What is the SPY ETF?

Before we get into the nitty-gritty of the Options Wheel Strategy, let’s start with the foundation: the SPY ETF. Officially known as the SPDR S&P 500 ETF Trust, SPY is one of the most popular exchange-traded funds (ETFs) in the world. It tracks the S&P 500 index, a collection of 500 of the largest publicly traded companies in the United States. Think household names like Apple, Microsoft, Amazon, and JPMorgan Chase—these are the market leaders driving the U.S. economy.

Since its launch in 1993, SPY has become a go-to investment for those seeking broad market exposure. With an average annual return of around 10% (including dividends) over the long term, it’s a symbol of stability and growth. But what makes SPY especially appealing for the Options Wheel Strategy? Here’s why:

- Unmatched Liquidity: SPY trades millions of shares daily, making it one of the most liquid assets in the market. This means tight bid-ask spreads and easy execution for your trades—crucial when dealing with options.

- Built-In Diversification: With exposure to 500 companies across sectors like technology, finance, and healthcare, SPY spreads your risk. You’re not betting on a single stock but on the broader market.

- Long-Term Resilience: The S&P 500 has weathered recessions, crashes, and booms, consistently trending upward over decades. This stability makes it a solid base for income strategies.

- Robust Options Market: SPY’s options are some of the most actively traded, with contracts expiring multiple times a week. This gives you flexibility to tailor your trades to your goals.

In short, SPY combines liquidity, diversification, and a thriving options market—making it the perfect vehicle for generating monthly income with the Wheel Strategy.

What is the Options Wheel Strategy?

Now that we’ve covered the SPY ETF, let’s unpack the star of the show: the Options Wheel Strategy. This is a systematic, repeatable approach to earning income by selling options—specifically cash-secured puts and covered calls. It’s called the “wheel” because it spins through a cycle of steps, generating premiums and potentially profiting from SPY’s price movements.

How the Wheel Strategy Works: A Step-by-Step Guide

Here’s how the Options Wheel Strategy plays out:

- Sell Cash-Secured Puts

- You start by selling a put option on SPY with a strike price below its current market price.

- A put option gives the buyer the right to sell SPY to you at the strike price. In return, you collect a premium upfront.

- If SPY stays above the strike price at expiration, the put expires worthless, and you keep the premium as profit.

- If SPY falls below the strike price, you’re “assigned” the shares, meaning you buy 100 shares of SPY per contract at the strike price.

- Hold Shares and Sell Covered Calls

- Once you own SPY shares (after assignment), you sell a call option with a strike price above the current market price.

- A call option gives the buyer the right to buy SPY from you at the strike price. You collect another premium for selling it.

- If SPY stays below the strike price, the call expires worthless, and you keep the premium.

- If SPY rises above the strike price, your shares are “called away,” meaning you sell them at the strike price for a profit (plus the premium).

- Repeat the Cycle

- If your shares are called away, you pocket the profit and start over by selling another cash-secured put.

- If the calls expire worthless, you keep selling covered calls until the shares are sold—or hold them as part of your portfolio.

Why It’s a Winner Across Market Conditions

The Wheel Strategy shines because it’s adaptable:

- Bullish Markets: Rising SPY prices mean your shares gain value, and you can sell calls at higher strikes for bigger premiums.

- Bearish Markets: Falling prices let you buy SPY at a discount via put assignments, while premiums cushion the cost.

- Sideways Markets: When SPY stalls, you still collect premiums from selling options—turning a flat market into a cash cow.

But it’s not all sunshine. If SPY plunges sharply, you could end up holding shares at a loss. That’s why risk management (more on that later) is key to making this strategy work.

A Real-World Example: The Wheel in Action

Let’s bring the Wheel Strategy to life with a hypothetical scenario. Imagine SPY is trading at $400 per share. Here’s how it might play out:

Step 1: Selling a Cash-Secured Put

- You sell a $390 strike put expiring in 30 days, collecting a $5 per share premium ($500 total, since one contract covers 100 shares).

- Outcome 1: SPY stays at $400 or higher

- The put expires worthless, and you keep the $500. You’re free to sell another put and repeat.

- Outcome 2: SPY drops to $380

- You’re assigned 100 shares at $390. Your cost is $39,000, but the $500 premium lowers your effective cost basis to $385 per share ($39,000 – $500 ÷ 100).

Step 2: Selling a Covered Call

- Now you own 100 SPY shares at a cost basis of $385. You sell a $400 strike call expiring in 30 days for a $3 per share premium ($300 total).

- Outcome A: SPY stays at $390

- The call expires worthless, and you keep the $300. You can sell another call next month.

