On Friday, January 19, 2024, the S&P 500 index closed at a record high, marking its first record close in over two years. The benchmark index rose 1.2% to close at 4839.81, surpassing the previous record set in January 2022. This record-breaking performance was driven by a rally in technology stocks and other heavyweight sectors.

The Technology Sector Leads the Rally

During the trading session, the technology sector of the S&P 500 notably gained 2.4% on Friday, with shares of AI companies like Nvidia and Meta Platforms closing at new record highs. The rally in technology stocks was driven by strong earnings reports from major tech companies, including Apple, Microsoft, and Amazon. These companies reported better-than-expected earnings, which boosted investor confidence in the technology sector.

Table of Contents

Rising Consumer Confidence and Easing Inflation Concerns

The record high was also influenced by rising consumer confidence and easing inflation concerns. The University of Michigan’s monthly consumer sentiment index rose significantly, reaching its highest level since July 2021. This increase in consumer sentiment, along with expectations of a slowdown in the rate of inflation, contributed to the positive market sentiment.

The Bull Market Continues

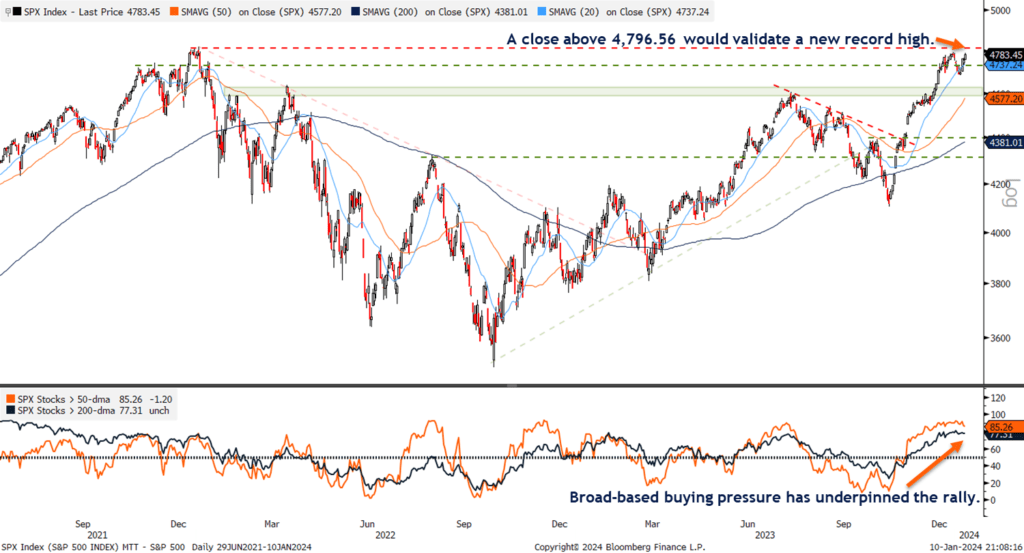

The S&P 500’s record-breaking performance confirms that the stock market is in a bull market and suggests that the rally has further to go in 2024. The index’s surge to a new all-time high on Friday cleared the charts of resistance ahead of a big week of earnings and inflation data. The broader index ended the day at 4,839.81, above both its closing and intraday records that it last reached in January 2022.

Encouraging Sign for Equities

The S&P 500’s record high

is an encouraging sign for equities, even amid lingering concerns of slowing economic growth. Some worry that the major averages are overvalued after last month’s dovish pivot from the Fed has stocks. However, there is nothing bearish about new highs, according to Katie Stockton, founder and managing partner at Fairlead Strategies. When a major index like the S&P 500 reaches a new all-time high, it clears the way for further gains.

The S&P 500 index close

at a record high on Friday, January 19, 2024, marking its first record close in over two years. The benchmark index rose 1.2% to close at 4839.81, surpassing the previous record set in January 2022. This record-breaking performance was driven by a rally in technology stocks and other heavyweight sectors.

During the trading session

, the technology sector of the S&P 500 notably gained 2.4% on Friday, with shares of AI companies like Nvidia and Meta Platforms closing at new record highs. The rally in technology stocks was driven by strong earnings reports from major tech companies, including Apple, Microsoft, and Amazon. These companies reported better-than-expected earnings, which boosted investor confidence in the technology sector.

The record high was also influenced

by rising consumer confidence and easing inflation concerns. The University of Michigan’s monthly consumer sentiment index rose significantly, reaching its highest level since July 2021. This increase in consumer sentiment, along with expectations of a slowdown in the rate of inflation, contributed to the positive market sentiment.

The S&P 500’s record-breaking performance

confirms that the stock market is in a bull market and suggests that the rally has further to go in 2024. The index’s surge to a new all-time high on Friday cleared the charts of resistance ahead of a big week of earnings and inflation data. The broader index ended the day at 4,839.81, above both its closing and intraday records that it last reached in January 2022.

The S&P 500’s record high

is an encouraging sign for equities, even amid lingering concerns of slowing economic growth. Some worry that the major averages are overvalued after last month’s dovish pivot from the Fed has stocks. However, there is nothing bearish about new highs, according to Katie Stockton, founder and managing partner at Fairlead Strategies. When a major index like the S&P 500 reaches a new all-time high, it clears the way for further gains.

Frequently Asked Questions

- What is the S&P 500 index?

The S&P 500 is a stock market index that measures the stock performance of 500 large companies listed on the NYSE or NASDAQ stock exchanges. It is one of the most widely followed equity indices, often considered as the best representation of the U.S. stock market. - What caused the S&P 500 to reach a new record high?

The S&P 500 reached a new record high on January 19, 2024, due to a rally in technology stocks and other heavyweight sectors, rising consumer confidence, and easing inflation concerns. Strong earnings reports from major tech companies, including Apple, Microsoft, and Amazon, also contributed to the rally. - What does the S&P 500’s record high mean for the stock market?

The S&P 500’s record high is an encouraging sign for equities, as it clears the way for further gains. The index’s surge to a new all-time high confirms that the stock market is in a bull market and suggests that the rally has further to go in 2024. - What is a bull market?

A bull market is a market condition in which stock prices are rising. It is characterized by optimism and confidence among investors, leading to increased buying activity and higher stock prices. - What is the University of Michigan’s monthly consumer sentiment index?

The University of Michigan’s monthly consumer sentiment index is a measure of consumer confidence in the U.S. economy. It is based on a survey of consumers’ attitudes about the economy, their personal financial situation, and their expectations for the future. - What is the Federal Reserve’s dovish pivot?

The Federal Reserve’s dovish pivot refers to a shift in the central bank’s monetary policy stance, where it becomes more accommodative and less likely to raise interest rates. This can lead to lower borrowing costs and stimulate economic growth. - What is Katie Stockton’s view on the S&P 500’s record high?

Katie Stockton, founder and managing partner at Fairlead Strategies, believes that the S&P 500’s record high is an encouraging sign for equities, as it clears the way for further gains. She suggests that the rally has further to go in 2024.

In conclusion

the S&P 500’s record-breaking performance on Friday, January 19, 2024, was driven by a rally in technology stocks and other heavyweight sectors, rising consumer confidence, and easing inflation concerns. The index’s surge to a new all-time high confirms that the stock market is in a bull market and suggests that the rally has further to go in 2024. The record high is an encouraging sign for equities, clearing the way for further gains.