Introduction: The Atomic Allure of Oklo

- A world powered by self-consuming atomic furnaces, reactors so small they hum away unnoticed, quietly banishing our energy woes. Sounds like a tale spun from a science fiction loom, doesn’t it? But pull back the curtain, and you’ll find Oklo Inc. (NYSE: OKLO), a company that’s not just making waves – it’s threatening to rewrite the entire energy narrative.

- Overview: We’re not talking about your grandpa’s nuclear plant. We’re diving into the realm of advanced nuclear tech, compact fast reactors, and a bold, some might say audacious, vision for clean, reliable, and affordable energy. But what does “Oklo stock” actually represent? Is it a golden ticket to a carbon-free utopia, or a speculative bubble inflated by wishful thinking and the ravenous energy demands of artificial intelligence? Let’s unpack the atomic excitement, the historical context, and the eyebrow-raising debates that surround this enigmatic company.

Chapter 1: Unpacking Oklo – Small Reactors, Big Ambitions

- What They Do: Oklo isn’t interested in building behemoth nuclear power plants. Their focus is on deploying “Aurora Powerhouses” – compact fast neutron reactors (ranging from 15 to 75 MWe, with aspirations to hit 100 MWe+). Their business model is rather fascinating: Energy-as-a-Service. Instead of selling you a power plant, they sell you the power itself. It’s like subscribing to energy, a concept ripe for disruption in a sector resistant to change.

- The “Walk-Away Safe” Promise: Here’s where things get interesting, bordering on revolutionary. Oklo touts “inherent safety” – a self-stabilizing design cooled passively by the immutable forces of nature. This isn’t just a design feature; it’s a paradigm shift in how we perceive nuclear power. The specter of meltdowns and cascading failures is replaced with a system designed to shut down safely, automatically, without human intervention.

- Waste Not, Want Not: At the heart of Oklo’s vision lies a profound commitment to nuclear fuel recycling. They aim to transform used nuclear waste – a persistent and problematic byproduct of traditional reactors – into fresh fuel. This closes the fuel cycle, minimizing waste, extracting maximum energy, and turning a liability into an asset. It’s alchemy for the atomic age.

- Target Market: Who exactly is clamoring for clean, always-on power? The answer is, perhaps, everyone. But Oklo is specifically targeting data centers (essential infrastructure for the burgeoning AI revolution!), remote communities starved for reliable energy, energy-intensive industrial sites, and even military bases requiring secure power solutions. As the world electrifies and AI permeates every facet of our lives, the demand for this kind of power is only set to explode.

Chapter 2: A Blast from the Past – Oklo’s Journey to the Public Eye

- Humble Beginnings (2013): Every revolution has its genesis. For Oklo, it began in 2013, the brainchild of MIT graduates Jacob DeWitte and Caroline Cochran. Even their company name is a subtle homage to the ancient natural nuclear fission reactors discovered in Oklo, Gabon – a geological marvel that predates human civilization.

- Early Milestones: From the prestigious Y Combinator program to becoming the first advanced fission company to apply for a combined license with the Nuclear Regulatory Commission (NRC) in 2016, Oklo embarked on a long and arduous journey through the regulatory labyrinth. Securing regulatory approval is a gauntlet every nuclear startup must run, and Oklo has been at it for years.

- The SPAC Boom & Sam Altman: Oklo entered the public arena in May 2024 via a SPAC merger with AltC Acquisition Corp. The connection to OpenAI’s Sam Altman (who founded the SPAC and initially served as chairman) injected a dose of Silicon Valley glamour into the nuclear equation. Altman later stepped down as chairman to preempt potential conflicts of interest – a move that underscores the high-profile scrutiny Oklo faces.

- IPO Volatility: As with many SPAC-backed ventures, Oklo’s stock market debut was anything but smooth. The initial response was tepid, with the stock price dipping to $5.35 by September 2024. However, the narrative shifted dramatically, with the stock price experiencing a meteoric rise to highs in the $85-$120 range by September 2025. Such volatility is characteristic of disruptive tech stocks, especially those operating in highly regulated and capital-intensive sectors.

