Every month, you set aside Rs 13,000—about the cost of a few family dinners or a weekend getaway—and over time, it transforms into a jaw-dropping Rs 9 crore. Sounds like a fantasy, right? But here’s the kicker: it’s not magic; it’s math. With the power of Systematic Investment Plans (SIPs) and compound interest, this dream can become your reality. In this blog, we’re diving deep into how Rs 13,000 a month can grow into Rs 9 crore, complete with step-by-step calculations, practical tips, and everything you need to kickstart your wealth-building journey. Whether you’re a newbie investor or a seasoned pro

What is a SIP? Your Ticket to Wealth Creation

Let’s start with the basics. A Systematic Investment Plan (SIP) is like a financial superpower for the average person. It’s a method where you invest a fixed amount—say, Rs 13,000—into mutual funds every month. No need to drop a massive lump sum; SIPs make investing affordable and disciplined.

Here’s why it’s brilliant: SIPs use something called rupee cost averaging. When mutual fund prices dip, your Rs 13,000 buys more units; when prices soar, it buys fewer. Over time, this smooths out market volatility. Combine that with the magic of compounding, and you’ve got a recipe for serious wealth. Think of it as planting a small seed today that grows into a towering money tree tomorrow.

“The stock market is a device for transferring money from the impatient to the patient.” – Warren Buffett

The Power of Compounding: The Real Game-Changer

Ever heard compound interest called the “eighth wonder of the world”? There’s a reason for that. When you invest through an SIP, your money doesn’t just sit there—it works for you. The returns you earn start earning returns of their own, creating a snowball effect that gets bigger and faster over time.

Picture this: your first Rs 13,000 earns a return. Next month, you add another Rs 13,000, and now both amounts are growing. Fast forward 10, 20, or 30 years, and that snowball is an avalanche of wealth. The secret? Time. The longer you stay invested, the more explosive the growth. That’s how Rs 13,000 a month can turn into Rs 9 crore.

“Compound interest is the most powerful force in the universe.” – Attributed to Albert Einstein