- Outcome B: SPY climbs to $410

- Your shares are called away at $400. You sell for $40,000, earning a $15 per share profit ($400 – $385) plus the $300 premium—totaling $1,800 on the trade.

Step 3: Back to the Start

- With your shares sold, you take your profits and sell another $390 put, spinning the wheel again.

This example shows how the Wheel Strategy generates income through premiums and lets you buy or sell SPY at favorable prices. Even if assigned, the premiums reduce your risk and boost your returns.

How to Pick the Right Options

Success with the Wheel Strategy hinges on choosing the right strike prices and expiration dates. Here’s how to do it:

Selling Puts

- Strike Price: Pick a price you’d be happy to buy SPY at—say, 2-5% below the current price. Use technical analysis to spot support levels where SPY might bounce.

- Expiration: 30-45 days is a sweet spot—long enough for decent premiums, short enough to stay flexible. Weekly options work if you’re active, while 60+ days suit a hands-off approach.

Selling Calls

- Strike Price: Choose a price above your cost basis where you’re okay selling—like 2-5% above the market. If you’re bullish, go higher to capture more upside.

- Expiration: Similar to puts, 30-45 days balances income and flexibility.

Pro Tips

- Implied Volatility (IV): High IV means juicier premiums but signals bigger price swings. Sell when IV is elevated for max profit.

- Delta: For puts, a delta of 0.20-0.30 (20-30% chance of assignment) is common. For calls, 0.30-0.50 keeps income steady without losing shares too often.

Get these right, and you’ll maximize income while keeping risks in check.

Capital Requirements and Position Sizing

The Wheel Strategy isn’t cheap—SPY’s price tag means you need real capital to play. At $400 per share, one contract (100 shares) requires $40,000 in cash to secure a put if assigned. Here’s what to consider:

- Cash vs. Margin: Many brokers let you use margin, cutting the cash needed. But borrowing amps up risk—only do it if you’re comfortable.

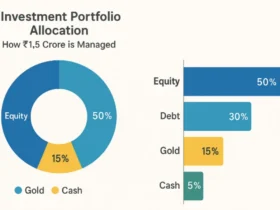

- Portfolio Allocation: Don’t put all your eggs in one basket. Limit each position to 5-10% of your portfolio to avoid overexposure.

- Scaling Up: Start with 1-2 contracts, then grow as you master the strategy.

For example, with a $100,000 portfolio, you might allocate $20,000 to SPY Wheel trades—enough for one contract with a cash buffer. Diversifying across other ETFs like QQQ or IWM can spread risk further.

Comparing the Wheel Strategy to Other Income Methods

How does the Wheel stack up against other income strategies? Check out this table:

| Strategy | Description | Pros | Cons |

|---|---|---|---|

| Wheel Strategy | Sell puts/calls on SPY | High income, flexible | Capital-intensive, assignment risk |

| Covered Calls | Own SPY, sell calls | Steady income, simple | Caps upside gains |

| Cash-Secured Puts | Sell puts on SPY | Income, buy at discount | Risk of owning falling shares |

| Dividend Stocks | Buy stocks for dividends | Passive, growth potential | Lower yields, stock-specific risk |

| Bonds | Buy bonds for interest | Low risk, predictable | Tiny returns, rate sensitivity |

The Wheel Strategy stands out for its adaptability and potential for higher returns—perfect for those willing to manage options actively.

Expert Voices on the Wheel Strategy

What do the pros say? Here are some insights:

- Tom Sosnoff, Options Trading Guru:

“The Wheel is a cash-flow machine if you pick the right underlying—like SPY—and stick to your plan. It’s all about collecting premiums consistently.”

- Sarah Lee, Full-Time Trader:

“I love the Wheel on SPY because it’s diversified and liquid. I’ve turned it into my monthly paycheck while riding the market’s long-term trend.”

These experts highlight the strategy’s income potential and why SPY is a top pick.

Managing Risks Like a Pro

No strategy is risk-free. Here’s how to protect yourself:

- Diversify: Don’t rely solely on SPY—mix in other assets to balance your portfolio.

- Size Smart: Keep positions small enough to weather a downturn without wiping you out.

- Roll Options: If a put or call goes against you, roll it to a later date or different strike to avoid assignment—though it’s not always a win.

- Stay Patient: If SPY tanks, keep selling calls to recover losses over time. The S&P 500’s history favors long-term holders.

Discipline is your shield—stick to your rules, and you’ll come out ahead.

FAQs: Your Wheel Strategy Questions Answered

Got questions? We’ve got answers:

Q: Is the Wheel Strategy good for beginners?

A: It’s doable but tricky. Learn options basics first, then start small—maybe paper trade to test the waters.

Q: How much money do I need to start?

