Introduction

Axis Bank, one of India’s leading private sector banks, offers a range of investment options to its customers, including Fixed Deposits (FDs). FDs are a popular investment choice due to their high-interest rates and the assurance of stable returns. In this article, we will discuss Axis Bank FD interest rates for 2023, their benefits, limitations, and other relevant details to help you make an informed investment decision.

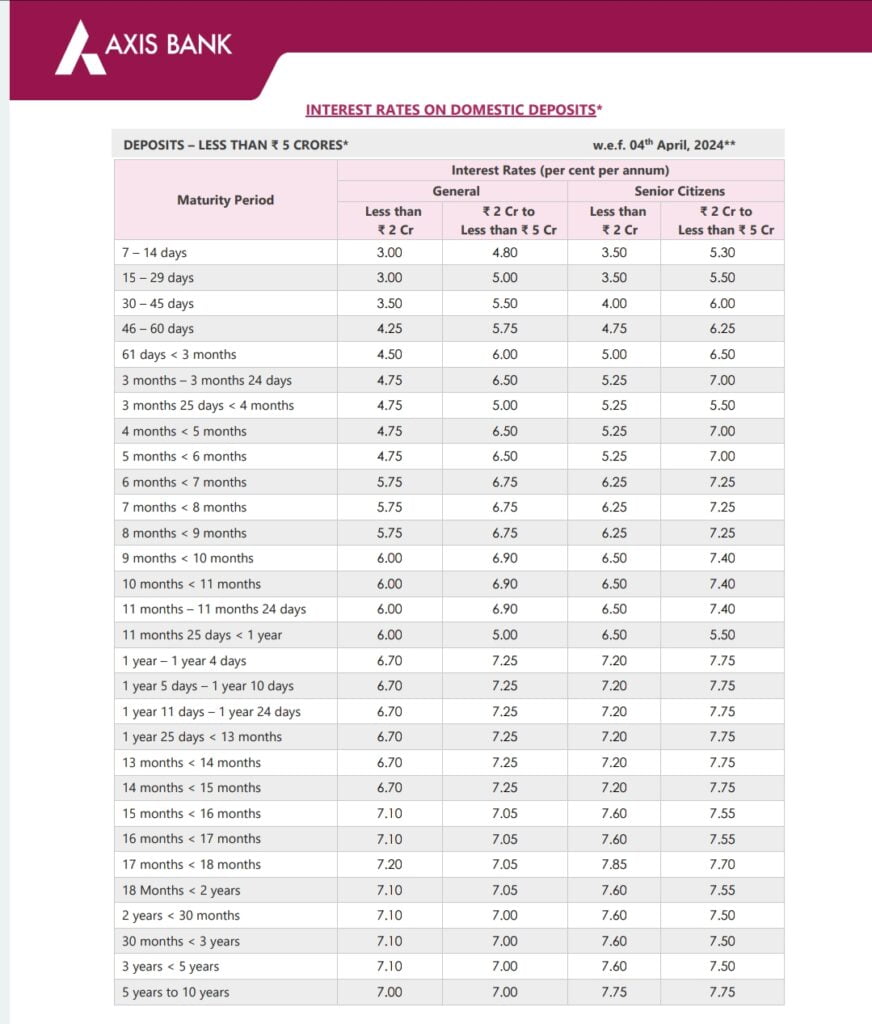

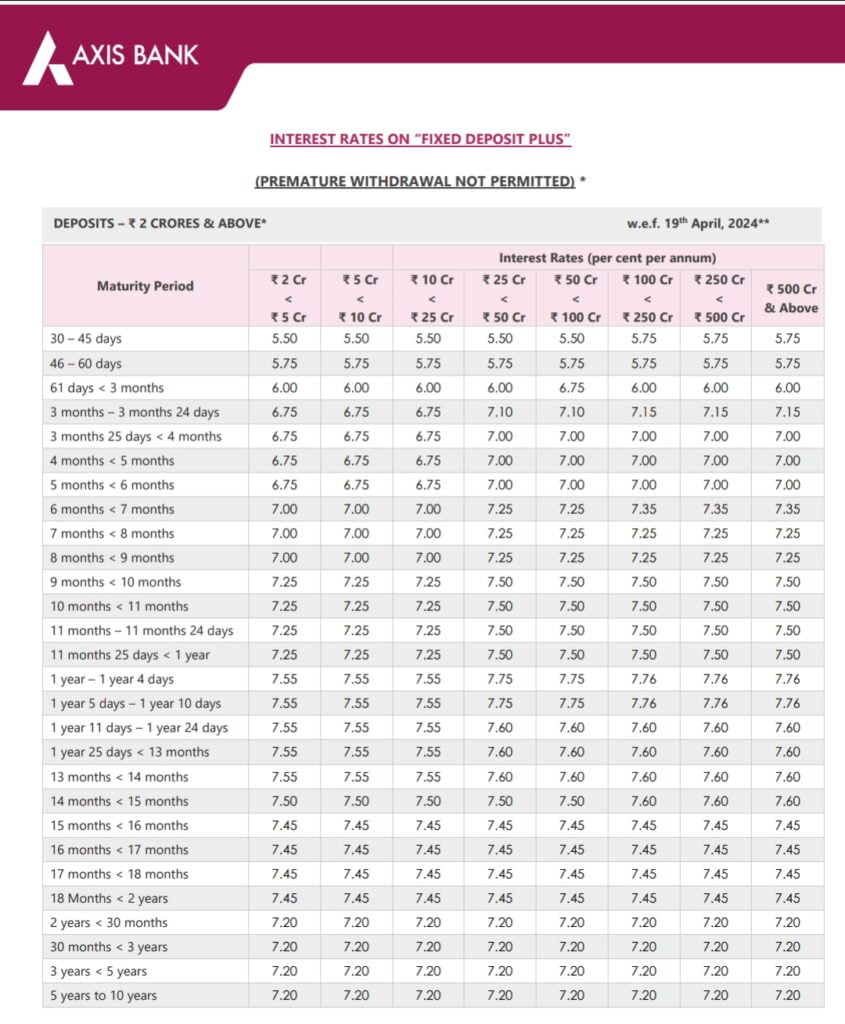

Axis Bank FD Interest Rates 2023

Axis Bank offers a range of interest rates on FDs, depending on the tenure of the deposit and the type of depositor. As of April 2023, the interest rates on Axis Bank FDs for normal depositors range from 3.50% to 7.26%, while for senior citizen depositors, the rates range from 4.01% to 8.01%. The minimum amount required to open an Axis Bank FD is ₹5,000 only, making it an accessible investment option for many.

Benefits of Axis Bank FDs

Axis Bank FDs offer several benefits, including:

- Comparatively safe investment: FDs are considered a safe investment option as they offer guaranteed returns, and the risk of losing capital is minimal.

- Stable and predicted returns: The interest rate on FDs is fixed for the entire maturity period, providing stable and predicted returns.

- Well-suited for conservative investors: FDs are an excellent investment option for conservative investors, such as senior citizens, who prefer low-risk investments.

- Flexible tenure: Axis Bank offers FDs with a tenure ranging from 7 days to 10 years, providing flexibility to investors.

- Automatic renewal: Axis Bank offers an automatic renewal option, allowing investors to renew their FDs without any hassle.

Limitations of Axis Bank FDs

Despite their benefits, Axis Bank FDs have some limitations, including:

- Low liquidity: FDs have a lock-in period, and premature withdrawal is not permitted, making them less liquid than other investment options.

- Low returns: The effective returns on FDs are lower when considering taxes and inflation.

- Not suitable for long-term wealth creation: FDs are not recommended for long-term wealth creation, especially for investors with a high-risk appetite.

Taxation of Axis Bank FDs

The interest earned on Axis Bank FDs is taxable under the Income Tax Act, of 1961. If the interest amount accrued in a savings account exceeds ₹10,000, it will be subject to taxation at the marginal tax rate applicable to the account holder.