The Math: How Rs 13,000 Becomes Rs 9 Crore

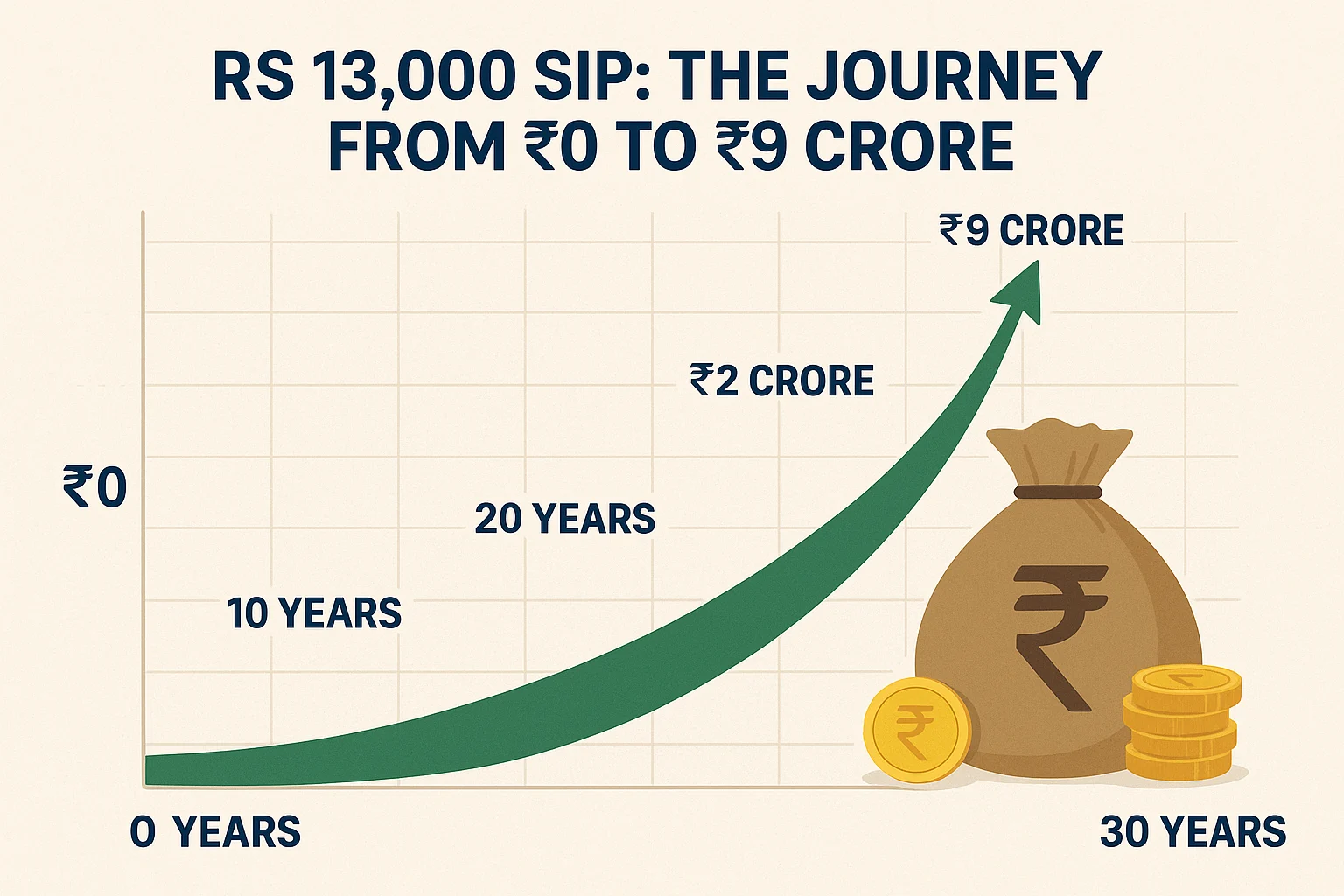

Now, let’s get to the juicy part—how does this actually work? We’ll break it down with numbers so you can see the journey from ₹0 to ₹9 crore.

The Formula

We’re using the future value of a series formula for SIPs:

[

\text{Future Value} = P \times \left( \frac{(1 + r)^n – 1}{r} \right)

]

Where:

- P = Monthly investment = Rs 13,000

- r = Monthly interest rate = 12% annual return ÷ 12 = 1% or 0.01

- n = Number of months

Our goal? Find out how long it takes for this to hit Rs 90,000,000 (aka Rs 9 crore).

Step-by-Step Calculation

Let’s solve for n:

- Set the equation:

[

90,000,000 = 13,000 \times \left( \frac{(1 + 0.01)^n – 1}{0.01} \right)

] - Simplify:

[

\frac{90,000,000}{13,000} = \frac{(1.01)^n – 1}{0.01}

] - Calculate the left side:

[

6,923.0769 = \frac{(1.01)^n – 1}{0.01}

] - Multiply both sides by 0.01:

[

69.230769 = (1.01)^n – 1

] - Add 1:

[

70.230769 = (1.01)^n

] - Take the logarithm (base 10 for simplicity):

[

n \times \log(1.01) = \log(70.230769)

] - Plug in the values:

- (\log(70.230769) \approx 1.8464)

- (\log(1.01) \approx 0.0043) [

n = \frac{1.8464}{0.0043} \approx 429.4 \text{ months}

]

- Convert to years:

[

429.4 \div 12 \approx 35.78 \text{ years}

]

So, it takes roughly 36 years to turn Rs 13,000 a month into Rs 9 crore, assuming a 12% annual return.

Growth Over Time: A Snapshot

Here’s a table to visualize how your money grows:

| Year | Total Invested (Rs) | Approximate Value (Rs) |

|---|---|---|

| 5 | 7,80,000 | 10,00,000 |

| 10 | 15,60,000 | 28,00,000 |

| 15 | 23,40,000 | 60,00,000 |

| 20 | 31,20,000 | 1,20,00,000 |

| 25 | 39,00,000 | 2,40,00,000 |

| 30 | 46,80,000 | 4,80,00,000 |

| 35 | 54,60,000 | 8,50,00,000 |

| 36 | 56,16,000 | 9,00,00,000 |

Notice how the value jumps from Rs 8.5 crore to Rs 9 crore in just one year? That’s compounding in action—the longer you stay, the steeper the curve!

