In the world of high-finance, we are conditioned to believe that market-beating returns are the exclusive province of Wall Street titans and hedge fund wizards. But every so often, a retail portfolio comes across my desk that shatters that illusion.

Table of Contents

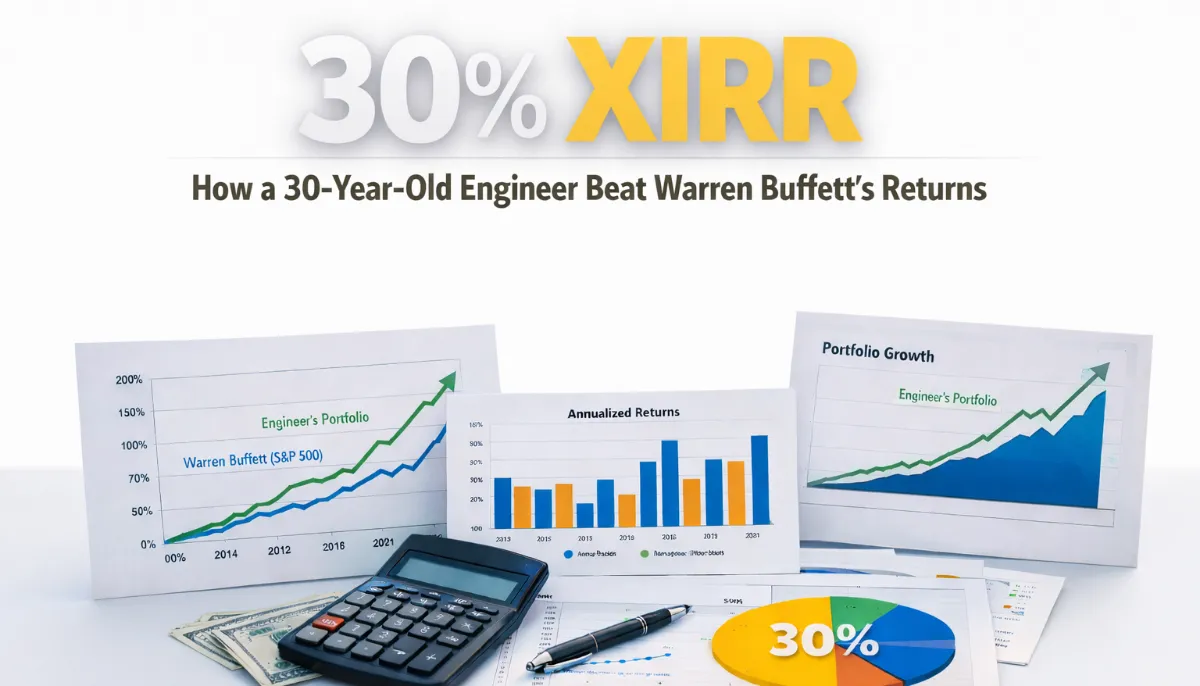

Meet Sanjay, a 30-year-old software engineer from Noida. Starting with a modest investment of just ₹5,000 in 2017, Sanjay built a portfolio that reached a staggering peak of ₹80 Lakh in early 2024, before he strategically booked profits for other investments, settling at a current value of ₹40 Lakh. With a total capital infusion of ₹21 Lakh and a current return of 93%, Sanjay’s portfolio boasts an XIRR of 30%.

To put that in perspective, a sustained 30% XIRR outperforms the career averages of both Warren Buffett and Peter Lynch. This isn’t just “good” investing; it is elite-level wealth compounding. But how does an average engineer achieve these numbers? The answer lies in a high-conviction framework that prioritizes data over sentiment.

1. The Magic of the Rule of 72 and the 30% “Truth-Teller”

While most investors obsess over “absolute returns,” the XIRR (Extended Internal Rate of Return) is the only metric that matters. It is the ultimate truth-teller because it accounts for the specific timing of every rupee that enters or leaves your portfolio.

At a 30% XIRR, the math of wealth creation becomes aggressive. Using the Rule of 72, we divide 72 by the rate of return to find the doubling period. While the pure math suggests 2.4 years, as a strategist, I prefer a conservative real-world estimate of 2.5 years to account for market friction.

