Are you tired of the ups and downs of the stock market? Do you want a reliable way to grow your wealth? Look no further than the Systematic Investment Plan (SIP). It’s a powerful tool that has changed the investment scene in India12.

In this guide, we’ll show you how SIP investing can lead to long-term financial success. We’ll cover the basics of SIP and how compounding works. You’ll learn strategies that have helped many people reach their financial goals12.

But why choose SIP over other investment options? What makes it special, and how does it help build wealth over time? Get ready to learn the secrets behind SIPs’ growing popularity in India12.

Table of Contents

Key Takeaways

- SIPs offer a disciplined and systematic approach to investing in mutual funds.

- SIPs leverage the power of compounding to grow your wealth over time.

- SIPs provide the benefits of rupee cost averaging, reducing investment risk.

- SIPs can be started with as little as ₹100 per month, making them accessible to all.

- SIPs offer flexibility and convenience, allowing you to align your investments with your financial goals.

Understanding the Fundamentals of SIP Investing

Systematic Investment Plans (SIPs) are a smart way to grow your wealth over time. They offer a steady, disciplined way to invest, unlike other options. This helps investors avoid the ups and downs of the market3.

SIPs can start with just ₹500 a month. This makes them open to everyone, no matter their income3.

What Makes SIP Different from Other Investment Options

SIPs work on the idea of rupee cost averaging and compounding. By investing a set amount regularly, you can handle market changes better. This method also helps you avoid the timing issues that can trip up many investors4.

Core Principles of Systematic Investing

SIPs use the power of compounding to grow your money. Returns are reinvested to earn more over time3. This makes SIPs a strong choice for building wealth in the long run.

Long-term thinking is key with SIPs. Returns are usually better when you invest for 10-15 years or more4.

Role of Regular Investment Intervals

Regular intervals, like monthly or quarterly, are central to SIPs. This steady approach makes managing your money easier. It also helps you benefit from market swings4.

Setting up SIPs is easy, thanks to recurring bank account debits. This adds to their convenience for investors4.

Learning about SIP investing can help you build wealth for the long term. It shows the power of systematic, disciplined investing in the mutual fund world.

The Power of Rupee Cost Averaging in SIP

Systematic Investment Plans (SIPs) are a great way to grow your wealth. Rupee cost averaging is a key part of their success. It means investing a set amount regularly, no matter the market. This can help reduce the impact of market ups and downs and may lead to better long-term gains5.

With SIPs, a fixed amount is taken out of your account at set times, like every month. This amount buys mutual fund units, with the number changing based on the current Net Asset Value (NAV)5. When the market is low, you buy more units. When it’s high, you buy fewer. Over time, this can lower your average cost per unit, boosting your returns6.

| Parameter | Lump-sum Approach | SIP Approach |

|---|---|---|

| Total Investment | ₹60,000 | ₹60,000 |

| Total Units Purchased | 1200 units | 1264.56 units |

| Average Cost per Unit | ₹50 | ₹47.45 |

| Value of Investment | ₹57,600 | ₹60,698.90 |

The table shows SIPs can lead to a lower average cost per unit and a higher investment value than lump-sum investing6. This proves rupee cost averaging can help manage market volatility and increase long-term gains5.

By investing a fixed amount regularly, you can take advantage of compounding. This helps build wealth over time, even with market fluctuations5. This disciplined method is a smart way to reach your long-term financial goals5.

Harnessing Compound Growth Through SIP

Systematic Investment Plans (SIPs) rely on compound growth for success. By investing a fixed amount regularly, investors see the compounding effect grow over time7.

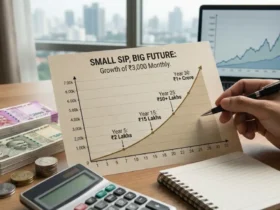

For example, investing Rs. 5,000 monthly at a 12.62% return could reach Rs. 11.58 lakhs in 10 years. In 30 years, it could grow to Rs. 1.74 crores. And in 40 years, it could reach Rs. 5.84 crores7. This shows how consistent investing can lead to significant wealth.