Assumptions: Keeping It Real

Before you get too excited, let’s talk about the fine print. Our calculation assumes:

- 12% Annual Return: This is a historical average for equity mutual funds in India, but markets aren’t a straight line. Some years might give you 20%, others 5% or even losses. Over decades, though, 12% is a reasonable benchmark.

- Fixed SIP Amount: We’ve kept it at Rs 13,000 monthly. If you increase it as your income grows, you could hit Rs 9 crore faster.

- No Withdrawals: You’re in it for the long haul—36 years without cashing out.

Real life isn’t a calculator, but staying disciplined through market ups and downs is what makes this work. As financial expert Peter Lynch said, “The real key to making money in stocks is not to get scared out of them.”

Tips to Supercharge Your SIP Journey

Ready to start? Here’s how to make your Rs 13,000 SIP a success:

- Start Early: Even a few extra years can double your corpus. A 25-year-old starting now beats a 35-year-old every time.

- Stay Consistent: Automate your SIPs to avoid skipping payments. Treat it like a bill you want to pay.

- Pick the Right Fund: Look for equity mutual funds with a solid 5–10-year track record. Check expense ratios and fund manager history.

- Review, Don’t Panic: Check your portfolio yearly, but don’t sell during dips—those are buying opportunities!

- Step Up Your SIP: Got a raise? Bump up your SIP by 5–10% annually. Small increases = big results.

Quick Action Plan:

- [ ] Define your goal (e.g., Rs 9 crore in 36 years).

- [ ] Research top mutual funds (e.g., large-cap or multi-cap funds).

- [ ] Set up an auto-debit SIP.

- [ ] Check progress annually.

- [ ] Increase contributions over time.

Real-Life Inspiration: SIP Success Stories

Need proof this works? While we can’t name names, consider this: a 30-year-old teacher started a Rs 10,000 SIP in 2000. By 2020, despite market crashes, her corpus crossed Rs 1 crore. Or take the IT professional who began with Rs 5,000 monthly in his 20s—by retirement, he’s sitting on crores.

The Association of Mutual Funds in India (AMFI) backs this up: equity funds have averaged around 12% over 20 years. These aren’t outliers; they’re examples of what discipline and time can do.

FAQs: Your SIP Questions Answered

Got doubts? Let’s clear them up:

Q: Is 12% return guaranteed every year?

A: No, it’s an average. Some years might be higher, others lower. Long-term consistency is what matters.

Q: What if I miss an SIP payment?

A: No biggie—your plan won’t collapse. Just resume next month. Automation helps avoid this.

Q: SIP vs. Lump Sum—Which is better?

A: SIPs win for most people. They spread risk and build discipline. Lump sums need perfect timing, which is tough.

Q: How do I pick a mutual fund?

A: Focus on consistency (5+ years of good returns), low costs (expense ratio below 1%), and your risk level (e.g., aggressive or balanced).

Q: Can I stop my SIP anytime?

A: Yes, it’s flexible. Pause or withdraw whenever, but staying invested maximizes gains.

Conclusion: Your Rs 9 Crore Journey Starts Now

Turning Rs 13,000 a month into Rs 9 crore isn’t a fairy tale—it’s a plan. With SIPs, compounding, and a little patience, you can build a fortune that seemed impossible. In 36 years, your total investment of Rs 56 lakh becomes Rs 9 crore—proof that small steps lead to giant leaps.

So, what’s stopping you? Start your SIP today, and let time do the heavy lifting. As the proverb goes, “The best time to plant a tree was 20 years ago. The second best time is now.”

Ready to take control of your financial future? Drop a comment below with your thoughts or questions—I’d love to hear from you!

Leave a Reply