Introduction: Turning Modest Earnings into Significant Wealth

India is home to millions of small entrepreneurs, gig workers, and street vendors who contribute significantly to the economy. While their daily earnings may seem modest, disciplined saving and strategic investing can create substantial wealth over time. Financial literacy and long-term planning are more critical than ever in 2025 due to changing investment trends, inflation pressures, and evolving economic conditions.

Table of Contents

India’s economy is projected to grow at 6.2–6.5%, with equities delivering 12–15% annual returns, gold expected to reach ₹110,000–₹125,000 per 10 grams, and small finance banks offering fixed deposits at 8–9% interest. This presents both opportunities and challenges for investors seeking to grow wealth responsibly.

This article narrates the journey of a self-made investor who started with modest street-side earnings and, through strategic investments, diversification, and disciplined saving, built a portfolio worth ₹1.5 crore by 2025. His story offers actionable lessons on portfolio allocation, risk management, and leveraging compounding for long-term growth — essential knowledge for anyone aiming for financial independence in today’s market.

Understanding the 2025 Financial Landscape

The Indian financial market in 2025 is dynamic, with multiple investment avenues offering growth, stability, and wealth preservation:

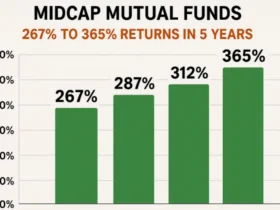

- Equities (Nifty50): Analysts project 12–15% annual returns in FY26, supported by GDP growth and corporate earnings (livemint.com).

- Gold: Forecasted to reach ₹110,000–₹125,000 per 10 grams, providing a hedge against currency depreciation and geopolitical risks (ndtv.com).

- Fixed Deposits (FDs): Small finance banks offer 8–9% returns, providing a secure income source (cleartax.in).

- Long-term Equities (10+ years): Historically, equities offer 8–11% annualized returns, outperforming inflation consistently.

Table 1: Market Forecasts (2025–2026)

| Asset Class | Expected Annual Return | Key Drivers |

|---|---|---|

| Equities (Nifty50) | 12–15% | Corporate earnings, domestic demand |

| Gold | 10–20% | Currency depreciation, geopolitical risk |

| Fixed Deposits | 8–9% | Competitive rates in small finance banks |

| Long-term Equities | 8–11% | Inflation-adjusted wealth creation |

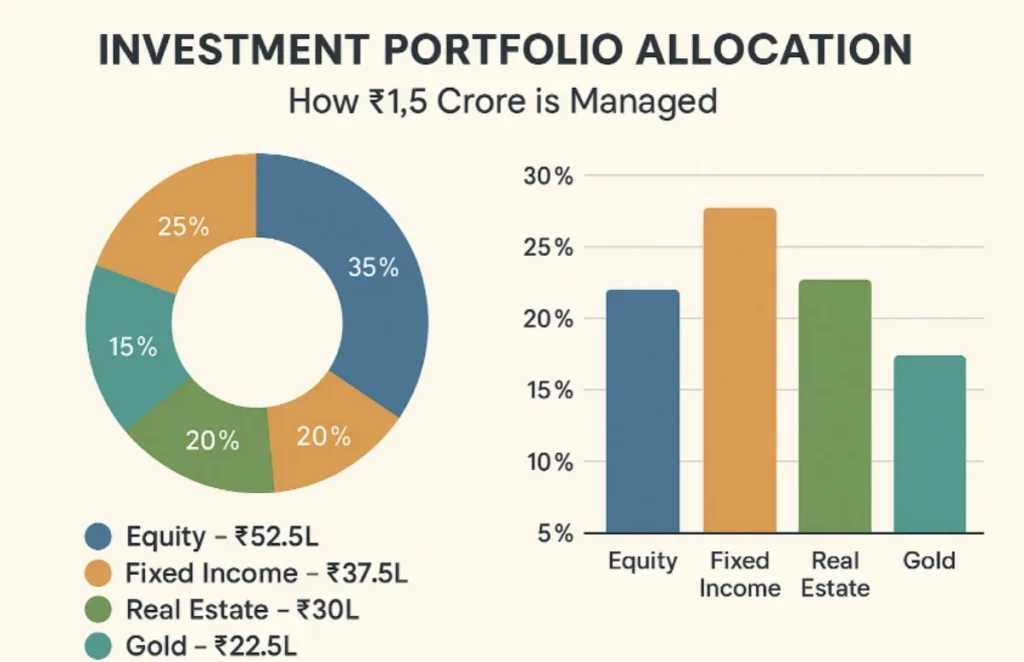

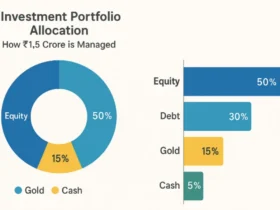

Building a Diversified Portfolio

The investor approached wealth creation using three core principles:

- Diversification: Balancing equities, debt, gold, and liquid instruments to reduce risk.

- Consistency: Monthly contributions through SIPs, increasing over time.

- Risk Management: Maintaining emergency funds and rebalancing allocations periodically.

Also releted: Mutual Funds That Earned Me $2,450 – My Winning Portfolio

Table 2: Portfolio Allocation (2025)

| Asset Class | Allocation % | Value (₹) | Purpose |

|---|---|---|---|

| Equity Mutual Funds & Large/Mid Cap Stocks | 40% | 60,00,000 | Long-term growth |

| High-Dividend Blue-Chip Stocks | 15% | 22,50,000 | Steady cash flow (~6–7% dividend) |

| Gold & Precious Metals | 10% | 15,00,000 | Inflation hedge, currency protection |

| Fixed Deposits | 15% | 22,50,000 | Stable returns |

| Bonds/Debt Mutual Funds | 10% | 15,00,000 | Portfolio stability |

| Emergency Fund | 10% | 15,00,000 | Liquidity for emergencies |

Managing Market Risks

Even a well-structured portfolio is subject to risks:

- Market Volatility: Global events, inflation, or policy changes can impact returns.

