Introduction

Building long-term wealth requires strategic investment choices, and mutual funds stand as powerful vehicles for achieving financial goals. These investment instruments pool money from multiple investors to purchase a diversified portfolio of stocks, bonds, or other securities.

Table of Contents

Mutual funds offer several distinct advantages for investors:

- Professional Management: Expert fund managers make informed investment decisions based on thorough market research and analysis

- Risk Diversification: Your investment spreads across multiple securities, reducing the impact of poor performance from any single investment

- Accessibility: You can start investing with relatively small amounts through systematic investment plans (SIPs)

- Liquidity: Most mutual funds allow you to buy or sell your investments on any business day

- Transparency: Regular portfolio disclosures help you track where your money is invested

The next decade presents unique investment opportunities and challenges. Market dynamics, technological advancements, and global economic shifts will shape investment returns. To help you navigate these waters, we’ve compiled expert recommendations for the best mutual funds positioned for strong performance over the next 10 years.

This guide examines top-performing funds across various categories – from large-cap stalwarts to emerging small-cap opportunities. You’ll discover detailed analyses of each fund’s investment strategy, risk profile, and historical performance to make informed investment decisions aligned with your financial objectives.

Understanding Different Types of Mutual Funds

A mutual fund pools money from multiple investors to purchase a diverse portfolio of stocks, bonds, or other securities. When you invest in a mutual fund, you’re buying shares of the fund’s portfolio, making you a partial owner of all its holdings.

Here’s a breakdown of the main mutual fund categories:

1. Equity Funds

These funds primarily invest in stocks with the goal of achieving long-term capital appreciation.

- Large-Cap Funds: Invest in established companies with market capitalizations exceeding $10 billion

- Mid-Cap Funds: Target companies valued between $2-10 billion

- Small-Cap Funds: Focus on companies under $2 billion in market value

- Sector Funds: Specialize in specific industries like technology, healthcare, or real estate

2. Debt Funds

Debt funds primarily invest in fixed-income securities such as bonds and aim to provide regular income to investors.

- Government Bond Funds: Invest in U.S. Treasury securities and government agency bonds

- Corporate Bond Funds: Hold corporate debt instruments

- Money Market Funds: Purchase short-term, high-quality debt securities

- Municipal Bond Funds: Focus on tax-exempt municipal securities

3. Hybrid Funds

Hybrid funds combine investments in both stocks and bonds to achieve a balance between growth and income.

- Balanced Funds: Maintain a fixed ratio of stocks and bonds (typically 60:40)

- Target-Date Funds: Automatically adjust asset allocation based on your retirement timeline

- Asset Allocation Funds: Dynamically change investment mix based on market conditions

4. Specialty Funds

Specialty funds focus on specific investment strategies or asset classes.

- Index Funds: Track specific market indices like the S&P 500

- International Funds: Invest in foreign markets

- Emerging Market Funds: Focus on developing economies

- Commodity Funds: Invest in raw materials and natural resources

Each fund type serves different investment goals:

- Equity funds aim for capital appreciation

- Debt funds prioritize regular income

- Hybrid funds balance growth with stability

- Specialty funds target specific market segments or strategies

Your choice depends on factors like:

- Investment timeline

- Risk tolerance

- Income needs

- Market outlook

- Tax considerations

Key Factors to Consider When Choosing Mutual Funds

Selecting the right mutual fund requires careful analysis of several critical factors that can significantly impact your investment returns. Let’s examine the key elements you need to evaluate:

1. Expense Ratios and Associated Fees

- Management Fees: These annual charges cover the fund manager’s services, typically ranging from 0.5% to 2.5% of your investment

- Transaction Costs: Hidden expenses incurred when the fund buys or sells securities

- Load Charges: Sales fees charged either when you buy (front-load) or sell (back-load) fund shares

- 12b-1 Fees: Annual marketing and distribution expenses, adding to your total cost

A fund with a 1% higher expense ratio can reduce your returns by $10,000 on a $100,000 investment over ten years. You’ll find better value in low-cost index funds, which typically charge 0.2% or less.

