Introduction: The ₹37,500 Mistake Most Investors Don’t Realize

Rakesh, a 35-year-old software engineer, invested ₹5 lakh in an equity mutual fund two years ago. He chose the dividend option thinking it meant regular income. His friend Meena chose the growth option for the same amount. Fast forward to today: Rakesh received dividends, yes — but paid a hefty ₹37,500 more in taxes than Meena. Shocking, right?

This isn’t an uncommon story. Thousands of investors are unknowingly leaking wealth through the wrong mutual fund choice.

With the latest Budget 2025 changes, LTCG (Long-Term Capital Gains) exemptions and slab-based tax treatment make the dividend vs growth decision more critical than ever.

Stay till the end. This one decision could redefine your investment strategy — and your future wealth.

Growth vs Dividend: What’s the Core Difference?

Let’s begin with clarity.

What is the Dividend (IDCW) Option?

- Income Distribution cum Capital Withdrawal (IDCW) is the new term for dividends in mutual funds.

- Profits are distributed regularly (monthly/quarterly/yearly).

- Taxed at your slab rate. If you’re in the 30% bracket, that’s significant.

What is the Growth Option?

- All profits are reinvested back into the fund.

- You don’t get regular payouts.

- Gains are taxed only when you redeem, and at a lower LTCG rate (12.5%) beyond exemption.

Table 1: Tax Impact on ₹5 Lakh Investment (2025)

| Particulars | Dividend Option (IDCW) | Growth Option |

|---|---|---|

| Investment Amount | ₹5,00,000 | ₹5,00,000 |

| Annual Return (10%) | ₹50,000 (payout) | ₹50,000 (reinvested) |

| Tax Rate Applied | 30% (assumed slab) | 12.5% (LTCG) over ₹1.25L |

| Tax Paid in Year 1 | ₹15,000 | 0 |

| Tax Paid over 5 Years | ~₹75,000 | ~₹37,500 |

| Total Tax Saved | ₹37,500 |

Note: Budget 2025 has raised the LTCG exemption to ₹1.25 lakh and reduced LTCG rate to 12.5%.

Why ₹37,500 Tax Saving on ₹5 Lakh Matters

The Snowball Effect

A rupee saved in tax isn’t just saved — it’s invested and compounded.

If you avoid paying ₹37,500 today and reinvest it:

- At 12% CAGR, it becomes ₹1.32 lakh in 10 years.

Emotional Impact

You work hard for every rupee. Why give away extra to taxes, when you can plan smartly?

Table 2: Growth vs Dividend — Compounded Wealth Over 10 Years

| Option | Annual Return | Tax Applied | Final Value (₹) | Net Wealth (₹) |

|---|---|---|---|---|

| Growth | 10% | 12.5% LTCG on gains | ₹13,00,000 | ₹12,68,750 |

| Dividend (IDCW) | 10% | 30% each year | ₹10,50,000 | ₹9,75,000 |

Wealth Gap after 10 years: ₹2.93 lakh just by selecting the right option.