The Impact of Time on Investment Growth

The longer you invest, the more the compounding effect grows. Starting early and being consistent are key to maximizing compounding7. A comparison between starting at 25 and 35 shows the power of time.

Understanding the Compounding Effect

The compounding effect in SIPs is a powerful tool for wealth creation. Returns are reinvested, leading to exponential growth8. Regular, disciplined contributions and flexibility in investment amounts help reach financial goals faster.

By staying patient and committed, investors can fully leverage compounding. This makes SIP a smart way to build lasting financial security7.

“Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it.” – Albert Einstein

SIPs’ exponential growth shows the impact of systematic, long-term investing. By using compounding, investors can quickly reach their financial goals and build wealth78.

| Investment Type | Investment Amount | Time Period | Rate of Return | Accumulated Wealth |

|---|---|---|---|---|

| Conventional Investment | Rs. 12,000 | 3 years | 10% | Rs. 3,600 (interest) |

| SIP Investment | Rs. 1,000 per month | 3 years | 10% | Higher profits than conventional investment |

The table shows SIPs’ benefits over conventional investments. SIPs use compounding to offer higher returns, showing the value of long-term investing7.

In summary, SIPs are a strategic way to create wealth through compound growth. Consistent, long-term investing unlocks exponential growth and financial security78.

Key Benefits of Starting a SIP Investment

Systematic Investment Plans (SIPs) are great for growing wealth over time. They help you reach your financial goals by investing regularly. You can start with just Rs. 100 a month9.

This makes it easy to keep up with your investments, even as your money situation changes9.

SIPs also use rupee cost averaging to reduce risk. By investing the same amount regularly, you can take advantage of market ups and downs. This can lead to better returns than investing all at once91011.

Another big plus is diversification. You can pick from many mutual fund types, like equity, debt, and hybrids. This lets you tailor your portfolio to your risk level9.

It also helps manage risk and can lead to more consistent returns.

The compounding effect of SIPs is huge. Consistent investing over time can make your wealth grow a lot1011. This approach is perfect for long-term financial planning and security.

“SIPs are a disciplined way to invest, allowing you to build wealth gradually and steadily over time, without the need to time the market.”

Types of Systematic Investment Plans

Investors have many Systematic Investment Plan (SIP) options to build wealth. These plans fit different investment needs and goals. They offer flexibility and customization for each investor12.

Top-up SIP: Accelerating Wealth Creation

Top-up SIP lets investors increase their investment amounts over time. This can lead to a bigger investment corpus than regular SIP1213.

Flexible SIP: Adapting to Life’s Changes

Flexible SIP lets you change your investment amounts as needed. It’s great for those with changing incomes or market conditions13.

Perpetual SIP: Lifelong Wealth Building

Perpetual SIP is for long-term wealth growth. It keeps investing until you stop or change it. This ensures ongoing benefits of investing1214.

There are also other SIP options like Trigger SIP, Multi SIP, and SIP with insurance. Each meets different investment goals and risk levels1314.

Choosing the right SIP depends on your financial goals, risk tolerance, and time horizon. Knowing the benefits of each SIP helps create a strategy that matches your goals. This supports your journey to long-term wealth1314.

| SIP Type | Key Features | Suitable For |

|---|---|---|

| Regular SIP | Fixed monthly investment amount, predetermined tenure | Investors seeking systematic wealth building |

| Flexible SIP | Ability to vary investment amounts based on financial circumstances | Investors with unpredictable income sources |

| Top-up SIP | Periodic increase in investment amounts, potentially higher returns | Early-career salaried employees with growing incomes |

| Perpetual SIP | Ongoing investments without a predefined duration | Investors focused on long-term wealth creation |

| Trigger SIP | Automated investments based on predefined market conditions | Experienced investors with good understanding of financial markets |

| Multi SIP | Investment across multiple mutual fund schemes or asset classes | Investors seeking portfolio diversification and risk management |

“The choice of the best SIP type depends on an investor’s financial goals, risk tolerance, and investment horizon.”