If you were to invest ₹10 Lakh at this rate, the trajectory is exponential:

| Time Horizon | Projected Portfolio Value |

| 2.5 Years | ₹20 Lakh |

| 5.0 Years | ₹40 Lakh |

| 7.5 Years | ₹80 Lakh |

| 10 Years | ₹1.6 Crore |

Understanding this math is the difference between “saving” for the future and “engineering” a fortune.

2. The “In-Form” vs. “Out-of-Form” Audit

To maintain elite returns, you must treat your portfolio like a professional sports franchise. You cannot afford to carry “players” who aren’t performing. Using the Power Up Money methodology, we audit funds into four clinical categories:

- In Form: Elite performers (e.g., Parag Parikh Flexi Cap). High conviction; continue or increase SIPs.

- On Track: Solid performers (e.g., Tata Small Cap). Maintain position but monitor closely.

- Off Track: Funds losing momentum. For example, Sanjay’s ICICI Prudential Small Cap showed a Power Rank of 17 out of 24 and a mediocre Volatility Score of 64/100. This is a signal to stop SIPs immediately.

- Out of Form: Chronic underperformers (e.g., Axis ELSS, Kotak Flexi Cap). These are liabilities.

Sanjay’s Axis ELSS fund was underperforming its category average by a massive 7.8%.

“If the category return is 20% but your fund’s return is 12%, loyalty is no longer a virtue—it’s a hidden cost. Staying invested in an underperforming fund is a direct tax on your retirement.”

3. The Concentration Trap and the Buffett Indicator

A deep-dive analysis of Sanjay’s portfolio revealed a classic “Concentration Trap”: 60% exposure to US markets via the Nasdaq 100 and US Tech funds.

While this heavy bet fueled his massive 2023-24 “spike” in returns, it left him dangerously over-leveraged in a single geography. Today, the Buffett Indicator (Market Cap to GDP ratio) for the US is at historic highs, signaling extreme overvaluation. This is a risk that works until it suddenly doesn’t.

To preserve Sanjay’s gains while positioning for the next cycle, I recommended a shift toward a Balanced Contrarian Portfolio:

- 40% Indian Equities: Capturing domestic growth and infrastructure tailwinds.

- 25% US Equities: Maintaining exposure to global tech but at a de-risked level.

- 25-30% China Equities: A high-conviction contrarian play, targeting deep undervaluation in an economy poised for a rebound.

- 10% Gold/Silver: Essential hedges to ensure the portfolio survives a recession or currency devaluation.

4. “Missed Gains” and the Art of Power Rebalancing

Most investors fear the “cost” of switching funds—taxes and exit loads. However, an expert strategist looks at the Missed Gains.

By switching from a laggard like Axis ELSS to a leaderboard fund like HDFC or Parag Parikh ELSS, Sanjay could capture an additional 11.8% XIRR. When you run the numbers, the “cost” of the switch is negligible compared to the gain. For instance, withdrawing ₹1.16 Lakh to rebalance might incur a tax liability of only ₹4,600, yet it unlocks lakhs in future compounded growth.

A Power Rebalance requires looking at three data points:

- Power Rank: Current performance relative to peers.

- Rank Trend: Is the fund’s trajectory improving or decaying over the last four quarters?

- Net Switch Gain: Ensuring the projected XIRR delta far outweighs the tax hit.

5. Every Giant Started at Zero

It is easy to be intimidated by a ₹40 Lakh or ₹80 Lakh figure. But we must remember that in 2017, Sanjay’s portfolio was a mere ₹5,000.

The massive spike he saw in 2023-24 wasn’t just luck; it was the result of being “in the room” when the market moved. He had stayed consistent during the quiet years, allowing his capital to be in position when the US Tech rally took off.

“Every investor, from the billionaire to the beginner, starts at zero. If you are at ₹5,000 today, you are exactly where Sanjay was seven years ago. The only difference is time and the discipline to audit your path.”

Conclusion: Risk Management is the Real Alpha

Achieving a 30% XIRR is a phenomenal feat of offensive investing, but the “defense”—risk management and active rebalancing—is what preserves wealth. High returns attract investors, but diversification and auditing keep them wealthy through recessions.

Your portfolio might look “On Track” today, but do you know which of your funds are quietly stealing your future?

Final Action Item: Perform a clinical audit of your portfolio today. Use Power Rank and Rank Trend to identify your “Out of Form” funds. Don’t let sentimentality toward a fund house blind you to the data. High-performance investing is a choice; make yours today.

Leave a Reply