Introduction

The FTSE 100 index, often referred to as the “Footsie,” represents the performance of the 100 largest companies listed on the London Stock Exchange. Because of its liquidity, volatility, and global exposure, it is a favorite among intraday traders. Unlike long-term investors, intraday traders seek to profit from short-term market moves within the same trading day, minimizing overnight risk.

Table of Contents

But how can you build a profitable intraday trading strategy for the FTSE 100 in today’s markets? This blog provides live market data, strategy frameworks, and future outlooks that can help traders make informed decisions.

Latest FTSE 100 Market Overview

Before crafting a trading plan, it is important to examine the FTSE 100’s current market position.

| Metric | Current Value (2025) | Notes |

|---|---|---|

| FTSE 100 Index (spot) | ~9,285 | Trading near recent highs |

| Day’s Range | 9,208 – 9,292 | Indicates intraday volatility |

| 52-week Range | 7,545 – 9,358 | Long-term price extremes |

| Forecast End-2025 | ~9,305 | Suggests mild upside potential |

| Forecast End-2029 | ~11,266 | Long-term bullish projection |

Insight: The FTSE 100 is currently trading close to its upper range, which means intraday moves may either continue into breakout zones or face resistance.

Core Elements of an Intraday Trading Strategy

A structured strategy reduces emotional decision-making and helps traders stay consistent.

| Element | Purpose | Example Tools |

|---|---|---|

| Trend Filter | Identifies overall market bias | 50 EMA, 200 EMA, ADX |

| Support & Resistance | Marks reaction zones | Daily pivots, prior highs/lows |

| Entry Signal | Determines when to trade | Breakouts, candlestick patterns |

| Confirmation | Reduces false entries | RSI, MACD, volume spikes |

| Stop Loss | Controls downside risk | ATR-based stop or swing points |

| Profit Target | Locks in gains | 2x risk-reward ratio |

| Exit Rule | Ensures discipline | Time-based exit before close |

By combining these rules, traders can avoid impulsive decisions and trade with confidence.

Sample Intraday Plan for FTSE 100

Here’s a step-by-step outline of a possible FTSE 100 intraday plan:

- Pre-Market Setup: Mark key support/resistance levels and check economic news.

- Opening Range Strategy: Define high/low of the first 20–30 minutes.

- Entry: Enter a trade if price breaks the opening range in trend direction.

- Stop Loss: Place stop just beyond swing points or 15–20 index points away.

- Profit Targets: Aim for at least 2x the risk.

- Exit Before Close: Close all trades before the London market ends.

| Scenario | Entry | Stop Loss | Target | Risk/Reward |

|---|---|---|---|---|

| Bullish Breakout | 9,296 | 9,280 | 9,328 | 1:2 |

| Bearish Breakdown | 9,260 | 9,275 | 9,230 | 1:2 |

This structure allows traders to plan trades without relying on guesswork.

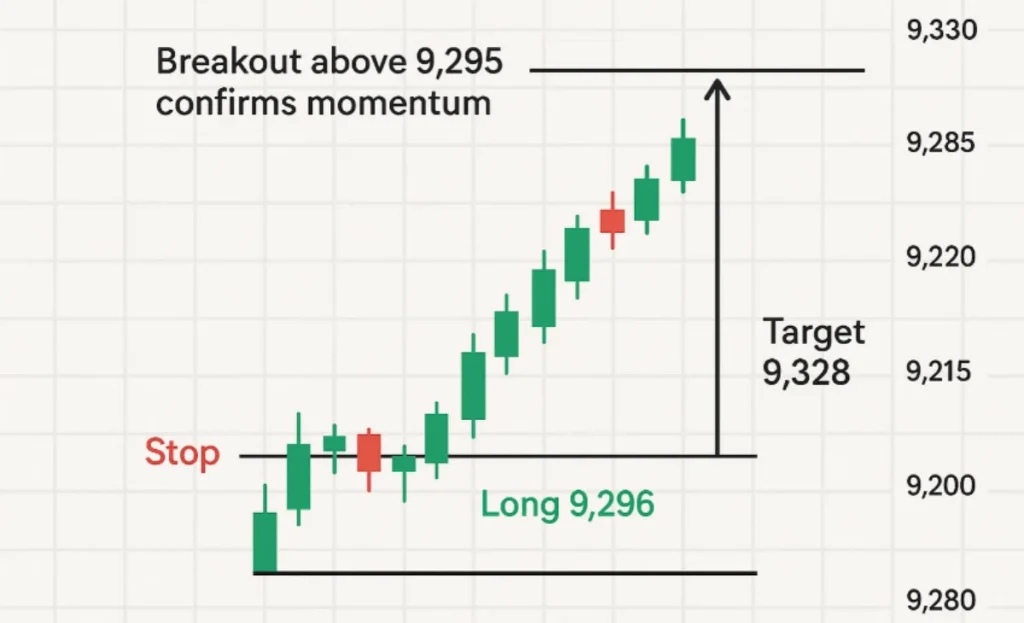

Hypothetical Trade Example

Imagine a trading day where the FTSE 100 opens strong:

- Opening range high: 9,295

- Opening range low: 9,260

- Trend: Upward (50 EMA rising)

A breakout above 9,295 confirms momentum. A trader enters long at 9,296, places a stop at 9,280, and targets 9,328. The reward is double the risk, and if momentum continues, trailing stops can capture further upside.

| Trade Setup | Value |

|---|---|

| Entry | 9,296 |

| Stop Loss | 9,280 |

| Target | 9,328 |

| Risk | 16 points |

| Reward | 32 points |

This kind of disciplined setup ensures that even if some trades fail, profitable ones outweigh losses.

Also Releted: MTF vs Normal Trading: 5 Key Differences You Should Understand

Risks and Backtesting

Intraday trading carries risks, and no strategy works every time. To improve reliability:

- Backtest strategies using historical FTSE 100 data.

- Factor in costs like spreads and commissions.

- Avoid trading during high-impact news unless you’re specifically trading volatility.

- Use strict risk management: never risk more than 1% of your capital per trade.

| Risk Factor | Impact on Trading | Solution |

|---|---|---|

| High Volatility | Sudden spikes hit stop-loss | Use wider ATR-based stops |

| Low Liquidity Hours | False breakouts | Trade London open & overlap |

| Emotional Bias | Overtrading | Stick to rules & journal |

Future Outlook for FTSE 100 Intraday Traders

Long-term forecasts indicate that the FTSE 100 could rise toward 11,000+ by 2029, supported by dividends, weaker currency trends, and economic recovery. For intraday traders, this suggests a slight bullish bias in the coming years.

| Forecast Year | Estimated Level | Sentiment |

|---|---|---|

| 2025 | 9,305 | Mild bullish |

| 2027 | 10,240 | Growth continuation |

| 2029 | 11,266 | Strong bullish |

Still, intraday strategies must remain flexible because day-to-day moves can swing in both directions regardless of long-term trends.

Conclusion

The FTSE 100 index offers excellent opportunities for intraday traders due to its liquidity, volatility, and global exposure. A successful strategy combines trend filters, support/resistance levels, strict entry rules, stop losses, and disciplined exits. While forecasts point toward long-term growth, intraday traders should focus on risk management and structured decision-making.

If executed with discipline, a FTSE 100 intraday strategy can generate consistent profits without exposing traders to overnight risks.

Leave a Reply