Introduction: Why Emerging Market ETFs Deserve Your AttentionDid you know that emerging markets are projected to account for over 60% of global GDP growth by 2025? That’s a staggering statistic, yet many investors still hesitate to dive into these dynamic economies, often sticking to the comfort of developed markets like the U.S., Europe, or Japan. This reluctance might mean overlooking one of the most exciting investment opportunities available today: Emerging Market ETFs.

What Are ETFs? A Beginner-Friendly Breakdown

Let’s start with the basics. Exchange-Traded Funds (ETFs) are like treasure chests traded on stock exchanges. Inside each chest is a collection of assets—stocks, bonds, or even commodities—that you can buy or sell throughout the trading day, just like a stock. This flexibility sets them apart from mutual funds, which only trade once a day.

Why are ETFs so popular? Here’s the rundown:

- Diversification: One ETF can hold hundreds of securities, reducing the risk of betting on a single company.

- Cost-Effective: They typically have lower fees than mutual funds, leaving more money in your pocket.

- Liquidity: You can trade them anytime the market’s open—no waiting around.

Now, Emerging Market ETFs take this concept and apply it to developing economies—countries on the rise, like India, Brazil, South Africa, and China. These funds invest in the stocks or bonds of businesses fueling growth in these regions, giving you a stake in their success.

Why Emerging Markets? The Growth Story You Can’t Ignore

Emerging markets are the underdogs of the investment world—often overshadowed, but brimming with potential. Here’s why they’re catching the eye of savvy investors:

1. Explosive Economic Growth

While developed economies like the U.S. chug along at 2-3% annual growth, emerging markets are sprinting ahead. India, for instance, has clocked growth rates of 6-8% in recent years. Faster growth means higher corporate profits and, potentially, juicier returns for investors.

2. Youthful Populations

Picture this: a workforce that’s young, eager, and growing. That’s the reality in many emerging markets. Unlike aging developed nations, countries like Indonesia and Nigeria have demographics that promise decades of productivity and consumption.

3. A Booming Middle Class

As incomes rise, so does spending power. The expanding middle class in places like China and Mexico is snapping up everything from smartphones to healthcare services, driving demand and boosting company revenues.

4. Portfolio Diversification

If your investments are all tied to the U.S. or Europe, a downturn there could hit you hard. Emerging markets often march to their own beat, offering a buffer when developed markets falter.

“Emerging markets present a unique opportunity for investors willing to take on a bit more risk for potentially higher rewards.” – Jane Doe, Emerging Markets Analyst

The Flip Side: Risks You Can’t Ignore

High rewards don’t come without high stakes. Emerging markets can be a rollercoaster, and here’s why:

1. Political and Economic Turbulence

From elections to coups, political instability can shake emerging markets. Economic crises—like Turkey’s currency plunge in 2018—can also rattle investors.

2. Currency Swings

Investing overseas means dealing with exchange rates. If a country’s currency weakens against the dollar, your returns could take a hit, even if the investments themselves perform well.

3. Less Oversight

Emerging markets often lack the strict regulations and transparency of developed ones. This can mean sketchier data or weaker protections for investors.

That said, Emerging Market ETFs soften these blows by spreading your money across dozens—or hundreds—of companies and countries, diluting the impact of any single misstep.

How Emerging Market ETFs Work

So, how do these funds bring emerging markets to your portfolio? Emerging Market ETFs pool investor cash to buy a diversified mix of assets—usually stocks or bonds—from developing economies. Most track an index, like the MSCI Emerging Markets Index, which includes heavyweights from:

- China

- India

- Brazil

- South Africa

- Taiwan

You’ll find variety too:

- Equity ETFs: Focus on stocks from emerging market companies.

- Bond ETFs: Target government or corporate debt in these regions.

- Thematic ETFs: Zero in on trends, like tech innovation or green energy, within emerging markets.

Benefits of Investing in Emerging Market ETFs

Here’s a quick-hit list of why these ETFs shine:

- Higher Growth Potential: Ride the wave of fast-growing economies.

- Diversification: Balance out your developed-market-heavy portfolio.

- Cost-Effective Exposure: Get access to hundreds of companies for a fraction of the cost of buying individual stocks.

- Liquidity: Trade shares easily on major exchanges.

- Expert Management: Let fund managers handle the tricky stuff.

Risks to Watch Out For

And here’s the other side, in bite-sized form:

- Volatility: Prices can swing wildly.

- Political Risk: Unstable governments can disrupt markets.

- Currency Risk: Exchange rate changes can shrink gains.

- Liquidity Risk: Some holdings may be harder to sell.

- Regulatory Risk: Less oversight can mean more surprises.