Chapter 3: The Nuclear Renaissance – What People are Saying Now

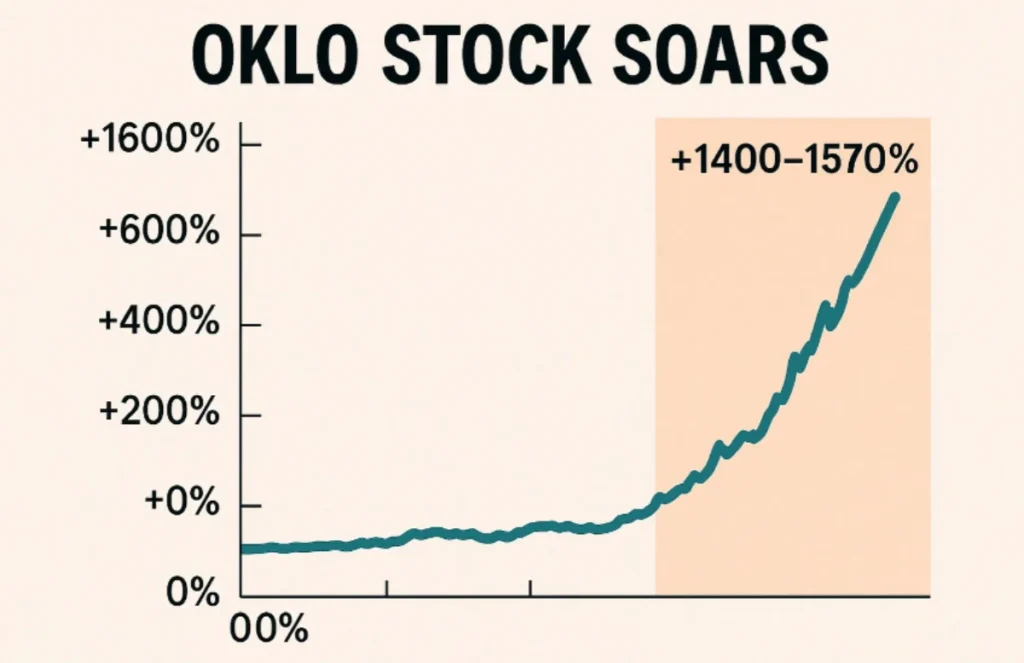

- Investor Enthusiasm: A palpable sense of nuclear fervor has gripped Wall Street. Oklo’s stock has soared, boasting gains of upwards of 1400-1570% in the past year! This surge is fueled by a confluence of factors: the insatiable energy demands of AI, a growing awareness of the limitations of intermittent renewables, and a broader recognition of nuclear power’s crucial role in achieving decarbonization goals.

- The “Moderate Buy” Consensus: Analysts, while generally optimistic, are also circumspect. While the consensus leans towards a “moderate buy” recommendation, price targets often fall below current trading levels. This suggests that while analysts recognize Oklo’s potential, they also harbor concerns about its current valuation. It’s a buy, but with a hefty dose of caution.

- Strategic Alliances are Key: The strategic alliances Oklo has forged are crucial indicators of its potential. The headline-grabbing 12 GW agreement with Switch data centers, coupled with commitments from Equinix and the U.S. Air Force, lend credence to Oklo’s vision. Collaborations with tech giants like Vertiv for integrated power and cooling solutions further solidify its position within the data center ecosystem.

- Government Backing: Federal initiatives are providing crucial tailwinds for advanced nuclear. The Reactor Pilot Program and the ADVANCE Act (aimed at reducing licensing costs) are creating a more favorable regulatory landscape for innovative nuclear technologies. This governmental support is essential for leveling the playing field and fostering a nuclear renaissance.

Chapter 4: Cracks in the Core – Controversies and Headwinds

- The NRC Roadblock: The Nuclear Regulatory Commission (NRC) represents a formidable hurdle for any nuclear company. Oklo experienced this firsthand when its initial combined license application was denied in 2022 due to what the NRC deemed insufficient information. Oklo plans to resubmit its application in Q4 2025, but the specter of regulatory delays continues to loom large.

