Mutual funds are one of the most reliable ways to grow wealth in India, and among them, midcap mutual funds have been the real wealth creators in recent years. These funds invest in medium-sized companies (ranked 101st to 250th by market capitalization), which often turn into tomorrow’s large-cap giants.

Table of Contents

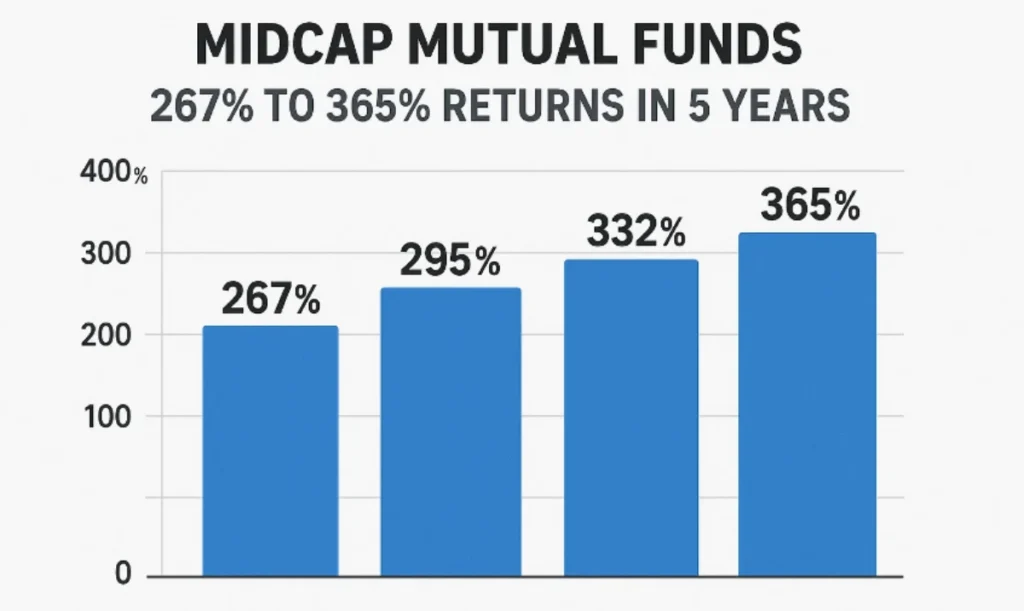

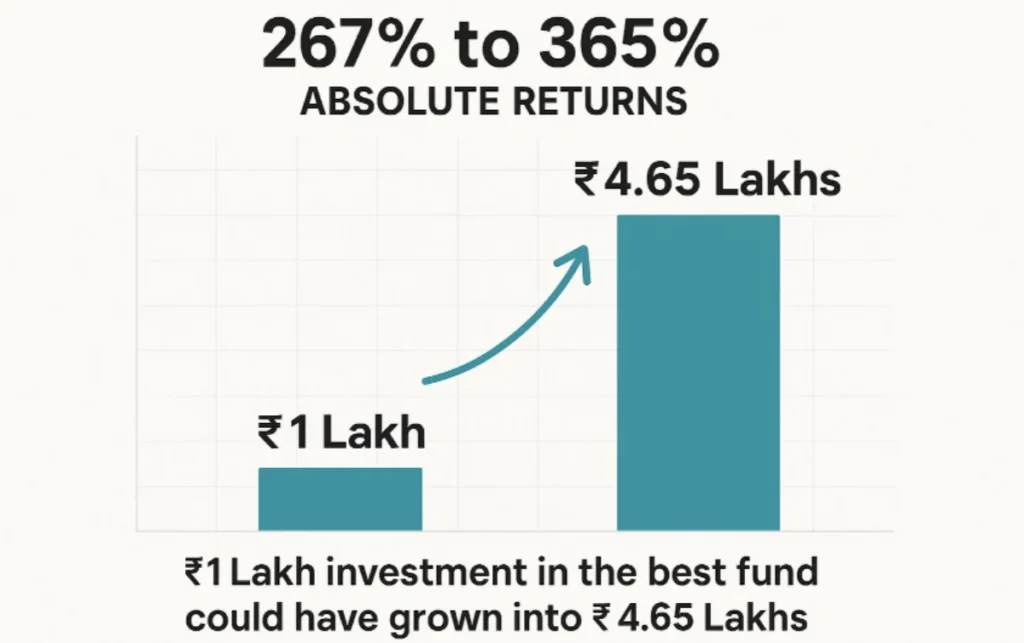

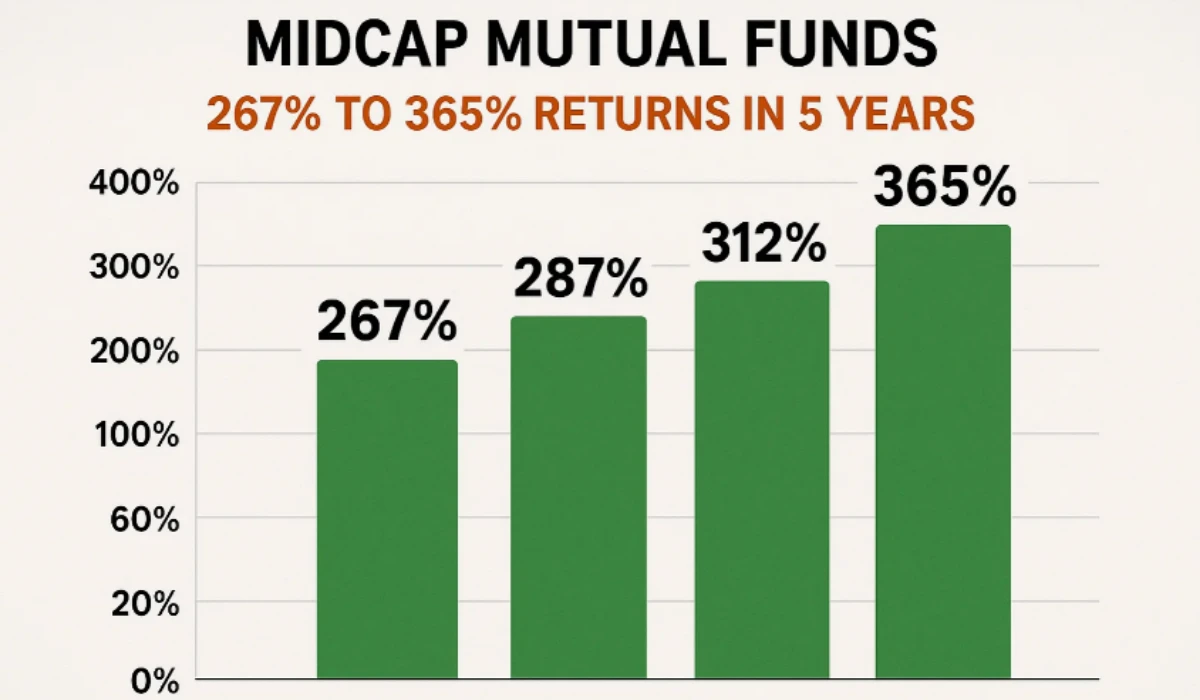

In the last five years (2020–2025), top-performing midcap mutual funds generated a jaw-dropping 267% to 365% absolute returns. This means a ₹1 Lakh investment in the best fund could have grown into ₹4.65 Lakhs.

What Are Midcap Mutual Funds?

Midcap mutual funds primarily invest in medium-sized companies with:

- Strong growth potential

- Opportunity to become future leaders

- Higher returns than large caps, but lower volatility than small caps

Key Features of Midcap Funds:

- High growth potential over the long term

- Suitable for investors with 5+ years horizon

- Moderate to high volatility

