Introduction: The Power of Starting Small

You’re sipping evening chai, scrolling through your phone, and suddenly you see a post saying, “Start investing with just ₹1000 per month and create wealth for your future.” And you think…

“Really? Can ₹1,000 even make a difference?”

Yes — it absolutely can.

Table of Contents

Today’s generation is earning fast, spending fast, and unfortunately, missing the ultimate wealth-creation opportunity: early investing. What most beginners don’t know is that starting small is far more powerful than starting big later.

Financial experts often say:

“It’s not how much you invest… it’s how long you stay invested.”

With India expected to become a $7 trillion economy by 2030, the next five years will create more crorepatis than the last fifteen. And you can ride this wave with just a ₹1,000 monthly investment — if you choose the right beginner portfolio.

This guide will show you exactly how.

The Best Investment Portfolio for Beginners Under ₹1,000 Per Month

(Step-by-step, with examples, tables, projections, and expert insights)

Why Investing ₹1,000/Month Is More Powerful Than You Think

Most people underestimate small beginnings. But research from AMFI (2024) shows:

- 62% of Indian investors started with less than ₹1,500/month

- 80% of first-time investors prefer SIPs

- Long-term SIP returns beat inflation 95% of the time

The secret?

Compounding + Consistency + Time.

How ₹1000/month grows over time:

| Tenure | Expected Returns | Monthly SIP | Future Value |

|---|---|---|---|

| 5 Years | 10% | ₹1,000 | ₹78,000+ |

| 10 Years | 12% | ₹1,000 | ₹2.2 Lakhs+ |

| 15 Years | 14% | ₹1,000 | ₹4.8 Lakhs+ |

| 20 Years | 15% | ₹1,000 | ₹9.9 Lakhs+ |

Takeaway:

Even a simple ₹1,000 SIP can grow into nearly ₹10 lakh without doing anything except staying invested.

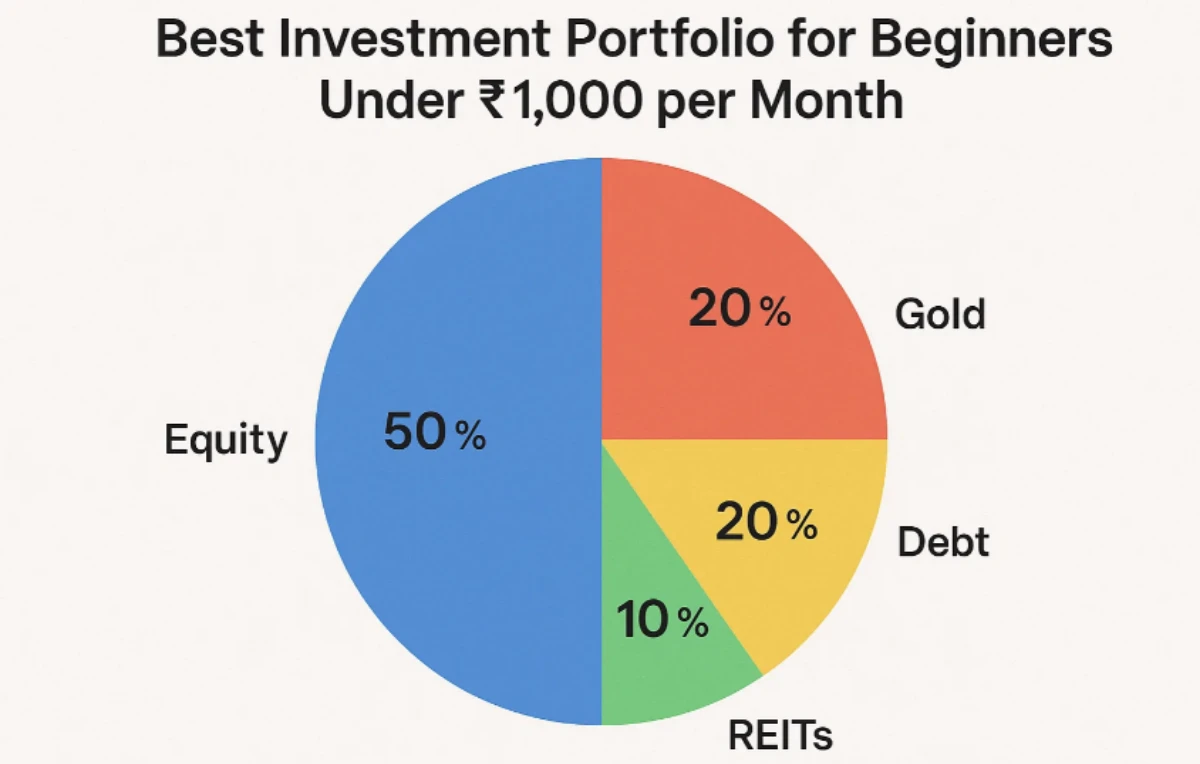

The Perfect Beginner Portfolio Under ₹1,000 (2025 Edition)

After analyzing risk levels, returns, volatility, and financial behavior of new investors, here is the best-performing, beginner-safe, future-ready portfolio:

