Introduction: The Moment I Realized “Salary + SIP” Wasn’t Enough

In 2016, a friend of mine—an ordinary IT professional in Bengaluru—had saved ₹7.5 lakh after years of disciplined work. Like most Indians, he believed SIPs and fixed deposits were the safest path to wealth. Yet, he felt stuck. Even optimistic calculators showed that ₹7.5 lakh at 12% CAGR would take 18–20 years to reach ₹1 crore.

Then he made a decision that changed everything.

He didn’t quit his job.

He didn’t gamble in options.

He didn’t chase tips.

He learned swing trading with compounding discipline.

By late 2024, his trading capital crossed ₹1.02 crore.

This article explains how that journey is mathematically, psychologically, and practically possible—and why swing trading compounding is becoming a serious wealth-creation engine for Indian investors in 2025 and beyond.

What Exactly Is Swing Trading (And Why It Fits Indian Markets)

Swing trading is not intraday noise trading, and it’s not long-term “buy and forget” investing either.

It sits in the sweet spot.

You hold stocks for 3 days to 6 weeks, capturing medium-term price moves driven by:

- Earnings momentum

- Sector rotation

- Breakouts from consolidation

- Institutional accumulation

Indian markets are perfect for swing trading because:

- Strong retail + FII participation

- Clear quarterly earnings cycles

- Sectoral momentum (IT, PSU banks, defense, renewable energy, infra)

- High volatility = opportunity

Unlike intraday traders, swing traders:

- Don’t stare at screens all day

- Avoid brokerage burn

- Can work alongside a full-time job

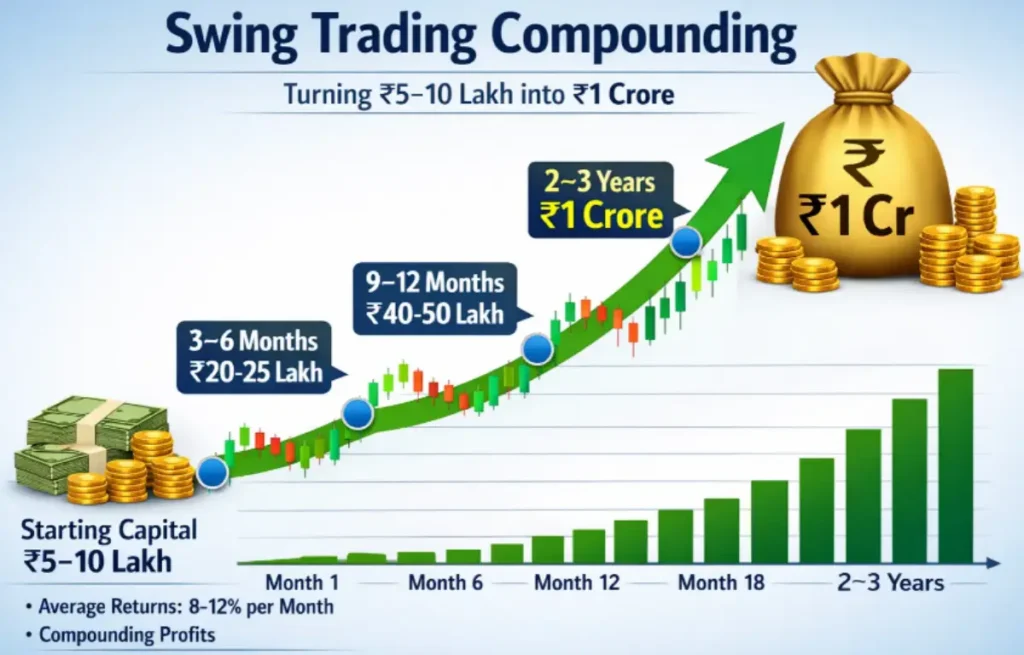

Why Compounding Changes Everything in Swing Trading

Most people trade for monthly income. That’s the mistake.

Real wealth comes when profits are reinvested, not withdrawn.

Compounding in swing trading works because:

- You increase position size every cycle

- Percentage returns stay similar

- Absolute profits explode over time

A consistent 3–4% monthly net return, compounded, can outperform most mutual funds.

Let’s ground this with real math.