- Perfect for wealth creation + portfolio diversification

6 Best Midcap Mutual Funds (5-Year Performance)

Here’s how the top midcap funds performed as of 20-Sep-2025:

| Mutual Fund | 5-Year CAGR | Absolute Returns (5Y) | ₹1 Lakh Investment → |

|---|---|---|---|

| Motilal Oswal Midcap Fund | 34.9% | 365% | ₹4.65 Lakhs |

| Edelweiss Mid Cap Fund | 30.6% | 280% | ₹3.80 Lakhs |

| Nippon India Growth Mid Cap Fund | 29.9% | 275.8% | ₹3.76 Lakhs |

| HDFC Mid Cap Fund | 29.7% | 269% | ₹3.69 Lakhs |

| Invesco India Mid Cap Fund | 29.3% | 275.8% | ₹3.76 Lakhs |

| Quant Mid Cap Fund | 29.2% | 267% | ₹3.67 Lakhs |

Clearly, Motilal Oswal Midcap Fund is the winner with 365% returns.

Detailed Analysis of Each Fund

Motilal Oswal Midcap Fund

| Period | Returns (CAGR) | ₹1 Lakh → |

|---|---|---|

| 1 Year | 2.3% | ₹1.02 Lakhs |

| 3 Years | 28.7% | ₹2.35 Lakhs |

| 5 Years | 34.9% | ₹4.65 Lakhs |

| 10 Years | 19.7% | ₹6.09 Lakhs |

Best for: Aggressive investors with a long-term outlook

Risk: High volatility, sector concentration

Future Outlook: CAGR 16%–18% (2025–2030)

