Warning: Undefined array key 0 in /home/u117450413/domains/smartblog91.com/public_html/wp-content/plugins/seo-image-optimizer/options/option-panel.php on line 141

Deprecated: pathinfo(): Passing null to parameter #1 ($path) of type string is deprecated in /home/u117450413/domains/smartblog91.com/public_html/wp-content/plugins/seo-image-optimizer/options/option-panel.php on line 141

Warning: Undefined array key 0 in /home/u117450413/domains/smartblog91.com/public_html/wp-content/plugins/seo-image-optimizer/options/option-panel.php on line 141

Deprecated: pathinfo(): Passing null to parameter #1 ($path) of type string is deprecated in /home/u117450413/domains/smartblog91.com/public_html/wp-content/plugins/seo-image-optimizer/options/option-panel.php on line 141

Warning: Undefined array key 0 in /home/u117450413/domains/smartblog91.com/public_html/wp-content/plugins/seo-image-optimizer/options/option-panel.php on line 141

Deprecated: pathinfo(): Passing null to parameter #1 ($path) of type string is deprecated in /home/u117450413/domains/smartblog91.com/public_html/wp-content/plugins/seo-image-optimizer/options/option-panel.php on line 141

Warning: Undefined array key 0 in /home/u117450413/domains/smartblog91.com/public_html/wp-content/plugins/seo-image-optimizer/options/option-panel.php on line 141

Deprecated: pathinfo(): Passing null to parameter #1 ($path) of type string is deprecated in /home/u117450413/domains/smartblog91.com/public_html/wp-content/plugins/seo-image-optimizer/options/option-panel.php on line 141

Federal Reserve Considers Rate Cuts

Potential Implications and Projected Timeline

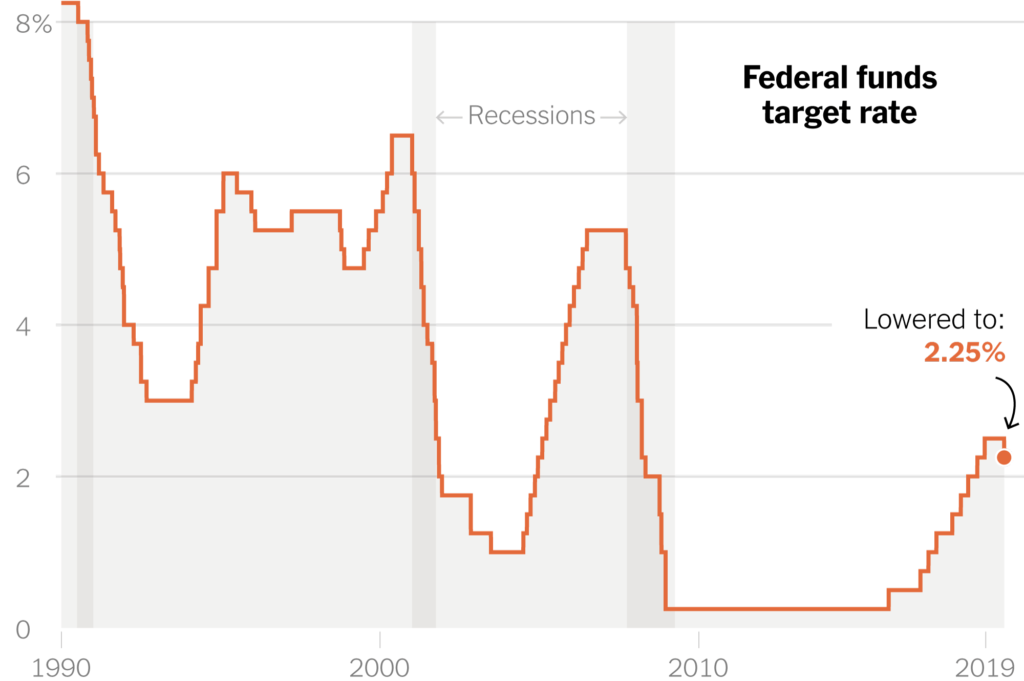

The Federal Reserve is currently in discussions regarding potential rate cuts in 2024. According to policymakers, there is a prospect of a decrease of 75 basis points in the upcoming year. Traders are anticipating the initiation of rate cuts as early as May 2024. During the December 2023 meeting, policymakers indicated the possibility of three rate cuts in 2024. While there is speculation that the first rate cut could materialize in March, some officials have underscored the importance of a cautious and systematic approach to implementing these cuts. An economist has also weighed in on the matter, suggesting the likelihood of rate cuts commencing in March, with an additional three cuts expected throughout 2024.

