Two friends, Amit and Bharat, standing at different crossroads in life. Amit, a sprightly 30-year-old, has just come into Rs 10 Lakh—perhaps an inheritance or a well-timed bonus. He’s eager to invest it for his future. Meanwhile, Bharat, a seasoned 45-year-old, has diligently saved Rs 50 Lakh over the years and is now ready to put it to work. Both have their sights set on one question: Who will be richer when they hit 60?

Table of Contents

Understanding the Investment Scenarios

Before we get to the good stuff (the money!), let’s set the stage. We’ll start by assuming both Amit and Bharat make a one-time investment at their respective ages—Amit with Rs 10 Lakh at 30, and Bharat with Rs 50 Lakh at 45. Their goal? To see whose wealth shines brighter at age 60.

To keep things fair, we’ll assume both investments grow at an annual rate of 10%, a realistic average for a balanced portfolio or stock market returns over the long term. Later, we’ll shake things up with different rates of return and even regular contributions. But for now, let’s stick to the basics and see where a single lump sum takes them.

Calculating Amit’s Future Wealth: The Early Bird’s Journey

Amit’s got Rs 10 Lakh in his pocket at age 30, and he’s got a solid 30 years until he turns 60. That’s a long runway for his money to grow, thanks to the magic of compounding. To figure out how much he’ll have, we’ll use the compound interest formula:

Future Value (FV) = Principal × (1 + Rate)^Time

Plugging in Amit’s numbers:

- Principal = Rs 10,00,000

- Rate = 10% (0.10)

- Time = 30 years

So, FV = 10,00,000 × (1.10)^30

Now, (1.10)^30 is roughly 17.449 (trust me, I’ve done the math!). That means:

FV_Amit = 10,00,000 × 17.449 = Rs 1,74,49,000

By age 60, Amit’s Rs 10 Lakh blossoms into a cool Rs 1.74 crore. Not bad for a 30-year-old who decided to plant his money tree early!

Calculating Bharat’s Future Wealth: The Late Bloomer’s Bet

Bharat, on the other hand, is starting later but with a heftier sum—Rs 50 Lakh at age 45. He’s got 15 years until 60, so let’s see how his investment fares with the same 10% return:

- Principal = Rs 50,00,000

- Rate = 10% (0.10)

- Time = 15 years

FV = 50,00,000 × (1.10)^15

Here, (1.10)^15 is approximately 4.177, so:

FV_Bharat = 50,00,000 × 4.177 = Rs 2,08,85,000

By age 60, Bharat’s Rs 50 Lakh grows to a tidy Rs 2.09 crore. Starting later didn’t stop him from building a bigger pile of cash!