2. Historical Performance Analysis

- Risk-Adjusted Returns: Compare returns against benchmark indices while considering volatility

- Performance Consistency: Check if the fund maintains steady returns across different market cycles

- Fund Manager Track Record: Research the current manager’s experience and past performance

- Rolling Returns: Analyze returns over multiple time periods rather than point-to-point returns

A fund’s past performance doesn’t guarantee future results, but consistent returns across various market conditions often indicate strong management and robust investment strategies.

3. Additional Critical Metrics

- Asset Size: Large funds might struggle to maintain performance due to size constraints

- Portfolio Turnover: Higher turnover rates can lead to increased costs and tax implications

- Fund Age: Established funds provide longer track records for analysis

- Investment Style Consistency: Ensure the fund maintains its stated investment approach

You can access these metrics through fund fact sheets, financial websites, or your broker’s research tools. Remember to compare similar funds within the same category for meaningful analysis.

Best Mutual Funds for the Next 10 Years: Expert Picks

Looking ahead to 2024-2034, expert analysts have identified several mutual funds poised for strong performance. These selections combine proven track records with strategic positioning for future market conditions.

1. Fidelity ZERO Large Cap Index Fund (FNILX)

The Fidelity ZERO Large Cap Index Fund stands out as a groundbreaking investment option, particularly notable for its 0% expense ratio – a feature that sets it apart in the investment landscape. This fund tracks the Fidelity U.S. Large Cap Index, providing exposure to approximately 500 of the largest U.S. companies.

Key Features:

- Zero expense ratio – maximizing investor returns

- No minimum investment requirement

- Strong historical performance with 16.3% 5-year annualized returns

- Tax-efficient management strategy

Investment Strategy:

The fund employs a passive investment approach, aiming to replicate the performance of large-cap U.S. stocks. FNILX invests at least 80% of its assets in:

- Blue-chip companies

- Industry leaders

- Well-established corporations with strong market positions

Risk Profile:

- Market risk aligned with large-cap equity investments

- Sector concentration risk

- Limited international exposure

- Lower volatility compared to mid and small-cap funds

Recent Performance Metrics:

- Year-to-date return: 19.2%

- 3-year average annual return: 14.8%

- Sharpe ratio: 0.89

- Beta: 1.02 (relative to S&P 500)

Portfolio Composition:

- Technology sector: 28.5%

- Financial services: 13.2%

- Healthcare: 12.8%

- Consumer cyclical: 11.5%

- Industrial: 9.8%

The fund’s zero-fee structure creates a significant advantage for long-term investors through compound interest benefits. A $10,000 investment in FNILX can save approximately $1,500 in fees over a 10-year period compared to the industry average expense ratio of 0.5%.

Top Holdings Include:

- Apple

2. Vanguard S&P 500 ETF (VOO)

The Vanguard S&P 500 ETF is a fundamental investment choice for building wealth over the long term. This fund follows the S&P 500 index, giving investors access to 500 of the largest companies in the United States across various industries.

Key Features:

- Ultra-low expense ratio of 0.03%

- High daily trading volume ensuring excellent liquidity

- Automatic dividend reinvestment options

- Minimum investment requirement of just one share

The fund’s portfolio includes industry giants like Apple, Microsoft, and Amazon, which make up around 25% of its total assets. This focus on leading tech companies positions VOO for potential growth in the digital economy.

Performance Metrics:

- 5-year average annual return: 16.3%

- 10-year average annual return: 14.5%

- Dividend yield: 1.5%

VOO’s tax efficiency comes from its low turnover rate, making it especially appealing for taxable accounts. The fund’s passive management approach keeps trading costs and capital gains distributions low.

Risk management is built-in through the index’s market-cap-weighted structure. Larger companies have a higher allocation, providing natural stability while still allowing for growth potential.