How to Calculate Interest on Axis Bank FDs

To calculate the interest on Axis Bank FDs, you can use the FD calculator available on the bank’s website. The calculator requires you to input the deposit amount, tenure, and interest payout frequency to calculate the maturity amount and interest earned.

Strategies to Maximize Your Axis Bank FD Returns

To maximize your returns on Axis Bank FDs, consider the following strategies:

- Laddering: Laddering is a technique where you divide your investment amount into multiple FDs with different tenures. This strategy provides liquidity and higher returns.

- Investing in senior citizen FDs: Axis Bank offers higher interest rates on FDs for senior citizens. If you are a senior citizen, investing in senior citizen FDs can help you earn higher returns.

- Investing in long-term FDs: Axis Bank offers higher interest rates on long-term FDs. If you can afford to lock in your investment for a longer period, investing in long-term FDs can help you earn higher returns.

Axis Bank FD Interest Rates for 2023

Overview of Axis Bank’s Fixed Deposit Rates

Axis Bank, one of India’s leading private sector banks, offers a range of fixed deposit (FD) options to its customers in 2023. The interest rates offered on these deposits vary depending on the tenure and the amount deposited. Typically, shorter tenure FDs have lower interest rates compared to longer ones. For instance, FDs spanning a few months may offer slightly lower returns than those locked in for a year or more. Senior citizens usually receive higher interest rates, adding an additional benefit for the elder segment of depositors.

Safety of Long-Term FD in Axis Bank

Investing in a long-term FD with Axis Bank is considered safe due to the bank’s robust financial footing and good credit ratings. Fixed deposits are one of the safest investment options as they are not subject to market fluctuations. Additionally, deposits up to INR 5 lakhs are insured by the Deposit Insurance and Credit Guarantee Corporation (DICGC), which adds an extra layer of security for depositors.

Comparison of NiYO Global Card and Other Forex Cards

Features of NiYO Global Card

The NiYO Global Card is designed primarily for Indian travelers going abroad and combines the features of a debit card with the benefits of Forex cards. It allows users to load money in INR and spend in multiple foreign currencies without incurring high currency conversion fees. The card is accepted worldwide and can be managed conveniently through an associated mobile app, offering real-time currency conversion rates.

Benefits and Drawbacks of NiYO Global Card

One of the major advantages of the NiYO Global Card is that it offers zero Forex markup on international transactions, which can lead to substantial savings. However, there are some drawbacks, including the reliance on digital infrastructure for managing transactions and potential issues with card acceptance in certain countries or establishments less familiar with this new financial technology.

Comparison with Competing Forex Cards

When compared to other popular Forex cards like the HDFC Multicurrency Platinum ForexPlus Chip Card and the Thomas Cook Forex Card, the NiYO Global Card holds its ground in terms of features like zero markup rates and ease of digital handling. However, more traditional cards might offer broader customer support channels and established reliability in more regions globally. This makes the choice of card dependent on the specific needs and travel habits of the user.

Axis Bank Savings Account Interest Rate

Current Interest Rate for Savings Account in Axis Bank

Axis Bank, one of India’s leading financial institutions, offers a competitive interest rate on savings accounts, which is crucial for customers looking to earn returns on parked funds. As of 2023, the interest rate varies depending on the account balance. Amounts up to a specified limit typically earn a lower rate, possibly around 3.5%, while balances above that limit can earn slightly higher rates. It’s essential for customers to check with the bank directly or through its online banking platform for exact rates applicable to their account balances.

Factors Affecting Savings Account Interest Rates

The interest rates on savings accounts depend on various factors such as the Reserve Bank of India’s policies, inflation rates, and the economic environment. Banks also consider their liquidity requirements and profit margins. During periods of high inflation, banks might increase rates to retain customers and attract new deposits. Conversely, during economic downturns, rates might be lowered to encourage borrowing and stimulate spending.

