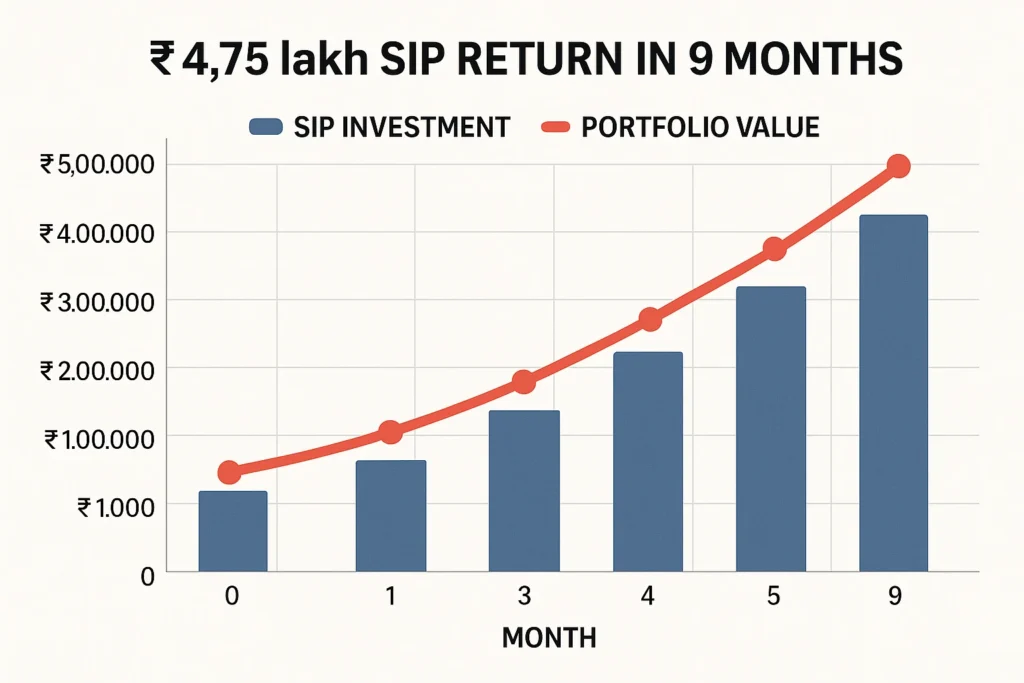

you’ve been diligently investing a fixed amount every month through a Systematic Investment Plan (SIP), and just nine months later, your investment has ballooned to ₹4.75 lakh. Sounds like a dream, right? But what if it’s not just a dream—what if the right mutual fund could make this a reality? If you’re wondering, “₹4.75 lakh SIP return in 9 months – which mutual fund is this?” you’re in the right place.

Table of Contents

What Does “₹4.75 Lakh SIP Return in 9 Months” Really Mean?

Before we dive into identifying the perfect mutual fund, let’s decode the query. The phrase “₹4.75 lakh SIP return in 9 months” could be interpreted in two ways in the context of mutual funds:

- Total Amount Accumulated: The ₹4.75 lakh could represent the final value of your SIP investment after 9 months, including both the money you put in and the returns earned.

- Profit Alone: Alternatively, it might mean that the profit or gain from your SIP investment is ₹4.75 lakh, on top of your total invested amount.

Since the query doesn’t specify the monthly SIP amount, the first interpretation—total amount accumulated—seems more practical for analysis. Why? Because a ₹4.75 lakh profit in just 9 months would require an extraordinarily high rate of return, which, while not impossible, is rare for mutual funds over such a short period. So, we’ll assume that after investing a certain amount monthly for 9 months, your SIP grows to ₹4.75 lakh. Our mission? To figure out which mutual fund could deliver such results!

Understanding SIPs: The Basics You Need to Know

If you’re new to investing, let’s start with the fundamentals. A Systematic Investment Plan (SIP) is a disciplined way to invest in mutual funds. Instead of dumping a lump sum into a fund, you invest a fixed amount—say, ₹10,000 or ₹50,000—every month. This approach has two superpowers:

- Rupee Cost Averaging: When markets dip, you buy more units; when they rise, you buy fewer. Over time, this smooths out volatility.

- Compounding: Your returns generate more returns, especially in equity mutual funds, where growth can accelerate over time.

But here’s the catch: SIP returns aren’t fixed like a bank FD. They depend on how well the mutual fund performs, which is tied to market conditions. Equity funds can soar during bull markets but may stumble during downturns. So, to hit ₹4.75 lakh in 9 months, we need a fund that’s been riding a strong upward wave.