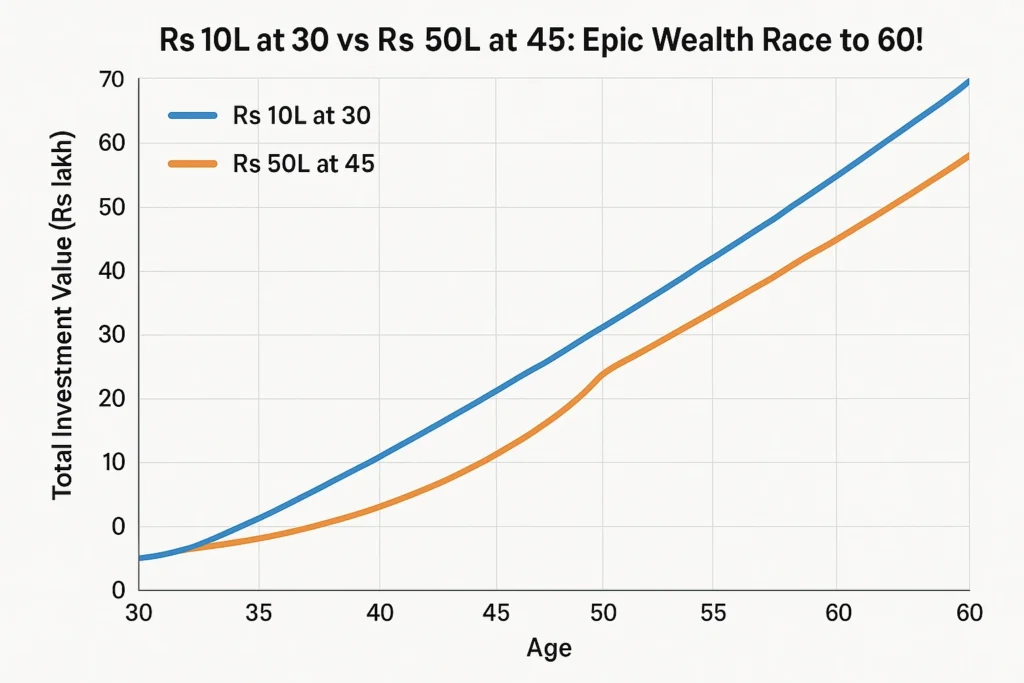

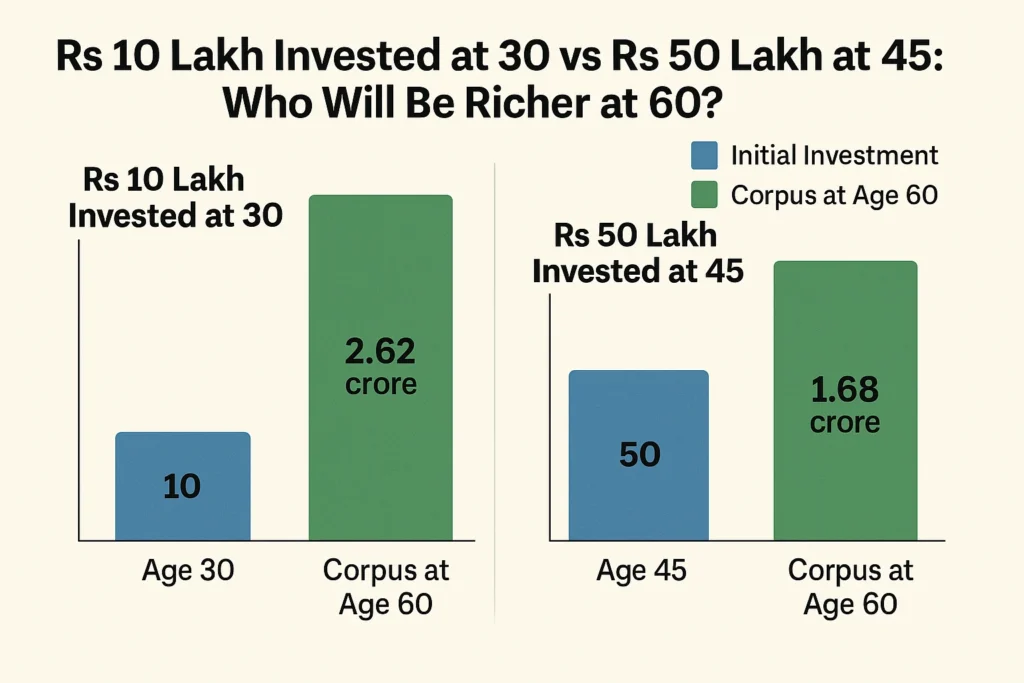

Comparing the Results: Who Wins Round One?

Let’s put Amit and Bharat head-to-head:

- Amit (Rs 10 Lakh at 30): Rs 1,74,49,000

- Bharat (Rs 50 Lakh at 45): Rs 2,08,85,000

Winner: Bharat, with about Rs 34 lakh more than Amit. Despite starting 15 years later, Bharat’s larger initial investment outpaces Amit’s early start. It’s a classic case of “more money now” beating “less money earlier”—but hold on, the story’s not over yet!

Why does Bharat come out ahead? Even though Amit’s money compounds for twice as long, Rs 50 Lakh is five times larger than Rs 10 Lakh. The bigger principal gives Bharat a head start that Amit’s extra time can’t quite overcome—at least not at 10%.

The Power of Compounding: Does Starting Early Always Win?

You’ve probably heard the saying, “The early bird catches the worm.” In investing, that worm is compounding—the process where your earnings generate more earnings over time. Starting at 30 gives Amit 30 years of compounding, while Bharat gets just 15. So why didn’t Amit win?

Here’s the catch: compounding is powerful, but it’s not magic. Amit’s Rs 10 Lakh grows impressively, but it’s still dwarfed by Bharat’s starting point. To match Bharat’s Rs 2.09 crore, Amit would’ve needed to invest around Rs 11.97 Lakh at age 30 (calculated as 2,08,85,000 ÷ 17.449). With only Rs 10 Lakh, he falls short.

As Warren Buffett wisely said, “Someone’s sitting in the shade today because someone planted a tree a long time ago.” Starting early is key—but the size of the seed matters too.

What If Amit Takes More Risk? Different Rates of Return

Let’s flip the script. Amit’s younger, with 30 years ahead—plenty of time to take on more risk for a higher reward. What if he scores a 12% annual return instead of 10%? Meanwhile, Bharat sticks to the safer 10%. Here’s how it plays out:

For Amit:

- FV = 10,00,000 × (1.12)^30

- (1.12)^30 ≈ 29.959

- FV_Amit = 10,00,000 × 29.959 = Rs 2,99,59,000

Now Amit’s sitting on nearly Rs 3 crore—a game-changer! Compare that to Bharat’s Rs 2.09 crore, and suddenly Amit’s ahead by over Rs 90 lakh.

