Introduction: The Golden Wave of 2025

What if your safest investment suddenly became your most profitable?

That’s exactly what happened in 2025. Gold, the timeless symbol of security, didn’t just protect wealth—it multiplied it. Across the globe, and especially in India, Gold ETFs (Exchange-Traded Funds) delivered jaw-dropping returns touching 66%, turning cautious savers into confident investors.

The surge wasn’t luck; it was a result of perfect timing, global economic shifts, and the growing realization that digital gold exposure through ETFs can be just as powerful as owning physical bullion—without the hassles.

Table of Contents

As we step into 2026, one question dominates investor conversations:

“Will Gold ETFs keep shining, or is the rally over?”

Let’s explore the full picture—what drove the 2025 boom, which funds performed best, and what the next decade could look like for gold investors.

Why Gold ETFs Exploded in 2025

1. Economic Uncertainty Fueled Demand

Throughout 2025, global economies juggled inflation, interest-rate cuts, and currency volatility. When stock markets turned choppy, gold once again became the world’s favorite safety net. In India, this sentiment translated into record inflows into Gold ETFs as investors sought stable, inflation-resistant returns.

2. Central Banks and Institutions Bought Big

Major central banks added tons of gold to their reserves. This large-scale demand acted like a magnet, pulling prices up and keeping the trend intact for months. Retail investors followed, fueling ETF growth further.

3. The Digital Gold Revolution

Unlike physical gold, Gold ETFs are easy to buy and sell via a Demat account. They track real-time market prices, remove purity doubts, and eliminate storage costs. In 2025, millions of young investors—especially from Tier-2 and Tier-3 cities—embraced this digital approach, giving ETFs unprecedented liquidity.

Data Snapshot: The 2025 Gold ETF Rally

| Metric | 2024 | 2025 | Growth |

|---|---|---|---|

| Average Gold Price (₹/10 g) | 62,000 | 1,03,000 | +66% |

| Average 1-Year Return of Top ETFs | 18% | 56–66% | +~48 pp |

| Total ETF AUM (India) | ₹28,000 cr | ₹47,000 cr | +68% |

| Retail Investor Participation | 1.4 mn accounts | 3.2 mn accounts | +129% |

Mini Takeaway: 2025 wasn’t just a gold rally—it was a financial phenomenon driven by accessibility, trust, and technology.

The Magic Behind 66% Returns

1. Early 2025 Momentum

The first quarter set the tone. As global uncertainties mounted, gold prices surged sharply. Those who entered Gold ETFs in January saw their holdings appreciate every month through mid-year.

2. Compounding Effect of ETFs

Gold ETFs mirror gold’s spot price but also benefit from compounding as reinvested gains build. Investors who held through the year captured the entire uptrend without worrying about physical logistics.

3. The Power of Digital Trust

Gold ETFs are regulated by India’s top financial bodies, giving investors confidence that their holdings are backed by certified gold stored in secure vaults. This assurance turned even skeptics into participants.

Performance Snapshot – Top Gold ETFs of 2025

| Rank | Fund Name | 1-Year Return (Approx.) | Expense Ratio | Liquidity |

|---|---|---|---|---|

| 1️⃣ | Nippon India Gold ETF (BeES) | 65% | Low | High |

| 2️⃣ | IDBI Gold ETF | 63% | Low | Moderate |

| 3️⃣ | SBI Gold ETF | 60% | Low | High |

| 4️⃣ | Aditya Birla Sun Life Gold ETF | 58% | Low-Medium | Good |

| 5️⃣ | HDFC Gold ETF | 56% | Low | Excellent |

(Data compiled from market-tracking reports 2025)

Mini Takeaway: Top funds with low expense ratios and high liquidity delivered the best inflation-adjusted returns.

Why Gold ETFs Beat Physical Gold

Owning gold physically brings hidden costs—making charges, purity risks, locker fees, and liquidity delays. Gold ETFs remove all of these.

