Introduction — The Story of a Midcap Giant Rising

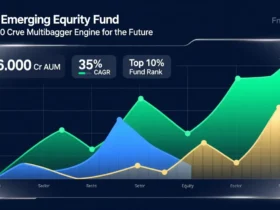

In India’s fast-growing investment landscape, very few mutual funds have built a legacy as powerful as the Kotak Emerging Equity Fund. What began as a disciplined midcap fund slowly transformed into a ₹26,000 crore powerhouse—one that has consistently delivered superior risk-adjusted returns for more than a decade.

Table of Contents

If you meet seasoned investors today, you’ll often hear a similar story:

They started with a SIP of ₹5,000–₹10,000 in this fund, held it patiently through cycles, and ended up with life-changing gains. Some doubled their capital in less than four years. Others built multi-lakh portfolios from modest contributions. And a few, who stayed for a decade, turned this fund into their biggest wealth creator.

Why does this fund inspire such trust?

Why is it considered a future multibagger engine?

And why, despite market volatility, does it keep attracting thousands of new investors every month?

1. The Rise of a ₹26,000 Crore Titan

Kotak Emerging Equity Fund didn’t grow overnight. It earned its size.

While many midcap funds struggle to sustain performance beyond ₹8,000–12,000 crore, Kotak’s disciplined research engine allowed it to scale without compromising returns. Even as assets surged, the fund manager maintained quality, conviction, and clear allocation discipline.

2024–25 marked a breakthrough year. India witnessed a midcap supercycle—driven by manufacturing growth, export competitiveness, and expanding domestic demand. This fund rode the wave strategically, entering scalable businesses before they reached mainstream popularity.

By 2025, the fund crossed ₹26,000 crore AUM, becoming one of the largest and most respected midcap funds in India.

TABLE 1: AUM Growth Journey (Past to Future)

| Year | AUM (₹ Crore) | Market Phase | Notes |

|---|---|---|---|

| 2020 | 15,000 | Post-Covid Recovery | Rapid inflows through SIPs |

| 2022 | 18,500 | Bull Cycle | Strong midcap rotation |

| 2024 | 22,000 | Pre-election rally | Large new investors added |

| 2025 | 26,000 | Midcap supercycle | Fund crosses major milestone |

| 2027 (Proj.) | 34,000 | Manufacturing boom | PLI-driven expansion |

| 2030 (Proj.) | 48,000 | $7 trillion India | Midcaps expected to dominate returns |

2. Why Midcaps Are the Golden Goose of India’s Future

If large caps represent stability and small caps represent hope, midcaps represent growth with balance. They are the backbone of India’s transition into a high-income economy.

Between 2013 and 2024, midcaps delivered 2.1× higher returns than large caps.

Between 2024 and 2030, experts predict midcaps may outperform by 25–40%, driven by:

- India’s manufacturing and export push

- Rising middle-class consumption

- Digital transformation of traditional businesses

- Capex revival across sectors

Kotak Emerging Equity Fund positions itself at the heart of this transformation. It invests in companies:

- Just before they enter expansion phase

- Just before they become market leaders

- Just before they turn into large caps

In short—

It catches future multibaggers early, when valuations still make sense.

TABLE 2: Historical Returns – Midcap vs Large Cap

| Category | 5-Year CAGR | 10-Year CAGR | Volatility | Return Stability |

|---|---|---|---|---|

| Large Cap Funds | 12–14% | 11–12% | Low | Stable |

| Small Cap Funds | 16–20% | 17–19% | Very High | Unstable |

| Midcap Funds | 15–18% | 14–16% | Moderate | Strong |

| Kotak Emerging Equity Fund | 17–20% | 16–18% | Moderate | Very Strong |

3. What Makes Kotak Emerging Equity Fund Truly Special?

Here’s the secret:

This fund doesn’t chase hype.

It doesn’t over-diversify.

It doesn’t fall into FOMO traps.

Instead, it follows a deep-research, high-conviction approach.

Its core strengths include:

1. Bottom-Up Stock Selection

Every company is chosen after deep financial, management, and industry analysis—not market noise.

2. Scalable Business Models

The fund invests in midcaps that can grow into large caps—companies with strong balance sheets, expanding markets, and pricing power.

3. Sector Diversification with Logic

The fund avoids over-exposure to any cyclical theme.

Top sectors typically include:

- Industrials

- Manufacturing

- Banking & financials

- Consumer & retail

- Technology & digital solutions

4. Long-Term Compounding Philosophy

The fund does not trade aggressively; it builds wealth patiently and consistently.

