In the world of wealth management, the numbers “1” and “10” carry a psychological weight far beyond their mathematical value. For the modern Indian investor, reaching a ₹1 Crore corpus is the first definitive marker of financial security, while the ₹10 Crore (10-digit) milestone represents true generational freedom. However, most investors fail to reach these goals not because they lack the capital, but because they suffer from linear thinking in an exponential world.

Table of Contents

The math of wealth creation is surprisingly simple, but it is counter-intuitive. Success requires navigating the “traps” where entry prices freeze portfolios and the “mirages” where inflation erodes purchasing power. To build a fortune that lasts, you must look past the brochures and understand the deeper dynamics of the market.

1. The 8-4-3 Rule: Why the First Third is the Hardest

The most common reason early-stage investors quit is a perceived lack of progress. They see their contributions as the primary driver of their portfolio for years and assume it will always be this difficult. This is a failure to recognize the “8-4-3 Rule” of wealth velocity.

Based on an annualized return of 12%, the journey to your first ₹1 Crore (broken into equal thirds of ₹33.3 Lakhs) follows a non-linear acceleration:

- The First ₹33.3 Lakhs: Takes approximately 8 years.

- The Second ₹33.3 Lakhs: Takes only 4 years.

- The Third ₹33.3 Lakhs: Takes a mere 3 years.

The reason for this dramatic shift is what strategists call the “heavy lifting” phase. During the first eight years, your fresh capital is doing nearly all the work. By the time you reach the final three-year segment, your accumulated returns have taken over the labor. Research on Nifty 50 long-term dynamics suggests that:

“Once compounding kicks in, your wealth will multiply faster than you expect.”

For those who can survive the initial eight-year grind, the reward is an exponential “runway” where the math finally begins to work for you rather than against you.

2. The “Trapping Period”: How Entry Price Can Freeze Your Wealth

Timing the market is often dismissed as a fool’s errand, but ignoring valuation is a strategic error. A multi-scale analysis of the Nifty 50 (1990–2024) reveals the existence of a “trapping period”—a window where an investor can see zero or negative returns for years simply because they entered at a high price.

However, the market has matured. While the historical “worst-case” trapping period was 10 years, data from the post-1999 reformed market shows this window has shortened to just 6 years, reflecting significantly higher market resilience. To navigate this, we categorize the market into five Price-to-Earnings (P/E) regimes:

- No Risk Zone (P/E < 13): Historically, entering here shows a zero probability of loss across all investment horizons.

- Low Risk Zone (P/E 13–16): Minimal downside with breakeven periods typically under 3 years.

- Moderate Risk Zone (P/E 16–22): Increased volatility with a 4-year recovery timeline.

- High Risk Zone (P/E 22–27): Significant downside risk requiring a 5-year trapping period before returns turn positive.

- Very High Risk Zone (P/E > 27): Extreme instability where the worst-case trapping period extends to 10 years (though shortened to 6 years in the post-1999 era).

While the Nifty 50 shows a 74% probability of gain over any one-year period with a modal return of 10.67%, the “worst-case” one-year return of -56.84% is a reminder that entry price determines how long you must wait to see a profit.

