Introduction to Bajaj Housing Finance

Bajaj Housing Finance Limited (BHFL) is a non-deposit-taking Housing Finance Company (HFC) registered with the National Housing Bank (NHB) since 2015. Established in 2008, this powerhouse has rapidly climbed the ranks to become one of India’s leading HFCs. BHFL offers a diverse range of financial products, including:

- Home Loans: Financing for purchasing or constructing residential properties.

- Loans Against Property (LAP): Leveraging property assets for liquidity.

- Lease Rental Discounting: Funding based on rental income streams.

- Developer Finance: Supporting real estate developers with project financing.

This diversification allows BHFL to cater to both individual borrowers and corporate clients, positioning it as a versatile player in the housing finance market. Within just seven years of starting its mortgage operations, BHFL became India’s second-largest HFC. By March 2024, it ranked as the eighth-largest NBFC (Upper Layer) by Assets Under Management (AUM) and the second most profitable HFC in the country, showcasing its meteoric rise.

Table of Contents

Why does this matter for the Bajaj Housing Finance share price? A strong market position and diversified portfolio often translate into investor confidence, which directly impacts stock performance. Let’s dive deeper into its journey on the stock market.

The IPO Frenzy and Initial Market Reception

Bajaj Housing Finance made its grand entrance into the stock market with a blockbuster Initial Public Offering (IPO) in September 2024. Priced at ₹70 per share, the IPO was a hot ticket, and on its listing day—September 16, 2024—the stock opened at an astonishing ₹150 on both the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE). That’s a jaw-dropping 114% gain right out of the gate! Investors who secured allotments celebrated this windfall, with many choosing to book partial profits while holding onto shares for potential long-term gains.

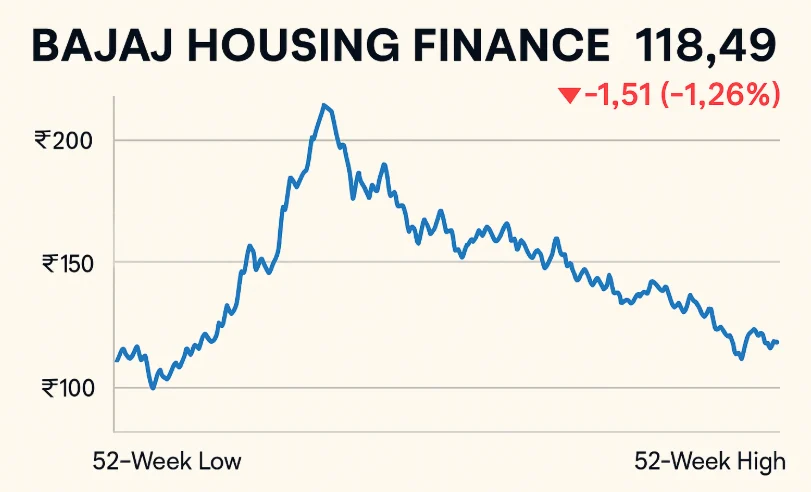

However, the euphoria didn’t last forever. After hitting a 52-week high of ₹188.50, the stock faced a correction, dipping to a 52-week low of ₹103.10. As of April 26, 2025, the Bajaj Housing Finance share price hovers around ₹118.49. This rollercoaster ride raises a critical question: Is BHFL still a stock worth watching, or has its shine faded? To answer that, let’s examine its current valuation and financial performance.

Current Share Price and Valuation Metrics

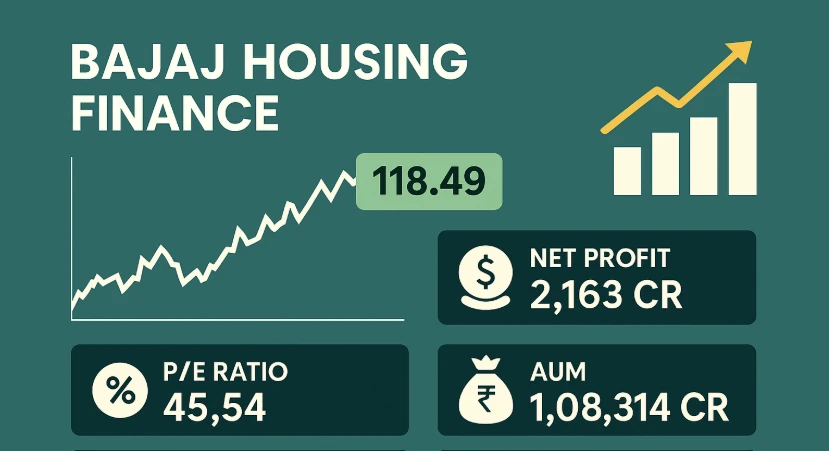

Understanding the Bajaj Housing Finance share price requires a look at its valuation metrics as of April 26, 2025. Here’s a snapshot:

