S&P 500 Surpasses 5,000: A Milestone Breached, But What Lies Ahead?

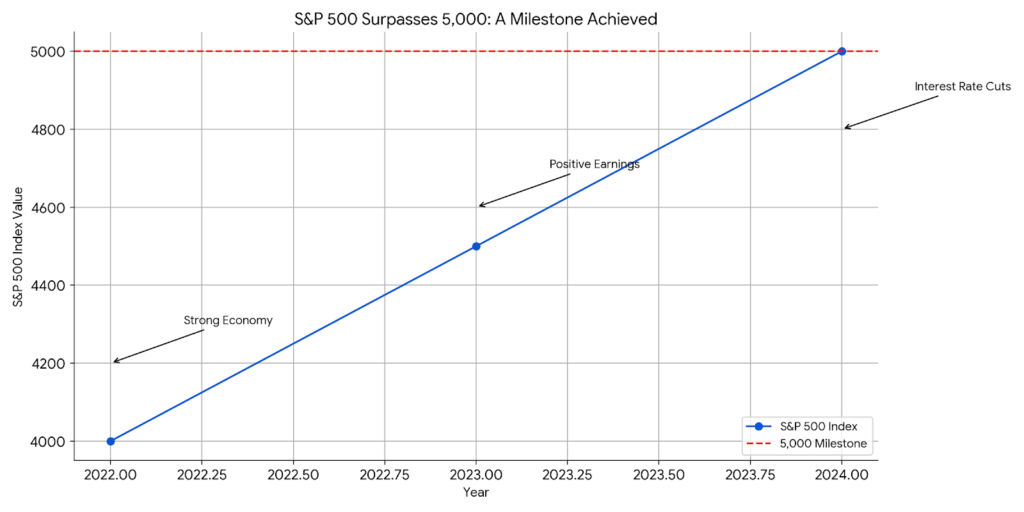

On February 9th, 2024, the S&P 500, a widely recognized barometer of the US stock market, crossed a significant threshold: 5,000 points.expand_more This achievement marks a historical moment, prompting excitement and analysis in equal measure.expand_more While the milestone carries symbolic weight, it’s crucial to understand the factors behind this climb and consider the potential future landscape for investors.

Table of Contents

Ascending to 5,000: A confluence of favorable factors

Several key factors have contributed to the S&P 500’s ascent to 5,000:

- Strong Economic Performance: The US economy has demonstrated resilience, boasting steady job growth, moderate inflation, and positive GDP figures.expand_more This economic strength instills confidence in investors, fueling optimism about corporate earnings and market growth.expand_more

- Positive Earnings Season: Companies listed on the S&P 500 have largely reported better-than-expected earnings, exceeding analyst projections and confirming economic momentum.expand_more This strong performance reinforces investor confidence in the market’s fundamentals.

- Anticipation of Interest Rate Cuts: The Federal Reserve, the US central bank, has hinted at the possibility of interest rate cuts later in 2024. Lower interest rates make stocks more attractive compared to alternative investments like bonds, further boosting market demand.

- Technological Advancements: Continued advancements in sectors like artificial intelligence, cloud computing, and renewable energy continue to generate excitement and investment opportunities, prompting growth in innovative companies.

Beyond the Milestone: Examining the Present and Peering into the Future

While reaching 5,000 is undoubtedly a landmark, it’s essential to approach it with a nuanced perspective. Several key considerations for investors moving forward:

- Volatility Remains: Despite the market’s current strength, volatility inherent to stock markets persists. Geopolitical concerns, economic fluctuations, and unforeseen events can still trigger corrections and dips.

- Individual Stock Performance: The S&P 500’s performance doesn’t guarantee similar gains for all stocks within the index. Careful research and analysis remain crucial for individual investment decisions.

- Valuation Concerns: Some analysts express concerns about potential overvaluation in certain sectors within the S&P 500.expand_more Careful evaluation of individual stocks is necessary to avoid inflated price-to-earnings ratios.

