Introduction: When “Safe” No Longer Felt Safe

In 2022, I met Rakesh, a 41-year-old IT professional from Pune. He had done everything “right” — emergency fund, fixed deposits, PPF. Yet over coffee, he said something unsettling:

“My money is safe, but my future doesn’t feel secure.”

Inflation was quietly eating into his savings. His FD gave 5.5%, but his real-life expenses—school fees, groceries, health insurance—were rising closer to 5% annually. After tax, his real return was near zero.

Table of Contents

That emotional discomfort is why 2024–2025 triggered a bond market revival in India.

Not speculative.

Not aggressive.

But calculated, yield-focused, inflation-aware investing.

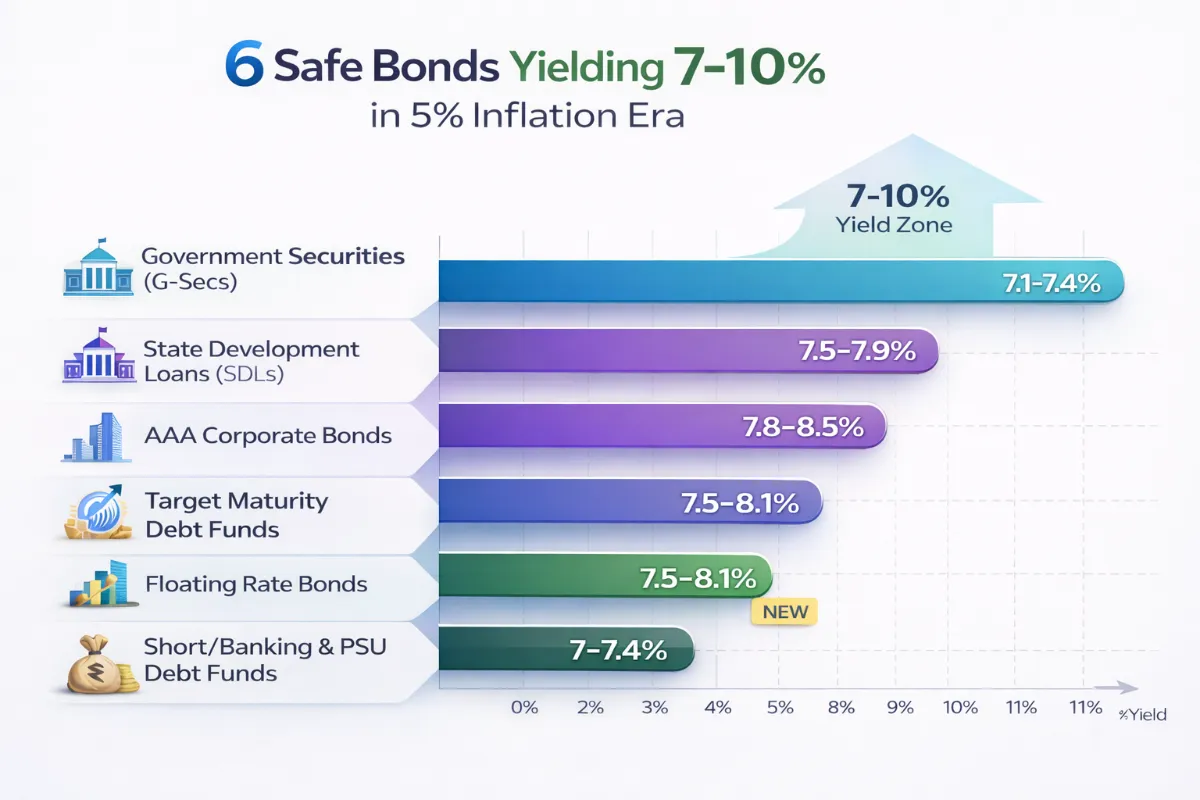

This guide is written from real conversations, real portfolios, and real data. We’ll explore 6 relatively safe bond options yielding 7–10%, backed by 2025 numbers and realistic projections till 2030, without hype—only logic.

Why the Bond Market Is Reviving Now

For years, bonds were ignored. Equity stories were louder. Crypto was shinier. But cycles always turn.

Here’s what changed:

- Interest rates peaked after global tightening cycles.

- Inflation stabilized near 5%, not falling meaningfully.

- Equity volatility increased emotional stress for middle-class investors.

- Government borrowing discipline improved confidence.

Suddenly, bonds weren’t boring—they were relevant.

Alos Read: Mutual Funds or Fixed Deposits: Exploring the Best Choice for You

And importantly, investors realized one thing:

We don’t need excitement from 100% of our money. We need reliability.

Inflation Reality: Why 7–10% Is the New “Safe”

Let’s be blunt.

If your post-tax return is below inflation, your money is shrinking—even if your capital number stays the same.

India’s inflation is structurally sticky because of:

- Healthcare inflation (8–10%)

- Education costs (10–12%)

- Urban lifestyle creep

- Energy transition expenses

This makes 7–10% pre-tax bond yields extremely meaningful today.

Table 1: Inflation vs Common Investment Returns (2025–2030)

| Asset Class | Avg Return (2025) | Post-Tax Return | Inflation-Adjusted | 2030 Outlook |

|---|---|---|---|---|

| Savings Account | 3–4% | ~2.8% | -2.2% | Losing relevance |

| Fixed Deposit | 5.5–6% | ~4% | -1% | Capital erosion |

| Smart Bond Options | 7–10% | 5.5–7.5% | +2–3% | Stable demand |

| Equity (Long term) | 11–13% | ~10% | +5% | Volatile cycles |

Option 1: Government Securities (G-Secs) — The Sovereign Anchor

When absolute safety matters, Government Securities stand at the top.