The discussions within the Federal Reserve regarding potential rate cuts have garnered significant attention and are indicative of the potential shifts in monetary policy in the coming year. Market participants and analysts are closely monitoring these developments to gauge their impact on various sectors, including housing, investment, and consumer spending.

The consideration of rate cuts by the Federal Reserve reflects a proactive approach to economic management, aiming to support growth and stability. As the discussions unfold, it is essential for businesses and investors to stay informed about the evolving monetary policy landscape and its potential implications for their financial strategies.

Table of Contents

Understanding Rate Cuts

Definition and Purpose

Rate cuts refer to the reduction of interest rates set by central banks, such as the Federal Reserve. The purpose of rate cuts is to stimulate economic growth by making borrowing cheaper and more accessible for businesses and consumers. This, in turn, can lead to increased spending, investment, and overall economic activity.

In the context of the Federal Reserve, rate cuts are typically implemented in response to economic downturns, inflationary pressures, or other factors that may negatively impact the economy. By lowering interest rates, the Fed aims to encourage borrowing and investment, which can help to boost economic growth and stability.

The Federal Reserve’s Role in Monetary Policy

Powers and Responsibilities

The Federal Reserve, often referred to as the “Fed,” is the central bank of the United States. It was established in 1913 to provide a stable monetary and financial system for the country. The Fed has several key responsibilities, including:

- Conducting the nation’s monetary policy: The Fed sets interest rates and manages the supply of money in the economy to promote maximum employment, stable prices, and moderate long-term interest rates.

- Supervising and regulating banks: The Fed oversees the safety and soundness of the nation’s banking system, ensuring that banks operate in a manner that protects the interests of their customers and maintains public confidence in the banking system.

- Promoting consumer protection and community development: The Fed works to protect consumers from unfair or deceptive practices and to promote community development through its supervision and regulation of banks and other financial institutions.

In the context of rate cuts, the Federal Reserve’s role is to carefully consider the economic conditions and potential implications of lowering interest rates. This involves weighing the benefits of stimulating growth against the risks of inflation or other negative consequences.

The Impact of Rate Cuts on Various Sectors

Housing Market

Rate cuts can have a significant impact on the housing market. Lower interest rates make it cheaper for homebuyers to borrow, which can lead to increased demand for housing and potentially higher home prices. This can be beneficial for homeowners and real estate investors, but it may also exacerbate housing affordability issues for first-time buyers and low-income households.

Investment and Consumer Spending

Lower interest rates can also stimulate investment and consumer spending. Businesses may be more inclined to invest in new projects or expand their operations, while consumers may be more likely to make large purchases or take on additional debt. This can contribute to economic growth, but it may also lead to increased leverage and potential risks for businesses and consumers.