| Metric | Value |

|---|---|

| Market Capitalization | ₹99,396.43 crore |

| Price-to-Earnings (P/E) Ratio | 45.54 |

| Price-to-Book (P/B) Ratio | 4.94 |

| Earnings Per Share (EPS, TTM) | ₹2.67 |

| Dividend Yield | 0.0% |

| 52-Week High | ₹188.50 |

| 52-Week Low | ₹103.10 |

What Do These Numbers Mean?

- Market Cap: At nearly ₹1 lakh crore, BHFL is a large-cap stock, signaling its significance in the Indian market.

- P/E Ratio: A P/E of 45.54 is notably higher than the industry average of ~23, suggesting investors are betting big on future growth—but it also hints at a premium valuation.

- P/B Ratio: Trading at 4.94 times its book value, BHFL is priced well above its peers, reflecting strong market confidence in its assets and prospects.

- EPS: An EPS of ₹2.67 indicates solid per-share profitability.

- No Dividends: BHFL reinvests profits into growth rather than paying dividends, a common strategy for expansion-focused companies.

This premium valuation is a double-edged sword. It reflects optimism about BHFL’s future but also raises concerns about overvaluation. Let’s explore the financials driving these figures.

Financial Performance: The Backbone of the Share Price

Bajaj Housing Finance’s financial performance is a cornerstone of its stock’s appeal. For fiscal year 2025, the company reported:

- Net Profit: ₹2,163 crore, up 25% year-on-year.

- Revenue: ₹9,576 crore, showcasing robust top-line growth.

- Assets Under Management (AUM): ₹1,08,314 crore as of December 2024, a 26% increase from the previous year.

What sets BHFL apart is its asset quality. With a net non-performing assets (NPA) ratio of just 0.13%, the company demonstrates exceptional risk management—a critical factor in the housing finance sector where loan defaults can erode profits. In Q4 FY25, BHFL’s net interest income (NII) grew by 31% to ₹823 crore, while profit before tax surged 47.42% to ₹719.75 crore.

Quote from Leadership

“Our focus on maintaining a high-quality loan book and leveraging digital channels has enabled us to deliver consistent growth while keeping risks in check.”

— Atul Jain, Managing Director, Bajaj Housing Finance

These numbers explain why investors remain intrigued by the Bajaj Housing Finance share price, even after its post-IPO correction. But financials alone don’t tell the whole story—external factors play a massive role too.

Key Drivers of Bajaj Housing Finance’s Share Price

Several factors influence the ups and downs of BHFL’s stock. Let’s break them down:

1. Company-Specific Drivers

- Growth Trajectory: BHFL’s 26% AUM growth and diversified portfolio signal a bright future, supporting its share price.

- Low NPAs: A net NPA of 0.13% is a testament to its prudent lending practices, boosting investor trust.

- Digital Push: Investments in technology have widened its customer reach, enhancing operational efficiency.

2. Macro-Economic Factors

- Interest Rates: As an HFC, BHFL is sensitive to RBI’s monetary policy. Rising rates could shrink net interest margins, pressuring profitability and the share price.

- Real Estate Market: A thriving housing sector fuels loan demand, while a slowdown could dampen growth.

- Regulatory Changes: New NHB or RBI rules could affect lending norms or capital requirements, impacting BHFL’s operations.

3. Market Sentiment and External Events

- Investor Mood: Positive earnings or analyst upgrades can spark rallies, while negative news triggers sell-offs.

- Geopolitical Risks: Recent tensions with Pakistan, for instance, caused market volatility in May 2025, indirectly affecting BHFL’s stock as traders reacted to uncertainty.

These drivers create a complex interplay, making the Bajaj Housing Finance share price a fascinating study in market dynamics.

