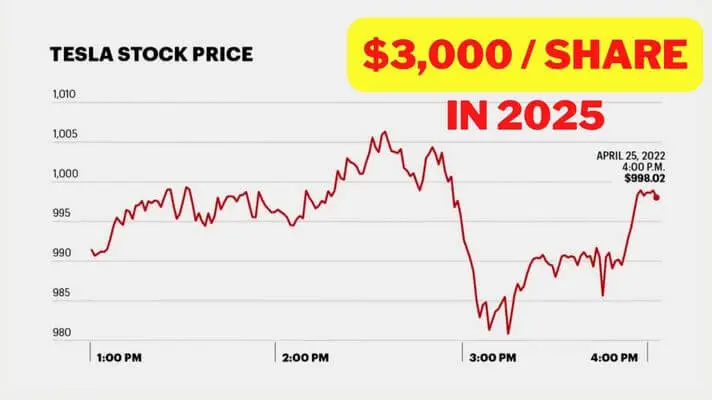

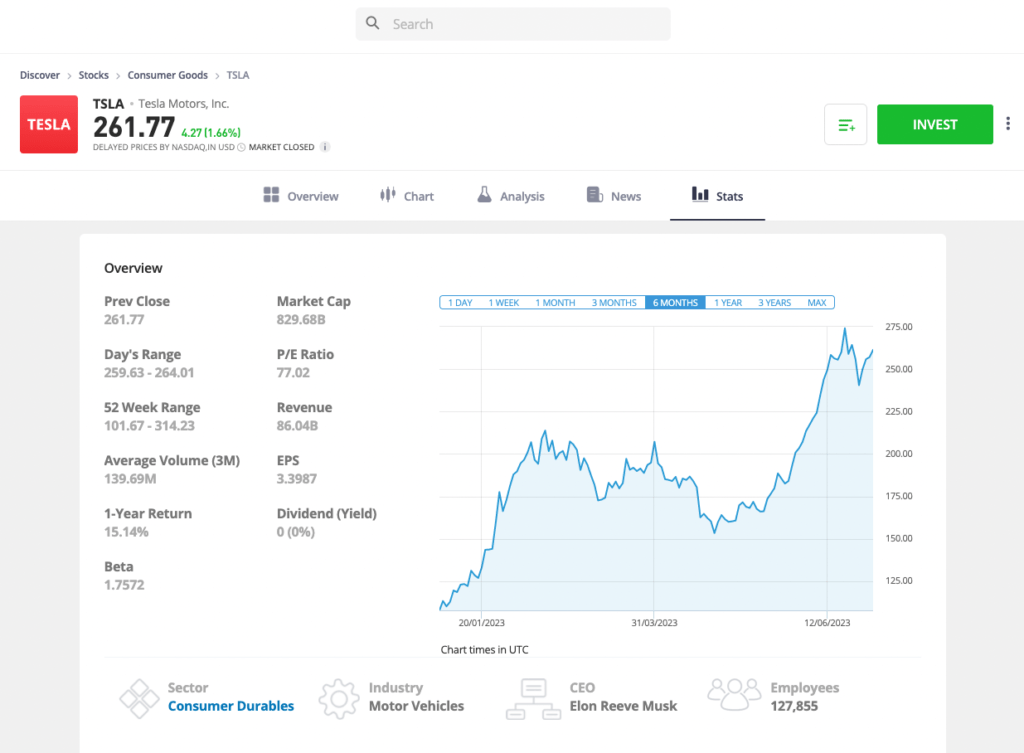

Tesla, the renowned electric vehicle (EV) and clean energy company, has been a subject of immense interest in the stock market since its IPO in 2010. As of September 2023, the stock has rebounded, trading around $269 and boasting a market capitalization of about $868 billion. Tesla’s stock has experienced significant volatility, reaching an all-time high of $313.80 in November 2021, followed by a sharp decline of over 65% in 2022.

Table of Contents

Tesla Stock Price Prediction 2025:

- Forecasted to span from $391 to $500, with an average of $445.

Tesla’s stock price predictions for 2025 range from $85 to $400. Craig Irwin, a Roth Capital analyst, believes Tesla is grossly overvalued today and predicts a target of $85. On the other hand, Cathie Wood, a famous growth investor, predicts Tesla will hit $1,400 or more by 2027. However, these predictions are subject to change as the company’s growth prospects and competitive landscape evolve.

Tesla Stock Forecast 2025:

- CoinPriceForecast predicts that the Tesla stock price will reach $247 in the first half of 2025, with a year-to-year change of 38%.

- Gov Capital forecasts a Tesla stock price of $392.39022112435 for January 27, 2025, which is an 87.621% increase from the current price.

- Another source predicts a Tesla stock price of $368.44923986475 for January 27, 2025, which is a 77.621% increase from the current price.

Tesla Stock Forecast 2026-2030:

- CoinPriceForecast predicts that the Tesla stock price will reach $573 by 2030, which is an 89% increase from the current price.

- Gov Capital forecasts a Tesla stock price of $1692.285 for 2030, which is a 776.621% increase from the current price.