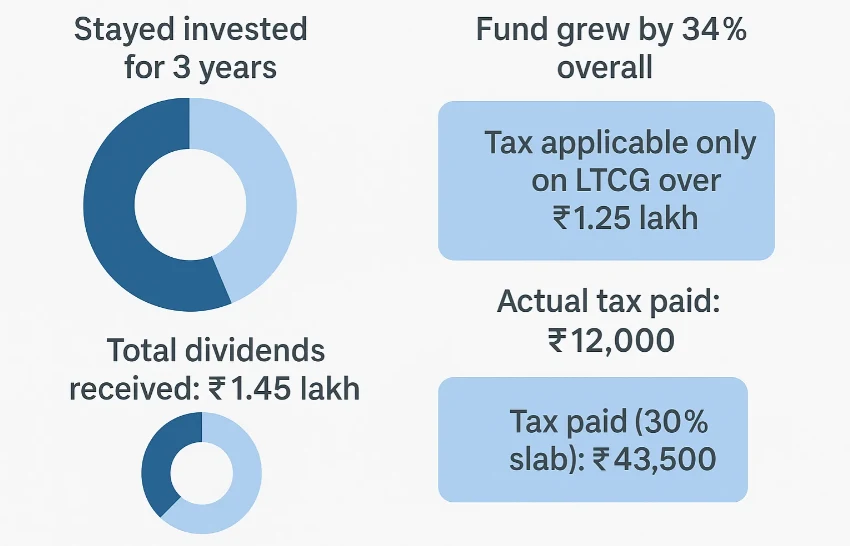

Real-Life Case Study: How Meena Saved ₹37,500

Profile:

- Name: Meena Sharma

- Age: 33

- Occupation: Government Employee

- Investment: ₹5 lakh in Axis Bluechip Fund (Growth)

Outcome:

- Stayed invested for 3 years

- Fund grew by 34% overall

- Tax applicable only on LTCG over ₹1.25 lakh

- Actual tax paid: ₹12,000

Compare with her colleague Ramesh:

- Same fund, IDCW option

- Total dividends received: ₹1.45 lakh

- Tax paid (30% slab): ₹43,500

Tax saved by Meena: ₹43,500 – ₹12,000 = ₹31,500

This is real money. Real impact.

“Growth options allow investors to defer tax and maximize compounding. Dividend may offer comfort but often destroys value.”

— Radhika Gupta, MD & CEO, Edelweiss AMC

Table 3: When to Choose Dividend vs Growth Option

| Scenario | Best Option | Why |

|---|---|---|

| Salaried, 30% slab, no income need | Growth | Lower LTCG tax, compounding gains |

| Retired, needs monthly income | Dividend | Regular payouts (though taxable) |

| Short-term goal (≤1 yr) | Growth | Lower STCG than dividend tax |

| New Tax Regime user | Growth | 80C no longer applies, dividend taxed at slab |

| Uncertain about holding period | Growth | Tax only on redemption |

Top 5 Tips to Save Maximum Tax with Growth Option

- Hold for at least 1 year to get LTCG benefits

- Choose Direct Plans to enhance net returns

- Rebalance only when needed to avoid multiple LTCG events

- Use tax-loss harvesting in poor years

- Review fund performance annually, but don’t panic-sell

FAQ: Dividend vs Growth Explained

Q1. How does Growth option help save ₹37,500 in tax?

Because gains are taxed only when redeemed and at 12.5% (LTCG), unlike dividend which is taxed annually at slab rate.

Q2. Is dividend income taxable in India?

Yes, fully taxable at the investor’s slab rate. Plus, 10% TDS if >₹5,000 per year.

Q3. Can I switch from dividend to growth?

Yes, but it’s treated as a redemption. Tax applies on gains.

Q4. What’s the LTCG exemption in 2025?

₹1.25 lakh per year, up from ₹1 lakh (as per Budget 2025).

Q5. Should retirees choose dividend?

Only if they need monthly income. Otherwise, SWP (Systematic Withdrawal Plan) from growth is often more tax-efficient.

Conclusion: Make This Small Shift for Massive Impact

Let’s be honest — most investors spend more time choosing a phone than selecting the right mutual fund option.

But now you know:

- Dividend vs Growth isn’t a minor detail.

- It’s a ₹37,500 decision on every ₹5 lakh invested.

- It could grow to lakhs more over a decade due to compounding.

Make your money work smarter. Choose Growth.

Take Action Now:

- Review your existing mutual fund holdings

- Switch to growth option if suitable

- Consult a tax advisor if in doubt

Because when your money grows quietly and tax-efficiently in the background — that’s true financial freedom.

Disclaimer: This blog is for informational purposes only. Please consult a registered financial advisor or tax consultant before making investment decisions.

1 Comment