Introduction: Imagine Turning Tea-Budget Savings Into a Fortune

you’re sipping your morning chai that costs about ₹20. Now, what if I told you that the same ₹20 — when consistently invested in the right mutual fund through an SIP (Systematic Investment Plan) — could grow into lakhs over time? Mind-blowing, right?

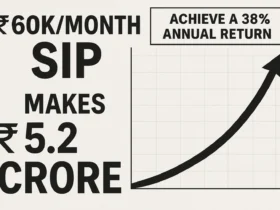

Now, stretch that to ₹10,000 a month. Could that really turn into ₹5 Crore someday? The answer is a big YES, provided you know where to invest, stay disciplined, and let compounding do its magic.

Why SIPs Are the Modern-Day Gold Rush

Before we jump into the specific funds, let’s answer the big question: Why SIPs?

Unlike traditional savings accounts or fixed deposits, SIPs combine:

- Power of Compounding – Your money grows on top of the growth it already created.

- Rupee Cost Averaging – You invest in ups and downs, which balances risk.

- Flexibility – Start with as little as ₹500, scale up when income grows.

If you invest ₹10,000 monthly for 25 years, even at a 12% average annual return, you’ll have ₹1.3 Crore. But at 18% (possible with well-performing equity funds), you’re staring at ₹5+ Crore.

3 SIP Plans to Create ₹5 Crore Wealth

1. Mirae Asset Large Cap Fund – Stability With Growth

If you’re someone who likes a balance of safety and wealth creation, large-cap funds are your friend.

- Why this fund?

- Invests in India’s top 100 companies.

- Historically delivered ~13–15% CAGR over long periods.

- Lower volatility compared to mid/small-cap.

- Example: A ₹10,000 SIP here over 20–25 years could potentially build ₹3–4 Crore. Pair it with another high-growth fund, and ₹5 Crore is within reach.

2. Axis Growth Opportunities Fund – Mid-Cap + Global Flavour

This one’s a smart blend of mid-cap Indian stocks and international exposure. Perfect for investors who want slightly higher returns than large-cap with diversification.

- Why this fund?

- Focuses on growth-oriented businesses.

- Mid-caps historically outperform large-caps in long bull runs.

- Global exposure reduces dependence on Indian markets alone.

- Returns so far: Around 16–18% CAGR in the last few years.

- Example: If maintained for 20–25 years, your ₹10,000 SIP can snowball into ₹4–5 Crore.

3. SBI Small Cap Fund – The Aggressive Wealth Builder

This one’s for the bold. Small-cap funds are riskier but can deliver explosive returns if you stay invested long enough.

- Why this fund?

- Focused on emerging businesses with high growth potential.

- Track record of 20%+ CAGR over a decade.

- Ideal for long-term wealth hunters willing to ride volatility.

- Example: A ₹10,000 SIP in this fund for 20+ years could cross ₹5 Crore alone, thanks to the power of small-cap compounding.

Expert Tips to Reach the ₹5 Crore Mark Faster

- Increase SIP by 10% annually – Salary hikes? Bump up your SIP. Even a small increase accelerates wealth creation.

- Stay invested through market crashes – History shows SIPs recover stronger after downturns.

- Diversify across categories – Mix large-cap, flexi-cap, and small-cap to balance risk.

- Review once a year – Don’t over-monitor. Annual reviews keep you on track.

- Think long-term, act patient – Compounding works best when left undisturbed.

Latest Updates Investors Should Know

- SEBI’s push for transparency: Funds now disclose expense ratios more clearly, helping investors save costs.

- AI-driven portfolio tracking apps: Tools like Kuvera, ET Money, and Groww now use AI to optimize SIP allocation.

- India’s GDP growth story: With IMF projecting India as the fastest-growing major economy, equity funds are set to ride the wave.

These tailwinds make the next 20 years a golden era for Indian SIP investors.

FAQs

Q1: Can a ₹10,000 SIP really make ₹5 Crore?

Yes, with consistent investing in high-performing funds and an 18–20% CAGR, it’s possible in 20–25 years.

Q2: Which is safer — large-cap or small-cap SIPs?

Large-cap is safer with stable returns; small-cap carries higher risk but higher long-term reward.

Q3: Should I start with one SIP or multiple?

Start with at least 2–3 funds across categories for better diversification.

Q4: What happens if I miss an SIP payment?

Nothing drastic — your fund continues. But consistency is key for compounding to work.

Q5: Is it better to invest lump sum or SIP?

SIPs are better for salaried individuals as they average out market volatility.

Conclusion: Your ₹5 Crore Journey Starts Today

Imagine checking your portfolio 20 years from now and seeing it touch ₹5 Crore. That future isn’t a fantasy — it’s math, discipline, and patience combined.

The question is: Will you start today or keep waiting for the “perfect time”?

Because here’s the truth: the best time to start investing was yesterday; the next best time is today.

Start your ₹10,000 SIP now and let your money work harder than you ever could.

1 Comment