Investing ₹1,000 per month in a Systematic Investment Plan (SIP) can be a fantastic way to grow your wealth over time. SIPs are designed to help you invest small amounts regularly, which can lead to significant returns through the power of compounding. In this article, we will explore the best SIP plans for ₹1,000 per month and discuss the benefits and factors to consider before investing.

Best SIP Plans for ₹1,000 Per Month

Several top-performing SIP plans are available for investments of ₹1,000 per month. Here are some of the best options:

- HDFC Life- Discovery Fund:

- Expected 5-year annualized returns: 21.90%

- Fund size: ₹3,020 crore

- NAV (as of January 2024): ₹29.41.

- Kotak Life – Frontline Equity Fund:

- Expected 5-year annualized returns: 16.30%

- Fund size: ₹2,317 crore

- NAV (as of January 2024): ₹52.72.

- Bajaj Life – Pure Stock Fund:

- Expected 5-year annualized returns: 14.70%

- Fund size: ₹5,250 crore

- NAV (as of January 2024): ₹64.82.

- Quant Active Fund:

- Expected 5-year annualized returns: 20.55%

- Fund size: ₹6,060 crore

- NAV (as of January 2024): ₹567.33.

- Parag Parikh Flexi Cap Fund:

- Expected 5-year annualized returns: 19.83%

- Fund size: ₹44,038 crore

- NAV (as of January 2024): ₹67.01.

Factors to Consider Before Investing

Before choosing the best SIP plan for your ₹1,000 monthly investment, consider the following factors:

- Risk Appetite:

- Assess your ability to absorb financial losses and adjust your investment accordingly.

- Investing Objectives and Time Frame:

- Determine your financial goals and the time frame for achieving them. This will help you choose the right SIP plan.

- Scheme Performance:

- Research the performance of the SIP plan and ensure it aligns with your goals.

- Fund House’s Reputation:

- Verify the credibility of the fund house and the SIP plan.

- Expenses:

- Evaluate the expense ratio of the SIP plan to ensure it is reasonable.

Benefits of Investing ₹1,000 Per Month

Investing ₹1,000 per month in a SIP offers several benefits:

- Rupee Cost Averaging:

- SIPs allow you to purchase more units when prices are low and fewer units when prices are high, averaging out the cost of investment over time.

- Power of Compounding:

- The returns generated from SIP investments can be significant due to the compounding effect.

- Flexibility:

- SIPs offer flexibility in investment amounts and the option to pause or stop investments as needed.

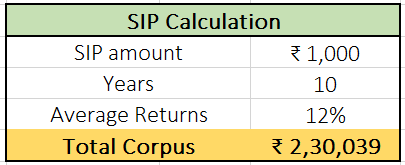

Calculations for ₹1,000 Monthly SIP

To illustrate the power of SIPs, let’s consider an example. If you invest ₹1,000 per month for one year with an expected annualized return of 10%, your total investment would be ₹12,000. At the end of the year, your corpus would be ₹26,667, which includes the principal amount and the interest earned.

Conclusion

Investing ₹1,000 per month in a SIP can be a great way to grow your wealth over time. By considering the best SIP plans, factors to invest in, and benefits of SIPs, you can make informed decisions about your investments. Remember to assess your risk appetite, investing objectives, and scheme performance before choosing the right SIP plan for you.

How to Invest ₹1,000 Per Month in SIP: A Step-by-Step Guide

Investing ₹1,000 per month in a Systematic Investment Plan (SIP) can be a fantastic way to grow your wealth over time. SIPs are designed to help you invest small amounts regularly, which can lead to significant returns through the power of compounding. In this article, we will provide a step-by-step guide on how to invest ₹1,000 per month in a SIP.

Step 1: Choose the Right SIP Plan

- Research and Shortlist:

- Research the best SIP plans available for ₹1,000 per month.

- Shortlist the plans that align with your financial goals and risk appetite.

- Check Fund Performance:

- Evaluate the performance of the shortlisted SIP plans.

- Ensure the plans have a good track record of returns.

Step 2: Open a Demat Account

- Choose a Demat Account Provider:

- Select a reputable demat account provider.

- Open a demat account with the provider.

- Fund the Account:

- Deposit the required amount in your demat account.

Step 3: Set Up the SIP

- Choose the SIP Plan:

- Select the SIP plan you want to invest in.

- Ensure the plan is available for ₹1,000 per month.

- Set the SIP Amount:

- Set the SIP amount to ₹1,000 per month.

- Choose the frequency of the SIP (e.g., monthly, quarterly, etc.).

Step 4: Monitor and Adjust

- Monitor the SIP:

- Monitor the performance of your SIP.

- Evaluate the returns and adjust your investment accordingly.

- Adjust the SIP Amount:

- Adjust the SIP amount if needed.

- Consider increasing the SIP amount to maximize returns.

Conclusion

Investing ₹1,000 per month in a SIP can be a great way to grow your wealth over time. By following these steps, you can set up a SIP and start investing regularly. Remember to monitor and adjust your SIP as needed to ensure it aligns with your financial goals and risk appetite.

How to Invest ₹1,000 Per Month in SIP: A Comparison of Top SIP Plans

Investing ₹1,000 per month in a Systematic Investment Plan (SIP) can be a fantastic way to grow your wealth over time. SIPs are designed to help you invest small amounts regularly, which can lead to significant returns through the power of compounding. In this article, we will compare the top SIP plans available for ₹1,000 per month and discuss the benefits and factors to consider before investing.

Comparison of Top SIP Plans

Several top-performing SIP plans are available for investments of ₹1,000 per month. Here are some of the best options:

- HDFC Life- Discovery Fund:

- Expected 5-year annualized returns: 21.90%

- Fund size: ₹3,020 crore

- NAV (as of January 2024): ₹29.41.