Comparison of Special FD Schemes by SBI, Bank of Baroda, and Axis Bank

Overview of Special FD Schemes

Special Fixed Deposit (FD) schemes offer higher interest rates compared to regular FDs, aimed at specific customer segments such as senior citizens. These schemes are designed to provide better returns on retirement savings, promoting financial security.

Interest Rates Offered by SBI, Bank of Baroda, and Axis Bank

As of 2023, the State Bank of India (SBI), Bank of Baroda, and Axis Bank offer various special FD schemes with attractive interest rates. SBI’s special FD schemes for seniors typically offer an additional interest rate of 0.5% over the regular rates. Bank of Baroda and Axis Bank follow similar practices, sometimes offering slightly higher or lower rates based on terms and deposit amounts.

Benefits of Special FD Schemes

Special FD schemes offer several benefits:

– Higher Interest Rates: These accounts often provide higher interest than regular deposits, especially for vulnerable groups like senior citizens.

– Tax Benefits: Many special FDs qualify for tax deductions under specific sections of the Income Tax Act.

– Loan Facilities: Customers can avail loans against their FDs up to a certain limit at competitive interest rates, providing financial flexibility.

These benefits make special FD schemes a preferred choice for many individuals looking to maximize their earnings from investments securely.

Safety of Axis Bank for Savings Account and FD

Axis Bank’s Safety Record for Savings Accounts

Axis Bank, one of India’s leading private sector banks, has maintained a strong reputation for the safety of its savings accounts. The bank is regulated by the Reserve Bank of India (RBI), ensuring adherence to stringent safety standards and protocols. Axis Bank employs advanced security measures to protect customer information and finances, including two-factor authentication and secure encryption methods. Its commitment to safety has helped it build trust among millions of customers nationwide.

Factors to Consider for FD Safety

When considering the safety of Fixed Deposits (FDs) at Axis Bank, several factors come into play. These include the bank’s credit rating, which signals its financial stability and ability to repay depositors. Additionally, the Deposit Insurance and Credit Guarantee Corporation (DICGC) insures each depositor’s savings up to a limit of ₹ 5 lakh, offering an added level of security. Potential customers should also consider the bank’s history of stability and reliability in the market.

Risks and Benefits of Banking with Axis

Despite the high safety standards, banking with Axis Bank, like any investment, comes with its own set of risks and benefits. The main benefit is the attractive interest rates on FDs, which often outperform those of many other banks, leading to higher returns. However, risks may include potential impacts of market fluctuations and economic downturns on the bank’s performance. Fortunately, Axis Bank’s robust risk management strategies minimize such risks effectively.

