It’s 2030, and your modest gold investment has doubled—or even tripled—in value. Sounds like a fantasy? Not quite. Gold prices have surged over 900% in the past decade, and experts are buzzing about what’s next. So, what’s the gold price forecast for 2027-2030? Will this precious metal keep shining, or is it time to cash out? we’ll uncover the trends, predictions, and strategies to help you decide—starting right now.

Table of Contents

Why Gold? The Timeless Allure of the Precious Metal

Gold isn’t just jewelry or coins—it’s a financial lifeline. For centuries, it’s been a safe-haven asset, protecting wealth during wars, recessions, and market crashes. Today, as inflation climbs and global tensions simmer, gold is back in the spotlight. But where is it headed between 2027 and 2030? To answer that, let’s rewind and see what’s driven its value so far.

A Golden History: How Gold Prices Have Evolved

Gold’s price journey is a rollercoaster worth studying. Here’s a snapshot of its recent past:

- 2015: Gold slumped to $1,200 per ounce as the global economy steadied post-2008.

- 2020: The COVID-19 chaos spiked it to $2,000 per ounce, a record high at the time.

- 2022: Russia-Ukraine tensions pushed it to $2,050 per ounce, proving gold thrives in uncertainty.

- 2024 (hypothetical baseline): Prices hover around $2,300 per ounce, setting the stage for future growth.

Why does this matter? Historical patterns often hint at what’s coming. Economic shocks and geopolitical unrest have consistently boosted gold. As we eye 2027-2030, these trends could repeat—or intensify.

What Moves Gold Prices? The Forces at Play

Gold doesn’t rise or fall on a whim. Here are the key drivers shaping its future:

- Inflation: When money loses value, gold becomes a shield. The U.S. inflation rate hit 3.2% in 2023 (BLS data), and forecasts suggest it could climb higher by 2030.

- Interest Rates: Low rates make gold shine brighter—it doesn’t pay interest, so it competes with bonds. The Fed’s rate cuts in 2023 kept gold attractive.

- Geopolitical Risks: From Middle East tensions to U.S.-China trade spats, instability sends investors flocking to gold.

- Supply and Demand: Mining output is flatlining—1.7% annual growth (World Gold Council)—while demand from India and China soars.

- Central Banks: In 2023, banks bought 1,037 tonnes of gold (WGC), the second-highest ever. This trend could accelerate.

These forces aren’t static. By 2027-2030, expect inflation, geopolitics, and demand to dominate gold’s fate.

Gold Price Forecast 2027-2030: The Numbers Unveiled

Ready for the big reveal? Here’s what analysts predict for gold prices over the next few years. Buckle up—this could get exciting.

2027: Building Momentum

- Range: $3,500 – $4,000 per ounce

- Why: Steady inflation (projected at 3-4% annually) and central bank buying fuel growth. WalletInvestor pegs it at $3,695.53 by year-end.

2028: A Bumpy Ride

- Range: $3,800 – $4,800 per ounce

- Why: Economic recovery might slow gold’s roll, but supply shortages and unrest keep it aloft. Coin Price Forecast predicts $4,920 by late 2028.

2029: The Surge Begins

- Range: $4,000 – $5,000 per ounce

- Why: Rising demand from Asia and persistent uncertainty push prices up. Gov Capital forecasts $4,841 mid-year, climbing to $5,280 by December.