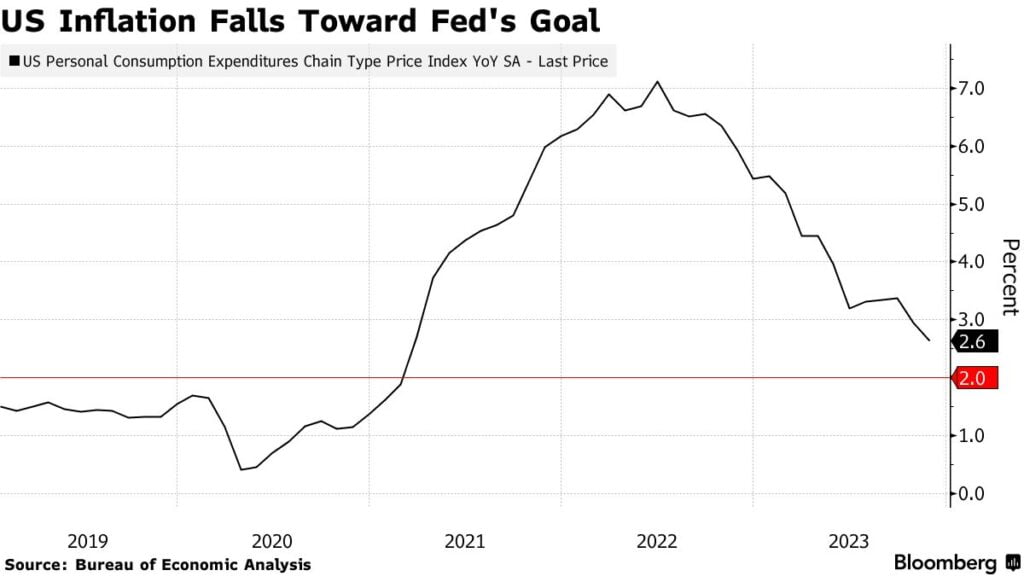

Inflation and Economic Stability

One of the primary concerns with rate cuts is the potential for inflationary pressures. Lower interest rates can lead to increased borrowing and spending, which can drive up demand for goods and services. If supply cannot keep pace with this increased demand, prices may rise, leading to inflation. The Federal Reserve must carefully balance the benefits of rate cuts with the risks of inflation and other potential negative consequences.

Staying Informed and Preparing for Rate Cuts

Importance of Monitoring Monetary Policy Developments

As the Federal Reserve considers rate cuts in 2024, it is crucial for businesses and investors to stay informed about the evolving monetary policy landscape. This includes monitoring the discussions and decisions of policymakers, as well as the potential impact of rate cuts on various sectors.

By staying informed, businesses and investors can better understand the potential implications of rate cuts for their financial strategies and adjust their plans accordingly. This may involve reevaluating investment opportunities, reassessing risk management strategies, or exploring new financing options.

Adapting to a Changing Monetary Policy Landscape

As the Federal Reserve moves closer to implementing rate cuts, businesses and investors must be prepared to adapt to the changing monetary policy landscape. This may involve:

- Reviewing financial strategies: Businesses and investors should reassess their financial strategies to account for the potential impact of rate cuts on their operations and investments.

- Exploring new financing options: With lower interest rates, businesses may have more opportunities to secure financing for growth and expansion. Investors may also need to adjust their portfolios to take advantage of these changes.

- Monitoring market trends: As rate cuts are implemented, businesses and investors should closely monitor market trends and adjust their strategies accordingly. This may involve reallocating assets, adjusting investment strategies, or exploring new opportunities.

FAQs

1. What are rate cuts, and how do they impact the economy?

Rate cuts refer to the reduction of interest rates set by central banks, such as the Federal Reserve. They are intended to stimulate economic growth by making borrowing cheaper and more accessible for businesses and consumers. This can lead to increased spending, investment, and overall economic activity. However, rate cuts can also lead to inflationary pressures and other potential negative consequences, so they must be carefully considered and implemented.

2. Why is the Federal Reserve considering rate cuts in 2024?

The Federal Reserve is considering rate cuts in response to evolving economic conditions. The potential for rate cuts in 2024 reflects the Fed’s proactive approach to economic management, aiming to support growth and stability. The discussions within the Federal Reserve regarding potential rate cuts have garnered significant attention and are indicative of the potential shifts in monetary policy in the coming year.

3. How might rate cuts impact the housing market?

Rate cuts can have a significant impact on the housing market. Lower interest rates make it cheaper for homebuyers to borrow, which can lead to increased demand for housing and potentially higher home prices. This can be beneficial for homeowners and real estate investors, but it may also exacerbate housing affordability issues for first-time buyers and low-income households.

4. What should businesses and investors do to prepare for potential rate cuts?

Businesses and investors should stay informed about the evolving monetary policy landscape and the potential implications of rate cuts for their financial strategies. This may involve reevaluating investment opportunities, reassessing risk management strategies, or exploring new financing options. Adapting to a changing monetary policy landscape may also require reviewing financial strategies, exploring new financing options, and monitoring market trends.

5. How can businesses and investors monitor monetary policy developments?

Businesses and investors can monitor monetary policy developments by staying informed about the discussions and decisions of policymakers, as well as the potential impact of rate cuts on various sectors. This may involve following economic news, consulting with financial advisors, and conducting thorough research on the potential implications of rate cuts for their specific industries and investments.

In conclusion,

the Federal Reserve’s consideration of rate cuts in 2024 highlights the importance of staying informed about monetary policy developments and their potential impact on various sectors. By staying informed and prepared, businesses and investors can better navigate the evolving monetary policy landscape and make informed decisions about their financial strategies.