Introduction: The ₹10,000 Question Every Investor Asks

Because ₹10,000 per month is not pocket change for most Indian families. It’s school fees postponed. It’s one weekend trip cancelled. It’s a discipline decision.

Why 7 Years Is a Crucial SIP Timeframe (Not 3, Not 20)

Seven years is long enough to:

- Witness one correction

- Experience one strong bull phase

- Test your emotional discipline

But it’s not long enough to hide mistakes.

This is where SIP myths break.

Most people assume:

- SIP = guaranteed smooth returns

- Markets rise every year

- Volatility “averages out” automatically

Reality?

Markets test your patience before rewarding discipline.

In the last 7-year rolling periods (2013–2020, 2016–2023, 2019–2026):

- Some investors earned 9% CAGR

- Others earned 16%+ CAGR

- Same SIP amount, different timing, same market

Let’s ground this with numbers.

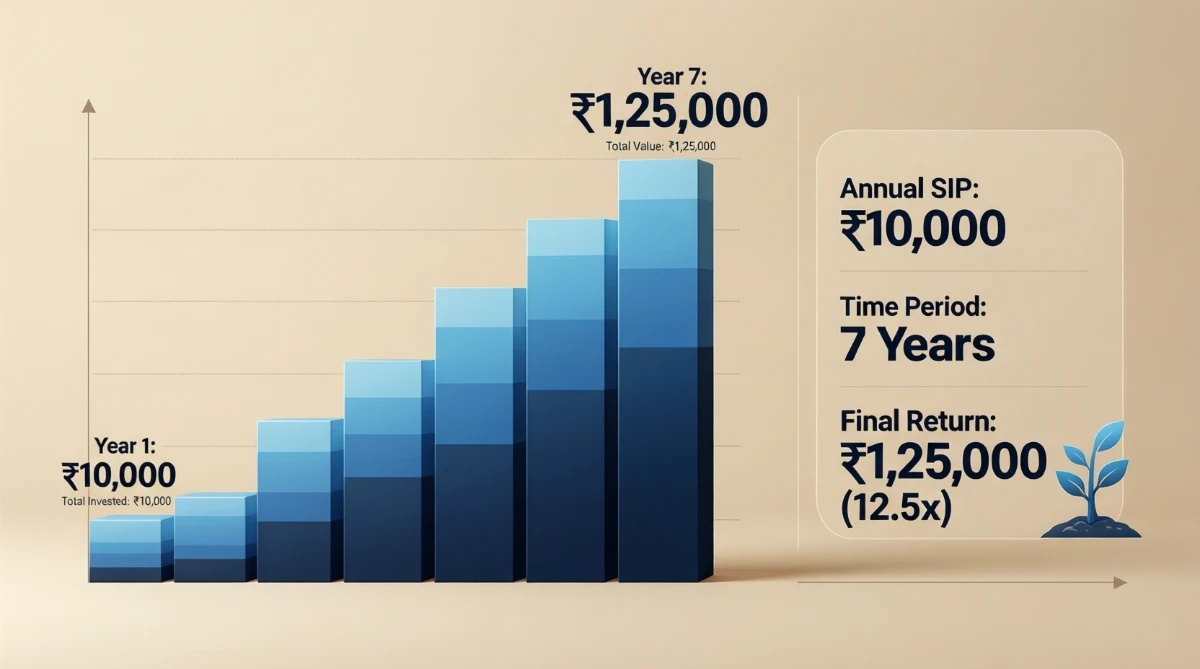

SIP Reality Snapshot (₹10,000/month for 7 years)

| Metric | Conservative | Realistic | Optimistic |

|---|---|---|---|

| Monthly SIP | ₹10,000 | ₹10,000 | ₹10,000 |

| Total Invested (7 yrs) | ₹8.4 lakh | ₹8.4 lakh | ₹8.4 lakh |

| CAGR Assumed | 9% | 12.5% | 15.5% |

| Final Value (2026 est.) | ₹11.9 lakh | ₹13.7 lakh | ₹15.6 lakh |

| Emotional Volatility | Low | Medium | High |

Key Insight:

Returns differ more due to behavior than fund selection.

What SIP Calculators Don’t Tell You (But Should)

Open any SIP calculator.

Enter:

- ₹10,000 monthly

- 15% return

- 7 years

It shows: ₹15–16 lakh

Looks simple. Feels reassuring.

But here’s the truth:

- You won’t earn 15% every year

- Some years you’ll earn –10%

- Some years +25%

- Most years will be boring

Your SIP result depends on sequence of returns, not just average CAGR.

Real Market Return Pattern (Typical 7-Year Cycle)

| Year | Market Phase | Annual Return |

|---|---|---|

| Year 1 | Volatile | +6% |

| Year 2 | Bull Run | +22% |

| Year 3 | Correction | –9% |

| Year 4 | Sideways | +4% |

| Year 5 | Bull Run | +18% |

| Year 6 | Mild Dip | –3% |

| Year 7 | Recovery | +14% |

Same market. Same SIP.