This twist shows that a higher rate of return can tilt the scales. With a longer horizon, Amit can afford to invest in stocks or mutual funds with higher growth potential, while Bharat might lean toward safer options like bonds. Risk tolerance and time can rewrite the ending!

Adding Regular Contributions: The Power of Consistency

What if Amit and Bharat don’t stop at a one-time investment? Let’s say they each add Rs 1 Lakh annually to their portfolios—Amit for 30 years (age 30 to 60), Bharat for 15 years (age 45 to 60). This changes everything.

Amit’s New Total

- Initial Investment: Rs 10 Lakh grows for 30 years at 10% = Rs 1,74,49,000 (as before).

- Annual Contributions: Rs 1 Lakh per year for 30 years. We use the future value of an annuity formula: FV_annuity = Annual Amount × [(1 + Rate)^Time – 1] ÷ Rate FV_annuity = 1,00,000 × [(1.10)^30 – 1] ÷ 0.10 ≈ 1,00,000 × 164.49 = Rs 1,64,49,000

- Total FV_Amit = 1,74,49,000 + 1,64,49,000 = Rs 3,38,98,000

Bharat’s New Total

- Initial Investment: Rs 50 Lakh grows for 15 years at 10% = Rs 2,08,85,000.

- Annual Contributions: Rs 1 Lakh per year for 15 years: FV_annuity = 1,00,000 × [(1.10)^15 – 1] ÷ 0.10 ≈ 1,00,000 × 31.77 = Rs 31,77,000

- Total FV_Bharat = 2,08,85,000 + 31,77,000 = Rs 2,40,62,000

The New Winner

- Amit: Rs 3,38,98,000

- Bharat: Rs 2,40,62,000

Winner: Amit, by nearly Rs 98 lakh! Starting early and investing consistently flips the outcome. Amit’s extra 15 years of Rs 1 Lakh contributions compound into a fortune, proving that small, steady steps can outrun a big leap.

Key Takeaways: What We’ve Learned

Let’s break it down with some bold insights:

- Starting Early Pays Off—With a Twist: Amit wins big with regular contributions, but not in the one-time scenario.

- Size Matters: Bharat’s Rs 50 Lakh gives him an edge in the lump-sum race.

- Rate of Return is a Game-Changer: A 2% boost to 12% rockets Amit past Bharat.

- Consistency Wins: Regular investments amplify growth, especially over decades.

Here’s a handy table summarizing the scenarios:

| Scenario | Amit’s Wealth (Rs) | Bharat’s Wealth (Rs) | Winner |

|---|---|---|---|

| One-time at 10% | 1,74,49,000 | 2,08,85,000 | Bharat |

| One-time, Amit at 12% | 2,99,59,000 | 2,08,85,000 | Amit |

| With Rs 1 Lakh/year | 3,38,98,000 | 2,40,62,000 | Amit |

Real-Life Wisdom: Quotes to Inspire You

Let’s sprinkle in some wisdom from the pros:

- “The stock market is a device for transferring money from the impatient to the patient.” – Warren Buffett

Amit’s patience with regular contributions proves this point. - “Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it.” – Albert Einstein

Both Amit and Bharat harness this wonder, but timing and strategy decide the victor. - “It’s not how much money you make, but how much you keep, how hard it works for you, and how many generations you keep it for.” – Robert Kiyosaki

A reminder to think long-term, like Amit does with consistency.

FAQs: Your Burning Questions Answered

Q: What if Amit and Bharat get different rates of return?

A: If Amit snags a higher rate (like 12%), he can leapfrog Bharat, as we saw. Younger investors often have room for riskier, high-return options.

Q: How do regular contributions change the game?

A: They’re a game-changer! Amit’s 30 years of Rs 1 Lakh annual investments outstrip Bharat’s 15 years, showing the power of time and consistency.

Q: Lump sum or regular investments—which is better?

A: Lump sums benefit from instant compounding (Bharat’s edge), but regular investments spread risk and build habits (Amit’s win). It depends on your cash flow and goals.

Q: What else should I consider for my investments?

A: Look at risk tolerance, taxes, inflation, and diversification. A financial advisor can tailor a plan just for you.

Conclusion: Who’s Really Richer?

So, who’s richer at 60? In the one-time investment scenario at 10%, Bharat takes the crown with Rs 2.09 crore to Amit’s Rs 1.74 crore. But tweak the story—Amit earning 12% or adding Rs 1 Lakh yearly—and he surges ahead with Rs 2.99 crore or Rs 3.39 crore.

The real lesson? Start early if you can, but don’t despair if you’re starting later with more. Boost your returns where possible, and consider regular investments to supercharge your growth. Wealth isn’t just about timing—it’s about strategy.

Ready to plant your own money tree? Whether you’re 30 or 45, the time to invest is now. Let Amit and Bharat inspire you to take control of your financial future!

Leave a Reply