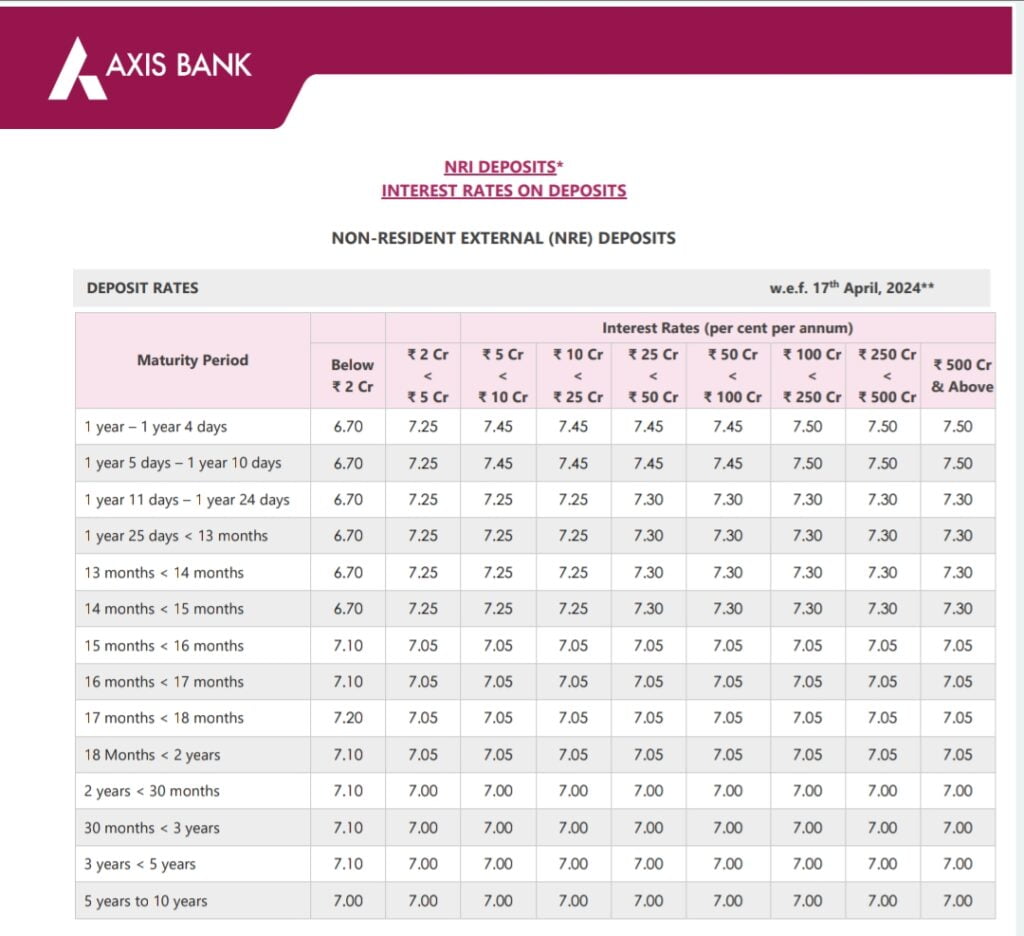

Choice of Bank for NRE Account

Factors to Consider for NRE Accounts

Choosing the right bank for an NRE (Non-Resident External) account involves considering several factors. These include the interest rates offered, service charges, branch network, and customer support. One must also evaluate the bank’s expertise in handling foreign currency transactions and its online banking interfaces, which are crucial for non-resident Indians managing their finances from abroad.

Best Banks for Opening NRE Account

Besides Axis Bank, other top banks for opening an NRE account include HDFC Bank, State Bank of India, and ICICI Bank. These banks offer competitive interest rates and have extensive international banking experience. They provide comprehensive NRE account services such as easy repatriation, internet banking, and linked NRE savings accounts for facile financial management.

Comparing USD Exchange Rates

For NRIs investing in India, comparing USD to INR exchange rates offered by different banks is essential. The rates can significantly affect the value of money sent to India and ultimately the returns on investments like FDs. Axis Bank frequently provides competitive exchange rates, but it’s advisable to compare with other banks periodically to ensure you are getting the best deal on your currency exchange.

Considerations for Personal Loan from Axis Bank

Interest Rates and Terms of Personal Loans

When exploring personal loans from Axis Bank, the interest rates and repayment terms are critical factors to consider. Axis Bank offers competitive interest rates that vary based on loan amount, tenure, and the borrower’s credit profile. The terms of loans can range from 12 to 60 months, providing flexibility in repayment options. It is essential to understand how these rates and terms can affect the overall cost of the loan and plan accordingly to manage the monthly payments effectively.

Benefits of Choosing Axis Bank for a Personal Loan

Choosing Axis Bank for a personal loan comes with multiple advantages. First, the bank offers quick loan approval and minimal documentation, which can be extremely helpful for urgent financial needs. Additionally, Axis Bank provides customized loan offers tailored to meet individual financial situations, which can include lower interest rates for existing customers. The availability of a detailed online management system helps borrowers easily track their loan status and repayment schedule, enhancing the customer experience.

Axis Bank Savings Account, FD, RD, and Credit Card Approval

Impact of Savings Account, FD, and RD on Credit Card Approval

Your financial relationship with Axis Bank, including your history with savings accounts, fixed deposits (FD), and recurring deposits (RD), can significantly impact your credit card approval chances. A robust history of savings and investments with the bank demonstrates financial stability and responsibility, which in turn can influence the bank’s decision on your credit card application. Having a higher balance in these accounts might also result in higher credit limits or lower interest rates on the credit card.

