Introduction: Why Millions Trust This ELSS Fund

Every year, around February and March, a very predictable thing happens across India. Offices buzz with HR emails asking for proof of tax-saving investments. People rush to buy last-minute LICs, fixed deposits, or PPF deposits. And somewhere in that noise, a young professional — maybe like you — searches Google for “best ELSS fund for tax saving.”

Table of Contents

This is where the Axis Long Term Equity Fund quietly enters the picture.

Not with loud marketing.

Not with unrealistic promises.

But with a solid 14+ year track record, a ₹32,800 crore investor base, and a reputation built on discipline, consistency, and long-term wealth creation.

But people don’t invest in mutual funds just because a website says it’s “good.”

They invest because they want security, growth, and a financial future they can believe in.

A True Story: How a Simple ELSS Investment Changed a Family’s Future

Meet Rohit, a 29-year-old employee working in Pune. In 2016, when he first heard about ELSS, he had no idea how it worked. He believed mutual funds were “risky gambling.” But his mentor insisted he start a ₹3,000 SIP in Axis Long Term Equity Fund.

Rohit reluctantly agreed, mostly because it helped him save tax.

Fast forward to 2025.

His SIP — something he started without expectations — had grown into a sizeable corpus. Not huge. Not magical. But big enough to pay for his sister’s postgraduate studies without taking a loan.

When he looked at the numbers, he realised something profound:

“Risk wasn’t in the market.

Risk was in depending only on salary.”

Axis Long Term Equity Fund didn’t just save Rohit tax — it quietly built a financial backbone for his family.

And this, more than anything, explains why this fund has become a ₹32,800 crore favourite among Indian tax-saving investors.

Table 1: Evolution of Axis Long Term Equity Fund (2015–2025 + Future Outlook)

| Year | AUM (₹ Crore) | 5-Year Return Trend | Key Market Condition |

|---|---|---|---|

| 2015 | 9,400 | 16–18% | Mid-cap boom |

| 2018 | 19,700 | 14–16% | Volatility + Elections |

| 2020 | 22,600 | 10–12% | COVID Crash |

| 2022 | 28,000 | 12–14% | Recovery Phase |

| 2025 | 32,800 | 12–15% | Stable earnings cycle |

| 2027 (Projected) | 40,000–45,000 | 12–14% | Rising MF penetration |

| 2030 (Projected) | 55,000–65,000 | 11–13% | Strong India growth |

What Exactly is Axis Long Term Equity Fund?

✔ ELSS on the surface, a diversified equity machine underneath

Axis Long Term Equity Fund belongs to the ELSS (Equity Linked Savings Scheme) category. That means:

- You get Section 80C benefit up to ₹1.5 lakh

- It has a 3-year lock-in (shortest among tax-saving instruments)

- It invests majorly in equities

- It targets long-term wealth creation, not short-term gains

While its name suggests it’s about long-term investing, the fund is actually known for:

Quality stock selection

Disciplined risk management

Minimal churn

High-conviction bets

This is not a “buy anything because it’s trending” type of fund. It’s more like a seasoned investor who prefers consistency over drama.

Fund Summary (Expert Breakdown)

- AUM (2025): ₹32,800 Crore

- Expense Ratio (Direct Plan): ~0.80%

- Equity Allocation: ~95–98%

- Large Cap Exposure: 45–55%

- Mid Cap Exposure: 15–25%

- Small Cap Exposure: 5–10%

- Riskometer: Very High

- Lock-in: 3 years (mandatory)

Most investors appreciate that while Axis Long Term Equity Fund is an equity fund, it doesn’t behave like a reckless high-risk product. It chooses companies with:

- Strong cash flow

- Consistent earnings

- Low debt

- Long-term growth visibility

This makes the journey smoother even during volatile market phases.

Table 2: Portfolio Composition Snapshot (2024–2025)

| Category | Weight | Trend (2025–2030) | Notes |

|---|---|---|---|

| Large Cap | 50% | Stable at ~50% | Risk buffer |

| Mid Cap | 20% | May rise to 25% | Growth driver |

| Small Cap | 7% | Remains under 10% | Controlled risk |

| Equity Total | 97% | 96–98% | Core strategy |

| Cash/Other | 3% | <5% | Tactical allocation |

How Has the Fund Performed?

Axis Long Term Equity Fund is popular because it survived multiple economic cycles without permanently damaging investor wealth.

✔ 1-Year Return (2025):

~7–9% (moderate due to broad market consolidation)

✔ 3-Year CAGR:

~13–15%

✔ 5-Year CAGR:

~12–14%

✔ Since Inception CAGR (2013–2025):

~14–15%, which is higher than inflation and many 80C alternatives.

But numbers alone don’t tell the whole story.

Why Many Investors Prefer This Fund Over PPF, FD, or NPS

Fastest Lock-In Among 80C Instruments

- ELSS: 3 years

- NPS: Till age 60

- PPF: 15-year lock-in

- Tax-saving FD: 5-year lock-in

That 3-year period gives ELSS a huge edge.

Equity Returns With Tax Advantage

PPF gives ~7.1%.

FD gives 6–7%.

But Indian equities historically return 11–15% over long periods.

