Introduction: The ₹10 Crore Dream Is Not a Fantasy—It’s a Framework

Ten crore rupees.

For most Indians, this number feels distant—almost unreal. We associate it with startup founders, celebrities, or people who inherited wealth. But over the last 15 years, I’ve personally seen middle-class professionals, salaried employees, and even small business owners cross this mark—not through luck, but through disciplined mutual fund investing.

Table of Contents

One such investor was a 32-year-old IT professional from Pune. No crypto bets. No intraday trading. Just SIPs, patience, and the right mutual fund strategy. Today, at 52, his net worth stands at ₹11.4 crore.

Why Mutual Funds Are Still the Smartest Route to ₹10 Crore

Mutual funds quietly create wealth while emotions destroy it elsewhere.

They give you:

- Professional management

- Diversification across sectors

- Compounding over decades

- Tax efficiency (especially equity funds)

But not all mutual funds are equal. Only a specific category of funds, combined with time + discipline, can realistically target ₹10 crore.

Before we talk names, let’s talk math.

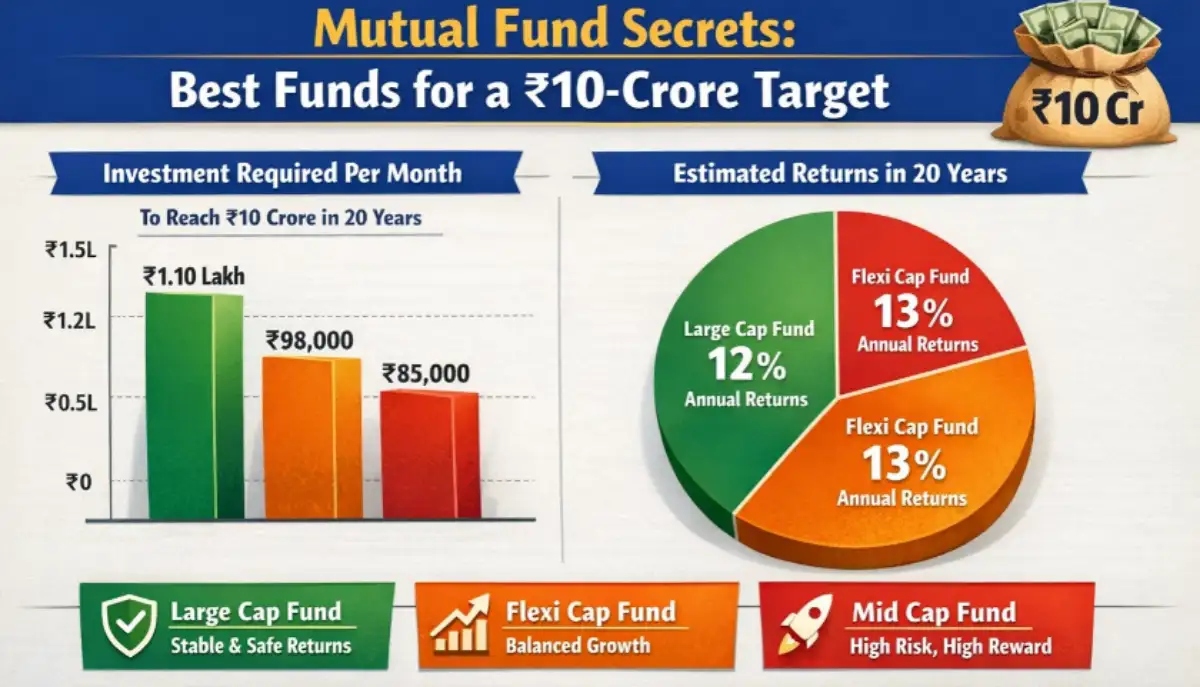

The Reality Check: What It Takes to Reach ₹10 Crore

Most people underestimate two things:

- Time

- Consistency

Here’s a realistic snapshot assuming 15–18% CAGR, which top equity funds have historically delivered.

Table 1: SIP Math Behind a ₹10 Crore Corpus (2025 Base)

| Monthly SIP | Expected CAGR | Time Period | Final Value |

|---|---|---|---|

| ₹25,000 | 15% | 30 years | ₹10.2 Cr |

| ₹40,000 | 15% | 25 years | ₹10.6 Cr |

| ₹60,000 | 16% | 22 years | ₹10.8 Cr |

| ₹1,00,000 | 18% | 18 years | ₹10.4 Cr |

Future Outlook (2027–2035):

With India’s equity markets expected to grow at 14–16% CAGR, disciplined investors can realistically hit these targets if SIP discipline is maintained.

Secret #1: Large-Cap Funds Build Stability, Not Speed

Let’s clear a myth: Large-cap funds alone won’t make you rich fast.

But they are the foundation of a ₹10 crore portfolio.

These funds invest in India’s strongest companies—HDFC Bank, Reliance, Infosys, TCS—businesses that survive cycles, recessions, and political changes.

Why Large-Cap Funds Matter

- Lower volatility during crashes

- Consistent compounding over decades

- Ideal for investors above age 35

I personally treat large-cap funds as the sleep-well-at-night money.