3. The Step-Up Superpower: The 10% Rule That Changes Everything

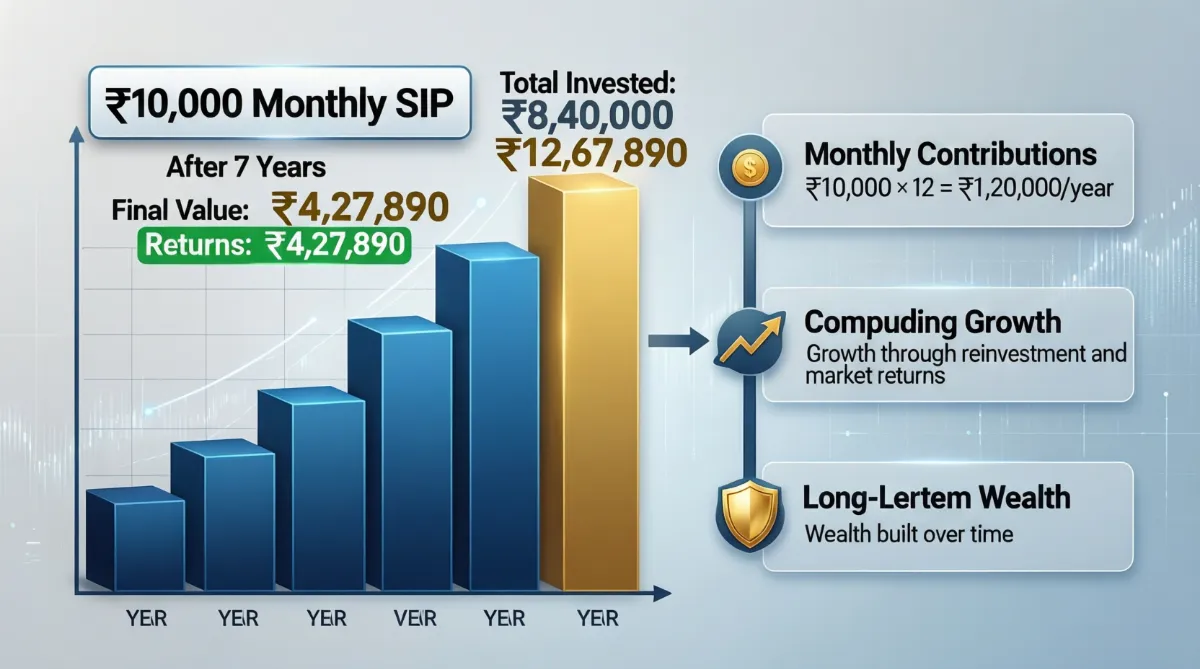

Most investors treat their Systematic Investment Plan (SIP) as a “set it and forget it” tool. This is a missed opportunity. Because your income likely grows annually, your investment should grow with it. By applying a 10% annual “Step-Up” to your contributions, you can bridge the gap between a modest retirement and a 10-digit fortune.

The following comparison, based on a 10-year horizon at 12% returns, illustrates the disparity:

| Investment Strategy | Final Corpus (10 Years) | Wealth Gap |

| Standard SIP (₹10k Fixed) | ₹23.2 Lakhs | — |

| Step-Up SIP (10% Annual Raise) | ₹33.7 Lakhs | +₹10.5 Lakhs |

A simple 10% annual increase leads to a corpus that is over ₹10 Lakhs larger in a single decade. This strategy allows you to start with a manageable amount and let your rising earning capacity handle the “acceleration” of your wealth building.

4. The Inflation Illusion: Why ₹1 Crore is Actually ₹2.15 Crore

The biggest mistake I see in long-term planning is setting a goal in “today’s money” for a “tomorrow” reality. If you are targeting a ₹1 Crore corpus to fund a house or a lifestyle a decade from now, you are chasing a ghost.

By using the Future Value (FV) calculation—a standard technical formula used by wealth strategists—we can see the impact of an 8% inflation rate over 10 years. To have the same purchasing power that ₹1 Crore has today, your target must actually be:

- Inflation-Adjusted Target (10 Years): ₹2,15,89,250 (Approx. ₹2.15 Crore).

As The Economic Times analysis emphasizes:

“It’s crucial to account for the inflation rate and adjust the goal amount accordingly. Prices of goods and services won’t remain constant over your investment horizon.”

5. The 15-15-30 Roadmap: Moving from One Crore to Ten

Reaching ₹1 Crore requires discipline; reaching ₹10 Crore requires a “runway.” Specific rules of thumb illustrate the leverage of time:

- The 15-15-15 Rule: Investing ₹15,000 per month for 15 years at a 15% return results in ₹1 Crore.

- The 15-15-30 Rule: Investing the same ₹15,000 at 15% for 30 years results in ₹10 Crore.

Notice that by doubling the time (from 15 to 30 years), the wealth doesn’t just double—it increases ten-fold. If you have a shorter 20-year horizon, the math becomes more aggressive, requiring a ₹1 Lakh monthly SIP at a 12% return.

However, a senior strategist’s advice doesn’t stop at the target. You must also focus on de-risking. While you may target 13–15% returns through equity early on, you should shift toward fixed income (7–8% returns) as you approach your multi-crore target to protect the principal from the very market volatility that helped build it.

Conclusion: The Patience Premium

Building significant wealth is ultimately a game of endurance. Over a 25-year tracking period, the Indian market has delivered 20 positive years against only 5 negative years. While the “trapping periods” and high-valuation cycles can be daunting, they are temporary states for the disciplined investor.

The “Crore Math” is clear: the most powerful lever you have is not your ability to pick stocks, but your ability to extend your runway and account for the costs of the future.

Ask yourself: “Are you investing for the amount you need today, or the reality of what that amount will cost tomorrow?” Mastery of the math is the first step; the patience to let it play out is the second.

Leave a Reply