Understanding the benefits of each SIP type helps create a tailored investment plan. This plan aligns with your goals and supports long-term wealth creation and investment flexibility121314.

Systematic Investment Plan: A Smart Way to Build Wealth

Investing for the long-term can seem tough, but a Systematic Investment Plan (SIP) makes it easier. SIPs help you manage market ups and downs, making your money grow over time15. You can start investing with just ₹500 a month, making it easy for many to grow their wealth16.

SIPs can give you more than twice the returns of traditional savings, like Fixed Deposits and Recurring Deposits15. Plus, you can save up to ₹1.5 lakh on taxes, thanks to Section 80C of the Income Tax Act15.

There are many types of SIPs, like Top-Up SIP and Flexible SIP, to fit your needs and goals15. The magic of compounding means your returns can grow even more, leading to higher earnings over time15.

SIPs also use Rupee Cost Averaging, which helps you invest wisely by buying more when prices are low15. You can choose how often to invest, from weekly to quarterly, and even pause payments if needed15.

With SIPs, you don’t have to worry about timing the market, and you can pause payments if money is tight15. This makes investing simpler and more appealing for those looking to build wealth over the long term15.

| Type of Customer | Future Value of Current Investment | Investment Required for Future Goal | Investment Duration Options | Annual Growth Expectation |

|---|---|---|---|---|

| Individual Investors | ₹100,000,000 | Monthly SIP starting from ₹5,000 | 12 months and 300 months | Interest earned on principal amount invested |

In summary, Systematic Investment Plans are a smart way to build wealth. They suit many investors and goals. By using compounding, Rupee Cost Averaging, and flexible options, SIPs are a great choice for long-term growth151716.

Setting Financial Goals with SIP

Investing wisely is key to reaching your financial goals with a Systematic Investment Plan (SIP). Whether you dream of buying a car or retiring comfortably, a solid investment strategy is essential18.

Working with a financial advisor can help you set clear goals18. SIPs can then be customized to fit your needs. This ensures your investments align with your personal goals18.

- The Appreciate app lets you invest in the US markets starting at just Rs. 1 with Fraction18.

- Appreciate’s Pro trading product lets you trade global stocks and ETFs. It comes with advanced tools for analysis18.

- Change Savings by Appreciate helps you save spare change. It’s a way to build wealth passively18.

| Financial Goal | Recommended SIP | Expected Returns |

|---|---|---|

| Short-term (1-5 years) | Debt Funds | 6-8% per annum |

| Medium-term (5-10 years) | Balanced Funds | 8-10% per annum |

| Long-term (10+ years) | Equity Funds | 12-15% per annum |

Aligning your financial planning with a SIP can help you achieve your dreams18. This approach ensures your investments support your life goals. It leads to a secure and prosperous future18.

“Systematic Investing is a powerful tool for building long-term wealth, as it allows you to take advantage of the power of compounding and dollar-cost averaging.”

Step-Up SIP: Accelerating Your Wealth Creation

Investing for the long term is a great way to grow your wealth. The Step-Up SIP is a tool that can speed up this process. It lets you increase your investment amounts over time, matching your growing income or changing financial goals19.

Calculating Step-Up Benefits

The Step-Up SIP lets you raise your investment by a set percentage or amount at set times, usually every year20. This makes your investments grow faster over time19.

For instance, a Rs. 10,000 monthly SIP with a 10% annual increase can grow to Rs. 2.21 crores in 20 years. Without the step-up, it would be Rs. 1.14 crores19. This shows how much Step-Up SIP can help in building wealth.

When to Consider Step-Up Options

Step-Up SIP is perfect for long-term goals. It helps match your investments with your growing income or changing needs20. It’s great for young people with rising incomes or anyone wanting to grow their wealth steadily19.

Using Step-Up SIP in your investment plan can help you take advantage of market chances and fight inflation. It’s a smart way to build wealth over the long term20. This flexible option offers a clear path to reaching your financial goals, making it a key tool for growing your wealth.