The Math Behind ₹4.75 Lakh in 9 Months

To pinpoint the right mutual fund, we need to estimate the monthly investment and the rate of return required to reach ₹4.75 lakh in 9 months. The formula for the future value (FV) of an SIP is:

[ FV = P \times \left( \frac{(1 + i)^n – 1}{i} \right) ]

Where:

- FV = Future Value (₹4,75,000 in this case)

- P = Monthly SIP amount

- i = Monthly rate of return

- n = Number of months (9 here)

Since the query doesn’t provide the SIP amount, let’s test a realistic figure—say, ₹50,000 per month—and see what return rate we’d need.

- Total Invested: ₹50,000 × 9 = ₹4,50,000

- Target FV: ₹4,75,000

- Returns Needed: ₹4,75,000 – ₹4,50,000 = ₹25,000

Now, let’s plug this into the SIP formula and solve for the monthly rate (i):

[ 4,75,000 = 50,000 \times \left( \frac{(1 + i)^9 – 1}{i} \right) ]

This equation isn’t easily solved by hand, so let’s try a few monthly rates:

- Monthly Rate = 1.5% (Annual ~19.56%):

- ((1.015)^9 ≈ 1.143)

- (\frac{1.143 – 1}{0.015} = \frac{0.143}{0.015} ≈ 9.533)

- (FV = 50,000 \times 9.533 ≈ 4,76,650)

Bingo! A monthly SIP of ₹50,000 at a 1.5% monthly return (roughly 19-20% annualized) gets us to approximately ₹4,75,000. But is a 20% annual return realistic in 9 months? Let’s explore.

Can Mutual Funds Deliver 20% Returns in 9 Months?

Here’s the million-rupee question: can a mutual fund achieve an annualized return of around 20% over a 9-month period? The short answer is yes, but it’s not guaranteed. Equity mutual funds, especially those in high-growth categories like small-cap, mid-cap, or sectoral funds, can deliver such returns during exceptional market conditions.

For context:

- Historical Data: In India, top-performing equity funds have posted annualized returns exceeding 30-40% in strong bull markets (e.g., post-COVID recovery in 2020-21).

- Short-Term Spikes: Over shorter periods like 6-9 months, some funds have seen even higher gains during sectoral booms (think PSU or infrastructure funds in 2023).

For example, a Zee Business report highlighted funds delivering up to 47% SIP returns in 6 months. If a fund can achieve that in 6 months, extending that momentum to 9 months isn’t far-fetched. However, mutual fund returns are volatile, and such performance is tied to specific market cycles.

Top Mutual Funds That Could Fit the Bill

While we can’t pinpoint the exact fund without more data (like the SIP amount or the specific 9-month period), we can spotlight some high-performing mutual funds in India that have historically delivered stellar short-term returns. These are prime candidates that, under the right conditions, could help you reach ₹4.75 lakh in 9 months with a ₹50,000 monthly SIP.

1. Nippon India Small Cap Fund

- Category: Small-Cap

- Historical Returns: Up to 44.90% annualized

- Why It Works: Small-cap funds thrive in bullish markets, offering explosive growth potential.

2. Motilal Oswal Midcap Fund

- Category: Mid-Cap

- Historical Returns: Around 37.50% annualized

- Why It Works: Mid-caps balance growth and stability, making them a strong contender.

3. SBI Small Cap Fund

- Category: Small-Cap

- Historical Returns: Around 36.46% annualized

- Why It Works: Known for picking high-potential small companies, this fund shines in uptrends.

4. ICICI Prudential Infrastructure Fund

- Category: Sectoral/Thematic

- Historical Returns: Around 33.47% annualized

- Why It Works: Infrastructure booms can drive outsized returns in short bursts.

5. HDFC Small Cap Fund

- Category: Small-Cap

- Historical Returns: Around 30.86% annualized

- Why It Works: A consistent performer with a knack for capitalizing on market rallies.

6. Kotak Small Cap Fund

- Category: Small-Cap

- Historical Returns: Around 29.87% annualized

- Why It Works: Diversified small-cap exposure with a solid track record.

Disclaimer: Past performance doesn’t guarantee future results. These returns are annualized figures from specific periods and may not reflect 9-month performance exactly.

How to Simulate This Yourself: A Step-by-Step Example

Let’s bring this to life with a practical example. Suppose you pick the Nippon India Small Cap Fund, expecting a 20% annual return, and invest ₹50,000 monthly for 9 months.

- Monthly Rate: 20% ÷ 12 ≈ 1.67%

- Calculation:

- ((1.0167)^9 ≈ 1.160)

- (\frac{1.160 – 1}{0.0167} ≈ 9.58)

- (FV = 50,000 \times 9.58 ≈ 4,79,000)

You’d end up with ₹4,79,000—slightly above ₹4,75,000—proving that a fund with a 20% annual return could do the trick. Adjust the SIP amount slightly (e.g., ₹49,000), and you’d land closer to the target.