Analyst Opinions: What the Experts Say

Analyst views on BHFL’s stock vary, reflecting its nuanced position:

- Phillip Capital (September 2024):

“We initiate coverage with a ‘Buy’ rating and a target price of ₹210, implying a 27% upside. BHFL’s growth potential and market leadership justify its premium valuation.”

They pegged the stock at 6.5x its September 2026 book value.

- Skeptical Voices: Some analysts warn that the P/E of 45.54 and P/B of 4.94 leave little margin for error. A failure to meet growth expectations could trigger a correction.

- Social Media Buzz: On X, opinions range from bullish (“Still a multibagger in the making!”) to cautious (“P/E too high—wait for a dip”).

This mix of optimism and caution underscores the need for investors to dig deeper into BHFL’s prospects.

Peer Comparison: How Does BHFL Stack Up?

Here’s how Bajaj Housing Finance compares to its competitors:

| Company | Market Cap (₹ Cr) | P/E Ratio | P/B Ratio | Dividend Yield (%) |

|---|---|---|---|---|

| Bajaj Housing Finance | 99,396.43 | 45.54 | 4.94 | 0.0 |

| HDFC Ltd. | ~5,00,000 | 20.5 | 2.5 | 1.5 |

| LIC Housing Finance | ~35,000 | 10.2 | 1.2 | 1.5 |

| PNB Housing Finance | ~15,000 | 12.5 | 1.5 | 0.47 |

| Aadhar Housing Finance | ~10,000 | 15.0 | 1.8 | 0.0 |

BHFL’s premium valuation stands out. While its growth justifies some of this, it also suggests higher risk if market conditions sour.

Technical Analysis: Charting the Share Price Trends

For traders, technical analysis offers clues about future movements:

- 52-Week Range: ₹103.10 (low) to ₹188.50 (high).

- Current Price: ₹118.49 (April 26, 2025).

- Support Levels: ₹111.50–₹117.50.

- Resistance Levels: ₹125–₹130.

- Moving Averages:

- 50-day: ~₹120 (bearish signal below this).

- 200-day: ~₹140 (long-term downtrend).

- RSI: ~45 (neutral, no overbought/oversold signals).

The stock appears range-bound, but a breakout above ₹130 could signal a bullish reversal.

Risks to Watch Out For

Investing in BHFL isn’t without risks:

- Interest Rate Hikes: Could squeeze margins and profitability.

- Regulatory Shifts: Stricter norms might raise costs or limit lending.

- Competition: Rivals like HDFC and LIC Housing Finance are formidable.

- Economic Slowdown: A sluggish real estate market could hurt loan growth.

Future Outlook: Where Is the Share Price Headed?

BHFL’s management aims for a 24%–26% growth in home loans, backed by digital innovation and a strong risk framework. If achieved, this could justify its premium valuation over time. However, short-term volatility from geopolitical risks or rate changes remains a wildcard.

For long-term investors, BHFL’s fundamentals make it a compelling hold. For short-term traders, timing entries and exits around support/resistance levels is key.

Conclusion: Navigating the Bajaj Housing Finance Share Price

Bajaj Housing Finance is a standout in the housing finance space, blending strong financials with ambitious growth plans. Yet, its share price—currently ₹118.49—carries a premium that demands scrutiny. Investors must balance its potential against risks like interest rate shifts and market volatility.

Whether you’re eyeing BHFL as a long-term gem or a short-term trade, staying informed is your best tool. The stock market rewards those who dig deep, and this analysis is your starting point to mastering the Bajaj Housing Finance share price.

FAQs: Your Burning Questions Answered

Q: What is the current share price of Bajaj Housing Finance?

A: As of April 26, 2025, it’s approximately ₹118.49.

Q: Is Bajaj Housing Finance a good investment?

A: It has strong fundamentals, but its high valuation requires careful risk assessment based on your goals.

Q: What drives the Bajaj Housing Finance share price?

A: Key drivers include financial performance, interest rates, real estate trends, and market sentiment.

Q: Does BHFL pay dividends?

A: No, it reinvests profits into growth rather than paying dividends.

Q: What are the risks of investing in BHFL?

A: Interest rate hikes, regulatory changes, competition, and economic slowdowns are key risks.

Leave a Reply