Introduction

The Indian Renewable Energy Development Agency (IREDA) has become one of the most closely watched renewable energy financing companies in India. Backed by the Government of India, IREDA plays a crucial role in funding solar, wind, biomass, and green hydrogen projects.

Table of Contents

With India’s ambitious 500 GW renewable energy capacity target by 2030, investors are asking one question: What could be the share price of IREDA in 2030?

What is IREDA?

IREDA (Indian Renewable Energy Development Agency) is a public sector financial institution under the Ministry of New and Renewable Energy (MNRE). Established in 1987, its mission is to provide financial support for renewable energy and energy efficiency projects.

Unlike commercial banks, IREDA focuses only on green energy financing, which makes it a strategic growth driver for India’s clean energy future.

| Parameter | Details |

|---|---|

| Established | 1987 |

| Sector | Renewable Energy Financing |

| Parent Ministry | MNRE (Govt. of India) |

| Listed On | NSE & BSE (IPO in 2023) |

| Market Cap (2025) | ~₹40,000 Crore |

Current Share Price Performance (as of 2025)

As of September 2025, IREDA’s share price was trading around ₹147 – ₹150 with a 52-week high of ₹239.90 and a low of ₹137.01. This volatility reflects both investor optimism and concerns about the broader NBFC sector.

| Metric | Value |

|---|---|

| Current Price (Sep 2025) | ₹147 – ₹150 |

| 52-Week High | ₹239.90 |

| 52-Week Low | ₹137.01 |

| PE Ratio | ~26.7 |

| EPS | ~₹5.51 |

This base data is essential for projecting the stock’s potential by 2030.

India’s Renewable Energy Boom – The Biggest Catalyst

India is pushing aggressively towards green energy to cut carbon emissions and reduce dependence on fossil fuels. By 2030, India targets 500 GW of renewable energy capacity, which will require trillions of rupees in financing.

Since IREDA is the primary green financing institution, it is expected to be a key beneficiary. The government’s push for energy transition ensures a strong long-term demand pipeline for IREDA loans.

| India’s Renewable Targets (by 2030) | Planned Capacity |

|---|---|

| Solar Power | 280 GW |

| Wind Energy | 140 GW |

| Hydropower | 60 GW |

| Biomass & Others | 20 GW |

| Total | 500 GW |

IREDA’s Financial Strength

For FY 2024–25, IREDA reported strong growth in revenue, loan book, and net profit. This shows that the company is not just policy-driven but also financially sound.

- Loan Book Growth: Rapid expansion in renewable project financing

- Profit After Tax (PAT): Healthy year-on-year increase

- Net Interest Margins: Stable compared to other NBFCs

| Financial Metric (FY 2024–25) | Value |

|---|---|

| Revenue | ₹5,200+ Crore (approx.) |

| Loan Book | ₹59,000+ Crore |

| PAT | ₹1,300+ Crore |

| Net Worth | ₹8,000+ Crore |

These fundamentals provide a strong base for long-term valuation models.

Step-by-Step Price Prediction for 2030

To estimate IREDA’s share price in 2030, let’s use a transparent EPS × PE approach.

Step 1 – Current EPS

- Current Price = ₹147.65

- Current PE = 26.79

- EPS = Price ÷ PE = ₹5.51

Step 2 – EPS Growth Assumptions (2025 → 2030, 5 years)

- Bear Case (5% CAGR): EPS ≈ ₹7.03

- Base Case (15% CAGR): EPS ≈ ₹11.09

- Bull Case (25% CAGR): EPS ≈ ₹16.82

| Scenario | CAGR Assumed | EPS in 2030 |

|---|---|---|

| Bear | 5% | ₹7.03 |

| Base | 15% | ₹11.09 |

| Bull | 25% | ₹16.82 |

Step 3 – P/E Multiples Assumptions

- Bear: 8–10

- Base: 12–16

- Bull: 18–25

Step 4 – Target Price Calculation

| Scenario | EPS (2030) | P/E Range | Predicted Price |

|---|---|---|---|

| Bear | ₹7.03 | 8 – 10 | ₹56 – ₹70 |

| Base | ₹11.09 | 12 – 16 | ₹133 – ₹177 |

| Bull | ₹16.82 | 18 – 25 | ₹303 – ₹420 |

Final Prediction (2030):

- Bearish: ₹56 – ₹70

- Base Case: ₹133 – ₹177

- Bullish: ₹303 – ₹420

This range reflects both risks and opportunities, making IREDA a medium to high-risk, high-reward stock.

Also Releted: IREDA Stock Price Prediction 2025–2030: Expert Forecast

Key Risks to Watch

Even though the growth potential is massive, investors must stay cautious about risks:

- Credit Risk: NPAs if renewable projects fail to generate expected returns.

- Interest Rate Risk: Rising borrowing costs can squeeze margins.

- Government Policy Risk: Sudden stake sales or dilution can affect share price.

- Sectoral Risk: Technology changes or delays in green projects may impact loan repayments.

| Risk Factor | Impact on IREDA |

|---|---|

| NPAs (Bad Loans) | Reduces profitability |

| High Borrowing Cost | Lower net margins |

| Govt. Stake Sale | Share supply pressure |

| Policy Delays | Slower loan growth |

Catalysts That Could Push Prices Higher

Despite risks, several factors could drive IREDA’s share price upwards by 2030:

- India’s 500 GW renewable energy target

- Global push for decarbonization

- IREDA’s expanding loan book and strong PAT growth

- Potential inclusion in green indices/ETFs

- Government incentives for clean energy

| Catalyst | Possible Outcome |

|---|---|

| Renewable Energy Expansion | Higher loan demand |

| PAT Growth | Investor confidence |

| Inclusion in Green ETFs | Increased FII inflows |

| Policy Support | Stronger valuations |

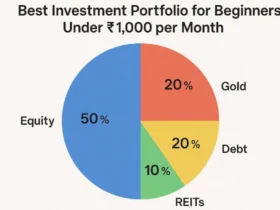

Investor Strategy – Should You Invest for 2030?

- Long-Term Investors (5+ years): Can consider small allocations and use SIP/DCA strategy to manage volatility.

- Short-Term Traders: Should remain cautious, as government stake sales can cause sharp corrections.

- Conservative Investors: May wait for more stability in loan book and NPA data.

| Investor Type | Suggested Approach |

|---|---|

| Long-Term | Small SIP-based entry |

| Short-Term | Trade on volatility |

| Risk-Averse | Wait & watch |

Conclusion – The 2030 Outlook

IREDA is more than just another NBFC — it is a strategic pillar in India’s renewable energy mission. With ambitious national targets, strong financials, and government support, it has significant long-term potential.

- Bearish Case: ₹56 – ₹70

- Base Case: ₹133 – ₹177

- Bullish Case: ₹303 – ₹420

The real outcome will depend on how effectively IREDA balances loan growth, asset quality, and government policy support.

For investors who believe in India’s green energy revolution, IREDA could be a rewarding long-term bet — but caution, diversification, and risk management are essential.

FAQs on IREDA Share Price Prediction 2030

Q1. Is IREDA a good long-term investment?

Yes, given India’s renewable push, IREDA has long-term growth potential, but risks remain.

Q2. What is IREDA’s expected share price in 2030?

Our prediction range is ₹133 – ₹177 (base case), with upside potential of ₹300+ in bullish conditions.

Q3. Is IREDA risk-free?

No. It faces credit, policy, and interest rate risks like any NBFC.

Q4. Should I buy IREDA at current levels (2025)?

If you are a long-term investor with a high-risk appetite, you can consider small allocations.

Leave a Reply