For investors looking for broad market exposure, VOO offers professional management of a diversified portfolio at a fraction of the cost of actively managed funds. With over $800 billion in assets, the fund’s size ensures close tracking of the underlying index with minimal tracking error.

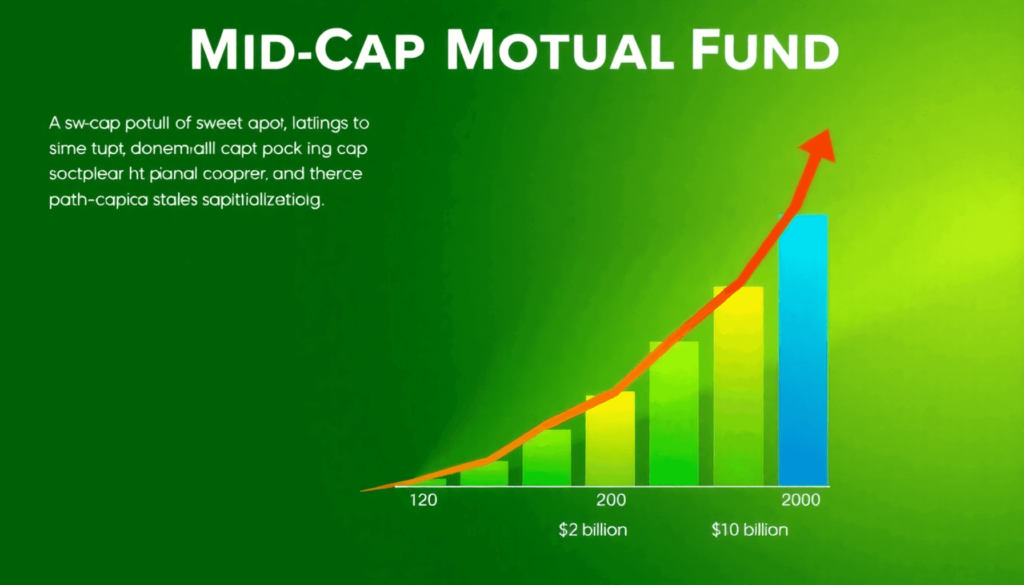

Best Mid-Cap Mutual Funds for the Next Decade: Expert Recommendations

Mid-cap mutual funds present a sweet spot in the investment landscape, combining the growth potential of small-cap stocks with the stability of large-cap companies. These funds target companies with market capitalizations between $2 billion and $10 billion, offering investors exposure to businesses in their expansion phase.

Investment experts predict mid-cap funds will play a crucial role in portfolio growth over the next decade. These companies often demonstrate:

- Strong market positioning

- Established business models

- Significant room for expansion

- Better resistance to economic downturns than small-caps

- Higher growth potential than large-caps

The mid-cap segment has historically outperformed both large-cap and small-cap sectors during economic recovery periods. This characteristic makes them particularly attractive for investors looking ahead to the next 10 years.

1. T. Rowe Price Mid-Cap Growth Fund (RPMGX)

The T. Rowe Price Mid-Cap Growth Fund stands out as a premier choice for mid-cap exposure. This fund implements a growth-oriented strategy, focusing on companies showing:

- Above-average earnings growth potential

- Strong competitive positions

- Experienced management teams

- Sustainable business models

Key Fund Characteristics:

- Expense Ratio: 0.73%

- Minimum Investment: $2,500

- Assets Under Management: $31.2 billion

- Average Annual Return (10-year): 12.8%

Top Holdings Include:

- Cadence Design Systems

- Microchip Technology

- Synopsys

- Chipotle Mexican Grill

- Veeva Systems

The fund’s management team employs a bottom-up selection process, analyzing individual companies rather than making broad sector bets. This approach has proven successful through various market cycles, with the fund maintaining consistent performance rankings in its category.