Documents Required for SIP Investment

Investing in a Systematic Investment Plan (SIP) requires careful attention to the documents needed21. From a simple cheque to KYC formalities, the right documents are key for a smooth SIP registration21.

For SIP investment, you’ll need a valid ID like a PAN or Aadhaar card. Also, a recent address proof, like a utility bill, is required. You’ll need a cancelled cheque or bank passbook to confirm your bank account details2122.

Completing KYC (Know Your Customer) is also essential. This involves submitting KYC documents and sharing personal info2122. It ensures you follow current rules, making your investment smooth21.

Investors can start their SIP through online or offline channels21. This flexibility meets different investors’ needs, making SIP registration easier and more accessible21.

By submitting documents on time and following KYC rules, investors can start their SIP journey confidently. This sets the stage for building wealth over the long term2122.

“Systematic Investment Plans offer a disciplined approach to investment, helping investors mitigate risks associated with market volatility.”

How to Start Your SIP Journey

Starting a Systematic Investment Plan (SIP) is easy and rewarding. First, complete the Know Your Customer (KYC) requirements. You can do this at banks, post offices, or online23. After that, pick a trusted broker or advisor to sign up for an SIP.

Next, choose a mutual fund plan, decide how much to invest, and when. You can do this online or offline, based on what you prefer23. There are many mutual fund types, like Equity and Hybrid Funds, to choose from23.

Choosing the Right Investment Platform

Finding the right platform for your SIP is key. Look for reputable online brokers and advisors. They offer tools and advice to help you register for SIPs smoothly23. These platforms also have easy-to-use interfaces and educational resources to guide you.

“Investing in mutual funds through SIP is a smart way to build long-term wealth. It allows me to take advantage of rupee cost averaging, compounding, and professional portfolio management.” – Seema, a professional planning her retirement

By choosing wisely and following a clear plan, you can start your SIP journey easily. This path helps you reach your financial goals23. It’s a way to grow your wealth over time, thanks to SIP’s benefits2324.

Selecting the Ideal SIP Amount

Choosing the right SIP amount is key to growing your wealth. It’s all about your investment planning, budget allocation, and financial capacity25.

SIPs are flexible, letting you start small and grow your investment as you can. This helps you build a consistent investment habit without stress25.

Mutual funds come in many risk levels, from safe to bold. They match your investment goals and how much risk you’re willing to take25. Equity funds are for those looking to grow their money over time. Debt funds are better for those who want stability and lower risk25.

Hybrid funds mix equity and debt, aiming for a balance. They’re good for both long-term and shorter goals25. Regularly check and adjust your plan to keep it in line with your goals and market changes25.

Using SIP calculators and looking at different SIP funds in India can help you craft a plan that fits your financial capacity25. This way, you can build wealth over time through steady and smart investing25.

| Metric | Value |

|---|---|

| SIP Inflows in India (April 2024) | Rs. 20,371.47 crore |

| Mutual Fund Industry’s Net AUM (April 2024) | Rs. 57.26 lakh crore |

| New SIP Registrations (April 2024) | 63.65 lakh |

The data shows SIPs are getting more popular in India. There’s been a big increase in inflows, AUM, and new registrations26. This shows more people are seeing the value of systematic investment planning for investment planning and wealth creation.

Understanding Market Timing with SIP

Systematic Investment Plans (SIPs) make it easy to invest without worrying about market timing27. They help you invest a fixed amount at set times. This way, you avoid missing out on good times or losing money in bad times28.

During big market crashes, like the COVID-19 one, SIPs showed their worth27. Even when the market was very volatile, SIP investors kept investing. This helped them use the rupee cost averaging principle28. It makes sure you don’t have to guess the right time to invest to reach your goals.