- Kotak Life – Frontline Equity Fund:

- Expected 5-year annualized returns: 16.30%

- Fund size: ₹2,317 crore

- NAV (as of January 2024): ₹52.72.

- Bajaj Life – Pure Stock Fund:

- Expected 5-year annualized returns: 14.70%

- Fund size: ₹5,250 crore

- NAV (as of January 2024): ₹64.82.

- Quant Active Fund:

- Expected 5-year annualized returns: 20.55%

- Fund size: ₹6,060 crore

- NAV (as of January 2024): ₹567.33.

- Parag Parikh Flexi Cap Fund:

- Expected 5-year annualized returns: 19.83%

- Fund size: ₹44,038 crore

- NAV (as of January 2024): ₹67.01.

Factors to Consider Before Investing

Before choosing the best SIP plan for your ₹1,000 monthly investment, consider the following factors:

- Risk Appetite:

- Assess your ability to absorb financial losses and adjust your investment accordingly.

- Investing Objectives and Time Frame:

- Determine your financial goals and the time frame for achieving them. This will help you choose the right SIP plan.

- Scheme Performance:

- Research the performance of the SIP plan and ensure it aligns with your goals.

- Fund House’s Reputation:

- Verify the credibility of the fund house and the SIP plan.

- Expenses:

- Evaluate the expense ratio of the SIP plan to ensure it is reasonable.

Benefits of Investing ₹1,000 Per Month

Investing ₹1,000 per month in a SIP offers several benefits:

- Rupee Cost Averaging:

- SIPs allow you to purchase more units when prices are low and fewer units when prices are high, averaging out the cost of investment over time.

- Power of Compounding:

- The returns generated from SIP investments can be significant due to the compounding effect.

- Flexibility:

- SIPs offer flexibility in investment amounts and the option to pause or stop investments as needed.

Conclusion

Investing ₹1,000 per month in a SIP can be a great way to grow your wealth over time. By comparing the top SIP plans, considering the factors to invest in, and understanding the benefits of SIPs, you can make informed decisions about your investments. Remember to assess your risk appetite, investing objectives, and scheme performance before choosing the right SIP plan for you.

Frequently Asked Questions (FAQs) for Investing ₹1,000 Per Month in SIP

Q: What is a Systematic Investment Plan (SIP)?

A: A Systematic Investment Plan (SIP) is a type of investment strategy where you invest a fixed amount of money at regular intervals, usually monthly, in a mutual fund or other investment vehicle.

Q: What are the benefits of investing ₹1,000 per month in a SIP?

A: Investing ₹1,000 per month in a SIP offers several benefits, including:

- Rupee Cost Averaging: SIPs allow you to purchase more units when prices are low and fewer units when prices are high, averaging out the cost of investment over time.

- Power of Compounding: The returns generated from SIP investments can be significant due to the compounding effect.

- Flexibility: SIPs offer flexibility in investment amounts and the option to pause or stop investments as needed.

Q: How do I choose the right SIP plan for my ₹1,000 monthly investment?

A: To choose the right SIP plan for your ₹1,000 monthly investment, consider the following factors:

- Risk Appetite: Assess your ability to absorb financial losses and adjust your investment accordingly.

- Investing Objectives and Time Frame: Determine your financial goals and the time frame for achieving them. This will help you choose the right SIP plan.

- Scheme Performance: Research the performance of the SIP plan and ensure it aligns with your goals.

- Fund House’s Reputation: Verify the credibility of the fund house and the SIP plan.

- Expenses: Evaluate the expense ratio of the SIP plan to ensure it is reasonable.

Q: What are some of the best SIP plans available for ₹1,000 per month?

A: Some of the best SIP plans available for ₹1,000 per month include:

- HDFC Life- Discovery Fund: Expected 5-year annualized returns: 21.90%

- Kotak Life – Frontline Equity Fund: Expected 5-year annualized returns: 16.30%

- Bajaj Life – Pure Stock Fund: Expected 5-year annualized returns: 14.70%

- Quant Active Fund: Expected 5-year annualized returns: 20.55%

- Parag Parikh Flexi Cap Fund: Expected 5-year annualized returns: 19.83%

Q: How do I set up a SIP for ₹1,000 per month?

A: To set up a SIP for ₹1,000 per month, follow these steps:

- Choose the Right SIP Plan: Select a SIP plan that aligns with your financial goals and risk appetite.

- Open a Demat Account: Open a demat account with a reputable demat account provider.

- Fund the Account: Deposit the required amount in your demat account.

- Set Up the SIP: Set up the SIP by selecting the SIP plan, setting the SIP amount to ₹1,000 per month, and choosing the frequency of the SIP.

Q: How do I monitor and adjust my SIP?

A: To monitor and adjust your SIP, follow these steps:

- Monitor the SIP: Monitor the performance of your SIP and evaluate the returns.

- Adjust the SIP Amount: Adjust the SIP amount if needed, considering increasing the SIP amount to maximize returns.

Q: What are some common mistakes to avoid when investing in a SIP?

A: Some common mistakes to avoid when investing in a SIP include:

- Not Assessing Risk: Not assessing your risk appetite and investing without considering the potential for losses.

- Not Setting Clear Goals: Not setting clear financial goals and investing without a clear direction.

- Not Monitoring Performance: Not monitoring the performance of your SIP and adjusting it accordingly.

Q: How do I calculate the returns on my SIP?

A: To calculate the returns on your SIP, follow these steps:

- Calculate the Total Investment: Calculate the total investment made in the SIP.

- Calculate the Returns: Calculate the returns generated by the SIP.

- Calculate the Total Corpus: Calculate the total corpus, including the principal amount and the interest earned.

2 thoughts on “Can I Invest 1000 ₹ Per Month In Sip?”