Also Read: Gold Price Today (14K, 16K, 18K, 20K, 22K, 23K, 24K) – Live Update

Advantages at a Glance

- No making charges or purity issues

- Easy to buy/sell like stocks

- Backed by 99.5% pure bullion

- No storage risk or insurance hassle

- Lower transaction costs

- Eligible for loan collateral in some cases

Comparison Table

| Feature | Physical Gold | Gold ETFs |

|---|---|---|

| Purity Risk | High | None |

| Liquidity | Medium | High |

| Storage Cost | Yes | No |

| Making Charge | 5–10% | 0% |

| Price Transparency | Low | Real-time Market Price |

| Tax on Sale | Capital Gains | Capital Gains (Same Rules) |

Mini Takeaway: Gold ETFs offer every benefit of owning gold without any drawbacks—ideal for the modern investor.

Can the Rally Continue Beyond 2025?

1. Economic Forecast for 2026–2030

Experts predict moderate inflation and currency fluctuations over the next five years, which should keep gold demand healthy. Even if returns normalize from 66% to 10–15% annually, compounding could double capital in 5–6 years.

2. The ETF Growth Curve

Gold ETFs in India still represent a small portion of overall mutual-fund AUM. As digital literacy spreads and micro-investment apps grow, the next wave of investors is expected to double ETF holdings by 2030.

3. Global Demand Trends

If global central banks and sovereign funds continue hoarding gold, prices will stay supported. Industrial demand in electronics and green energy applications is also rising, adding a new growth dimension.

Gold Price Projection 2026–2030

| Year | Expected Avg Gold Price (₹/10 g) | Annual Return Estimate |

|---|---|---|

| 2026 | 1,08,000 | +5% |

| 2027 | 1,18,000 | +9% |

| 2028 | 1,28,000 | +8% |

| 2029 | 1,42,000 | +11% |

| 2030 | 1,55,000 | +9% |

Mini Takeaway: While the extraordinary 2025 returns may not repeat each year, gold ETFs can still deliver steady double-digit gains in the next decade.

How to Choose the Best Gold ETF

1. Check Expense Ratio

A lower ratio means less cost drag. Look for funds charging under 0.5%.

2. Review Tracking Error

ETFs that closely mirror the spot price of gold ensure you get what you pay for.

3. Examine Liquidity and AUM

High trading volumes and larger AUM indicate ease of entry and exit.

4. Historical Performance

Consistency matters more than a single year’s spike.

5. Fund House Reputation

Stick to established AMCs with transparent auditing and secure vaulting arrangements.

Quick Checklist

| Factor | Ideal Range |

|---|---|

| Expense Ratio | ≤ 0.5% |

| Tracking Error | ≤ 0.3% |

| Liquidity | High (daily trading volume) |

| AMC Rating | 4★ or higher |

| AUM Size | ≥ ₹500 crore |

Mini Takeaway: When returns are huge, details matter even more. Always pick efficiency and trust over hype.

Smart Investor Moves After a 66% Year

1. Rebalance Your Portfolio

After such a massive run, reduce gold exposure to 10–15% and redeploy profits into growth assets like equities.

2. Use SIP Strategy

Systematic Investing in ETFs smooths out price volatility and builds wealth over time.

3. Stay Updated with Global Cues

Monitor interest rates, currency moves, and geopolitics—they impact gold more than domestic events.

4. Avoid Emotional Buying

Don’t chase gold after it has already doubled. Wait for consolidation phases.

