Introduction: Why $300 a Month Can Change Everything

In early 2026, $300 a month doesn’t sound flashy. It won’t buy a luxury car or a beachfront villa. But here’s the truth most people miss: $300 of consistent monthly investment income is the psychological tipping point.

It’s the moment when money starts working even while you sleep.

It’s when EMIs feel lighter.

It’s when panic around layoffs, inflation, or emergencies reduces.

Table of Contents

I’ve met readers who used $300/month to:

- Pay health insurance premiums stress-free

- Cover groceries during volatile months

- Reinvest and compound faster toward $1,000/month

The Reality Check Most Blogs Avoid

Before strategies, we need honesty.

To earn $300/month ($3,600/year) sustainably:

- You don’t need to be rich

- You do need discipline

- You must align capital + yield + time

In 2026 markets, safe long-term yields realistically range from 5% to 14%, depending on risk and asset class.

That means:

- At 6% yield → ~$60,000 capital

- At 10% yield → ~$36,000 capital

- At 12% blended yield → ~$30,000 capital

Understanding the $300/month Formula

Let’s simplify income investing into one clean equation:

Monthly Income = Invested Capital × Annual Yield ÷ 12

If you reverse-engineer it, clarity emerges.

Example:

- Capital: $40,000

- Yield: 9%

- Annual income: $3,600

- Monthly income: $300

Now the real question becomes:

Which investments can realistically deliver this in 2026–2030?

Table 1: Capital Required to Earn $300/Month (2026 Reality)

| Asset Type | Avg Yield (2026) | Capital Needed | Risk Level | 2030 Yield Outlook |

|---|---|---|---|---|

| Govt Bonds | 4.5% | $80,000 | Very Low | 4–5% |

| Dividend ETFs | 7% | $51,500 | Low | 7–8% |

| REITs | 8.5% | $42,300 | Medium | 8–10% |

| Hybrid Funds | 9% | $40,000 | Medium | 9–10% |

| High-Yield Income Mix | 11–12% | $30,000–33,000 | Medium-High | 10–12% |

Strategy #1: Dividend ETFs – The Backbone of Monthly Income

Dividend ETFs are the emotional stabilizers of income portfolios.

They don’t excite headlines, but they pay quietly and consistently.

In 2026, global dividend-paying companies are stronger due to:

- Post-inflation pricing power

- Cash-rich balance sheets

- AI-driven efficiency gains

Why Dividend ETFs Work

- Built-in diversification

- Quarterly or monthly payouts

- Lower volatility than individual stocks

A reader from Bengaluru shared how his $25,000 dividend ETF portfolio now covers his utility bills every month—without selling a single unit.

Table 2: Dividend ETF Income Projection (2026–2030)

| Year | Avg Yield | Annual Income on $25,000 | Monthly Income |

|---|---|---|---|

| 2026 | 6.8% | $1,700 | $142 |

| 2027 | 7.1% | $1,775 | $148 |

| 2028 | 7.4% | $1,850 | $154 |

| 2030 | 8.0% | $2,000 | $167 |

Strategy #2: REITs – Turning Real Estate into Monthly Cash Flow

Buying property is expensive. Owning REITs is not.

REITs convert rent from offices, warehouses, hospitals, and data centers into investor income.

In 2026:

- Warehousing REITs benefit from e-commerce

- Data-center REITs ride AI demand

- Healthcare REITs grow with aging populations

The emotional appeal?

You earn rent without tenants calling you at midnight.

Table 3: REIT Income Scenario

| Investment | Amount | Avg Yield 2026 | Monthly Income | 2030 Outlook |

|---|---|---|---|---|

| Global REIT ETF | $20,000 | 8.5% | $142 | Yield stable |

| Data Center REIT | $10,000 | 9.2% | $77 | Growth upside |

| Healthcare REIT | $5,000 | 8.0% | $33 | Defensive |

Total Monthly from REITs: ~$252

Strategy #3: Hybrid Income Funds – Stability Meets Growth

Hybrid income funds combine:

- Bonds (stability)

- Dividend stocks (income)

- Tactical allocation (risk control)

They shine in uncertain years—exactly like 2026–2028.

Also Read: 1 Lakh into 10 Lakhs in 4 Years Through Stock Investments

A Mumbai-based freelancer used a hybrid fund payout to smooth income during slow client months. That peace is underrated.

