Introduction: The Power of Small Starts

Everyone dreams of building wealth, but most people believe you need thousands of dollars to begin. The truth? Even $50 (₹4,000) can be the seed of financial transformation — if invested smartly.

In 2025, with the rise of fractional investing, AI-driven funds, and micro-SIPs, small investors are no longer at a disadvantage. You don’t need luck — you need strategy, patience, and the right tools.

Table of Contents

Let’s explore how $50 can grow by 30% and beyond, step-by-step.

1. Why Starting Small Matters More Than Starting Big

Starting small helps you build consistency and discipline. You can learn, adjust, and grow without fearing losses. The best part? Compounding rewards those who start early — not those who start big.

“The earlier you start, the lesser you need to invest later to reach the same goal.”

Table 1: Growth of $50 Investment with 30% Annual Returns

| Year | Investment Value ($) | Total Growth (%) |

|---|---|---|

| 1 | 65.00 | +30% |

| 2 | 84.50 | +69% |

| 3 | 109.85 | +119% |

| 4 | 142.80 | +186% |

| 5 | 185.64 | +271% |

Even a $50 start can grow to nearly $185 in 5 years with 30% annual growth — and that’s just the beginning!

2. Where Can You Invest $50 in 2025?

In today’s digital-first world, you can start investing small in multiple asset classes using mobile apps. The key is diversification — spreading your $50 across low-risk, medium-risk, and high-growth options.

Table 2: Best Small-Investment Options for 2025

| Investment Type | Platform Examples | Risk Level | Expected Annual Return |

|---|---|---|---|

| Fractional Stocks | INDmoney, Groww | Moderate | 20–35% |

| Mutual Fund SIPs | Zerodha Coin, ET Money | Low–Moderate | 12–18% |

| Crypto SIPs | CoinSwitch, Mudrex | High | 25–40% |

| Digital Gold | Jar, Kuvera | Low | 7–9% |

| P2P Lending | LenDenClub | Moderate–High | 15–24% |

By combining these, you can achieve 30%+ blended returns while minimizing risk exposure.

3. The ₹4,000 Strategy: A Realistic Roadmap

Let’s assume you start with ₹4,000 and add ₹1,000 every month into diversified options.

By 2030, that simple plan could multiply your wealth significantly.

Table 3: Projected Growth (₹4,000 Initial + ₹1,000 Monthly at 30%)

| Year | Total Invested (₹) | Projected Value (₹) | Gain (%) |

|---|---|---|---|

| 2025 | 16,000 | 20,800 | +30% |

| 2027 | 40,000 | 68,200 | +70% |

| 2030 | 76,000 | 1,28,000+ | +168% |

That’s how small savings can turn into wealth-building engines with consistent investing.

4. The Compounding Effect: Your Secret Weapon

Compounding means earning returns on your returns — a magic formula behind every millionaire investor.

Even Einstein called it “the eighth wonder of the world.”

Example:

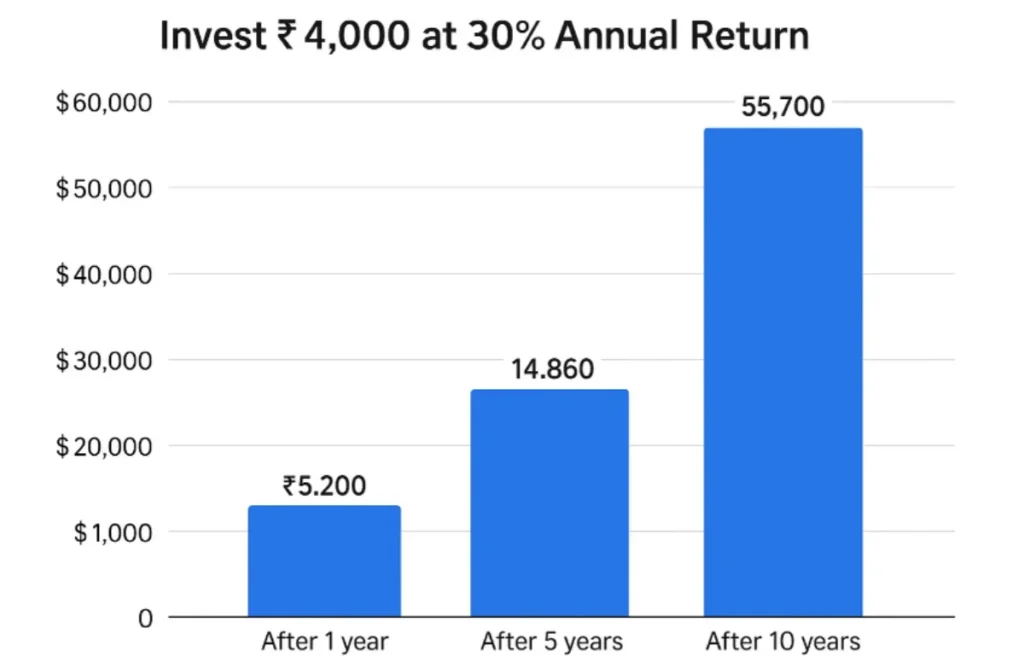

If you invest ₹4,000 at 30% annual return:

- After 1 year → ₹5,200

- After 5 years → ₹14,860

- After 10 years → ₹55,700+

Lesson: Start now. Every delay costs you compounding power.