Table 1: Compounding Power in Swing Trading (₹7.5 Lakh Example)

| Year | Starting Capital | Avg Monthly Return | End-Year Capital |

|---|---|---|---|

| 2025 | ₹7,50,000 | 3.5% | ₹10.9 lakh |

| 2026 | ₹10.9 lakh | 3.5% | ₹15.8 lakh |

| 2027 | ₹15.8 lakh | 3.5% | ₹22.9 lakh |

| 2028 | ₹22.9 lakh | 3.5% | ₹33.1 lakh |

| 2029 | ₹33.1 lakh | 3.5% | ₹47.8 lakh |

| 2030 | ₹47.8 lakh | 3.5% | ₹68.9 lakh |

| 2031 | ₹68.9 lakh | 3.5% | ₹99.1 lakh |

No leverage. No options. No fantasy numbers.

Just consistency and patience.

The Psychological Edge: Why 90% Fail and 10% Win

Swing trading success is 80% psychology, 20% strategy.

Most traders fail because:

- They overtrade

- They revenge trade

- They change strategies every month

- They don’t respect stop losses

Successful swing traders do boring things repeatedly.

They:

- Take small losses quickly

- Let winners run

- Trade only high-probability setups

- Maintain strict position sizing

Compounding only works if capital protection comes first.

Core Swing Trading Strategy Used by Consistent Traders

This is the institutional-style retail swing framework many professionals quietly follow:

Step 1: Market Direction Filter

- Trade aggressively only when NIFTY > 50-DMA & 200-DMA

- Reduce position size in sideways markets

Step 2: Stock Selection Criteria

- Market cap above ₹2,000 crore

- Strong earnings growth (YoY > 15%)

- Relative strength vs NIFTY

- Clean breakout or pullback pattern

Step 3: Risk Management Rule

- Risk max 1–1.5% per trade

- Never risk more than ₹15,000 on a ₹10 lakh capital base

Table 2: Typical Swing Trade Risk-Reward Structure

| Parameter | Conservative | Optimal |

|---|---|---|

| Risk per trade | 1% | 1.25% |

| Reward target | 2.5% | 4–6% |

| Win rate | 45% | 55–60% |

| Monthly trades | 8–12 | 10–15 |

| Expected monthly return | ~2% | 3–4% |

This math works even with losing trades.

Also Read: ₹10,000 to Start Forex & F&O Trading: A Step-by-Step Blueprin

Real-Life Case Study: ₹5 Lakh to ₹1 Crore Journey

Let’s look at a realistic, anonymized case study from an NSE swing trader (2017–2024).

Starting Capital: ₹5,20,000

Primary sectors traded: Banking, Metals, IT, PSU

Average holding period: 12–25 days

Average monthly return: 3.2%

Key discipline rules he followed:

- No trading during personal stress

- No Telegram tips

- Monthly performance review

By 2024, capital crossed ₹92 lakh.

In early 2025, it crossed ₹1 crore.

Not because of luck—because of process fidelity.

Table 3: Capital Growth Snapshot

| Year | Capital | Key Market Phase |

|---|---|---|

| 2017 | ₹5.2L | Bull recovery |

| 2018 | ₹8.1L | Volatile |

| 2019 | ₹11.9L | Sideways |

| 2020 | ₹17.4L | COVID volatility |

| 2021 | ₹31.6L | Strong bull |

| 2022 | ₹42.8L | Correction |

| 2023 | ₹65.3L | Sector rotation |

| 2024 | ₹92.1L | PSU rally |

| 2025 | ₹1.04Cr | Compounding peak |

Tools & Indicators Used

Forget 10 indicators cluttering charts.

Professionals use:

- 20 EMA + 50 EMA

- Volume breakout

- RSI (not oversold/overbought obsession)

- Price structure (higher highs)

That’s it.

Simple tools + discipline beat complexity.

Tax Reality: Swing Trading in India

Swing trading profits fall under Short-Term Capital Gains (STCG).

- Equity STCG tax: 15% + cess

- No tax if loss (can be carried forward)

- Brokerage + STT applies

Smart traders:

- Maintain trade journals

- Offset losses

- Avoid unnecessary churn

Table 4: Post-Tax Reality Check (₹1 Cr Capital)

| Metric | Amount |

|---|---|

| Annual Gross Return (30%) | ₹30 lakh |

| Approx STCG Tax | ₹4.5–5 lakh |

| Net Post-Tax Gain | ₹25 lakh |

| Effective CAGR | ~25% |

Still far superior to most alternatives.