Edelweiss Mid Cap Fund

| Period | Returns (CAGR) | ₹1 Lakh → |

|---|---|---|

| 1 Year | 3.2% | ₹1.03 Lakhs |

| 3 Years | 25.8% | ₹1.97 Lakhs |

| 5 Years | 30.6% | ₹3.80 Lakhs |

| 10 Years | 19.8% | ₹6.15 Lakhs |

Best for: SIP investors wanting balance of risk & return

Risk: Liquidity risks in small midcaps

Future Outlook: CAGR 15%–17% expected

Nippon India Growth Mid Cap Fund

| Period | Returns (CAGR) | ₹1 Lakh → |

|---|---|---|

| 1 Year | 1.6% | ₹1.01 Lakhs |

| 3 Years | 25.5% | ₹1.96 Lakhs |

| 5 Years | 29.9% | ₹3.76 Lakhs |

| 10 Years | 19.1% | ₹5.95 Lakhs |

Best for: Diversification beyond large caps

Risk: High volatility in corrections

Future Outlook: CAGR 14%–16% (next 5 years)

HDFC Mid Cap Fund

| Period | Returns (CAGR) | ₹1 Lakh → |

|---|---|---|

| 1 Year | 4.1% | ₹1.04 Lakhs |

| 3 Years | 26.2% | ₹2.00 Lakhs |

| 5 Years | 29.7% | ₹3.69 Lakhs |

| 10 Years | 19.2% | ₹5.98 Lakhs |

Best for: Investors wanting stability with growth

Risk: Short-term fluctuations

Future Outlook: CAGR 14%–16% till 2030

Invesco India Mid Cap Fund

| Period | Returns (CAGR) | ₹1 Lakh → |

|---|---|---|

| 1 Year | 9.8% | ₹1.09 Lakhs |

| 3 Years | 29.3% | ₹2.05 Lakhs |

| 5 Years | 29.3% | ₹3.76 Lakhs |

| 10 Years | 20.4% | ₹6.51 Lakhs |

Best for: Long-term SIP investors

Risk: May underperform in bearish markets

Future Outlook: CAGR 15%–17% (2025–2030)

Quant Mid Cap Fund

| Period | Returns (CAGR) | ₹1 Lakh → |

|---|---|---|

| 1 Year | -11.7% | ₹88,300 |

| 3 Years | 18.2% | ₹1.65 Lakhs |

| 5 Years | 29.2% | ₹3.67 Lakhs |

| 10 Years | 18.3% | ₹5.45 Lakhs |

Best for: Aggressive investors with high risk appetite

Risk: Very volatile, negative short-term returns

Future Outlook: CAGR 13%–15% (next 5 years)

Midcap vs Large-cap vs Small-cap

| Category | Avg 5-Year CAGR | Risk Level | Suitable For |

|---|---|---|---|

| Large Cap Funds | 12%–15% | Low | Stability, steady returns |

| Mid Cap Funds | 28%–35% | Medium-High | Long-term growth seekers |

| Small Cap Funds | 35%–40% | Very High | Aggressive investors only |

Midcaps offer the best balance between growth & risk.

Future Outlook: Midcap Funds (2025–2030)

Experts believe midcap funds will continue to thrive due to:

- Digital India & Make in India boom

- Government infrastructure push

- Rising domestic consumption

- Export competitiveness of Indian companies

Future Projection (₹1 Lakh SIP for 5 Years)

| CAGR | Final Value (5 Years) | Final Value (10 Years) |

|---|---|---|

| 12% | ₹8.5 Lakhs | ₹23 Lakhs |

| 15% | ₹9.3 Lakhs | ₹27 Lakhs |

| 18% | ₹10.5 Lakhs | ₹32 Lakhs |

A disciplined SIP in midcap funds can help investors build multi-crore wealth by 2035.

How to Invest in Midcap Funds

- Choose SIP over Lump Sum – Helps manage volatility

- Pick Trusted AMCs – HDFC, Nippon, Edelweiss, Motilal Oswal, Invesco

- Stay Invested for 5–10 Years – Avoid frequent exits

- Diversify Portfolio – Mix with large-cap or flexi-cap funds

- Review Annually – Track fund vs benchmark

FAQs

Q1. Are midcap funds safe?

They are not risk-free, but safer than small caps and riskier than large caps. Best for long-term investors.

Q2. Which is the best midcap fund for SIP in 2025?

Motilal Oswal, Edelweiss, and Invesco Midcap Funds stand out.

Q3. Can midcap funds double my money in 5 years?

Yes. Historically, they delivered 3–4.5x in 5 years.

Q4. What about tax?

- STCG (≤1 year): 15% tax

- LTCG (>1 year): 10% on gains above ₹1 Lakh

Key Takeaways

- Midcap funds delivered 267%–365% absolute returns in 5 years.

- Motilal Oswal Midcap Fund was the top performer.

- Best suited for 5–10 year investors with moderate-high risk appetite.

- Expected CAGR for 2025–2030: 14%–18%.

- SIP is the most effective way to invest.

Conclusion

Midcap mutual funds have proven themselves as the growth engine of Indian equities. They not only outperformed large-cap funds but also provided investors with a chance to ride India’s growth story.

For investors with patience, discipline, and a long-term vision, midcap funds can be the foundation for wealth creation by 2030 and beyond.

Leave a Reply