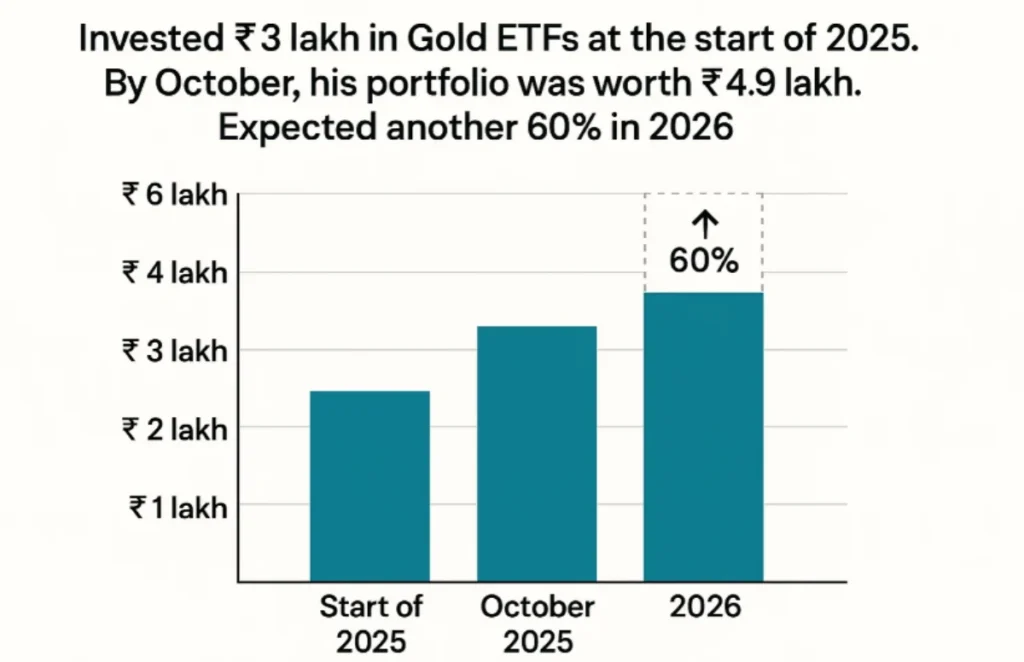

Investor Example

Ravi, a 34-year-old engineer, invested ₹3 lakh in Gold ETFs at the start of 2025. By October, his portfolio was worth ₹4.9 lakh. Instead of expecting another 60% in 2026, he booked profits and shifted ₹2 lakh into equity mutual funds while keeping ₹2.9 lakh in gold for long-term hedging. That balance made his portfolio future-proof.

Mini Takeaway: Smart investors celebrate gains but stay rational—they diversify, rebalance, and plan ahead.

The Psychology Behind the Gold Rush

Humans love tangibility. Gold connects emotionally because it represents safety and success. In 2025, social media buzz and family advice reinforced that trust—especially when digital apps made buying gold as easy as ordering groceries.

Also Read: Top 20 Gold ETF Funds of Fund (FoFs) in India 2025 – Best Gold Funds with 50%+ Returns

But smart investors know: sentiment alone can’t sustain returns. Discipline and patience do.

Mini Takeaway: Emotion may trigger investment, but data and discipline sustain wealth.

Risks You Should Not Ignore

- Price Volatility: Gold can correct 10–15% in short cycles.

- Currency Fluctuations: A stronger rupee may trim returns.

- Tracking Error: Small variance between ETF NAV and spot price.

- Over-exposure: Too much allocation to gold limits overall growth.

- Taxation: Capital gains apply; check the holding period rules.

Mini Takeaway: High returns often come with hidden risks—mitigate them through diversification and research.

FAQs

Q1. Are Gold ETFs safe to invest in?

Yes. They are regulated, backed by physical bullion, and audited regularly. They remove purity and storage risks found in physical gold.

Q2. How much should I invest in Gold ETFs?

Ideally allocate 5–15% of your portfolio to gold for diversification and inflation hedging.

Q3. Can Gold ETFs still give good returns after 2025?

Yes, but expect moderate 10–15% annual returns rather than 60% rallies. Gold works best as a steady hedge.

Q4. Do I need a Demat account?

Yes, Gold ETFs are traded on stock exchanges, so a Demat and trading account is required.

Q5. How are Gold ETF returns taxed?

They are treated similar to debt mutual funds. Check the current capital gains rules before redeeming.

Conclusion: The Future Is Golden – If You Stay Smart

The 2025 gold ETF boom proved that even the most traditional assets can become wealth engines when technology and timing align. Yes, returns of 66% won’t repeat every year, but the confidence in gold as a digital, liquid asset is here to stay.

If you’re planning your next investment move, make it an informed one. Understand your risk, watch global trends, and balance your portfolio for both growth and security.

Start your investment journey today with SmartBlog91.com — where smart ideas create smarter wealth.

Leave a Reply