Investment Strategy Highlights:

- Focus on companies with market caps between $3 billion and $30 billion

- Emphasis on businesses with strong free cash flow

- Priority on companies with sustainable competitive advantages

- Active management style with relatively low turnover

- Diversification across multiple sectors

The fund maintains a well-balanced sector allocation, with significant weightings in technology, consumer discretionary, and healthcare industries.

2. iShares Russell Mid-Cap ETF (IJH)

The iShares Russell Mid-Cap ETF (IJH) is a leading choice for mid-cap investments, tracking the performance of the Russell Midcap Index. This ETF offers investors exposure to around 800 mid-sized U.S. companies, ensuring a well-diversified portfolio across various sectors.

Key Features:

- Expense ratio: 0.05%

- Average daily trading volume: $250 million

- Assets under management: $65 billion

- Dividend yield: 1.5%

The fund’s strong liquidity profile makes it an appealing option for both institutional and retail investors. You can easily buy or sell shares without significantly affecting the price, thanks to its high trading volume and narrow bid-ask spreads.

Sector Allocation:

- Information Technology: 18.5%

- Industrials: 17.2%

- Consumer Discretionary: 14.8%

- Financials: 13.6%

- Healthcare: 11.2%

IJH primarily invests in companies with market capitalizations ranging from $2 billion to $10 billion. These mid-sized companies often demonstrate greater growth potential compared to large-cap stocks while maintaining more stability than small-cap stocks.

With an expense ratio of just 0.05%, the fund charges only $5 in annual fees for every $10,000 invested. This cost-effective structure helps preserve your returns over time, making IJH an efficient choice for capturing mid-cap market performance.

Best Small-Cap Mutual Funds for Long-Term Investors: Expert Picks

Small-cap mutual funds present a compelling opportunity for investors seeking substantial growth potential in their long-term portfolios. These funds invest in companies with market capitalizations typically ranging from $300 million to $2 billion, offering exposure to emerging businesses with significant room for expansion.

Research shows small-cap stocks have historically outperformed their larger counterparts during economic recovery periods. This makes them particularly attractive for investors with a 10-year investment horizon who can weather short-term market volatility.

Key Benefits of Small-Cap Funds:

- Higher growth potential compared to large-cap stocks

- Less analyst coverage creates opportunities for fund managers

- Exposure to innovative companies in emerging sectors

- Portfolio diversification benefits

1. DFA US Small Cap Portfolio (DFSTX)

The DFA US Small Cap Portfolio stands out as a top choice for long-term investors seeking exposure to value-oriented small-cap companies. This fund employs a systematic approach to identifying undervalued small-cap stocks with strong potential for appreciation.

Investment Strategy Highlights:

- Focuses on companies with market caps between $300 million and $2 billion

- Emphasizes value metrics including price-to-book and price-to-earnings ratios

- Maintains broad diversification across sectors

- Utilizes academic research to guide investment decisions, similar to the investment process employed by some leading firms in the field

Performance Metrics:

- 5-year average annual return: 12.8%

- Expense ratio: 0.37%

- Risk-adjusted returns consistently above category average

- Strong track record during market recoveries

The fund’s disciplined approach to stock selection involves:

- Systematic screening for value characteristics

- Regular portfolio rebalancing

- Cost-efficient trading strategies

- Risk management through broad diversification

DFSTX differentiates itself through its academic approach to investing, drawing on decades of financial research. The fund maintains strict size and value parameters, helping ensure consistent exposure to its target market segment.

Portfolio Composition:

- Financial services: 28%

- Industrial materials: 22%

- Technology: 15%

- Consumer cyclical: 12%

- Healthcare: 10%

- Other sectors: 13%

2. SPDR S&P 600 Small Cap ETF (SLY)

The SPDR S&P 600 Small Cap ETF is a great option for investors who want to focus on U.S. small-cap companies. This ETF follows the S&P SmallCap 600 Index, which includes around 600 small-sized companies with market values between $850 million and $3.6 billion.