Table: SIP Scenarios to Reach ₹4.75 Lakh in 9 Months

Here’s a handy table showing how different SIP amounts and return rates could get you to ₹4.75 lakh:

| Monthly SIP (₹) | Annual Return (%) | Monthly Return (%) | Future Value (₹) |

|---|---|---|---|

| 40,000 | 25% | 2.08% | 4,24,800 |

| 45,000 | 22% | 1.83% | 4,55,850 |

| 50,000 | 20% | 1.67% | 4,79,000 |

| 52,000 | 18% | 1.50% | 4,75,920 |

Key Takeaway: With ₹50,000 monthly and a 20% return, you’re in the ballpark. Tweak the SIP or pick a hotter fund, and you’re golden!

Expert Insights: What the Pros Say

To add credibility, here are some quotes from financial gurus:

“SIPs are a fantastic tool for wealth creation, especially in equity funds where timing the market isn’t necessary—just consistency is.”

– Ankit Sharma, Financial Analyst, ClearTax

These insights remind us that while ₹4.75 lakh in 9 months is achievable, it’s not risk-free.

Why Small-Cap and Sectoral Funds Might Be Your Best Bet

If you’re chasing high returns in a short timeframe, small-cap and sectoral/thematic funds are your MVPs. Here’s why:

- Small-Caps: Companies with smaller market caps have more room to grow, often delivering 30-50% returns in a single year during market rallies.

- Sectoral Funds: Funds focused on hot sectors (e.g., infrastructure, PSU, or technology) can surge when those industries boom.

For instance, during India’s infrastructure push in 2023, funds like ICICI Prudential Infrastructure Fund capitalized on government spending, posting impressive gains. Similarly, small-cap funds like Nippon India Small Cap Fund have ridden waves of retail investor enthusiasm.

Risks to Watch Out For

Before you jump in, let’s talk risks:

- Market Volatility: A 9-month window is short, and equity funds can dip just as fast as they rise.

- Fund-Specific Risks: Small-cap and sectoral funds are riskier than large-cap or diversified funds.

- Timing: Your 9-month period must align with a market upswing—luck plays a role.

Pro Tip: Consult a financial advisor and check the fund’s performance over the exact 9-month period you’re targeting.

Steps to Find Your ₹4.75 Lakh Fund

Here’s your action plan in bite-sized steps:

- Set Your SIP Amount: Decide how much you can invest monthly (e.g., ₹50,000).

- Research High-Growth Funds: Look at small-cap, mid-cap, or sectoral funds with strong recent performance.

- Use an SIP Calculator: Plug in your SIP amount, 9 months, and test return rates (e.g., 18-25%).

- Check Historical Data: Platforms like Moneycontrol or Value Research show fund returns over specific periods.

- Invest and Monitor: Start your SIP and track market trends—be ready to adjust if needed.

FAQs: Your Burning Questions Answered

1. What is an SIP, and how does it work?

An SIP lets you invest a fixed amount in a mutual fund regularly (usually monthly). Your money buys units based on the fund’s Net Asset Value (NAV), and returns depend on how the NAV grows.

2. Can I really get ₹4.75 lakh in 9 months with SIP?

Yes, with a high-performing fund and a substantial monthly SIP (e.g., ₹50,000), it’s possible if the fund delivers around 20% annualized returns. But it’s not guaranteed—markets can be unpredictable.

3. Which mutual fund is best for short-term high returns?

Small-cap funds (e.g., Nippon India Small Cap) or sectoral funds (e.g., ICICI Prudential Infrastructure) often lead in short-term gains, but they’re riskier.

4. How do I calculate SIP returns?

Use an online SIP calculator or the formula:

[ FV = P \times \left( \frac{(1 + i)^n – 1}{i} \right) ]

Enter your SIP amount, tenure, and expected return rate.

5. Are SIPs safe for short-term goals?

Equity SIPs are volatile in the short term (like 9 months). For safety, consider debt or liquid funds, though they offer lower returns.

Conclusion: Your Path to ₹4.75 Lakh

So, which mutual fund could turn your SIP into ₹4.75 lakh in 9 months? While we can’t name one definitive fund without exact historical data for a specific 9-month period, high-flyers like Nippon India Small Cap Fund, Motilal Oswal Midcap Fund, or ICICI Prudential Infrastructure Fund are strong contenders. With a monthly SIP of around ₹50,000 and a 20% annual return, you’re in the zone.

But here’s the real takeaway: achieving this requires a potent mix of a top-performing fund, a favorable market, and a bit of luck. Use SIP calculators, research recent fund performance, and consult an expert to tailor your strategy. Ready to start your investment journey? The power of SIPs awaits—go make your ₹4.75 lakh dream a reality!

1 Comment