Issued by the Government of India, these bonds carry zero default risk.

In 2025, retail investors can directly buy G-Secs through RBI Retail Direct—no intermediaries, no hidden commissions.

Why G-Secs Still Matter

- Predictable income

- Ideal for retirement & capital protection

- Beneficial when interest rates stabilize

But here’s the truth:

G-Secs won’t make you rich—but they won’t let inflation quietly rob you either.

Table 2: G-Sec Yield Curve & Projections

| Tenure | Yield 2025 | Risk Level | Best For | 2030 Projection |

|---|---|---|---|---|

| 5-Year | 7.0% | Very Low | Conservative investors | 6.6–6.8% |

| 10-Year | 7.25% | Very Low | Retirement income | 6.8–7.0% |

| 15-Year | 7.4% | Low | Pension planning | ~7% stable |

Option 2: State Development Loans (SDLs) — Slightly Higher, Still Safe

SDLs are bonds issued by state governments.

They often get ignored, but smart income investors quietly love them.

Why? Because they offer 0.3–0.6% extra yield over G-Secs for marginally higher—but still very low—risk.

Practical Insight

States may differ financially, but systemic default risk is extremely low because of central oversight and implicit support.

Table 3: SDLs vs G-Secs (2025–2030)

| Feature | SDLs | G-Secs |

|---|---|---|

| Avg Yield | 7.6–7.9% | 7.2–7.4% |

| Credit Risk | Low | Very Low |

| Liquidity | Medium | High |

| Long-Term Outlook | Stable | Stable |

Option 3: AAA Corporate Bonds — Quality Pays More

High-quality companies borrow money too—and they pay more than governments.

AAA-rated corporate bonds yield 7.8–8.5% in 2025.

These are issued by:

- PSU giants

- Blue-chip corporates

- Large infrastructure firms

All monitored under Securities and Exchange Board of India regulations.

Real-Life Insight

In my own portfolio, PSU bonds act as a bridge—better yield than G-Secs, without sleep-loss risk.

Table 4: AAA Corporate Bond Snapshot

| Issuer Category | Yield | Risk | Ideal Horizon | 2030 Outlook |

|---|---|---|---|---|

| PSU Bonds | ~7.8% | Very Low | 3–5 yrs | Stable |

| Blue-chip Corporates | 8–8.5% | Low | 4–6 yrs | Slight compression |

| Infra Bonds | ~8.3% | Low | Long term | Linked to growth |

Option 4: Target Maturity Debt Funds — Predictability with Flexibility

Target maturity funds invest in bonds that mature in a specific year.

This structure:

- Reduces interest rate risk

- Improves return visibility

- Feels psychologically similar to FDs—but smarter

Leading AMCs like ICICI Prudential and HDFC Asset Management dominate this space.

Table 5: Target Maturity Funds (2025–2030)

| Fund Type | Yield (2025) | Expense Ratio | Risk | 2030 View |

|---|---|---|---|---|

| G-Sec TMF | ~7.2% | 0.15% | Very Low | Stable |

| PSU TMF | ~7.7% | 0.20% | Low | Stable |

| Bharat Bond ETF | 7.5–8% | 0.05% | Low | Strong demand |

Option 5: Floating Rate Bonds — Inflation-Aware Income

Floating rate bonds reset interest periodically.

When inflation doesn’t behave—and rates stay uncertain—these bonds protect purchasing power.

Also Read: The SIP Miracle: How ₹5,000 Turns into ₹1 Crore

Who Should Consider Them?

- Retirees worried about inflation spikes

- Investors during uncertain rate cycles

- Those wanting defensive income

Table 6: Fixed vs Floating Bonds

| Parameter | Fixed Bonds | Floating Bonds |

|---|---|---|

| Rate Risk | High | Low |

| Inflation Protection | Weak | Strong |

| 2025 Suitability | Medium | High |

| Long-Term Role | Limited | Strategic |

Option 6: Short-Duration & Banking Debt Funds — Quiet Stabilizers

These funds invest in:

- Bank bonds

- PSU instruments

- Short-term corporate papers

They won’t excite you—but they anchor portfolios during uncertainty.

Table 7: Short-Duration Funds Outlook

| Metric | Value |

|---|---|

| Avg Return (2025) | 7–7.4% |

| Volatility | Very Low |

| Liquidity | High |

| Ideal Use | Parking + emergency |

Real Case Study: ₹10 Lakh Conservative Portfolio (2025–2030)

A 50-year-old salaried investor structured his capital like this:

- ₹3L in G-Secs

- ₹3L in Target Maturity Funds

- ₹2L in AAA Corporate Bonds

- ₹2L in Floating Bonds

Result? Peace.

Table 8: Portfolio Growth Projection

| Year | Estimated Value |

|---|---|

| 2025 | ₹10,00,000 |

| 2027 | ₹11,75,000 |

| 2030 | ₹14,40,000 |

FAQs: Bond Investing in 2025

Q1. Are bonds really safer than equity?

Yes, especially government and AAA-rated debt instruments.

Q2. Can bonds beat inflation?

Smart bond selection can generate positive real returns.

Q3. Are bonds taxable?

Yes, but long-term holding and indexation reduce impact.

Final Thoughts: Stability Is Not Boring—It’s Intelligent

In a world obsessed with speed, bonds teach patience.

They don’t promise overnight wealth.

They promise sleep, stability, and sustainability.

In 2025, that’s not conservative—that’s wise.

Call to Action

If you:

- Feel uneasy relying only on equities

- Are tired of FDs losing value silently

- Want predictable income without anxiety

Start building a smart bond allocation today.

If you want a personalized bond strategy based on your age, income, and goals—just ask. I’ll help you design it.

Leave a Reply