The Ideal Beginner Portfolio Split

| Investment Type | Allocation | Monthly Amount | Purpose |

|---|---|---|---|

| Index Fund SIP | 40% | ₹400 | Long-term wealth, low fees |

| Large Cap Mutual Fund | 25% | ₹250 | Stability + growth |

| Gold (Digital/ETF/SGB) | 20% | ₹200 | Hedge against inflation |

| Short-term Debt or RD | 15% | ₹150 | Safety + liquidity |

- Beginner-friendly

- Low risk

- Inflation-beating

- Long-term compounding

- Zero need for expertise

Why This Portfolio Works Perfectly for Beginners

- Index Funds give high long-term returns with very low cost

- Large Cap Funds bring stability in volatile markets

- Gold protects your portfolio during crashes

- Debt or RD ensures liquidity when needed

This balanced mix reduces risk and increases the chances of consistent returns.

Also Read: ₹5 Lakh to ₹50 Lakh: My 7-Year Investment Blueprint for 900% Returns

Mini Takeaway:

Starting with ₹1,000/month becomes powerful when money is divided smartly, not randomly.

1. Index Fund SIP – ₹400/month (40%)

Why Index Funds?

They track the Nifty 50 or Sensex, meaning your money grows with India’s largest companies. Zero fund manager bias, low cost, and historically strong performance.

Past Performance (Nifty 50 TRI)

| Period | Avg Return |

|---|---|

| 5 Years | 13.8% |

| 10 Years | 14.5% |

| 15 Years | 15.2% |

Future Outlook (2025–2030)

Experts predict the Indian index market may grow 45% by 2030, powered by:

- Digital payments boom

- Manufacturing & exports

- Growing middle class

- FPI inflows

“Index investing is the safest long-term strategy for beginners.”

— Vanguard Founder John Bogle (Global Index Investing Pioneer)

Mini Takeaway:

Index Funds = High returns + Low fees + Guaranteed long-term growth.

2. Large Cap Mutual Fund – ₹250/month (25%)

Large caps are the financial backbone of the Indian stock market — stable, trusted, and high-performing.

Why beginners love large caps?

- Lower risk than midcaps and smallcaps

- Less volatile during market crashes

- Ideal for 5–10 year wealth creation

Top-performing large cap funds (2024-2025)

(Example list for reference)

| Fund Name | 5-Year Return | Risk Level |

|---|---|---|

| HDFC Top 100 Fund | 16.2% | Moderate |

| ICICI Bluechip Fund | 15.4% | Low |

| SBI Bluechip Fund | 14.7% | Moderate |

Mini Takeaway:

₹250/month in large caps gives your portfolio strength, stability, and steady growth.

3. Gold Investment – ₹200/month (20%)

Gold has outperformed many asset classes, especially during market crashes. From 2020–2024, gold in India surged 65%+.

Why gold is essential?

- Protects your portfolio

- Beats inflation

- Easy to sell

- Future demand rising

Gold price forecast (2025–2030)

Analysts expect gold to grow nearly 30–40% due to:

- Global inflation

- Central bank gold purchases

- Weakening currencies

- Rise in gold ETFs

Best ways to invest ₹200/month:

- SIP in Gold ETF

- Digital Gold

- Sovereign Gold Bond (when open)

Mini Takeaway:

Gold is your “safety net” — small investments can protect your entire portfolio.

4. Debt Fund / Recurring Deposit – ₹150/month (15%)

This part of your portfolio ensures liquidity and safety.

Why this is important?

Emergencies don’t wait.

Investing everything in equity could force you to sell during bad market phases.

Options:

- Ultra-short debt fund

- Liquid fund

- Bank RD

What returns to expect?

- 5.5% to 7.5%

Not exciting — but extremely important for your financial discipline.

Mini Takeaway:

Debt is not for returns; it’s for stability.

Case Study – How Ravi Built ₹5.2 Lakhs from ₹1,000/month

Meet Ravi, a 23-year-old software intern from Bengaluru.

He started in 2010, investing just ₹1000/month using the exact portfolio given above. He stayed invested through:

- 2011 market fall

- 2016 demonetization

- 2020 COVID crash

- 2022 inflation crisis

By 2025, his ₹1,000 SIP grew into ₹5.2 lakhs.

His secret?

“Consistency beats timing. I never chased returns… I chased discipline.”

Mini Takeaway:

Do not underestimate consistency. It beats talent, luck, and timing.

What Smart Investors Are Doing in 2025

Here are four powerful trends shaping India’s investment behavior:

1. More first-time investors entering SIPs

Thanks to UPI, apps, and rising awareness.

2. Low-cost index funds gaining massive popularity

80% of new mutual fund SIPs in 2025 are index-based.

3. Gold investments rising during uncertainty

Digital gold demand is at an all-time high.

4. Debt + Equity hybrid strategies for beginners

To balance risk and reward.

Mini Takeaway:

Follow what smart investors are doing — start small, stay consistent.