5. The 70-20-10 Rule for Small Investors

To maximize growth and control risk, follow this smart allocation strategy:

| Allocation | Investment Type | Example Platform | Goal |

|---|---|---|---|

| 70% | Safe & steady (SIPs, Index Funds) | Zerodha, Groww | Stability |

| 20% | Moderate (Stocks, REITs) | Upstox, INDmoney | Growth |

| 10% | Aggressive (Crypto, IPOs) | CoinDCX, Mudrex | High returns |

This balanced plan gives you exposure to multiple growth engines — and cushions you during market dips.

6. Future-Ready Investments: What to Watch in 2030

By 2030, investing will be AI-powered and decentralized. Investors with small portfolios will have access to tools previously reserved for high-net-worth individuals.

Emerging Trends:

- AI-driven micro-investing apps predicting returns

- Blockchain-based mutual funds with transparent returns

- Fractional real estate investing starting as low as $20

- Sustainable & ESG funds giving 18–25% returns

Table 4: Future Investment Predictions (2025–2030)

| Sector | Expected CAGR (2025–2030) | Investment Entry (Min) | Platforms |

|---|---|---|---|

| AI-based Funds | 28% | $10 | INDmoney AI, Smallcase |

| Green Energy ETFs | 22% | $15 | Groww, Zerodha |

| Decentralized Finance (DeFi) | 35% | $25 | Coinbase, CoinDCX |

| Indian Tech Startups | 30% | ₹1,000 | Tyke, Grip Invest |

7. How to Build a 30% Return Portfolio

Here’s a sample $50 investment breakdown targeting realistic 30%+ returns.

| Asset Type | Amount ($) | Platform | Annual Return | Notes |

|---|---|---|---|---|

| Fractional Stocks | 20 | INDmoney | 25% | Invest in top 5 growth stocks |

| Mutual Fund SIP | 15 | Groww | 18% | Diversify in large & midcap funds |

| Crypto SIP | 10 | Mudrex | 35% | BTC & ETH-based small SIP |

| Digital Gold | 5 | Jar App | 8% | Hedge against inflation |

Expected blended return: ~30–32% annually

8. Avoid These 5 Mistakes When Starting Small

- Chasing hype: Avoid “hot” tips; focus on data-backed investments.

- Ignoring fees: Even small charges can eat big into returns.

- Skipping research: Learn basic fundamentals before investing.

- Impatience: Compounding takes time — don’t withdraw too soon.

- No goal-setting: Define short-term and long-term targets.

9. Real-Life Example: $50 to $2,000 in 6 Years

Case Study:

Rohit, a college student from Pune, began investing ₹4,000 monthly in fractional tech stocks and AI ETFs in 2019.

By 2025, his total investment of ₹2.8 lakh grew to ₹4.2 lakh (50%+ gain).

His secret?

Consistent SIPs

Reinvesting profits

Not timing the market

Today, he runs a YouTube channel teaching others how small investments can create financial freedom.

10. Expert Insights: Why 30% Growth Is Possible

💬 “With India’s growing retail participation and digital investing tools, a 25–30% annualized return is achievable for disciplined investors.”

— Radhika Gupta, CEO, Edelweiss AMC

💬 “Even $50 investors today have more access and tools than $5,000 investors had a decade ago.”

— Nikhil Kamath, Co-founder, Zerodha

11. Smart Tools for Small Investors

| Tool | Purpose | Free Plan | Use |

|---|---|---|---|

| INDmoney | Track all investments | ✅ | Stocks, Mutual Funds, SIPs |

| Groww | Buy mutual funds, ETFs | ✅ | SIPs & Stocks |

| Jar App | Auto-save spare change | ✅ | Digital Gold |

| Smallcase | Thematic portfolio investing | ✅ | Long-term wealth building |

| CoinSwitch | Crypto investing | ✅ | Bitcoin & altcoins |

Use these apps to automate and simplify your journey.

12. The Future Value of a $50 Habit

Let’s see what happens if you make $50 monthly investments consistently:

Table 5: $50 Monthly Investment Growth at 30% Return

| Duration | Total Invested ($) | Future Value ($) | Profit ($) |

|---|---|---|---|

| 1 Year | 600 | 715 | +115 |

| 3 Years | 1,800 | 3,000 | +1,200 |

| 5 Years | 3,000 | 7,000 | +4,000 |

| 10 Years | 6,000 | 27,000 | +21,000 |

Key Takeaway: Consistency beats capital. Your habit is more powerful than your income.

13. Quick Checklist Before You Start

Choose 2–3 apps with good user reviews

Start with ₹4,000 or $50

Set up an automated SIP

Review every 3 months

Reinvest profits for compounding

Avoid emotional trading

14. Final Thoughts: Your $50 Can Change Your Future

The real challenge isn’t how much you invest — it’s when you start. Every millionaire began with small steps.

Today, you have technology, access, and global tools that make investing effortless.

So, whether it’s ₹4,000 in India or $50 anywhere else, remember:

“It’s not the money that grows — it’s your mindset.”

Start today. Stay consistent. And in a few years, you’ll thank your past self for taking that first small step.

Leave a Reply