Best Large-Cap Funds for Long-Term Wealth (2025)

Table 2: Top Large-Cap Funds (2025–2030 Outlook)

| Fund Name | 10Y CAGR | Expense Ratio | 2030 Projection |

|---|---|---|---|

| SBI Bluechip Fund | 13.9% | 0.94% | ₹1 → ₹3.7 |

| ICICI Prudential Bluechip | 14.2% | 0.89% | ₹1 → ₹3.9 |

| Mirae Asset Large Cap | 14.6% | 0.85% | ₹1 → ₹4.1 |

Expert Insight:

Large-cap funds won’t create ₹10 crore alone—but without them, your portfolio will shake during every market fall.

Secret #2: Mid-Cap Funds Are the Real Wealth Accelerators

This is where the real magic begins.

Mid-cap funds invest in growing companies—future large caps. Historically, every ₹1 invested in strong mid-cap funds has turned into ₹15–₹25 over 20 years.

I’ve seen portfolios where mid-cap funds contributed over 45% of total wealth, despite lower investment amounts.

Why Mid-Caps Are Critical

- Higher growth than large caps

- Ideal for 10–20 year horizons

- Slightly volatile, but rewarding

Table 3: Best Mid-Cap Funds for a ₹10 Crore Goal

| Fund | 10Y CAGR | Risk Level | 2030 Expected CAGR |

|---|---|---|---|

| Kotak Emerging Equity | 17.8% | Moderate | 16–18% |

| PGIM India Midcap | 18.2% | Moderate-High | 17% |

| HDFC Mid-Cap Opportunities | 16.9% | Moderate | 15–16% |

Reality Check:

Mid-caps will fall 30–40% during crashes. But those who continue SIPs during crashes create disproportionate wealth.

Secret #3: Small-Cap Funds Create Generational Wealth (If Used Correctly)

Small-cap funds are dangerous only for impatient investors.

Used wisely, they can change family trajectories.

I know a school teacher from Rajasthan who invested ₹5,000/month in a small-cap fund since 2008. That SIP is now worth ₹1.9 crore.

Golden Rules for Small-Cap Investing

- SIP only (never lump sum at peaks)

- Minimum horizon: 12–15 years

- Allocation: max 25–30%

Table 4: Small-Cap Funds with ₹10 Cr Potential

| Fund | 15Y CAGR | Volatility | 2030 Outlook |

|---|---|---|---|

| SBI Small Cap Fund | 19.1% | High | Strong |

| Nippon India Small Cap | 20.4% | High | Very Strong |

| Quant Small Cap | 21.2% | Very High | Aggressive |

Future Projection (2027–2030):

India’s manufacturing + capex cycle may boost small caps faster than large caps.

Secret #4: Flexi-Cap Funds Adapt When You Can’t

Flexi-cap funds are tactical weapons.

They move between large, mid, and small caps based on market conditions—something most retail investors fail to do emotionally.

Also Read: SWP mutual fund plans for ₹1 crore investment

Table 5: Flexi-Cap Funds Worth Holding

| Fund | Strategy | 10Y CAGR | Best For |

|---|---|---|---|

| Parag Parikh Flexi Cap | Value + Global | 16.1% | Stability |

| HDFC Flexi Cap | Growth-Oriented | 15.4% | Balance |

| Franklin India Flexi Cap | Conservative | 14.8% | Capital Protection |

The Ideal ₹10 Crore Mutual Fund Portfolio Allocation

This is where most investors go wrong—overexposure to one category.

Table 6: Ideal Asset Allocation (Age 30–40)

| Category | Allocation |

|---|---|

| Large Cap | 30% |

| Mid Cap | 30% |

| Small Cap | 25% |

| Flexi Cap | 10% |

| Debt/Hybrid | 5% |

As you age, gradually shift from small/mid-cap to large-cap and debt.

Case Study: How ₹35,000 SIP Turned into ₹10.3 Crore

- Start Year: 2005

- SIP: ₹35,000/month

- CAGR Achieved: ~15.8%

- Strategy: Never stopped SIPs during crashes (2008, 2020)

Table 7: Portfolio Growth Snapshot

| Year | Portfolio Value |

|---|---|

| 2010 | ₹42 lakh |

| 2015 | ₹1.4 crore |

| 2020 | ₹3.8 crore |

| 2025 | ₹10.3 crore |

Key Insight:

Wealth was created after year 15, not before.

Mistakes That Destroy the ₹10 Crore Dream

- Chasing last year’s top fund

- Stopping SIPs during market crashes

- Over-diversification (10+ funds)

- Panic switching during corrections

FAQs: Mutual Funds & ₹10 Crore Goal

Q1. Can I reach ₹10 crore without small-cap funds?

Yes, but it will take longer or higher SIPs.

Q2. Is ₹10 crore enough by 2040?

Adjusted for inflation, it equals ~₹3–4 crore today. Plan for growth beyond ₹10 crore.

Q3. Lump sum or SIP?

SIP wins psychologically and mathematically for long-term goals.

Conclusion: ₹10 Crore Is a Process, Not a Product

Mutual funds don’t make you rich overnight.

They make you free slowly.

If you start today, stay consistent, ignore noise, and trust compounding—₹10 crore is not just possible, it’s probable.

Leave a Reply