TABLE 3: Sector Allocation (2024–25)

| Sector | Allocation % | Reason for Allocation |

|---|---|---|

| Industrials | 19–22% | Capex boom + Make in India |

| Financials | 13–15% | Credit expansion + rising loan demand |

| Consumer | 10–12% | Strong domestic consumption |

| Technology | 8–10% | Digital transformation |

| Chemicals | 6–8% | China+1 opportunity |

| Auto & Auto Ancillary | 5–6% | EV and export momentum |

4. Real-Life Case Study: The “₹10,000 SIP to ₹22 Lakh” Story

In 2014, a 28-year-old salaried employee from Pune began a SIP of ₹10,000/month in Kotak Emerging Equity Fund. He didn’t stop it, even during:

- 2016 demonetization

- 2018 midcap crash

- 2020 Covid fall

- 2022 Russia-Ukraine volatility

He stayed consistent and trusted the process.

By 2024, his investment had grown to:

- Total invested: ₹12,00,000

- Current value: ₹22,40,000

- Wealth gain: ₹10,40,000

A 22 lakh corpus—built from simple discipline, patience, and the right fund.

Stories like this are not rare.

They are common among long-term Kotak Emerging Equity investors.

TABLE 4: SIP Growth Analysis (10 Years)

| SIP Amount | Duration | Total Invested | Expected Fund Value (12–14% CAGR) |

|---|---|---|---|

| ₹5,000/month | 10 years | ₹6,00,000 | ₹11,50,000–₹13,20,000 |

| ₹10,000/month | 10 years | ₹12,00,000 | ₹22,00,000–₹26,40,000 |

| ₹15,000/month | 10 years | ₹18,00,000 | ₹33,00,000–₹39,60,000 |

5. Fund Manager Strategy — Experience That Builds Wealth

A mutual fund is only as strong as its fund manager.

Kotak AMC’s research-driven culture ensures:

- Consistent alpha generation

- Sharp risk management

- Scalable portfolio creation

- Efficient rebalancing across market cycles

The team identifies businesses with:

- High ROCE

- Low debt

- Consistent earnings visibility

- Strong management

- Expanding margins

This disciplined approach has allowed the fund to outperform category averages across multiple cycles.

TABLE 5: Performance Comparison (2024–25)

| Fund Category | 3-Year Return | 5-Year Return | Kotak Rank |

|---|---|---|---|

| Midcap Category Avg | 16% | 14% | — |

| Kotak Emerging Equity | 18–21% | 16–18% | Top Tier |

6. Future Projections: 2025–2030 Outlook

India is entering a decade of growth, supported by:

- PLI-driven manufacturing

- Digital India expansion

- Green energy investments

- Rising per-capita income

- Global supply-chain diversification

Midcaps are expected to be the biggest beneficiaries.

Projected returns for Kotak Emerging Equity Fund (Expert estimates):

- 2025–2027 CAGR: 13–15%

- 2027–2030 CAGR: 14–17%

If India hits a $7 trillion GDP milestone by 2030, funds like Kotak Emerging Equity could deliver some of the best post-tax returns for long-term investors.

TABLE 6: Future Value Projection (Lump Sum)

| Investment | Time Horizon | Expected CAGR | Future Value |

|---|---|---|---|

| ₹1,00,000 | 5 years | 14% | ₹1,92,000 |

| ₹5,00,000 | 7 years | 15% | ₹9,96,000 |

| ₹10,00,000 | 10 years | 15% | ₹40,45,000 |

7. Who Should Invest in Kotak Emerging Equity Fund?

This fund is ideal for investors who:

Want long-term wealth creation

Can tolerate moderate volatility

Want exposure to emerging companies

Aim for 12–16% long-term CAGR

Wish to participate in India’s growth story

It is not ideal for:

- Short-term traders

- Anyone needing money within 2–3 years

- Investors with low-risk appetite

Midcaps require patience—but reward greatly.

8. FAQs

1. Is Kotak Emerging Equity Fund risky?

Moderate risk. Returns are higher than large caps but lower than small caps.

2. Ideal investment duration?

Minimum: 5 years

Ideal: 7–10 years

3. SIP or Lump Sum?

SIP is best for volatility. Lump sum works well during corrections.

4. Can it give multibagger returns?

Yes—if held for 7–10+ years.

Conclusion — A Future Multibagger Engine Built on Discipline

Kotak Emerging Equity Fund is not just a mutual fund.

It is a wealth creation system backed by experienced management, deep research, and India’s strongest growth engines.

Its past is inspiring.

Its present is powerful.

Its future is full of multibagger potential.

If you are building long-term wealth and want to participate in India’s midcap miracle, this fund deserves a place in your portfolio.

Call to Action

If your goal is long-term compounding, retirement security, or building a high-growth portfolio for the next decade,

start a SIP or continue your existing SIP confidently in Kotak Emerging Equity Fund.

Your future self will thank you.

Leave a Reply