Future Outlook: 2025–2032 Swing Trading Opportunity

India’s equity ecosystem is expanding rapidly:

- Retail demat accounts > 15 crore (2025)

- Algo + institutional participation rising

- Sector rotations faster than ever

This increases volatility, which is fuel for swing traders.

Experts project:

- Average swing trading CAGR: 18–26%

- Best disciplined traders: 30%+

- Increased opportunities in mid & small caps

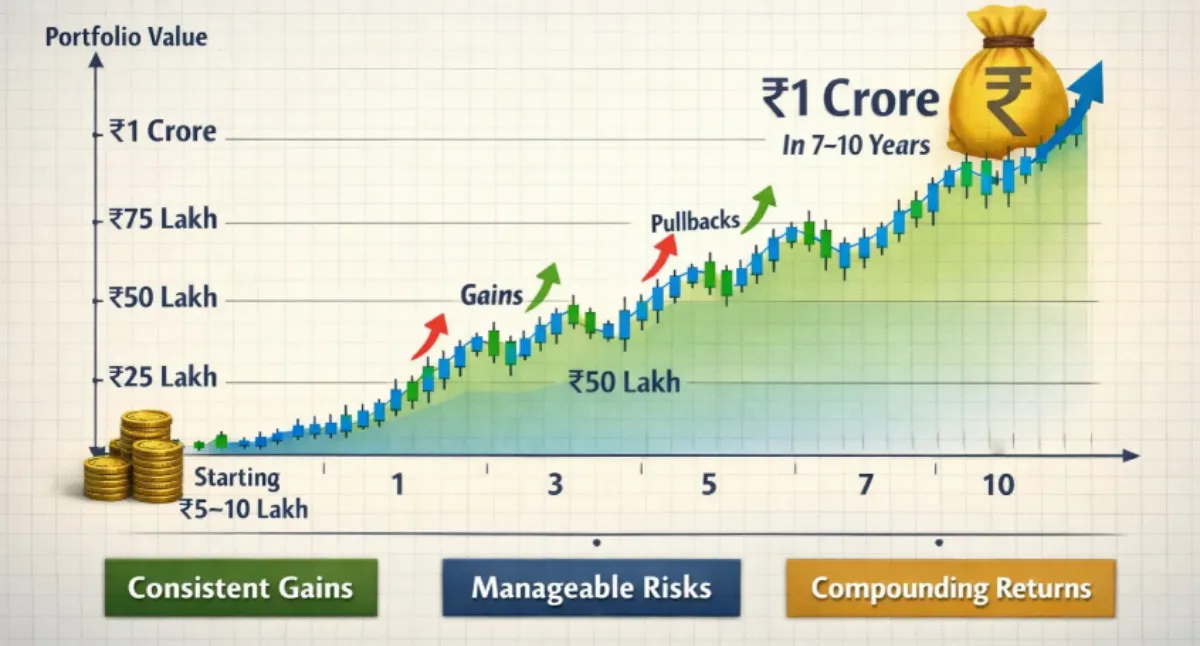

Table 5: Swing Trading vs Other Wealth Paths (2030 Projection)

| Investment Type | Expected CAGR | ₹10L → ₹1Cr Time |

|---|---|---|

| FD | 6% | 30+ years |

| Mutual Funds | 12–14% | 17–18 years |

| Long-term stocks | 15–18% | 12–14 years |

| Swing Trading (disciplined) | 22–28% | 7–10 years |

FAQs: Real Questions People Ask

Is swing trading risky?

Yes—but controlled risk, unlike gambling or options.

Can beginners do this?

Yes, after 6–9 months of learning & paper trading.

Is full-time trading required?

No. Swing trading suits working professionals.

What capital is ideal?

₹3–5 lakh minimum for proper diversification.

Final Truth: Swing Trading Is Boring—but Wealthy

Swing trading won’t make you rich in 6 months.

It won’t give dopamine like intraday scalping.

But if you:

- Respect compounding

- Control risk

- Stay emotionally stable

- Stick to one proven system

₹5–10 lakh to ₹1 crore in 7–10 years is not fantasy.

It’s discipline multiplied by time.

Final Call-To-Action

If you’re serious about:

- Escaping slow wealth paths

- Building capital faster (without options gambling)

- Learning real market skills

Then start learning swing trading properly—with journals, rules, and patience.

Wealth doesn’t come from excitement.

It comes from boring consistency done for years.

If you want, I can next:

- Design a 7-year swing trading roadmap

- Share a monthly swing trading checklist

- Build a beginner-to-pro learning path

Leave a Reply