What Will ₹1,000/Month Look Like by 2030? (Projections)

Assuming an average return of 12%, your ₹1000 SIP could grow into:

| Year | Portfolio Value |

|---|---|

| 2026 | ₹12,700 |

| 2027 | ₹27,400 |

| 2028 | ₹42,800 |

| 2029 | ₹60,700 |

| 2030 | ₹82,000+ |

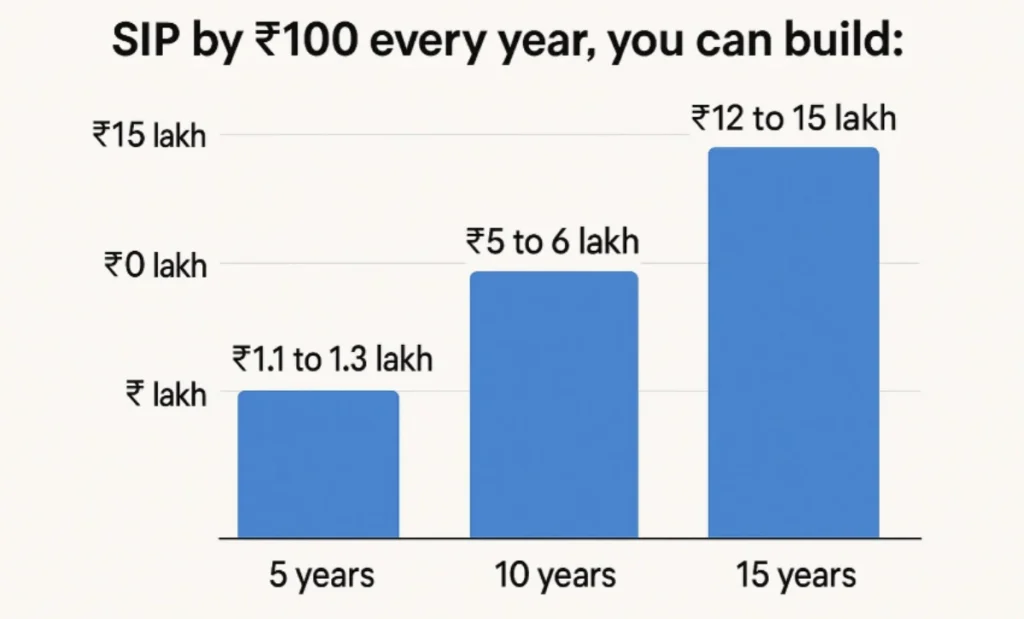

If you increase SIP by ₹100 every year, you can build:

₹1.1 to 1.3 lakh in 5 years

₹5 to 6 lakh in 10 years

₹12 to 15 lakh in 15 years

Mini Takeaway:

Tiny steps today = Big wealth tomorrow.

Mistakes Beginners Must Avoid at All Costs

1. Investing randomly

No strategy = No returns.

2. Expecting fast returns

Investing is not gambling.

3. Checking portfolio daily

This creates panic.

4. Avoiding SIP during market crashes

Crash = your buying opportunity.

5. No diversification

All money in one place is risky.

Mini Takeaway:

Avoiding mistakes is as important as choosing the right investments.

Checklist Before You Start Investing ₹1000/Month

Create UPI-enabled investment account

Link bank account

Enable auto-SIP

Start with recommended portfolio

Review every 6 months

Increase SIP when income rises

Mini Takeaway:

Simplify the process — investing should be automatic.

Also Read: ₹9 Lakh Investment Turn Into ₹1 Cr, ₹3 Cr & ₹8 Cr

The Foolproof ₹1,000/Month Portfolio (Final Summary)

| Category | Allocation | Amount | Why It Works |

|---|---|---|---|

| Index Fund | 40% | ₹400 | Long-term wealth |

| Large Cap Fund | 25% | ₹250 | Stability |

| Gold | 20% | ₹200 | Safety + hedge |

| Debt/RD | 15% | ₹150 | Liquidity |

Perfect for beginners

Perfect for low budgets

Perfect for long-term wealth building

FAQ Section

Q1: Can I start investing with even less than ₹1,000 per month?

Yes. Many apps allow SIPs from ₹100. You can start small and increase later.

Q2: Is ₹1,000/month enough to build wealth?

Absolutely. With compounding and consistency, even ₹1,000/month can grow to lakhs over time.

Q3: Which app is best for beginners to start SIP under ₹1,000?

Groww, Zerodha Coin, Upstox, Paytm Money — all are beginner-friendly.

Q4: Should beginners invest in stocks or mutual funds?

Mutual funds are the safest and easiest option for first-time investors.

Q5: How long should I continue the ₹1,000 SIP?

Ideally 5–10 years or more. Longer duration gives maximum compounding benefits.

Q6: Should I increase my SIP amount every year?

Yes. Increasing SIP by 10–20% annually boosts long-term returns significantly.

Conclusion

It doesn’t matter if you’re a student earning pocket money, a young employee, or someone just starting their financial journey.

What matters is that you start.

A simple ₹1,000 monthly investment can create life-changing wealth when done consistently and smartly. The portfolio you just learned is beginner-friendly, future-ready, and designed to grow with the Indian economy.

Now the next step is yours.

Start your investment journey today with SmartBlog91.com — where smart ideas create smarter wealth.

Leave a Reply