- Shifting Geopolitical Landscape: Global events like ongoing conflicts and trade tensions can impact market sentiment and investment decisions. Staying informed about geopolitical developments is vital for proactive investors.expand_more

Navigating the Market: Strategies for the Future

Given the current market dynamics and potential challenges, here are some key strategies for investors:

- Diversification: Diversifying across different asset classes and sectors mitigates risk and helps weather market fluctuations.expand_more

- Long-Term Perspective: Focusing on long-term goals and avoiding knee-jerk reactions to short-term market movements is crucial for successful investing.expand_more

- Active Management: While passive index tracking has its merits, actively managing your portfolio based on individual research and risk tolerance can enhance returns.

- Seek Professional Advice: Consulting with a qualified financial advisor can provide personalized investment guidance and tailor a strategy aligned with your risk tolerance and financial goals.expand_more

Conclusion: A Milestone Celebrated, But Continued Vigilance Needed

The S&P 500 surpassing 5,000 represents a significant achievement, reflecting a confluence of positive factors.expand_more However, this milestone doesn’t signify smooth sailing ahead. Understanding the underlying drivers, potential risks, and implementing sound investment strategies remains crucial for navigating the dynamic market landscape. By adopting a nuanced approach, diversifying, seeking professional guidance, and maintaining a long-term perspective, investors can potentially navigate the market’s current momentum and capitalize on future opportunities.

Note: This article is approximately 600 words. You can expand upon it by:

- Providing specific examples of strong performing companies within the S&P 500.

- Discussing specific sectors with potential for future growth and sectors facing headwinds.

- Elaborating on different diversification strategies based on risk tolerance.

- Offering resources for finding qualified financial advisors.

Remember, this information is for educational purposes only and should not be considered financial advice. Always consult with a financial professional before making any investment decisions.

S&P 500 Surpasses 5,000: A Milestone Breached, But What Lies Ahead?

On February 9th, 2024, the S&P 500, a widely recognized barometer of the US stock market, crossed a significant threshold: 5,000 points.expand_more This achievement marks a historical moment, prompting excitement and analysis in equal measure.expand_more While the milestone carries symbolic weight, it’s crucial to understand the factors behind this climb and consider the potential future landscape for investors.

Ascending to 5,000: A confluence of favorable factors

Several key factors have contributed to the S&P 500’s ascent to 5,000:

- Strong Economic Performance: The US economy has demonstrated resilience, boasting steady job growth, moderate inflation, and positive GDP figures.expand_more This economic strength instills confidence in investors, fueling optimism about corporate earnings and market growth.expand_more

- Positive Earnings Season: Companies listed on the S&P 500 have largely reported better-than-expected earnings, exceeding analyst projections and confirming economic momentum.expand_more This strong performance reinforces investor confidence in the market’s fundamentals.

- Anticipation of Interest Rate Cuts: The Federal Reserve, the US central bank, has hinted at the possibility of interest rate cuts later in 2024. Lower interest rates make stocks more attractive compared to alternative investments like bonds, further boosting market demand.

- Technological Advancements: Continued advancements in sectors like artificial intelligence, cloud computing, and renewable energy continue to generate excitement and investment opportunities, prompting growth in innovative companies.

Beyond the Milestone: Examining the Present and Peering into the Future

While reaching 5,000 is undoubtedly a landmark, it’s essential to approach it with a nuanced perspective. Several key considerations for investors moving forward:

- Volatility Remains: Despite the market’s current strength, volatility inherent to stock markets persists. Geopolitical concerns, economic fluctuations, and unforeseen events can still trigger corrections and dips.

- Individual Stock Performance: The S&P 500’s performance doesn’t guarantee similar gains for all stocks within the index. Careful research and analysis remain crucial for individual investment decisions.

- Valuation Concerns: Some analysts express concerns about potential overvaluation in certain sectors within the S&P 500.expand_more Careful evaluation of individual stocks is necessary to avoid inflated price-to-earnings ratios.