Tips for Getting Approved for an Axis Bank Credit Card

To enhance your chances of getting an Axis Bank credit card approval, consider maintaining a healthy credit score by making timely payments and keeping your debt-to-income ratio low. It’s advisable to use Axis Bank’s internet banking to regularly check and manage your accounts, as active account management reflects positively. Additionally, ensure that all your financial documents are updated and readily available, as this speeds up the verification process, making it smoother and faster. Lastly, applying for a credit card that matches your financial stature and spending habits is crucial; Axis Bank offers a variety of cards tailored to different economic needs and lifestyles.

Best Bank for NRI Account

Choosing the right bank for an NRI account is crucial for non-residents aiming to maintain financial stability in their home country. The best choice offers competitive interest rates on fixed deposits and seamless access to banking services across borders.

Factors to Consider in Opening an NRI Account

When selecting a bank for an NRI account, consider the following factors:

– Interest Rates: Look for banks that offer competitive interest rates on fixed deposits, which can significantly impact the growth of your investments.

– Customer Service: Accessibility to customer service, especially in different time zones, is vital. Opt for banks that provide robust support through various channels like internet banking, phone, and email.

– Banking Features: Evaluate the banking features offered, including online banking capabilities, mobile apps, and transaction ease. These features enhance the banking experience, making routine financial management more practical and accessible.

– Regulatory Compliance and Stability: Ensure the bank is compliant with regulatory standards and financially stable, which secures your money and personal information.

Recommendations for the Best Bank for NRI Account

Based on the above factors, Axis Bank emerges as a strong contender for the best bank for NRI accounts. It is known for:

– Offering attractive FD rates for NRIs, promoting the growth of deposits.

– Providing exceptional customer service with dedicated NRI help desks.

– Ensuring easy money management through advanced Internet banking solutions.

Axis Bank stands out due to its focus on catering to the unique needs of NRIs, making it a preferred choice for those seeking stable and efficient banking solutions abroad.

Conclusion

Axis Bank FDs are a popular investment choice due to their high-interest rates and stable returns. However, they have some limitations, such as low liquidity and low returns. Therefore, it is essential to consider your investment goals and risk appetite before investing in Axis Bank FDs. Additionally, it is crucial to stay updated with the latest interest rates and taxation rules to make informed investment decisions. By implementing strategies such as laddering and investing in long-term FDs, you can maximize your returns on Axis Bank FDs.

- What are the tenure options available for Axis Bank FD?

- Axis Bank provides FDs with tenures ranging from 7 days to 10 years, offering flexibility to investors.

- What is the minimum deposit amount needed to open an FD account with Axis Bank?

- The minimum deposit amount required to open an FD account with Axis Bank is ₹5,000.

- Can I add an additional amount to my Axis Bank FD account?

- No, additional amounts cannot be added to an existing Axis Bank FD account. Deposits are made at the time of opening the account.

- Is the interest earned on Axis Bank FD taxable?

- Yes, the interest earned on Axis Bank FDs is taxable under the Income Tax Act, of 1961. TDS is deducted by the bank at a rate of 10% if PAN is provided and 20% if not.

- What is the difference between a regular Axis Bank FD and a Tax-saver FD?

- In a Tax-saver FD, the investment is eligible for a deduction of up to ₹1.5 lakh under Section 80C of the Income Tax Act, with a lock-in period of 5 years. A regular FD does not offer tax deductions and has no lock-in period.

- What are the documents needed to start an FD account with Axis Bank?

- To open an FD account with Axis Bank, you need to provide address proof (Aadhar, driving license, passport, or voter ID) and proof of identity (PAN card).

These FAQs cover essential information about Axis Bank FDs, helping investors understand key aspects such as tenure options, minimum deposit amounts, taxation, and the difference between regular and Tax-saver FDs.