- “Paper Reactor” & Transparency Concerns: Critics, such as Kerrisdale Capital, have raised concerns about the lack of detailed public engineering schematics and have accused Oklo of making misleading claims. These accusations have even led to investigations by law firms like Pomerantz LLP, exploring potential securities fraud. The “paper reactor” allegation suggests that Oklo’s technology may be more theoretical than practical at this stage.

- Financial Red Flags: The financial landscape surrounding Oklo is complex and warrants careful scrutiny.

- Pre-Revenue & Unprofitable: Oklo is currently burning through cash at a rapid pace, projecting operational expenses of $65-$80 million for FY2025. The absence of commercial revenue (projected to commence in 2027/2028 at the earliest) raises questions about the company’s long-term financial sustainability.

- Dilution: Recent public offerings, such as the $440 million raise in June 2025, provide crucial capital but dilute the ownership stake of existing shareholders. The consensus is that further dilution is “inevitable” as Oklo continues to fund its ambitious plans.

- Stretched Valuation: With a market capitalization hovering around $15 billion and a high Price-to-Book ratio (22.2x compared to a peer average of 1.8x), some analysts argue that Oklo’s stock price is “priced for perfection.” This suggests that the market may be overly optimistic about Oklo’s prospects, leaving little room for error.

- Insider Selling: The fact that executives sold shares in late 2024 raised eyebrows and fueled concerns about potential conflicts of interest or a lack of confidence in the company’s future performance.

- HALEU Supply Chain: Oklo’s reliance on high-assay low-enriched uranium (HALEU) introduces a potential vulnerability. The limited domestic production capacity for HALEU raises concerns about supply chain security and the potential for price volatility.

Chapter 5: Powering Tomorrow – What’s Next for Oklo?

- First Reactor Deployment: The deployment of the first commercial Aurora powerhouse at Idaho National Lab, targeted for late 2027/early 2028, represents a crucial inflection point for Oklo. Successful operation of this initial reactor will be pivotal in validating the company’s technology and demonstrating its commercial viability.

- Advanced Fuel Center: Oklo’s ambitious plan to construct a $1.68 billion fuel recycling facility in Oak Ridge, Tennessee, slated for the early 2030s, underscores its commitment to closing the nuclear fuel cycle. This facility aims to secure a domestic fuel supply, reduce reliance on foreign sources, and transform nuclear waste into a valuable resource.

- Scaling Up: Oklo envisions expanding its Aurora capacity, exploring hydrogen production, and diversifying into radioisotope production. These initiatives demonstrate the company’s ambition to become a diversified energy and technology provider.

- Global Reach: Collaborations, such as the partnership with Korea Hydro & Nuclear Power (KHNP), signal Oklo’s global aspirations. The company aims to export its technology and expertise to international markets, contributing to the global transition to clean energy.

- High Stakes, High Reward: Oklo is undoubtedly a front-runner in the race to develop and deploy advanced nuclear technologies. Success would mean providing clean, reliable, and affordable power to an energy-hungry world, particularly to fuel the burgeoning AI revolution. However, failure could result in significant financial losses for investors, underscoring the high-risk, high-reward nature of this investment.

Conclusion: The Atomic Gamble – A Stock to Watch?

- Oklo embodies the inherent tension between promise and peril that characterizes disruptive technology. Its innovative reactor designs and fuel recycling capabilities offer a compelling vision for a decarbonized future.

- However, the path to success is fraught with challenges, including regulatory hurdles, intense capital demands, and skeptical scrutiny from critics. The stock’s dramatic ascent reflects both genuine excitement about the potential of advanced nuclear and a degree of speculative fervor.

- For those considering an investment in Oklo stock, it’s crucial to recognize that this is not simply about analyzing quarterly earnings reports (which are currently negative). It’s about making a bet on a technological revolution, navigating a complex regulatory landscape, and placing your trust in the long-term vision of clean nuclear energy. Will Oklo ultimately become a cornerstone of our future energy infrastructure, or will its ambitions fizzle out before they truly ignite? Only time, and the NRC, will tell whether this atomic gamble pays off.

Leave a Reply