Key Features:

- Expense ratio: 0.15%

- Average daily trading volume: 50,000+ shares

- Market price: $93.45 (as of latest data)

- Dividend yield: 1.42%

The fund’s investment strategy focuses on quality small-cap companies through strict inclusion criteria:

- Positive earnings in the most recent quarter

- Positive earnings over the past four quarters combined

- Adequate trading liquidity

- Public float of at least 50%

SLY’s sector allocation demonstrates strong diversification:

- Industrials: 18.2%

- Financials: 16.8%

- Information Technology: 14.5%

- Consumer Discretionary: 13.7%

- Health Care: 11.3%

This ETF is particularly appealing if you’re seeking exposure to companies with solid fundamentals and growth potential. The fund’s rigorous screening process helps mitigate the inherent volatility often associated with small-cap investments, making it a reliable choice for long-term portfolio growth.

The fund has achieved an average annual return of 9.8% over the past decade, highlighting its ability for sustainable long-term performance. Its low correlation with large-cap stocks offers additional benefits for diversifying your portfolio.

Best Index Funds for Passive Investors: Top Recommendations from Experts

Index funds are a key investment strategy for passive investors looking for steady, long-term growth. These funds track specific market indices, providing broad market exposure at low costs.

The appeal of index funds lies in their:

- Low expense ratios – reducing the impact of fees on returns

- Broad diversification – spreading risk across multiple securities

- Tax efficiency – minimal portfolio turnover

- Transparency – clear investment objectives

- Simplicity – easy-to-understand investment approach

1. Schwab S&P 500 Index Fund (SWPPX)

The Schwab S&P 500 Index Fund is a top choice for passive investors. With an industry-leading expense ratio of 0.02%, SWPPX offers excellent value for investors looking to invest in America’s largest companies.

Key Features:

- Investment Structure: The fund maintains a full replication strategy, holding all stocks in the S&P 500 index at their corresponding weights

- Minimum Investment: $1 initial investment requirement, making it accessible to most investors

- Tracking Error: Demonstrates minimal deviation from its benchmark index (typically less than 0.02%)

- Distribution Schedule: Quarterly dividend payments with a current yield of approximately 1.5%

Performance Metrics:

- 5-year annualized return: 16.3%

- 10-year annualized return: 14.7%

- Beta: 1.0 (indicating perfect correlation with market movements)

Portfolio Composition:

- Technology sector: 28.5%

- Healthcare: 13.2%

- Financial services: 12.8%

- Consumer discretionary: 10.5%

- Other sectors: 35%

The fund’s low expense ratio means significant cost savings – investing $10,000 incurs annual fees of just $2, compared to the category average of $70. This cost efficiency adds up over long holding periods.

SWPPX shows strong liquidity, with daily trading volumes exceeding $100 million. This high liquidity ensures investors can buy or sell shares without impacting the fund’s price significantly.

Conclusion

Index funds are an excellent choice for passive investors seeking long-term growth. With their low costs, broad diversification, and simplicity, they align perfectly with the goals of passive investing.

The Schwab S&P 500 Index Fund stands out as a top recommendation due to its industry-leading expense ratio and accessibility for all investors.

Consider adding index funds like SWPPX to your investment portfolio for a reliable and efficient way to grow your wealth over time.

2. Vanguard Total Stock Market Index Fund Admiral Shares (VTSAX)

The VTSAX is a top choice for passive investors looking to invest in the entire U.S. stock market. This fund follows the CRSP US Total Market Index, which means it includes all types of U.S. stocks, from small to large companies, and both growth and value investments.

Key Features:

- Minimum investment: $3,000

- Expense ratio: 0.04%

- Tax efficiency rating: High

- Number of stocks: 3,000+

The fund’s strategy of investing in a wide range of stocks helps reduce the risk associated with individual companies while also taking advantage of the potential growth of the entire U.S. stock market. It includes companies from various industries such as technology, healthcare, finance, and consumer goods.