SIPs also make you more disciplined with your money28. By investing the same amount regularly, you can handle market ups and downs. This way, you can grow your wealth over time, no matter what the market does29.

| Investment Strategy | Advantages | Disadvantages |

|---|---|---|

| Lump Sum Investment | Potential for higher returns in a bull market Simplified investment process | Susceptible to market timing risks Potential for losses in a bearish market |

| Systematic Investment Plan (SIP) | Eliminates the need for market timing Promotes financial discipline Advantages of rupee cost averaging Potential for long-term wealth creation | Lower returns in a bull market compared to lump sum Potential for short-term losses during market downturns |

In conclusion, SIPs are a smart way to invest that helps you deal with market ups and downs27. By investing regularly, you can use the power of compounding. This helps you reach your financial goals without worrying about market timing28.

“SIPs eliminate the need to time the market, a challenging task even for experienced investors. By investing regularly, SIP investors can take advantage of the power of compounding and achieve their financial goals.”

Risk Management Through SIP Investment

Systematic Investment Plans (SIPs) are a smart way to manage risk and grow wealth over time. They help spread out your investment risk by investing in different assets through mutual funds30. Regular investments in SIPs also help you average out the cost of your investments, reducing the impact of market ups and downs30.

This strategy is great for those looking to build wealth over the long term. It helps manage short-term market volatility well.

Portfolio Diversification Strategies

Diversification is key in SIP investing. By investing in various asset classes, sectors, and fund types, you can reduce risk and possibly increase returns30. For example, an SIP in an Equity Linked Saving Scheme (ELSS) mutual fund can give tax benefits under Section 80C. A debt-focused SIP can offer a more stable option31.

Creating a diversified portfolio helps you handle market changes better. It helps you reach your long-term financial goals.

Managing Market Volatility

SIPs help manage market volatility through rupee cost averaging. By investing a fixed amount regularly, you buy more units when prices are low and fewer when prices are high31. This method averages out your investment cost, making short-term market swings less impactful30.

Also, the compounding effect of SIPs can build significant wealth over time, even with market ups and downs30.

| Investment Scenario | Corpus Value |

|---|---|

| Rs. 25,000 SIP for 20 years | Rs. 2.85 crores30 |

| Rs. 10,000 monthly SIP for 20 years | Rs. 1.14 crores30 |

| Rs. 10,000 monthly SIP with 10% annual step-up for 20 years | Rs. 2.21 crores30 |

By using SIP investments, you can manage risk, diversify your portfolio, and achieve long-term financial goals, even with market changes31.

“Consistent investment through SIPs, coupled with a diversified portfolio, can be a game-changer in achieving your financial objectives.”

The success of your SIP investment journey depends on staying disciplined and invested for the long term. By using SIP investing’s risk management strategies, you can navigate market changes and build a secure financial future31.

Building Long-Term Wealth Through SIP

Systematic Investment Plans (SIPs) are great for growing wealth over time. They use compounding and regular investing to build a big amount of money32. For example, investing Rs. 25,000 every month for 20 years can grow to Rs. 2.85 crores, with a 13% return32. SIPs help you stay disciplined and are perfect for long-term goals like retirement.

The Nifty 50 Index has grown 26 times in 29 years, with a 11.89% CAGR32. It has bounced back from crises like the Asian financial crisis and US sanctions32. This shows the long-term strength of equity investments through SIPs.

A step-up SIP grows wealth faster than a regular SIP32. It increases your investment over time, making your money grow faster32. Mutual funds also spread out your risk by mixing different investments33.

SIPs are key for long-term financial security and wealth33. A mutual fund with a 10-year return of 13% can triple your money33. Starting a SIP with an equity mutual fund helps you grow your money despite market ups and downs33.

In summary, SIPs are a smart way to grow wealth over time. They use compounding, diversification, and regular investing to help you reach your financial goals and secure your future.

| Metric | Value |

|---|---|

| Nifty 50 Index Growth | 26 times in 29 years |

| Nifty 50 Index CAGR | 11.89% from inception |

| Monthly SIP of Rs. 25,000 for 20 years | Rs. 2.85 crores corpus |

| Franklin India Prima Fund SIP Growth | From Rs. 3.6 lakhs to Rs. 2.1 crores in 30 years with 21.4% XIRR |

“SIPs have the power of compounding, allowing investors to benefit from reinvested returns and see substantial growth over time.”32

Most mutual fund houses start SIPs at Rs. 100, making them accessible to everyone32. Equity mutual funds are best for the long term, matching your financial goals33. Regularly checking and adjusting your portfolio helps in creating wealth33.