A: At $400 per share, one SPY contract needs $40,000 in cash. Margin can lower that, but $10,000-$20,000 is a practical minimum.

Q: Can I use this on other ETFs?

A: Absolutely—QQQ, IWM, or DIA work if they’ve got liquid options. SPY’s just the gold standard.

Q: What if the market crashes?

A: Your shares lose value, but premiums soften the blow. Hold tight—SPY usually rebounds.

Q: How often should I sell options?

A: 30-45 days is popular for steady income. Weekly options suit active traders; longer terms fit passive ones.

Wrapping Up: Spin the Wheel to Win

The SPY ETF Options Wheel Strategy is your ticket to generating monthly income from market leaders. By selling puts and calls on SPY, you tap into a cycle of premiums and potential profits, all while leveraging the S&P 500’s strength. It’s not a get-rich-quick scheme—it’s a disciplined, repeatable way to build wealth in bull, bear, or flat markets.

ค่าย PG SLOT โบนัสแตกกระจาย!

รวยได้ทุกวัน แค่ปลายนิ้วก็รวยได้!,หมดปัญหาเกมสล็อตทำเงินยาก!

ต้อง PGSLOT เลย! ทำเงินได้ไว รับทรัพย์เต็มๆ,รีบเลย!

ค่าย PG แจกหนัก ทุก User,

ทุนน้อยก็รวยได้!

PGSLOT เกมสล็อตยอดนิยม โบนัสเยอะ กำไรงาม,สมัคร PGSLOT เลย!

พิชิตแจ็คพอตหลักล้าน ไม่ต้องรอ,ที่สุดของความบันเทิงและรางวัลใหญ่ เล่น

PGSLOT เลย!,

PGSLOT: มีคืนยอดเสียให้! เล่นเสียก็ยังได้คืน รับเงินคืนไปเลย!,สมัครวันนี้ รับเลย!

พีจีสล็อต รับเครดิตฟรี กดรับเองได้เลย,ห้ามพลาดเด็ดขาด!

พีจีสล็อต โปรโมชั่นเด็ดประจำสัปดาห์ แจกโบนัสเพียบ,ฝากน้อยได้เยอะกับ PGSLOT!

โบนัสสุดคุ้ม รอคุณอยู่เพียบ,พีจีสล็อต ชวนเพื่อนมาเล่น รับโบนัสเพื่อนชวนเพื่อน!,สุดยอดความคุ้มค่า!

เดิมพัน PGSLOT ได้กำไรแน่นอน โบนัสเพียบ โปรแน่น,

สนุกกับ PGSLOT ได้ทุกที่!

รองรับทุกแพลตฟอร์ม มือถือ คอมพิวเตอร์ ครบจบในที่เดียว,ปลอดภัยหายห่วง!

PGSLOT เว็บตรง มั่นคง ฝาก-ถอนออโต้ ฉับไว!,พร้อมดูแลตลอด 24 ชั่วโมง!

แอดมินใจดี ใส่ใจทุกปัญหา,พีจีสล็อต เว็บสล็อตยอดนิยม การันตีความปลอดภัย,เริ่มเล่น PGSLOT ได้เลย เล่นผ่านเว็บบราวเซอร์ สะดวกสบายสุดๆ,ระบบลื่นไหล ไม่มีสะดุด!

PGSLOT มอบประสบการณ์สุดยอด,

ยืนยันจากผู้เล่นจริง!

PGSLOT แตกจริงทุกเกม เล่นแล้วรวย!,ประทับใจบริการ

PGSLOT มาก ทำรายการรวดเร็ว ไม่ต้องรอนานเลย,นี่แหละสล็อตที่ตามหา!

พีจีสล็อต กราฟิกสวย เล่นเพลิน แจ็คพอตแตกกระจาย!,จากใจคนเคยเล่น!

PGSLOT ไม่ทำให้ผิดหวัง ไม่ผิดหวังแน่นอน,ถ้ายังไม่ลอง PGSLOT คุณพลาดแล้ว!

ช่องทางรวยง่ายๆ มาคว้าไปเลย!,เว็บสล็อตที่ดีที่สุดในตอนนี้!

พีจีสล็อต เกมแตกง่าย

เพลินตลอด!

This is the correct blog for anybody who needs to seek out out about this topic. You understand so much its nearly arduous to argue with you (not that I really would need…HaHa). You definitely put a brand new spin on a topic thats been written about for years. Great stuff, simply nice!

Hi, i read your blog from time to time and i own a similar one and i was just wondering if you get a lot of spam comments? If so how do you prevent it, any plugin or anything you can recommend? I get so much lately it’s driving me crazy so any assistance is very much appreciated.