Table 4: Hybrid Fund Income Projection

| Capital | Yield | Annual Income | Monthly Income | Risk |

|---|---|---|---|---|

| $15,000 | 9% | $1,350 | $112 | Medium |

| $25,000 | 9.5% | $2,375 | $198 | Medium |

| $40,000 | 10% | $4,000 | $333 | Medium |

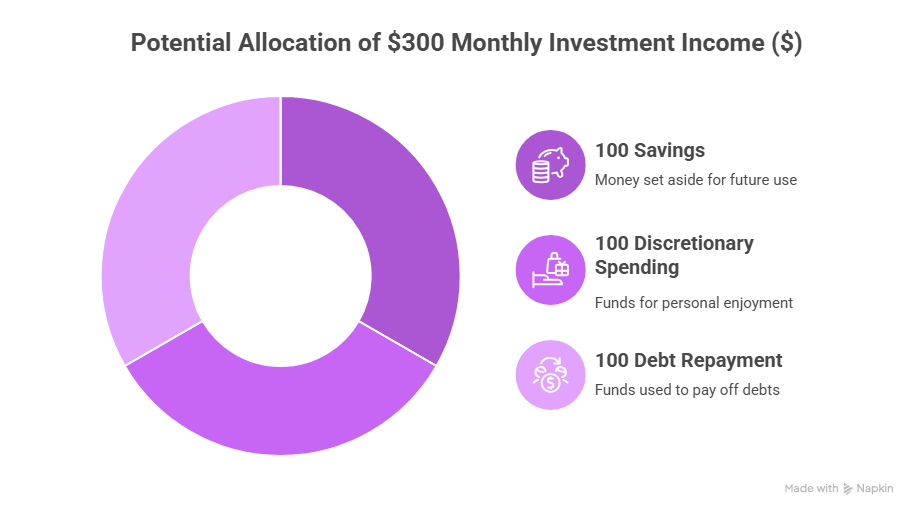

The Smart $300/Month Portfolio

Instead of betting on one asset, professionals blend.

Ideal 2026 Allocation:

- 40% Dividend ETFs

- 35% REITs

- 25% Hybrid Income Funds

This reduces volatility and smooths cash flow.

Also Read: Build a Portfolio for 15% Returns Over 10-12 Years with SIP Investments

Table 5: Blended Portfolio Breakdown

| Asset | Capital | Yield | Monthly Income |

|---|---|---|---|

| Dividend ETFs | $16,000 | 7% | $93 |

| REITs | $14,000 | 8.8% | $103 |

| Hybrid Funds | $10,000 | 10% | $83 |

| Total | $40,000 | — | $279–310 |

How Long Will It Take to Reach $40,000?

This is where emotion meets math.

If you invest $600/month starting 2026 at 10% CAGR:

Table 6: Wealth Accumulation Timeline

| Year | Total Invested | Portfolio Value |

|---|---|---|

| 2026 | $7,200 | $7,500 |

| 2027 | $14,400 | $16,000 |

| 2028 | $21,600 | $26,000 |

| 2029 | $28,800 | $37,000 |

| 2030 | $36,000 | $46,000 |

By 2030, $300/month income becomes sustainable.

Common Mistakes That Kill Monthly Income Dreams

- Chasing ultra-high yields

- Ignoring tax impact

- Reinvesting nothing

- Selling during volatility

Income investing rewards patience, not panic.

FAQs – Honest Answers

Is $300/month realistic for beginners?

Yes, with time and consistency not overnight.

Is this safe?

No investment is risk-free, but diversification reduces damage.

Should I reinvest initially?

Absolutely. Reinvest for first 2–3 years.

Can this scale to $1,000/month?

Yes. Same model, more capital.

Final Thoughts: Why This Matters More Than Ever

In a noisy world chasing quick money, monthly income is emotional safety.

$300/month means:

- Fewer sleepless nights

- More confident decisions

- Faster compounding

You don’t need perfection.

You need a calm plan and the courage to start.

Call to Action

If this guide helped you see money differently:

- Start with one ETF

- Set one monthly auto-investment

- Commit for 36 months

Future you is already grateful you started in 2026.

If you want, I can next create:

- A step-by-step beginner portfolio

- A country-specific version (US / India / Global)

- Or a $1,000/month income roadmap

Just tell me.

1 Comment