Tax-saving mutual funds like ELSS can grow your wealth while saving on taxes33. A mix of 60% equity and 40% debt in your portfolio keeps your risk and return balanced33.

Conclusion

Systematic Investment Plans (SIPs) are a smart way to grow your money and plan your investments. They offer many benefits like averaging costs, compounding, reducing risks, and being easy to use28. SIPs help people reach their financial goals, no matter their investment level.

Starting early and staying committed are key to making the most of SIPs34. Being patient, consistent, and disciplined helps build wealth over time34. Getting advice from a mutual fund distributor can also help tailor your investment plan to your needs.

In short, SIPs are a smart way to build wealth. They help you manage market ups and downs, stay disciplined, and grow your money over time2835. By following SIP investing, we can work towards our financial dreams and a secure future.

FAQ

What is a Systematic Investment Plan (SIP)?

A Systematic Investment Plan (SIP) is a great way to grow your wealth in India. It lets you invest a fixed amount regularly in mutual funds. This helps you stay disciplined and benefits from compounding.

How does SIP investing differ from other investment options?

SIP investing is unique because it encourages regular, disciplined investing. It uses rupee cost averaging and compounding. These strategies help you manage market ups and downs and build wealth over time.

What is rupee cost averaging and how does it work in SIP investing?

Rupee cost averaging is key in SIP investing. It means buying more units when prices are low and fewer when prices are high. This way, you get a lower average cost per unit over time. It helps you deal with market changes and can increase your returns in the long run.

How does compounding benefit SIP investments?

Compounding is very important in SIP investing. It lets your returns earn more returns. This means your investments can grow a lot over time, leading to significant wealth.

What are the key benefits of SIP investments?

SIP investments have many advantages. They help you achieve your financial goals, stay disciplined, and are easy to manage. They also reduce risk and take advantage of compounding. You can start with small amounts.

What are the different types of SIPs available?

There are many SIP types to meet different needs. You can choose from top-up SIPs, flexible SIPs, perpetual SIPs, and trigger SIPs. Each has its own benefits.

How do I set financial goals for my SIP investments?

Setting clear financial goals is essential for SIP investing. Goals can be short-term or long-term, like planning for retirement. A financial advisor can help you set these goals through a detailed planning process.

What is a step-up SIP, and how can it accelerate wealth creation?

Step-up SIPs let you increase your investment amount over time. For example, a Rs. 10,000 monthly SIP with a 10% annual increase can grow your wealth faster than a fixed SIP.

What documents are required to start a SIP investment?

To start a SIP, you need ID proof, PAN Card, address proof, and a valid bank account. You also need a copy of your passport or driving license. Make sure you meet the latest KYC norms.

How do I start a SIP investment?

To start a SIP, first complete your KYC. Then, choose a reputable broker or advisor. Pick the right plan and decide on your investment amount and SIP dates. You can do this online or offline by submitting the necessary forms.

How do I determine the ideal SIP amount?

The right SIP amount depends on your financial goals, risk tolerance, and liquidity needs. Consider your monthly income, expenses, and savings. Starting small and increasing gradually is a good strategy.

How does SIP investing help manage market timing?

SIPs make market timing easier. They let you invest regularly, regardless of market conditions. This averages out your investment cost over time, helping you avoid losses and miss out on rallies.

How do SIPs help in risk management?

SIPs manage risk through diversification and rupee cost averaging. By investing in various assets through mutual funds, SIPs spread out risk. Regular investments also help manage market volatility by averaging out costs over time.

How can SIPs contribute to long-term wealth creation?

SIPs are great for building long-term wealth. They use compounding and regular investing to grow your wealth over time. SIPs promote financial discipline and are perfect for long-term goals like retirement planning.

AXECO Tesla Steering WheelFor global Tesla owners, Customize a more personalized and richer exclusive steering wheel.