- Shifting Geopolitical Landscape: Global events like ongoing conflicts and trade tensions can impact market sentiment and investment decisions. Staying informed about geopolitical developments is vital for proactive investors.expand_more

Navigating the Market: Strategies for the Future

Given the current market dynamics and potential challenges, here are some key strategies for investors:

- Diversification: Diversifying across different asset classes and sectors mitigates risk and helps weather market fluctuations.expand_more

- Long-Term Perspective: Focusing on long-term goals and avoiding knee-jerk reactions to short-term market movements is crucial for successful investing.expand_more

- Active Management: While passive index tracking has its merits, actively managing your portfolio based on individual research and risk tolerance can enhance returns.

- Seek Professional Advice: Consulting with a qualified financial advisor can provide personalized investment guidance and tailor a strategy aligned with your risk tolerance and financial goals.expand_more

Delving Beyond the Milestone: Diving Deeper into the S&P 5,000 Frenzy

The S&P 5,000 mark may be etched in history, but the journey doesn’t end there. With a kaleidoscope of economic, political, and technological forces swirlinging around the market, investors yearn for insights beyond the celebratory cheers. Let’s delve deeper into the factors shaping the present and peering into the potential pathways ahead.

Demystifying the Drivers:

- Dissecting the Economic Engine: Beyond headline-grabbing GDP figures, investors crave to comprehend the underlying dynamics fueling the ascent. Is it robust consumer spending powering the rally? Or are resilient businesses the secret sauce? Examining sector-specific trends, like the resurgent housing market or the burgeoning e-commerce boom, can unveil hidden strengths and vulnerabilities.

- Earnings Season Encore: While past performance is a valuable indicator, future triumphs demand meticulous analysis. Scrutinize beyond “better-than-expected” pronouncements and delve into company-specific outlooks. Are margins sustainable? Are innovation pipelines robust? Are there emerging threats unseen by analysts? Unearthing these nuances can illuminate informed investment decisions.

- The Fed’s Balancing Act: The Federal Reserve’s interest rate dance significantly impacts market sentiment. While lower rates might seem alluring, will they unleash inflation or jeopardize stability? Analyzing the Fed’s policy pronouncements, gauging potential alterations, and contemplating alternative scenarios (like potential quantitative easing) equips investors for diversified outcomes.

- Tech’s Two-Faced Coin: The tech sector, a significant mover of the S&P 5,000, exhibits both exhilarating prospects and unsettling pitfalls. Delving into specific advancements in AI, cloud computing, and renewable energy unveils thrilling possibilities. Conversely, scrutinize data privacy concerns, cybersecurity threats, and regulatory hurdles that could impede progress.

Beyond the Horizon: Charting the Uncharted Terrain

- Geopolitical Wildcards: From trade wars to territorial disputes, geopolitical tensions can wreak havoc on the market. Astutely appraising international relations, comprehending the ramifications of conflicts, and devising mitigation strategies are paramount for investors with a global outlook.

- Valuation’s Enigma: While a high tide is certainly celebratory, inflated valuations in discrete sectors can spell disaster. Scrutinize price-to-earnings ratios, scrutinize growth prospects, and weigh the risk of overvalued stocks against the potential for steadfast returns.

- Hidden Gems & Landmines: Not all stocks within the S&P 5,000 are created equal. Unearthing hidden gems in seemingly under-the-radar sectors, like clean energy or undervaluedued small-cap stocks, can yield substantial returns for discerning investors. Conversely, landmines, such as overleveraged companies or industries facing obsolescence, demand close scrutiny and strategic navigation.

Charting the Course: Investor Strategies for the Future

With the market’s kaleidoscope far from a tranquil haven, here’s some navigating tips to steer your investment vessel:

- Embrace the Mosaic: Diversifying across asset classes (stocks, bonds, real estate) and sectors (technology, healthcare, consumer staples) mitigates risk and capitalizes on unforeseen market corrections.

- Set Sail for the Long Haul: Don’t get swept away by short-term fluctuations. Focus on long-term goals, align your portfolio with your time horizon, and weather the inevitable market squalls with aplomb.