- Interest Rate Fluctuations: FD rates and debt yields vary with RBI policies.

- Valuation Risks: High P/E ratios may limit near-term equity gains.

Table 3: Risk vs Reward (2025–26 Outlook)

| Asset | Base Case Return | Downside Risk | Upside Potential |

|---|---|---|---|

| Equities | 12–15% | 5–8% during slowdown | 18–20% in strong growth |

| Gold | 10–20% | Flat if rupee strengthens | 25–40% during geopolitical tension |

| FDs | 8–9% | Inflation may reduce real returns | Stable income during downturns |

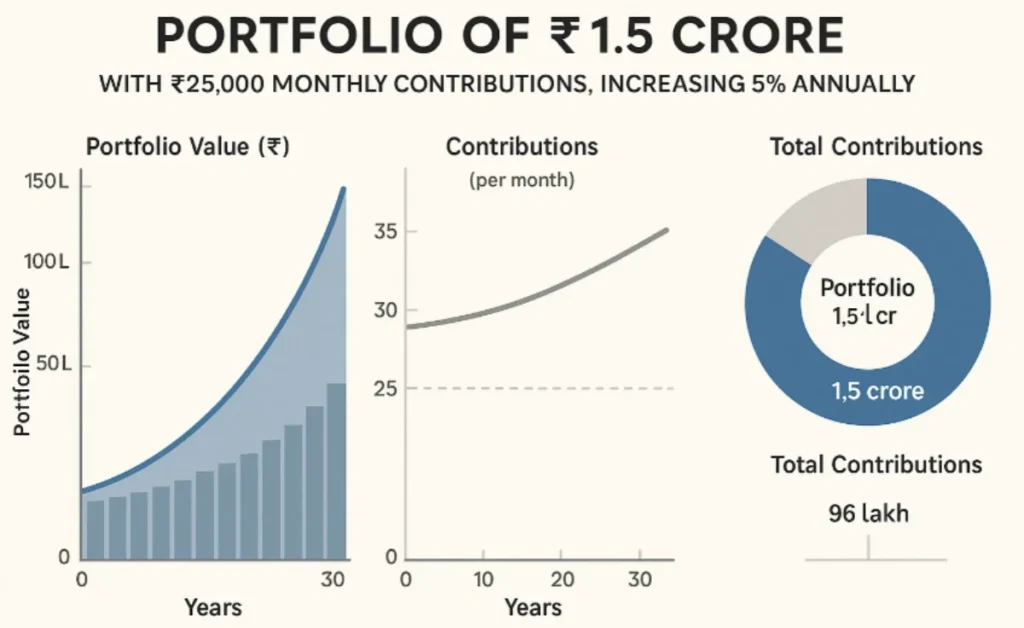

Projecting Growth: 2025–2030

Assuming a starting portfolio of ₹1.5 crore, with ₹25,000 monthly contributions, increasing 5% annually, and a blended portfolio return of 10%, projections are:

Table 4: Portfolio Growth Projection

| Year | Annual Contribution (₹) | Portfolio Start (₹) | Expected Growth @10% | Portfolio End (₹) |

|---|---|---|---|---|

| 2025 | 3,00,000 | 1,50,00,000 | 15,00,000 | 1,68,00,000 |

| 2026 | 3,15,000 | 1,68,00,000 | 16,80,000 | 1,87,95,000 |

| 2027 | 3,30,750 | 1,87,95,000 | 18,79,500 | 2,10,05,250 |

| 2028 | 3,47,288 | 2,10,05,250 | 21,00,525 | 2,34,53,063 |

| 2029 | 3,64,652 | 2,34,53,063 | 23,45,306 | 2,61,62,000 |

| 2030 | 3,82,884 | 2,61,62,000 | 26,36,200 | 2,93,81,000 |

By 2030, the portfolio could almost double, demonstrating the power of long-term investing and compounding.

Key Takeaways for Modern Investors

- Start Early and Stay Consistent: Even small investments grow significantly over time.

- Diversify Across Assets: Equities, debt, and gold reduce overall risk.

- Invest Strategically: High-dividend stocks and small finance FDs provide stability and cash flow.

- Plan for Liquidity: Emergency funds protect against market shocks.

- Leverage Technology: Robo-advisors and online SIPs simplify disciplined investing.

Table 5: Comparison of Saving vs Investing

| Option | Annual Return | ₹1,000/month for 15 years | Portfolio Value |

|---|---|---|---|

| Savings Account | 3% | 1.8 lakh | 2.5 lakh |

| Fixed Deposit | 6% | 1.8 lakh | 3.5 lakh |

| Equity Mutual Fund | 12% | 1.8 lakh | 6.5 lakh |

| Direct Stocks (Long-Term) | 15% | 1.8 lakh | 10 lakh |

Conclusion: Building Wealth the Right Way

The journey of this modern self-made investor proves that discipline, planning, and informed decision-making can transform modest earnings into significant wealth. From humble beginnings to a ₹1.5 crore portfolio in 2025, his approach demonstrates that consistent investing, diversification, and risk management are the keys to financial independence.

Financial freedom is not achieved overnight; it’s the result of small, consistent, well-informed decisions compounded over time. Begin today, invest strategically, and let your wealth grow with time and patience.

1 Comment