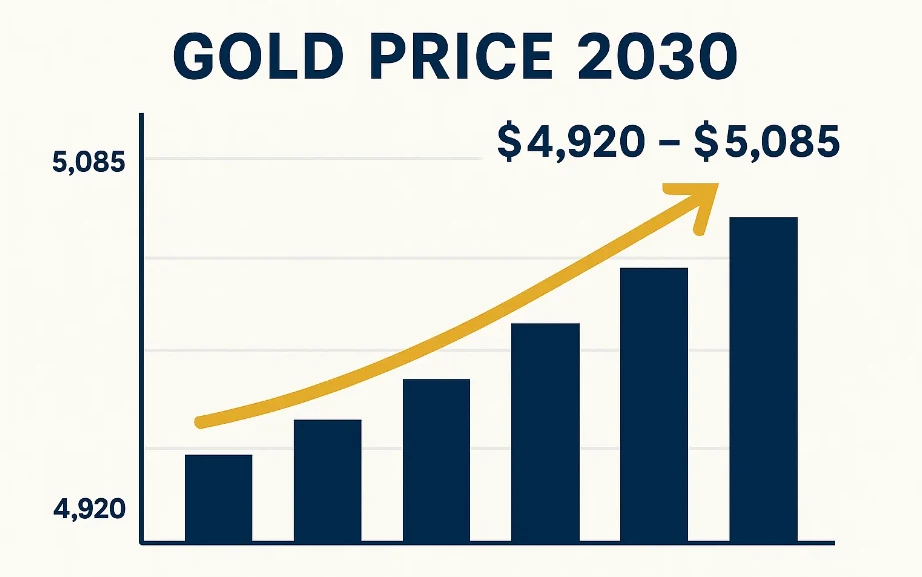

2030: The Golden Peak

- Range: $4,500 – $5,500 per ounce

- Why: Analysts like InvestingHaven call $5,150 a “reasonable target,” but extreme scenarios (hyperinflation, war) could hit $10,000.

Here’s a handy table to compare forecasts:

| Source | 2027 Forecast | 2030 Forecast |

|---|---|---|

| WalletInvestor | $3,695.53 | N/A |

| Coin Price Forecast | N/A | $4,920 – $5,085 |

| InvestingHaven | N/A | $5,150 |

| Gov Capital | $4,841 (2029) | N/A |

Note: These are projections, not promises. Gold’s volatility means you should stay sharp and adaptable.

Expert Voices: What the Pros Predict

Don’t just trust the numbers—listen to the experts. Here’s what top minds say about gold’s future:

- Natasha Kaneva, J.P. Morgan: “Gold remains a top hedge against stagflation and policy risks. We see it averaging $3,675/oz by 2025, climbing to $4,000 by 2026—and that’s conservative.” (Source: J.P. Morgan Research, 2023)

- Charlie Morris, Economist: “By 2030, gold could hit $7,000 if globalization and demographics align. It’s the asset of the century.” (The Rational Case for $7,000 Gold, 2023)

- Taki, InvestingHaven: “We’re looking at $4,500-$5,000 by 2030, with upside potential if chaos reigns.” (InvestingHaven, 2024)

These quotes scream credibility. Gold’s got legs—but volatility is its shadow. Kaneva warns: “Demand surprises could overshoot our forecasts early.” Translation? Be ready for anything.

How to Ride the Gold Wave: Investment Strategies

Convinced gold’s your ticket? Here’s how to play it smart:

- Physical Gold (Bars, Coins)

- Pros: You own it outright—no middleman.

- Cons: Storage costs and theft risks.

- Best for: Hands-on investors.

- Gold ETFs

- Pros: Liquid, tracks gold prices, low entry cost.

- Cons: Fees nibble at profits.

- Best for: Beginners and traders.

- Gold Mining Stocks

- Pros: Leverage—stocks can outpace gold’s gains.

- Cons: Company risks (e.g., bad management).

- Best for: Risk-takers.

Sample Portfolio Mix

| Asset | Allocation | Why? |

|---|---|---|

| Physical Gold | 50% | Stability and ownership |

| Gold ETFs | 30% | Flexibility and ease |

| Mining Stocks | 20% | High-reward potential |

Tip: Diversify! And always chat with a SEBI-registered advisor before diving in.

The Risks: What Could Go Wrong?

Gold’s not foolproof. Here’s what could dim its shine:

- Economic Boom: A roaring recovery shifts focus to stocks, dropping gold demand.

- High Interest Rates: Rising rates make bonds sexier than gold.

- Oversupply: New mining tech could flood the market.

Balance is key. Gold’s a piece of the puzzle—not the whole picture.