Performance Metrics:

- 10-year average annual return: 12.1%

- Dividend yield: 1.5%

- Portfolio turnover rate: 2%

VTSAX is designed to be tax-efficient because it has a low turnover rate and follows a passive management approach. This means that the fund buys and holds onto its investments for a long time, resulting in fewer taxable events. This makes it an appealing option for investors who have to pay taxes on their investment gains.

The Admiral Shares class of this fund offers a significant cost advantage compared to actively managed funds, with an expense ratio of only 0.04%. This means that for every $10,000 you invest, you’ll only pay $4 in fees each year, allowing more of your money to grow over time through compounding.

SIPs for Long-Term Growth: Best Plans Recommended by Experts

Systematic Investment Plans (SIPs) create a disciplined approach to wealth building through regular, automated investments. Expert analysts recommend these top SIP options for the next decade:

Large-Cap SIP Options:

- Fidelity ZERO Large Cap Index Fund (FNILX)

- Vanguard 500 Index Fund (VFIAX)

- Schwab S&P 500 Index Fund (SWPPX)

Mid-Cap Growth Opportunities:

- T. Rowe Price Mid-Cap Growth Fund (RPMGX)

- Vanguard Mid-Cap Index Fund (VIMAX)

Small-Cap Value Picks:

- DFA US Small Cap Portfolio (DFSTX)

- Vanguard Small-Cap Value Index Fund (VSIAX)

Recommended Monthly SIP Investment:

- Beginners: $100-$500

- Intermediate Investors: $500-$2,000

- Advanced Investors: $2,000+

Expert SIP Strategy Tips:

- Start early to maximize compound growth

- Maintain consistent investment schedule

- Diversify across market caps

- Stick to low-expense ratio funds

- Review and rebalance annually

These SIP recommendations align with a long-term investment horizon, offering potential for substantial wealth creation through market cycles. Your chosen SIP amount should reflect your financial goals, risk tolerance, and current income level.

FAQs (Frequently Asked Questions)

What are mutual funds and why are they significant for long-term wealth creation?

Mutual funds are investment vehicles that pool money from multiple investors to purchase a diversified portfolio of stocks, bonds, or other securities. They are significant for long-term wealth creation as they offer professional management and diversification benefits, helping investors mitigate risk while aiming for capital growth over time.

What types of mutual funds are available for investors?

There are several types of mutual funds including equity funds, which invest in stocks; debt funds, which focus on fixed-income securities; and hybrid funds, which combine both equity and debt investments. Each type has unique characteristics that cater to different investment goals and risk tolerances.

How should I evaluate mutual funds before investing?

When evaluating mutual funds, it’s crucial to analyze the expense ratios and fees associated with the fund, as these can impact your overall returns. Additionally, reviewing the historical performance of the fund helps you make informed decisions based on past results and market conditions.

What are some expert-recommended mutual funds for the next 10 years?

Experts recommend several mutual funds for the next decade, including Fidelity ZERO Large Cap Index Fund (FNILX) and Vanguard S&P 500 ETF (VOO) for large-cap investments, T. Rowe Price Mid-Cap Growth Fund (RPMGX) for mid-cap exposure, and DFA US Small Cap Portfolio (DFSTX) for small-cap opportunities.

What is the benefit of investing in index funds?

Index funds offer a cost-effective way to gain broad market exposure with lower expense ratios compared to actively managed funds. They typically track a specific market index, providing diversification and minimizing tracking error while allowing passive investors to participate in overall market growth.

What are Systematic Investment Plans (SIPs) and how can they help with long-term growth?

Systematic Investment Plans (SIPs) allow investors to contribute a fixed amount regularly into mutual funds. This disciplined approach helps in averaging out costs over time, reducing the impact of market volatility. SIPs are recommended by experts as an effective strategy for achieving long-term growth through consistent investment.

1 Comment