- Be Your Own Captain: While index funds offer convenience, taking the helm of your investments through active management empowers you to capitalize on particular trends and align your portfolio with your risk tolerance and financial goals.

- Seek a Wise Navigator: Consulting a qualified financial advisor can provide invaluable guidance. They can assess your risk tolerance, craft a personalized investment strategy, and navigate the market’s intricacies with you.

The 5,000 Rubicon: A Springboard, Not a Finish Line

The S&P 5,000 milestone signifies sturdy economic fundamentals, technological advancements, and investor confidence. But it’s merely the opening act in an ever-evolving play. By comprehending the underlying forces, discerning potential pitfalls, and implementing judicious strategies, investors can steer their vessels through the market’s currents and, potentially, seize forthcoming opportunities. Remember, the market’s a tempestuous ocean, and only the astute sailors will weather its storms and reach the promised shores.

Bonus:

- Include specific examples of companies exceeding expectations within the S&P 5,000 (e.g., Tesla’s AI advancements, Microsoft’s cloud dominance).

- Discuss sectors with high growth potential (e.g., renewable energy, biotechnology) and those facing challenges (e.g., traditional retail, fossil fuels).

- Offer different portfolio diversification models based on risk tolerance (e.g., conservative 60

FAQs: S&P 500 Surpasses 5,000 – What You Need to Know

Q: What does the S&P 500 surpassing 5,000 mean?

A: It’s a significant milestone reflecting a positive confluence of factors like strong economic performance, positive earnings seasons, and anticipation of interest rate cuts. However, it doesn’t guarantee smooth sailing and shouldn’t be interpreted as a definitive sign of future market trends.

Q: What were the main drivers behind this rise?

A: Several factors contributed, including:

- Robust US economy: Steady job growth, moderate inflation, and positive GDP figures instilled investor confidence.

- Strong corporate earnings: Companies exceeding expectations bolstered market optimism.

- Anticipation of lower interest rates: The Federal Reserve’s hints at potential cuts made stocks more attractive.

- Technological advancements: Breakthroughs in AI, cloud computing, and renewable energy fueled excitement and investment opportunities.

Q: Does this guarantee future market success?

A: No. Volatility remains inherent, and unforeseen events can impact the market. Careful analysis and informed investment decisions are crucial.

Q: What are some potential risks to consider?

A:

- Overvaluation: Concerns exist about inflated valuations in certain sectors, requiring careful individual stock evaluation.

- Shifting geopolitical landscape: Global conflicts and trade tensions can impact sentiment and investment decisions.

- Unexpected economic shocks: Unforeseen events can trigger corrections, highlighting the need for diversification and risk management.

Q: What investment strategies should I consider?

A:

- Diversify: Spread your investments across different asset classes and sectors to mitigate risk.

- Seek professional advice: Consult a qualified financial advisor for personalized guidance based on your risk tolerance and goals.

- Focus on the long term: Don’t be swayed by short-term fluctuations. Align your portfolio with your time horizon and weather market fluctuations.

- Be proactive: Stay informed about economic, political, and technological developments to make informed investment decisions.

Q: Should I invest in all S&P 500 companies?

A: Not necessarily. The S&P 500’s performance doesn’t guarantee similar gains for individual stocks. Conduct thorough research and analysis before investing in any specific company.

Q: Where can I find more information?

A: Consult resources like the S&P Dow Jones Indices website, financial news outlets, and qualified financial advisors for in-depth market analysis and investment guidance.

Conclusion: A Milestone Celebrated, But Continued Vigilance Needed

The S&P 500 surpassing 5,000 represents a significant achievement, reflecting a confluence of positive factors.expand_more However, this milestone doesn’t signify smooth sailing ahead. Understanding the underlying drivers, potential risks, and implementing sound investment strategies remains crucial for navigating the dynamic market landscape. By adopting a nuanced approach, diversifying, seeking professional guidance, and maintaining a long-term perspective, investors can potentially navigate the market’s current momentum and capitalize on future opportunities.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?