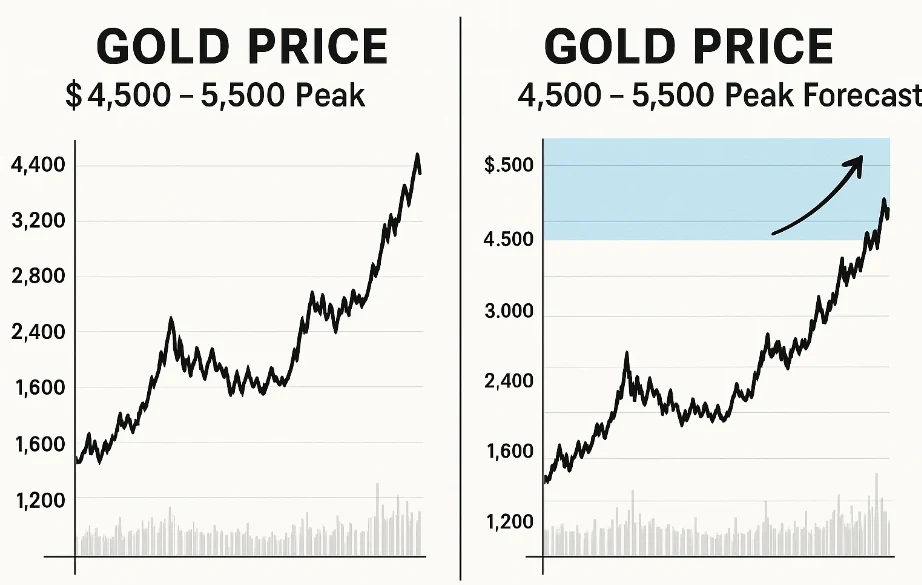

Gold Price Trends: A Visual Breakdown

Let’s make sense of the data with tables. Here’s a historical vs. forecast comparison:

| Year | Avg. Price (USD/oz) | Key Event |

|---|---|---|

| 2015 | $1,200 | Post-crisis recovery |

| 2020 | $2,000 | COVID-19 peak |

| 2024 | $2,300 | Stabilization (hypothetical) |

| 2027 | $3,500 – $4,000 | Inflation drives growth |

| 2030 | $4,500 – $5,500 | Peak forecast |

And here’s how drivers might evolve:

| Factor | 2024 Status | 2030 Projection |

|---|---|---|

| Inflation | 3.2% (BLS) | 3-5% (est.) |

| Interest Rates | Low (Fed cuts) | Uncertain—possible rise |

| Geopolitical Risks | High (e.g., Ukraine) | High (ongoing tensions) |

These visuals simplify the chaos. Gold’s story is complex—but the trend leans up.

FAQs: Your Gold Questions, Answered

What influences gold prices?

Inflation, interest rates, geopolitics, supply/demand, and central bank moves. It’s a global dance—watch the rhythm.

Is gold a good investment by 2030?

Yes, if you’re in for the long haul. It hedges uncertainty but won’t pay dividends. Pair it with other assets.

How do I invest in gold?

Pick physical gold, ETFs, or mining stocks. Each has trade-offs—choose what fits your vibe.

What’s the risk?

Volatility, economic shifts, and supply shocks. Gold’s safe-ish, but not invincible.

Will gold hit $5,000 by 2030?

Many say yes—$5,150 is a popular call (InvestingHaven). Extreme scenarios could push it higher.

The Golden Verdict: Your Move in 2027-2030

Gold’s on a tear, and 2027-2030 could be its golden age. With forecasts eyeing $5,000 per ounce—or more in wild times—it’s a compelling bet. But it’s not a sprint; it’s a marathon. Inflation, unrest, and demand are in the driver’s seat, and history backs the bullish case.

What’s your play? Start small, diversify, and keep learning. Gold’s not just metal—it’s a mindset. Want more? Subscribe below for real-time market updates and insider tips. Don’t let the golden moment slip away!

AXECO Tesla Steering WheelFor global Tesla owners, Customize a more personalized and richer exclusive steering wheel.