Factors Affecting Tesla Stock Predictions:

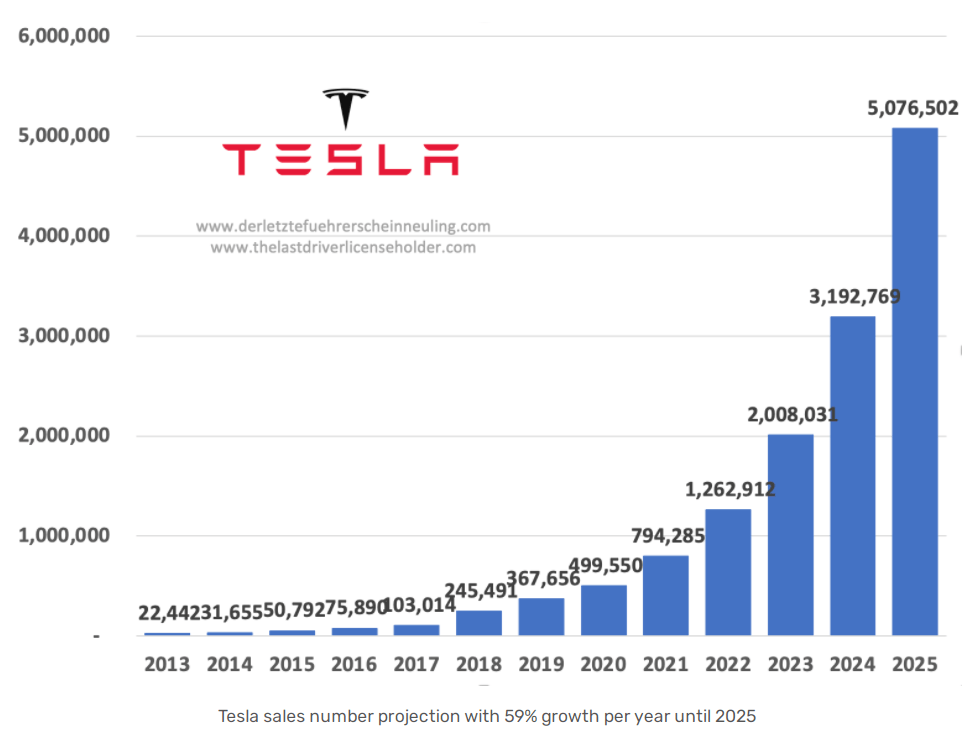

- Market Trends: The electric vehicle market is expected to grow significantly in the coming years, driven by increasing environmental concerns and government incentives for EV adoption. This growth is likely to benefit Tesla, as it is a leading player in the EV industry.

- Company Performance: Tesla’s financial performance, including revenue growth, profitability, and cash flow, will play a crucial role in determining its stock price. The company’s ability to scale its operations, expand its product line, and enter new markets will also impact its stock performance.

- Industry Growth: The growth of the clean energy sector, including solar energy and energy storage, will also influence Tesla’s stock price. The company’s involvement in these areas through its SolarCity subsidiary and its energy storage products will benefit from the growth of the clean energy market.

- Competition: The increasing competition in the EV market, particularly from traditional automakers and new entrants, will impact Tesla’s stock price. The company’s ability to maintain its market share and innovate will be crucial in this regard.

Factors Influencing Tesla’s Stock Price:

- Competition: Tesla faces stiff competition from established automakers like Ford, General Motors, and Nissan, as well as emerging players like Li Auto, Lucid Group, Rivian Automotive, Nio Inc, Nikola Corp, and Canoo Inc.

- Market Share: Immediate threats to Tesla’s market share include Ford and Chinese EV maker BYD. The years-long delay on the Tesla Cybertruck launch has opened the door for Ford, Rivian, and GMC to build audiences for their EV trucks.

- Growth Prospects: Despite these challenges, Tesla still has good growth prospects. However, as competition heats up, its growth trajectory may be tempered relative to the company’s history.

- Technological Advancements: Tesla’s Dojo, a supercomputer designed to accelerate AI research, is expected to be a growth factor for the company.

- Market Capitalization: As of September 2023, Tesla has a market capitalization of about $868 billion.

Tesla’s stock price predictions for 2025 are subject to change as the company’s growth prospects and competitive landscape evolve. The stock is considered risky but has the potential to play big rewards down the line. Investors should closely monitor Tesla’s performance and keep an eye on the company’s growth prospects and competitive landscape to make informed investment decisions.

Financial Performance

Several financial predictions have been made for Tesla stock in 2025. For instance, Barclays and JP Morgan have predicted a rise of 170%, reaching $480 to $535[3]. Additionally, it is expected that Tesla will earn $6.68 per share by 2025.

Market Trends

Market trends play a crucial role in stock performance. According to various forecasts, the Tesla stock price is predicted to range from $391 to $500, with an average of $445 in 2025. These predictions take into account factors such as volume changes, price changes, and market cycles.

Technological Advancements

Tesla’s technological advancements, particularly in the electric vehicle and clean energy sectors, are likely to impact its stock performance. It is essential to explore how Tesla’s technological developments may influence its market position and stock value.

Competitor Analysis

Tesla faces competition from established automakers and emerging players in the electric vehicle industry. Analyzing the competitive landscape and how it may evolve by 2025 is crucial for understanding Tesla’s potential stock performance.

By incorporating these aspects, the article will provide a comprehensive overview of the factors that may influence Tesla’s stock performance in 2025. It will draw on the various predictions and analyses to offer a well-rounded perspective on what the future may hold for Tesla stock.

Q&A

Q: What is Tesla’s current stock price?

A: As of January 28, 2024, Tesla’s stock price is $209.14.

Q: What is Tesla’s financial performance?

A: Tesla’s financial performance has been impressive in recent years, with the company reporting a net income of $3.7 billion in 2022. This growth is expected to continue, with Tesla aiming to produce 20 million electric vehicles per year by 2030.

Q: What is driving the growth of the electric vehicle market?

A: The electric vehicle market is expected to grow significantly in the coming years, driven by increasing environmental concerns, government incentives, and advancements in battery technology.

Q: What are the risks associated with investing in Tesla stock?

A: Investing in Tesla stock can be a lucrative opportunity, given the company’s strong financial performance and growth potential. However, investors should also consider the risks associated with investing in a single stock, such as market volatility and company-specific risks. It is essential to diversify your portfolio and conduct thorough research before making any investment decisions.