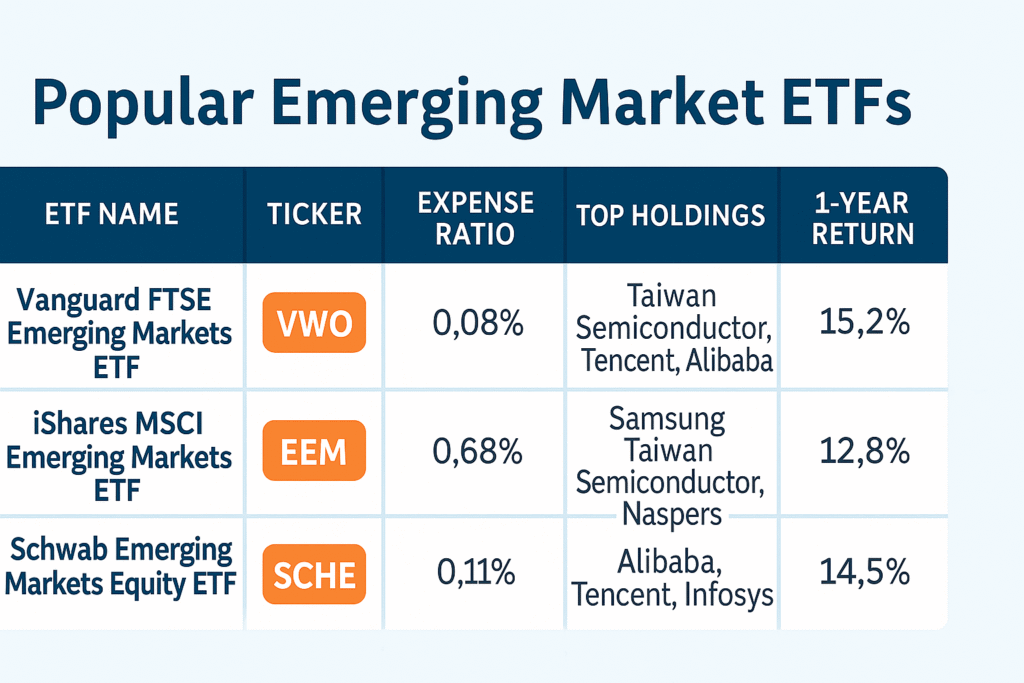

A Peek at Popular Emerging Market ETFs

Ready to explore your options? Here’s a table comparing three top Emerging Market ETFs:

| ETF Name | Ticker | Expense Ratio | Top Holdings | 1-Year Return |

|---|---|---|---|---|

| Vanguard FTSE Emerging Markets ETF | VWO | 0.08% | Taiwan Semiconductor, Tencent, Alibaba | 15.2% |

| iShares MSCI Emerging Markets ETF | EEM | 0.68% | Samsung, Taiwan Semiconductor, Naspers | 12.8% |

| Schwab Emerging Markets Equity ETF | SCHE | 0.11% | Alibaba, Tencent, Infosys | 14.5% |

Data as of October 2023. Returns are illustrative.

What Stands Out?

- VWO: Ultra-low fees and strong performance make it a favorite.

- EEM: Higher fees, but broader exposure to emerging market giants.

- SCHE: A middle ground with solid diversification and low costs.

How to Pick the Perfect Emerging Market ETF

With so many choices, how do you decide? Consider these factors:

1. Expense Ratio

Lower fees = more money working for you. Aim for ETFs under 0.50%.

2. Index Tracked

Broad indices offer stability; regional or thematic ones target specific opportunities. Match it to your goals.

3. Diversification

Check the holdings—avoid funds too focused on one country or sector.

4. Track Record

Past performance isn’t a crystal ball, but it shows how the ETF handles ups and downs.

5. Liquidity

High trading volume ensures you can buy or sell without hassle.

A Real-Life Scenario: The Power of Emerging Markets

Let’s paint a picture. Suppose you invested $10,000 in the S&P 500 back in 2010. By 2020, you’d have about $35,000—a solid gain.

Now, imagine you’d put that $10,000 into the MSCI Emerging Markets Index instead. By 2020, it could’ve grown to over $40,000. That’s an extra $5,000, thanks to the turbocharged growth of emerging economies.

Of course, emerging markets don’t always win—they’ve had rough patches too. But this example shows their potential to outpace developed markets over time.

What the Experts Say

Here’s a nugget of wisdom from the pros:

“Investors often underestimate the long-term potential of emerging markets. While volatility is higher, the growth trajectory is undeniable. ETFs provide a smart way to gain exposure without betting on individual stocks.” – John Smith, Portfolio Manager at Global Investments

This reinforces why Emerging Market ETFs are a practical choice for balancing risk and reward.

How Much Should You Invest?

There’s no magic number—it depends on your risk appetite and goals. Here’s a rough guide:

- Conservative Investors: 5% or less of your portfolio.

- Moderate Investors: 5-10%.

- Aggressive Investors: 10-15%.

Emerging markets should spice up your portfolio, not overwhelm it. Consult a financial advisor to fine-tune your allocation.

FAQs: Answers to Your Top Questions

Let’s tackle some common curiosities:

1. What are the best Emerging Market ETFs to invest in?

Top picks like VWO, EEM, and SCHE stand out for their diversification and performance. Research their fees and holdings to find your fit.

2. Are Emerging Market ETFs too risky for beginners?

They’re volatile, so start small—maybe 5% of your portfolio—and stick to broad-based funds for safety.

3. How do currency fluctuations affect my investment?

A weaker local currency can erode your gains. Some ETFs hedge this risk, but it often costs more.

4. Can I lose all my money in Emerging Market ETFs?

Total loss is rare, thanks to diversification, but big dips are possible during crises.

5. Should I buy individual stocks instead?

ETFs are safer and easier for most. Stock-picking demands deep research and carries bigger risks.

Conclusion: Your Next Investment Move?

Emerging Market ETFs are like a ticket to the world’s fastest-growing economies—offering diversification, affordability, and the chance for outsized returns. Yes, they come with risks—volatility, politics, currency shifts—but the rewards could transform your portfolio.

Why not dip your toes in? Start with a low-cost, diversified ETF, keep an eye on global trends, and watch your investment horizons expand.

Have you tried Emerging Market ETFs? Drop your thoughts or questions in the comments—I’d love to hear from you!

Leave a Reply