Axis Long Term Equity Fund captures exactly that opportunity.

Also Read: Unveiling the Hidden Risks of SWP in Equity Mutual Funds for Long-Term Income

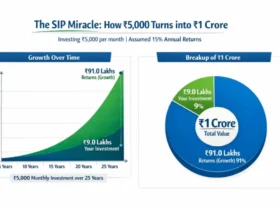

SIP Friendly + Low Minimum Investment

Even ₹500 SIP can create real wealth over time.

Table 3: ELSS vs PPF vs FD vs NPS (2025 + Future Projections)

| Instrument | Lock-In | Expected Return (2025) | Risk Level | Corpus in 10 Years (₹1 lakh/year) |

|---|---|---|---|---|

| Axis ELSS | 3 years | 12–15% | High | 19–20 lakh |

| PPF | 15 years | 7.1% | Low | 14–15 lakh |

| FD (Tax Saver) | 5 years | 6–7% | Low | 13–14 lakh |

| NPS | Till 60 | 9–11% | Medium | 17–18 lakh |

Expert View: What Makes Axis Long Term Equity Fund Unique?

✔ Consistency Over Hype

Some funds deliver 40% in one year and then crash 20%.

Axis Long Term Equity prefers steady long-term compounding.

✔ Fund Manager Discipline

Axis AMC is known for its “bottom-up stock picking.”

They focus on:

- Profitability

- Long-term visibility

- Good governance

- Quality over momentum

✔ Not Overexposed to Small Caps

This prevents drastic crashes during volatile periods.

✔ Ideal Blend of Large and Mid Caps

Large caps act as a cushion.

Mid caps act as growth engines.

Case Study: A SIP That Built a Dream Corpus

Nisha, a 32-year-old HR professional, started a ₹4,000 SIP in Axis LT Equity Fund in 2017.

She never stopped it — even during COVID.

Today in 2025, her SIP has:

- Survived a pandemic

- Survived inflation

- Outperformed bank deposits

- Built a corpus big enough for a home down payment

Her words:

“I didn’t get rich overnight.

But I became financially confident gradually.”

That’s the true essence of this fund — slow, steady, meaningful transformation.

Table 4: SIP Growth Projection (Based on 12–14% CAGR)

| SIP Amount | 5-Year Value | 10-Year Value | 15-Year Value |

|---|---|---|---|

| ₹2,000/month | ₹1.7–1.9 lakh | ₹4.5–5.2 lakh | ₹10–12 lakh |

| ₹5,000/month | ₹4.5–5.2 lakh | ₹11–13 lakh | ₹25–28 lakh |

| ₹10,000/month | ₹9–10 lakh | ₹22–25 lakh | ₹50–55 lakh |

Future Outlook (2027–2030)

Experts believe that ELSS funds — especially well-managed ones like Axis Long Term Equity — will benefit massively from:

- India’s growing GDP

- Rising retail investor participation

- Increasing SIP culture

- Decline in FD rates

- More awareness about inflation

- Digital adoption of financial products

Projected CAGR 2027–2030: 11–14%

Projected AUM 2030: ₹55,000–65,000 Crore

Projected SIP Inflows: ₹250–300 crore per month

Table 5: Expected Growth Indicators (2025–2030)

| Metric | 2025 | 2027 (Projected) | 2030 (Projected) |

|---|---|---|---|

| AUM | ₹32,800 Cr | ₹40k–45k Cr | ₹55k–65k Cr |

| Rolling 3-Year Returns | 12–15% | 11–14% | 11–13% |

| SIP Inflows | ₹150–200 Cr/m | ₹220–260 Cr/m | ₹300+ Cr/m |

| Investor Base | 40–45 lakh | 50–55 lakh | 60–70 lakh |

Who Should Invest in Axis Long Term Equity Fund?

✔ Ideal For

- Salaried individuals under Section 80C

- First-time equity investors

- Long-term wealth creators

- Investors who want stability + growth

- SIP investors

- People who prefer a hybrid of large-cap stability + mid-cap growth

Avoid If

- You need money within 3 years

- You cannot handle NAV fluctuations

- You expect guaranteed returns

FAQ Section

Is this fund risky?

Yes — because it invests in equities.

But it is a controlled risk, backed by quality selection.

Is it better than PPF?

For long-term wealth creation, yes.

For guaranteed returns, no.

How long should I stay invested?

Ideally 5–10 years for maximum compounding.

Can I invest lumpsum?

Yes, but SIP is generally more stable during volatile markets.

Is it good for beginners?

Yes. It is one of the best beginner-friendly ELSS options.

Final Verdict: Should You Invest in Axis Long Term Equity Fund?

If you are looking for:

Reliable tax-saving

Long-term wealth creation

A fund with proven history

Moderate, stable, disciplined growth

A blend of safety + opportunity

Then Axis Long Term Equity Fund is absolutely worth considering.

It won’t make you a millionaire overnight.

But it will walk with you — step by step — toward financial freedom.

Strong CTA

If you’re serious about building wealth, don’t wait for “perfect timing.”

Start a SIP — even ₹500.

Start early — even if unsure.

Start now — because compounding rewards the patient, not the perfect.

Leave a Reply