But emotions swing wildly.

A Real-Life SIP Story (Not a Screenshot Story)

Let me share Ankit’s case (name changed, numbers real).

Ankit started:

- SIP: ₹10,000/month

- Fund: Nifty 50 Index

- Start Year: 2019 (just before COVID)

What happened?

- 2020: Portfolio down –23%

- He continued SIP

- Everyone told him to stop

- News screamed “Worst Crash Ever”

By 2026:

- Total invested: ₹8.4 lakh

- Portfolio value: ₹14.2 lakh

- CAGR: ~13.1%

The magic?

He bought maximum units during fear.

Unit Accumulation Reality

| Phase | NAV Avg | Units Bought |

|---|---|---|

| Pre-COVID | High | Low |

| COVID Crash | Very Low | Very High |

| Post-Recovery | Rising | Medium |

SIP works only if you don’t interfere emotionally.

The Emotional Curve of a 7-Year SIP Journey

Every SIP investor goes through 4 psychological stages:

- Excitement (Year 1)

“Investing feels easy.” - Doubt (Year 2–3)

“Why isn’t it growing fast?” - Fear (Correction Year)

“Should I stop SIP?” - Confidence (Year 6–7)

“Glad I stayed invested.”

Most people quit at Stage 3.

That’s why average investor returns are lower than fund returns.

Investor Behavior vs Returns

| Investor Action | CAGR Outcome |

|---|---|

| Stayed disciplined | 12–14% |

| Paused during crash | 7–9% |

| Stopped & restarted | 5–7% |

| Panic exited | Negative real returns |

2026 Reality Check: What ₹10,000 SIP Actually Builds

Let’s freeze fantasy and look at 2026 ground reality.

Portfolio Composition (Typical Balanced Equity SIP)

| Asset | Allocation | Purpose |

|---|---|---|

| Large Cap Equity | 45% | Stability |

| Mid Cap Equity | 30% | Growth |

| Small Cap Equity | 15% | Volatility kicker |

| Debt / Cash | 10% | Shock absorber |

7-Year Outcome Snapshot (2026)

| Metric | Value |

|---|---|

| Monthly SIP | ₹10,000 |

| Total Invested | ₹8,40,000 |

| Portfolio Value | ₹13–14.5 lakh |

| Real CAGR | 11.8–13.6% |

| Inflation-Adjusted Return | ~7–9% |

That’s real wealth creation, not viral wealth.

What Happens If You Continue Till 2030? (Where SIP Becomes Powerful)

Here’s where patience flips the game.

If you continue the same SIP beyond 7 years:

10–14 Year Projection (₹10k/month)

| Duration | Total Invested | Expected Value |

|---|---|---|

| 7 Years (2026) | ₹8.4 lakh | ₹14 lakh |

| 10 Years (2029) | ₹12 lakh | ₹24–27 lakh |

| 14 Years (2033) | ₹16.8 lakh | ₹45–52 lakh |

Same SIP.

Different outcomes.

Time does the heavy lifting.

SIP vs Other Investment Options (Reality Comparison)

| Option | 7-Year CAGR | Risk | Liquidity |

|---|---|---|---|

| Fixed Deposit | 5–6% | Low | Medium |

| PPF | 7–7.5% | Low | Low |

| SIP (Equity MF) | 11–14% | Medium | High |

| Direct Stocks | 12–18% | High | High |

SIP wins risk-adjusted consistency.

Mistakes That Kill SIP Returns (Be Honest)

If your SIP underperforms, it’s usually because of:

- Fund hopping every year

- Stopping SIP during crashes

- Increasing SIP too late

- Expecting linear growth

- Checking portfolio daily

Return Impact of Common Mistakes

| Mistake | Return Damage |

|---|---|

| Stopping SIP for 1 year | –2 to –3% CAGR |

| Panic exit once | –4 to –6% CAGR |

| Late SIP increase | –1.5% CAGR |

Expert Insight: What Professionals Actually Expect

Most fund managers do not promise 15% every year.

Their real expectation:

- 12–13% CAGR over long cycles

- Stronger returns after 8–10 years

- Discipline > fund selection

That’s why SIP success stories sound boring — because boring is sustainable.

Frequently Asked Questions

Q1. Is ₹10,000 SIP enough for wealth creation?

Yes, if:

- You stay invested

- Increase SIP with income

- Give it 10+ years

Q2. Can SIP give negative returns in 7 years?

Rare, but possible if:

- Market enters prolonged stagnation

- You exit emotionally

Q3. Which SIP is best for 7 years?

- Index + Flexi Cap combination

- Avoid over-themed funds

Q4. Should I increase SIP yearly?

Absolutely. Even 10% annual step-up changes outcomes massively.

Final Truth: What ₹10,000 SIP Really Gives You

₹10,000 SIP won’t make you rich overnight.

But it will give you:

- Financial discipline

- Emotional maturity

- Inflation-beating wealth

- Control over your future

After 7 years, you won’t just have money.

You’ll have confidence.

Leave a Reply