. Skipping Diversification

Don’t bet everything on one fund. Spread your money across equity, hybrid, or debt funds to balance risk.

Time: Your Secret Weapon for 18.2% Returns

The real magic of the 18.2% Return Plan? Time. The longer you stay invested, the more your money multiplies. Check this out:

Table 3: The Power of Time and Compounding

| Years | Monthly SIP (₹) | Total Invested (₹) | Maturity Value (₹) | Wealth Multiplier |

|---|---|---|---|---|

| 5 | 10,000 | 6,00,000 | 9,50,000 | 1.58x |

| 10 | 10,000 | 12,00,000 | 30,00,000 | 2.5x |

| 15 | 10,000 | 18,00,000 | 75,00,000 | 4.16x |

| 20 | 10,000 | 24,00,000 | 1,50,00,000 | 6.25x |

In 20 years, ₹24 lakhs invested becomes ₹1.5 crores. That’s not a typo—it’s compounding at work. Start early, and time does the heavy lifting.

Case Study: How SIPs Built a Dream Life

The Jain Family’s Journey

Meet Rakesh Jain, a 40-year-old shopkeeper from Jaipur. In 2010, he started a ₹1,500 monthly SIP in an equity fund. Over 13 years, he bumped it up to ₹5,000 as his business grew. By 2023, his total investment of ₹4.5 lakhs had swelled to ₹22 lakhs, averaging 18.5% returns.

With this money, Rakesh paid off his home loan and funded his son’s engineering degree. “I never thought small savings could do this,” he says. His story proves that SIPs aren’t just for the wealthy—they’re for anyone willing to start.

Lesson: Small steps today lead to giant leaps tomorrow.

Expert Tips to Supercharge Your SIP Returns

1. Step Up Your SIP

As your salary grows, increase your SIP by 10-15% annually. It’s like giving your wealth a turbo boost.

2. Reinvest Profits

Opt for the growth option—let dividends compound instead of cashing out.

3. Stay Calm

Markets will dip. Don’t freak out. Patience pays off in the long run.

4. Mix It Up

Diversify across equity, debt, and even gold funds. It’s like a safety net for your money.

Expert Quote: “Success in investing doesn’t come from being clever—it comes from being consistent.” – Peter Lynch, Investing Legend

FAQs: Your SIP Questions Answered

1. How much do I need to start an SIP?

You can kick off with just ₹500 a month. Some funds even offer ₹100 SIPs!

2. Can I stop my SIP anytime?

Absolutely. SIPs are flexible—no penalties for pausing or stopping.

3. Are 18.2% returns guaranteed?

Nope. Returns depend on the market, but equity funds have hit 18%+ historically. Pick wisely and stay long-term.

4. SIP vs. lump sum—Which is better?

SIPs spread risk with regular investments. Lump sums can work if you time it right, but that’s trickier.

5. How do I find the best fund?

Look for consistent 5-10 year returns, low fees, and a skilled fund manager.

6. When should I start?

Today! Every day you wait is a missed chance to grow your money.

Conclusion: Your Wealth Journey Starts Now

Here’s the truth: The 18.2% Return Plan isn’t a get-rich-quick scheme—it’s a get-rich-smart strategy. With SIPs, you’re not just investing cash—you’re investing in hope, security, and freedom. Priya’s ₹5 lakhs, Arjun’s home down payment, and the Jains’ debt-free life all started with one decision: to begin.

You don’t need a fortune to start. You don’t need to be an expert. All you need is a small step today. Open an SIP account, pick a solid fund, and let time work its magic. Your dreams—big or small—are closer than you think.

Start your SIP now and build the future you deserve!

Leave a Reply